I. Review of High Position Judgment

After the price broke above 94,000, I clearly indicated that the upper limit of this rebound is likely around 98,000, and I judged that the daily adjustment had ended, with the market continuing the downward trend at the daily and weekly levels.

This rebound is essentially a typical short squeeze and inducement to go long, aimed at liquidating short positions with high leverage in the short term. This view was given on January 14 when the price was around 95,000.

Ultimately, the price formed a top signal near 98,000 and subsequently entered and continued the current downward trend.

II. No Long Positions During the Downtrend

During the decline from 98,000 to 86,000, I did not provide any long position signals.

This round of decline is far from over and is not suitable for bottom-fishing based on feelings or experience.

Looking back at the previous market, the price fell from 100,700 to around 80,000, a cumulative drop of about 27,000 points, with almost no effective adjustments along the way.

The logic of the current round of decline has not fundamentally changed. Those who previously set up long-term short positions at high levels can continue to hold.

The true confirmation of the trend is when 94,000 forms an effective breakdown.

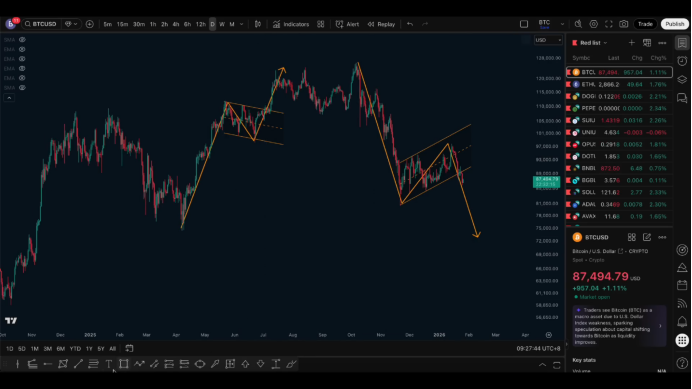

III. Daily Structure Judgment

From the daily structure perspective, the current segment of the trend belongs to a continuation structure during the downtrend, which can also be understood as a sharp adjustment.

After the price declined, it formed an upward channel, but the channel was ultimately broken down, indicating that the downward trend will continue.

In an upward market, breaking the channel upwards will continue the rise; in a downward market, breaking the channel downwards will continue the decline.

Corresponding to the structure, this round of decline is likely to create a new low.

IV. Key Level: 75,000

The most critical position currently is around 75,000, which is an important liquidation point for bulls.

From the structural judgment, this round of decline is likely to break below 75,000, and it is even possible to further explore below 70,000.

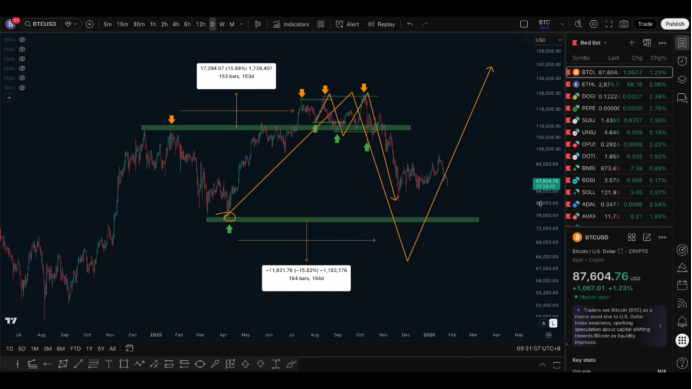

Since 124,000, I have indicated that this round of market is likely to form a diffusion structure, characterized by continuously breaking high points and low points, obtaining liquidity through repeated liquidation of both bulls and bears.

V. Liquidation Logic and Target Range

The common path of a diffusion structure is:

First, break the high point to complete the short liquidation;

Then, break the low point to complete the long liquidation;

Only after the liquidation is complete will the trend truly unfold.

After the previous high point was broken, the price did not continue to rise but instead turned to decline. Correspondingly, to complete the long liquidation, the preceding low point needs to be effectively broken down.

Referring to historical structures, after the high point was broken, there was an extension of about 15%, with an increase of about 17,000 points.

If the low point breaks down and similarly extends by about 15%, the target below is roughly between 60,000 and 65,000.

VI. Future Market Judgment and Trading Ideas

From a comprehensive structural perspective, the target range for this round of decline is likely between 60,000 and 65,000, possibly occurring in the first half of this year.

The complete path may be:

High point breakdown → Low point breakdown → Long liquidation completed → Start the next real rise, continuing the bull market cycle.

In terms of operations:

For those who already have long-term short positions, continue to hold.

For those who have not entered the market, wait for new opportunities.

For short-term trading, use the high point after a rebound or key resistance levels during the decline as entry points.

In a bearish trend, the key is not whether it declines, but whether there are clear defense points.

Follow me, join the community, and let's progress together.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。