Original|Odaily Planet Daily (@OdailyChina)

Silver, once referred to as the "poor man's gold," is sweeping the global market with a stormy momentum. The reason is simple: its terrifying price surge.

Recently, the price of silver briefly surpassed $117 per ounce, reaching a historic high. Since the peak of the crypto cycle in 2017, silver has officially outperformed Bitcoin (approximately 500%) and gold (slightly below 300%) with a cumulative increase of about 517%. According to data from 8marketcap, the current price of silver is around $110, with a market capitalization of $6.18 trillion, ranking second among global assets, only behind gold. Such an astonishing trend has naturally sparked market enthusiasm. In addition to purchasing silver funds or physical silver through traditional brokers or offline stores, tokenized silver may also be an option, especially leveraged contracts on exchanges and on-chain Perp DEX.

Current Status of Tokenized Silver: Only 2 Tokens with Relatively Good Liquidity

According to data from Coingecko, the overall market capitalization of the tokenized silver sector is currently reported at around $446 million, with a 24-hour increase of about 5.6%; specifically, the two silver tokens with relatively good liquidity are as follows:

Kinesis Silver (KAG): Market Cap Currently Reported at $406 Million

Like the gold token KAU, the KAG silver token is issued by the UK-based Kinesis registered in the Cayman Islands, with major trading platforms including Kinesis Money, BitMart, and the UAE exchange Emirex.

It is understood that KAG is backed by a fully insured and regularly audited vault (globally distributed storage), with each token anchored to 1 ounce of investment-grade silver; it supports real-time global payments; allows for physical silver redemption; and has no storage fees.

Its potential risks are similar to those of Tether, the issuer of the XAUT gold token, as this token heavily relies on the asset credibility of the issuer and faces certain regulatory uncertainties. Additionally, due to its relatively small market capitalization, market depth is generally average, and market volatility may lead to premiums or discounts, making it quite dependent on the trading platform for order matching.

Nevertheless, Coingecko's information** shows that KAG's 24-hour trading volume is approximately $5.5 million, making it the second-largest in the silver token market.

iShares Silver Trust (SLV): Market Cap Currently Reported at $39.5 Million

The iShares silver trust token issued by Ondo Finance is anchored to silver through the BlackRock iShares Silver Trust (SLV) ETF, which holds the corresponding physical silver.

Its advantages include tracking the regulated traditional SLV ETF, better liquidity, and supporting instant minting or redemption (for non-U.S. users); it combines traditional finance with blockchain convenience; has institutional-level endorsement; and does not require direct handling of physical silver.

Its potential risks lie in its heavy reliance on the asset credibility of issuers like BlackRock and Ondo, and it does not support ownership of physical silver or direct redemption; it includes certain ETF fund management fee costs; U.S. user transactions are restricted and face potential securities regulatory limitations.

Major trading platforms include centralized exchanges such as Gate, Bitmart, Bitget, and AscendEX.

It is worth mentioning that SLV also supports contract trading, with a maximum leverage of 10 times.

Coingecko's information** shows that SLVON's 24-hour trading volume is approximately $21.2 million, ranking first in the silver token market.**

In addition to the two major silver tokens KAG and SLVON, the silver token Silver rStock (SLVR) launched by the Solana ecosystem stock tokenization platform Remora Market and the silver token Gram Silver (GRAMS) anchored to 1 gram of silver launched by Token Teknoloji A.Ş. also belong to the spot token category, but their market capitalization and liquidity are extremely low, with a larger price gap compared to KAG and SLVON, making trading participation not advisable.

Silver Leverage Trading Platforms: Hyperliquid, Binance, Bitget, and Other Exchanges

In addition to spot silver tokens, many U.S. stock tokenization trading platforms, on-chain Perp DEX, CEX, and DEX have opened silver-related leveraged contract trading, supporting up to 20 times leverage. Below are specific trading platforms for readers' reference:

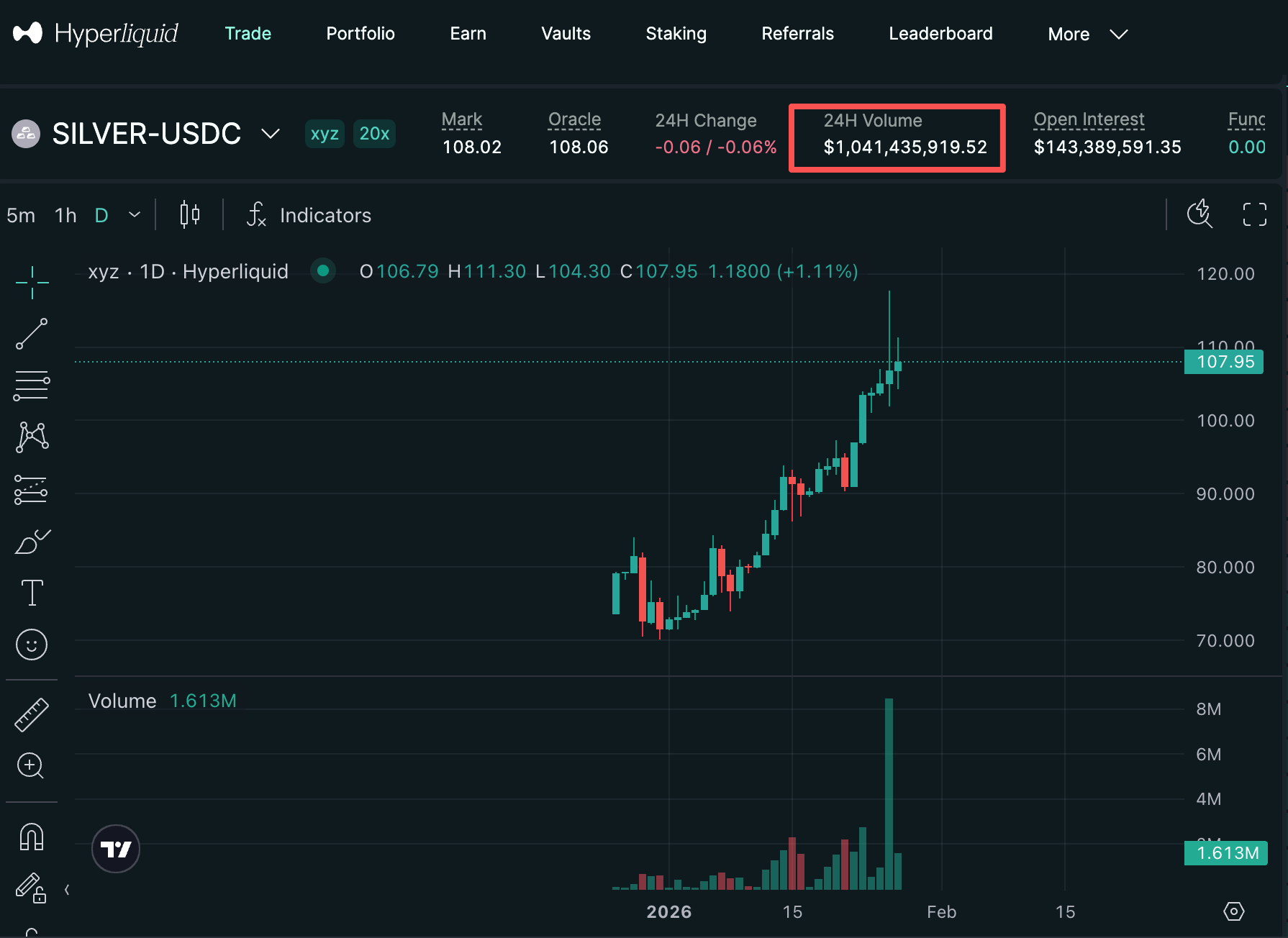

Channel One——Hyperliquid: https://app.hyperliquid.xyz/trade/xyz:SILVER, with the silver/USDC contract trading pair's 24-hour trading volume exceeding $1 billion;

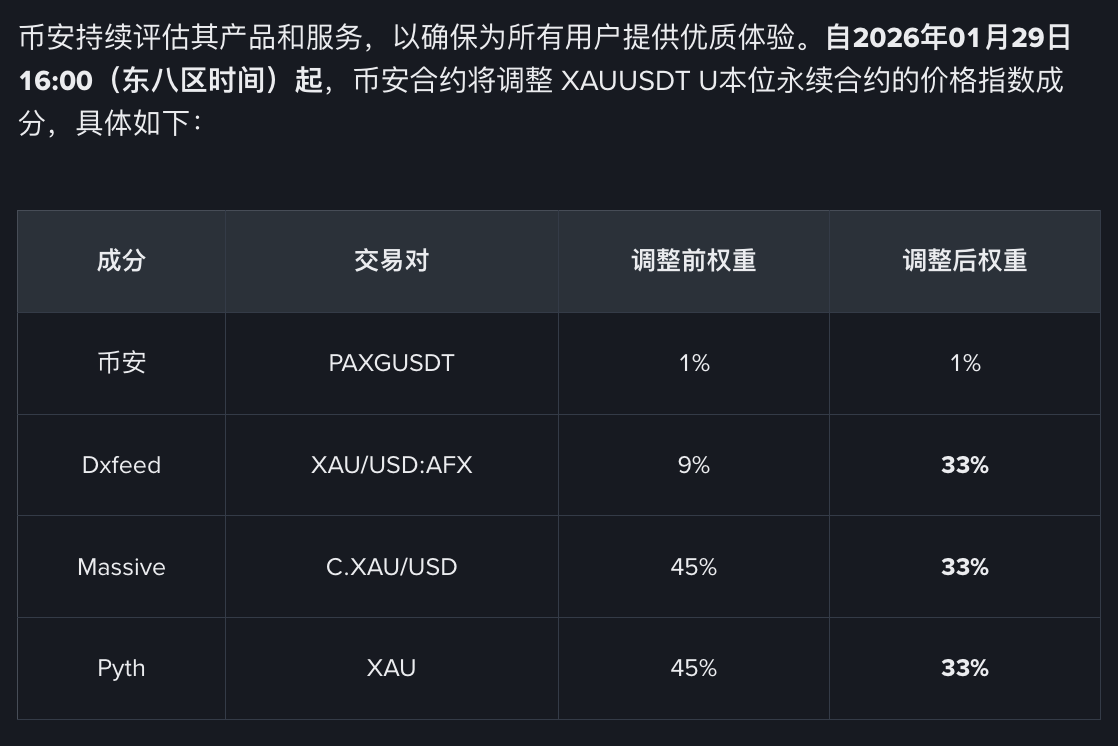

Channel Two——Binance: https://www.binance.com/zh-CN/futures/XAGUSDT, supports leveraged trading for the XAG/USDT trading pair, with a maximum leverage of 20 times. Currently, the 24-hour trading volume is $1.32 billion. According to the official announcement, this trading pair was officially opened on January 7; latest news shows that Binance will change the contract price index components on January 29, 2026.

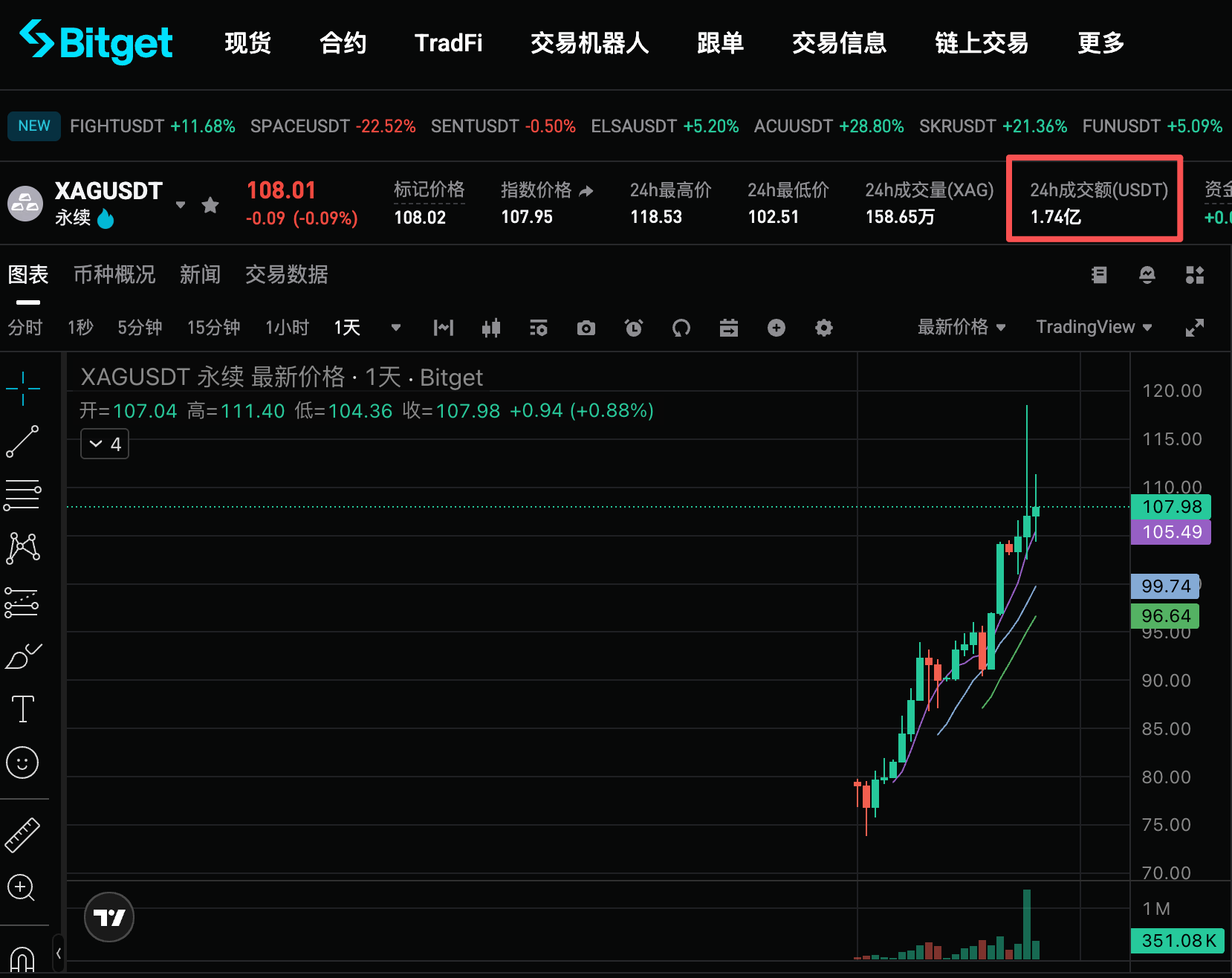

Channel Three——Bitget: https://www.bitget.site/zh-CN/futures/usdt/XAGUSDT, supports leveraged trading for the XAG/USDT trading pair, with a maximum leverage of 20 times. Currently, the 24-hour trading volume is $174 million.

Conclusion: Trump's Hawkish Policies and Preference for Rate Cuts Will Be the Best Catalysts for Precious Metals

Looking back, the international political and economic tensions, tariff trade wars, and the preference for interest rate cuts stemming from Trump's administration are the best catalysts for the rise in precious metal prices. Specifically for silver, apart from past supply tightness and its importance as a raw material, the transfer of risk assets and the U.S. attitude are crucial.

J. Safra Sarasin strategist Claudio Wewel pointed out that the continuous surge in silver prices is due to the market's diminishing expectations for U.S. rate cuts and silver's newly acquired status as a critical mineral. The U.S. Department of the Interior included silver in its list of critical minerals in November, increasing the likelihood of tariffs on this metal. He noted that this has exacerbated the long-term supply tightness and prompted U.S. importers to accelerate silver procurement. At the same time, retail investors, finding it difficult to purchase gold at historically high prices, are turning to silver as a safe-haven asset.

In other words, the main rise in silver comes from both "scarcity" and "safe-haven" appeal, and combined with the recently tense situation in the Middle East, the price peak of silver may still be far from over.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。