On January 27, 2026, three major whale addresses concentrated their withdrawals of gold tokens XAUT and PAXG on Bybit, Gate.io, and MEXC, with a total on-chain outflow of approximately $14.33 million, quickly attracting attention during the trading session in the UTC+8 time zone. According to on-chain data breakdown, this batch of assets includes multiple transactions of XAUT and one transaction of PAXG, withdrawn simultaneously from multiple exchanges, with both the rhythm and scale significantly deviating from daily levels. Meanwhile, the 24-hour trading volume of gold-related contracts on the decentralized contract platform Hyperliquid reached approximately $169 million, with open positions around $160.7 million (single-source data), indicating a simultaneous increase in participation from the derivatives side. In market views, this is seen as one of the largest on-chain gold asset transfers since 2026, with analysis focusing on whether this is a risk-hedging allocation against regulatory and market volatility or a hedging and speculative layout in conjunction with contract trading.

Three Major Whales Withdraw Gold Simultaneously: $14.33 Million Anomaly

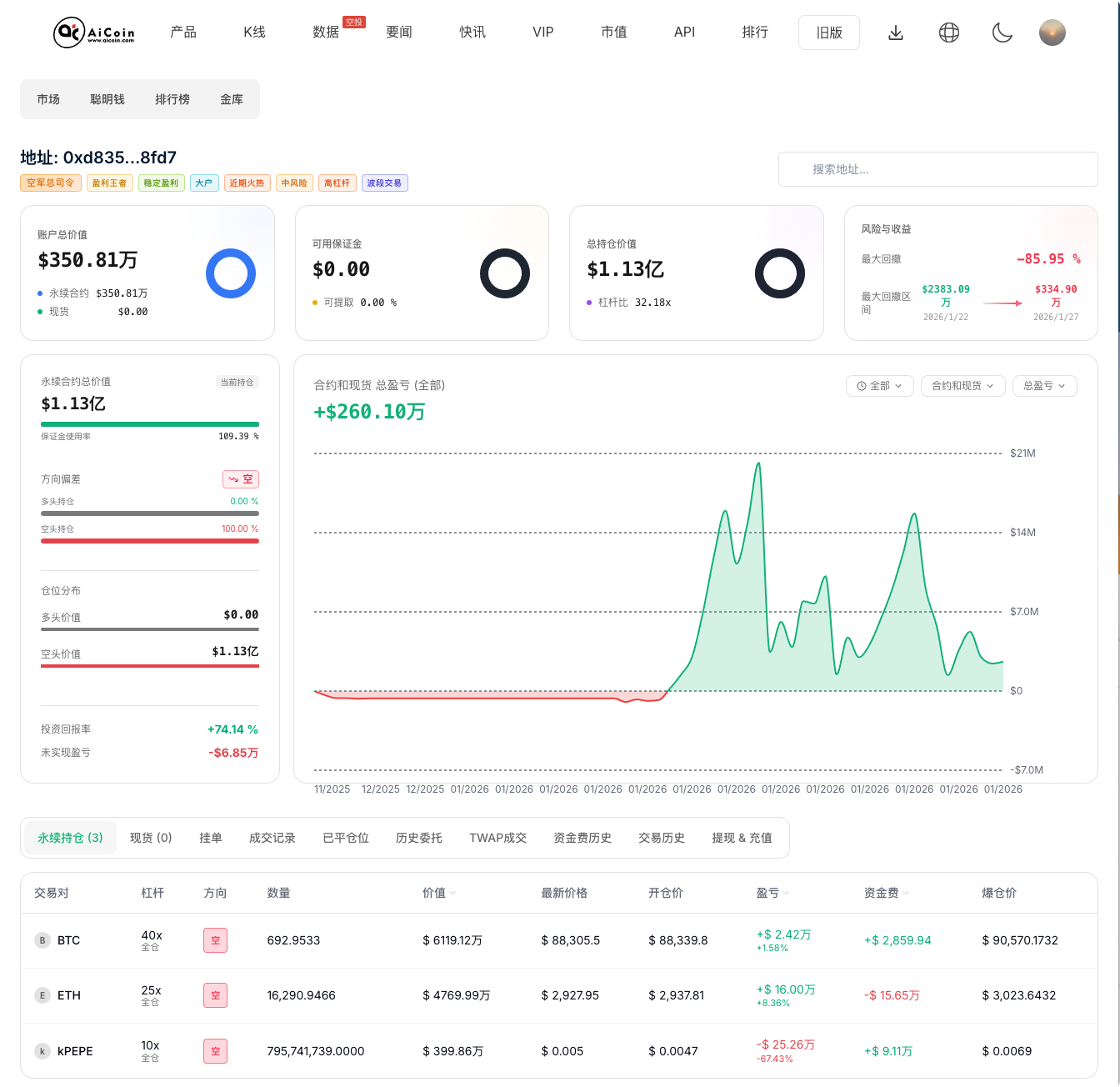

● Fund Breakdown Structure: On-chain data shows that the approximately $14.33 million in gold tokens withdrawn was primarily completed by three major whale addresses: 0xbe4C, 0x0F67, 0x1b7D. This includes 1,959 XAUT (approximately $9.97 million), 559 XAUT (approximately $2.83 million), 194.4 XAUT (approximately $993,000), and 106.2 PAXG (approximately $538,000), with multiple transactions forming a considerable concentrated outflow, all occurring within the time window of January 27.

● Degree of Anomaly Characterization: From the perspective of exchange fund flow habits, single-day withdrawals of million-dollar levels of a single asset are not uncommon on leading platforms, but simultaneous withdrawals of the same type of gold tokens from multiple addresses across Bybit, Gate.io, and MEXC are significantly above background noise. Market data indicates that this XAUT single-day withdrawal volume has reached the historical top 3% percentile range on Gate.io, meaning that this scale has entered the ranks of very few large outflow events in the platform's past data samples, reflecting characteristics of "abnormal" fund movements.

● Event Qualitative Analysis and Information Sources: Some analytical institutions and media (such as market views relayed by @theblockbeats) describe this operation as “one of the largest on-chain gold asset transfer events since 2026.” This judgment is more based on publicly available on-chain data and some monitoring tools for inflows and outflows from exchanges, rather than official reports, which carries a degree of subjectivity. However, under the currently visible samples, it indeed constitutes one of the most representative concentrated migrations of gold tokens this year.

On-Chain Gold Heating Up: Resonance Between Contract Trading and Spot Migration

● Contract Trading Volume: During the same time window as the whale withdrawals of gold tokens, the 24-hour trading volume of gold-related contracts on the decentralized derivatives platform Hyperliquid reached approximately $169 million, with open positions around $160.7 million (both from single platform data). For a single derivatives platform, this level reflects significant attention on gold prices and related trading strategies in a short time, indicating that funds are not only positioning in the spot token side but also actively building positions or hedging on the derivatives side.

● Cross-Product Heat Comparison: On the same platform, the precious metals sector is overall active, with silver contracts trading approximately $1.1 billion in 24 hours and copper contracts around $71.52 million. In absolute trading value, silver is more active, but relative to its historical base and market size, gold contracts' trading and open positions are rising in tandem, showing a characteristic of "steady expansion." Compared to the high-frequency trading of silver and the cyclical nature of copper, gold is more inclined towards being a risk-hedging and hedging vehicle, making this simultaneous volume phenomenon further highlight gold's position among "defensive" assets.

● Strengthening of Spot and Contract Alignment: On one side, XAUT and PAXG are being concentrated and withdrawn from centralized platforms by whales, while on the other side, gold derivatives trading and open positions are simultaneously expanding on decentralized platforms, with both paths highly overlapping in time. Although it cannot currently be proven that the withdrawn funds necessarily enter Hyperliquid or corresponding contracts, the combination of spot "on-chain" and the warming of contract trading forms a typical "risk-hedging position + speculative hedging" resonance structure: some funds may view gold tokens as on-chain safe assets while also using high-leverage contracts to capture short-term volatility.

Rising Risk Aversion: Gold Tokens and Solana Fund Diversion

● Solana Cross-Chain Fund Scale: As gold tokens were swept up and withdrawn by whales, there was also a significant migration of public chain ecosystems on-chain. According to reports, approximately $80 million in funds flowed into Solana across chains during the same period, with about $50 million coming from the Ethereum ecosystem. This scale is sufficient to have a visible impact on Solana's on-chain liquidity and DeFi participation, showing ongoing interest in high-performance public chains and high-volatility strategies.

● Dual-Path Fund Preference: Observing the two fund flows together, one points towards gold tokens like XAUT/PAXG with physical anchoring attributes, while the other points towards high-volatility public chain opportunities represented by Solana. The former aligns more with the idea of "asset preservation, hedging against regulatory and systemic risks," while the latter caters to the demand for "pursuing returns, gaming new narratives, and high-frequency strategies." The coexistence of these two types of actions in the same time window suggests that market funds are layering allocations between "risk-hedging assets" and "high-volatility returns," rather than making a one-sided bet in a single direction.

● Related but Not Causal: In terms of scale, the approximately $14.33 million withdrawal of gold tokens is still secondary compared to the $80 million Solana cross-chain funds, but its asset attribute has a higher "gold content"; in terms of timing, both are concentrated around January 27, showing clear synchrony; in terms of asset nature, gold is defensive, while Solana is offensive. Considering these three dimensions, this round of gold token migration and Solana fund flow appear to be different manifestations of the same market sentiment—one is increasing defensive positions, while the other is ramping up offensive chips, with no evidence currently indicating a direct causal relationship or internal reallocation of the same funding unit.

Risk Aversion Under Regulatory Shadows: ASIC and Custody License Expectations

● ASIC Risk Statement: At the macro narrative level, the Australian Securities and Investments Commission (ASIC) has listed crypto-related risks as a key regulatory focus for 2026, emphasizing market misconduct, custody risks, and investor protection issues related to digital assets in public documents. This statement provides another signal source for tightening global regulation and rising compliance costs, as well as a background for some funds considering early adjustments to their positions, based solely on publicly available information without involving undisclosed content.

● Custody Licensing Direction: In line with regulatory focus, Australia is advancing the "2025 Company Law Amendment," which has clarified the direction of licensing requirements for digital asset custodians—institutions providing custody and related services to the public will need to meet higher thresholds in terms of capital adequacy, operational standards, and asset segregation. Although specific terms and details have not yet been fully implemented, the market generally expects that the business space for non-compliant custodians and "gray area" service providers will be compressed.

● Regulatory Expectations and Gold Token Preference: Under the expectation of "tightening regulation + increased custody requirements," some medium to long-term funds may lean towards self-custody or high-transparency on-chain assets, especially those with physical anchoring and clear valuation logic. Gold tokens like XAUT and PAXG, which are backed by offline gold reserves, are more easily categorized within the realm of "traditional finance" in regulatory discourse. For funds concerned about risks associated with centralized platforms and custody, transferring gold exposure to on-chain wallets while retaining physical gold backing constitutes a compromise risk-hedging solution that balances compliance expectations and asset security.

Exchanges and New Product Listings: Noise or Signal

● Multi-Platform Coordinated Behavior: This whale withdrawal is not concentrated on a single exchange but spans multiple platforms such as Bybit, Gate.io, and MEXC, reflecting a high level of execution complexity and pre-planning. Multi-platform coordination can both disperse liquidity shocks and monitoring attention from a single platform and reflect that holders themselves have deep layouts across multiple exchanges. Whether the motivation is purely risk-hedging or in conjunction with strategic trading, this form of cross-platform simultaneous outflow is structurally more significant than the usual "large withdrawals from a single exchange."

● Disruption from OKX New Product Listing: On the same day, January 27, 2026, at 20:00 (UTC+8), OKX announced the launch of the SENT spot trading pair, providing the market with a brand new high-volatility product. Currently, there is no evidence to suggest a direct link between the launch of SENT and the concentrated withdrawal of gold tokens; it is more likely just a parallel event on the same day. Considering that SENT belongs to a new narrative theme while XAUT/PAXG represents traditional risk-hedging assets, there are significant differences in funding attributes and participant profiles, making the correlation likely low.

● Thematic Speculation and Risk Hedging: Observing the broader exchange ecosystem, the emergence of new products and the strengthening of traditional risk-hedging assets are interwoven during the same time period: on one side, there is short-term speculation around new tokens and new narratives, while on the other side, there is defensive allocation around gold tokens and mainstream assets. Funds are rebalancing at both ends: some traders capture excess returns with new products, while some medium to long-term funds choose to increase defensive positions in gold tokens to hedge against regulatory and volatility risks, which also explains why gold tokens can still attract concentrated transfers from whales even as new products like SENT draw attention.

Risk Aversion or Speculation: Observation Checklist After Whale Withdrawals

● Fund Preferences in the Same Time Window: In summary of this event, three key threads overlap in the window of January 27: first, three major whales concentrated their withdrawals of approximately $14.33 million in XAUT and PAXG from multiple exchanges, constituting a rare migration of gold tokens this year; second, Hyperliquid's gold contracts had a 24-hour trading volume of $169 million and open positions of $160.7 million, with overall heating in precious metal contracts; third, approximately $80 million in funds flowed cross-chain to Solana, with $50 million coming from Ethereum. These three clues collectively indicate that funds are reallocating weights between offense and defense.

● Short to Medium-Term Impact of Gold Tokens: In the short term, such a scale of withdrawal means that the circulating supply of gold tokens within exchanges is compressed. If demand remains unchanged, this may drive up on-site price premiums and borrowing rates, increasing the opportunity cost of holding gold tokens. In the medium term, it depends on the subsequent on-chain direction of these tokens—if they continue to be held in self-custody addresses, gold tokens will function more like "on-chain gold bars," serving as a hedge and store of value; if some flow into DeFi or derivatives platforms, it may enhance the financialization of gold as a strategic underlying asset. It is important to emphasize that without more on-chain traces, the true motives of the whales cannot be confirmed, and all judgments should remain at the level of scenario analysis rather than motive inference.

● Focus Points for Investors: For ordinary participants, rather than simply following the whale's gold withdrawal actions, it is more important to pay attention to three types of subsequent signals: first, the subsequent on-chain flow and holding structure, such as whether these gold tokens enter DeFi, lending, or contract platforms; second, the rhythm of regulatory details being implemented, including how ASIC and other jurisdictions evolve specific requirements for custody and trading platforms; third, their own risk exposure management, establishing clearer position boundaries between high-volatility assets, new product themes, and hedging positions. Whale operations can serve as observational samples, but should not become simple trading guides.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Welfare Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Welfare Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。