┈┈➤What is the significance of CZ attending Davos?

In January 2026, CZ officially attended the Davos WEF (World Economic Forum) and delivered an impressive speech.

The name of the Davos Forum is well-known, but its status may not be familiar to everyone.

The Davos Forum is recognized as the highest-level unofficial economic coordination platform in the world, gathering political leaders, central bank governors, and business leaders each year to jointly assess and set the global economic agenda.

On January 22, 2026, CZ officially attended the "New Era for Finance" sub-forum within the official agenda of the World Economic Forum (WEF). The New Era for Finance is one of the formal agendas at the main venue in Davos.

CZ is transitioning from being a "recipient" of rules to a "maker" of rules, becoming one of the giants capable of influencing the global economic direction!

This directly benefits Binance's development, bringing it into the view of global economic leaders.

However, numerous data indicate that Binance is almost equivalent to the entire cryptocurrency industry. CZ's moment in Davos is, in fact, a process of the global mainstreaming of the cryptocurrency industry.

┈┈➤Binance's Market Impact and Leadership

╰┈✦Static Data on Asset Scale

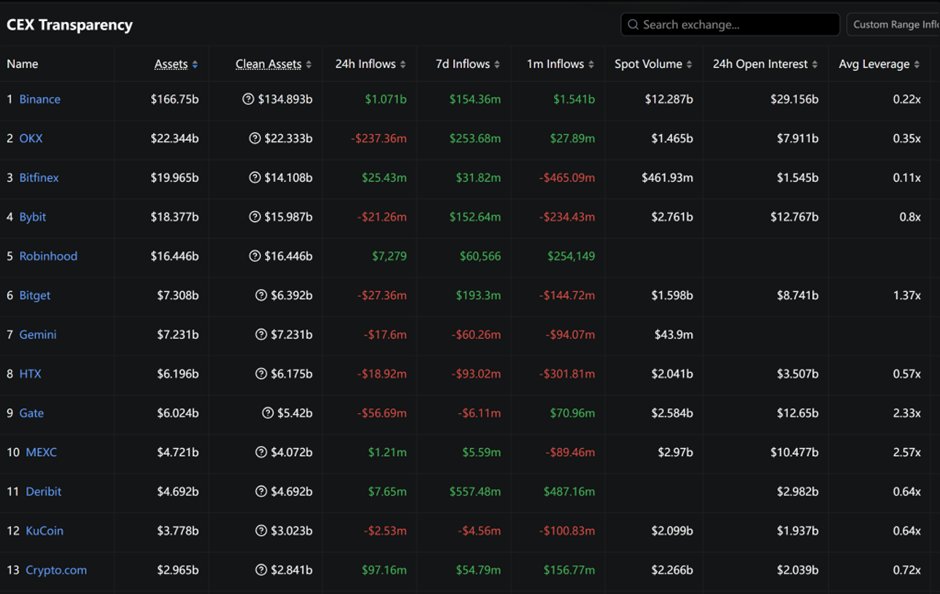

According to Binance's proof of reserves, the total amount of cryptocurrency assets in the Binance wallet is $166.75 billion, which is 7.5 times that of the second-ranked platform. Even excluding Binance's native token BNB, the assets in the Binance wallet still amount to $134.893 billion, which is 6 times that of the second-ranked platform.

This also exceeds the total TVL (Total Value Locked) of all DeFi protocols on the network ($119.664 billion).

Among these, the Binance wallet holds:

636,914.163 BTC, accounting for approximately 23.27% of all exchanges' BTC supply and about 3.2% of the total circulating BTC.

4,343,899.193 ETH, accounting for approximately 26.47% of all exchanges' ETH supply and about 3.6% of the total circulating ETH.

38,665,008,077.439 USDT, accounting for approximately 20.69% of the circulating USDT.

7,633,433,933.612 USDC, accounting for approximately 10.4% of the circulating USDC.

Those who have used blockchain should understand that these ratios indicate Binance's extremely significant influence on the market.

The assets in the Binance wallet belong to the users, thus Binance's user ecosystem has unparalleled influence in the cryptocurrency market.

╰┈✦Dynamic Data on Trading Volume

According to CoinMarketCap data, Binance's 24-hour spot trading volume is $1.25 billion, which is 7.5 times that of the second-ranked platform, Coinbase.

Binance's 24-hour contract trading volume is $29.2 billion, which is more than the combined total of Bybit and Gate, ranked third and fourth.

Binance's trading volume data shows that its user base not only holds the largest cryptocurrency asset scale globally but is also a highly active user group.

With such asset scale and trading activity, the trading sentiment and behavior of Binance users have significant leadership over the entire cryptocurrency market.

╰┈✦Comprehensive User Behavior Data

Using the 24-hour spot trading volume divided by asset storage, Binance has the smallest ratio. This is because many users use Binance as an asset storage or even payment tool, rather than just a trading venue.

This is due to the widespread trust in Binance's security. Even in Web3 payment scenarios, when both parties mention UID, the default scenario is Binance UID.

The ratio of 24-hour derivatives trading volume to spot trading volume places Binance in a moderately low range, reflecting that Binance users are not primarily engaged in aggressive contract trading, but are also not overly conservative.

Therefore, for users, Binance is the preferred choice for asset storage, payments, stable investments, and aggressive trading.

╰┈✦Returns from Retained Assets

Behind Binance's proof of reserves is a massive amount of retained assets, which provide users with substantial returns.

In the entire year of 2025, Binance distributed $1.2 billion in rewards to users through capital preservation and coin earning.

The reason Binance offers such financial returns to users is due to two major product innovations in 2025: the Alpha market and OTC selection. This not only integrates Binance into the on-chain ecosystem but also enhances the connection between Web3 and Web2 in daily life.

This further increases Binance's scale while accelerating the co-prosperity of on-chain and off-chain within Web3 and the coupling with external Web2. These expansions and integrations enhance Binance's core competitiveness while also benefiting Web3 users. This reflects Binance's sense of responsibility and pioneering spirit as an industry leader in advancing the sector.

┈┈➤Binance's Product Reputation and User Base

╰┈✦Product Reputation

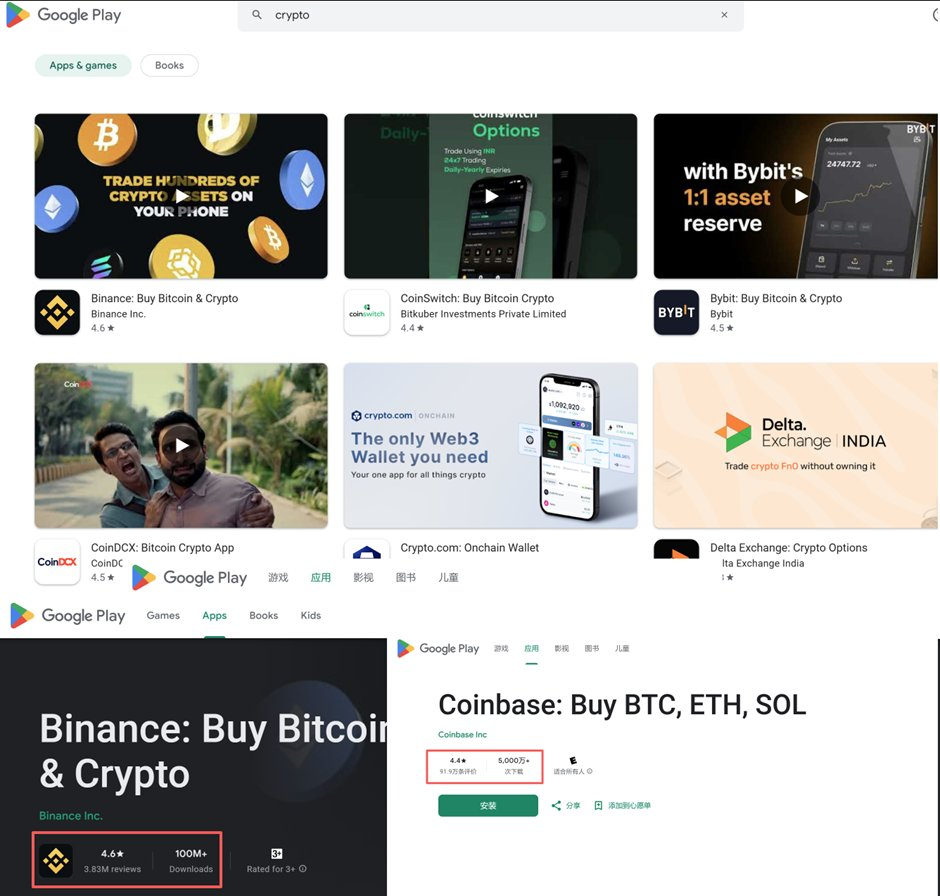

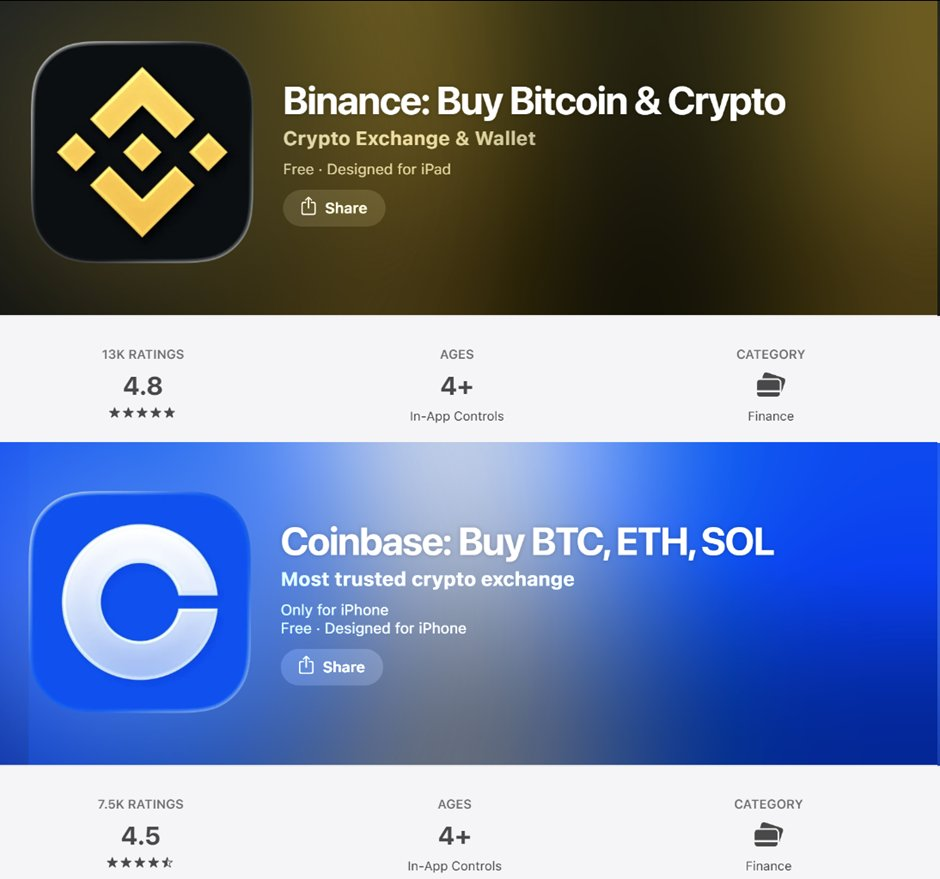

Data from Google and Apple show that Binance is the most popular, highest user activity, and best-rated cryptocurrency application in the market.

On Google Play, the Binance app is the most downloaded cryptocurrency application, with over 100 million downloads and a rating of 4.6.

Next are Trust Wallet and Coinbase, with over 50 million downloads. Coinbase has a rating of 4.4 in the U.S. (lower in other regions).

Following that are TradingView, Metamask, Phantom, Bybit, and others, each with over 10 million downloads.

On the Apple App Store, Binance has received 13,000 reviews with an average rating of 4.8, while Coinbase has 7,500 reviews with an average score of 4.5.

Generally speaking, it is difficult to satisfy everyone; the more users there are, the more participants there are in the evaluation, and the ratings tend to be lower.

However, the greater participation in evaluations has resulted in higher ratings for the Binance app. This confirms that Binance is not only the most widely used cryptocurrency application but also offers an excellent user experience.

The product standard of Binance has, to some extent, defined the highest user experience standards in the cryptocurrency industry.

╰┈✦User Base

By December 2025, the total number of Binance users surpassed 300 million, accounting for 4.2% of the global adult population.

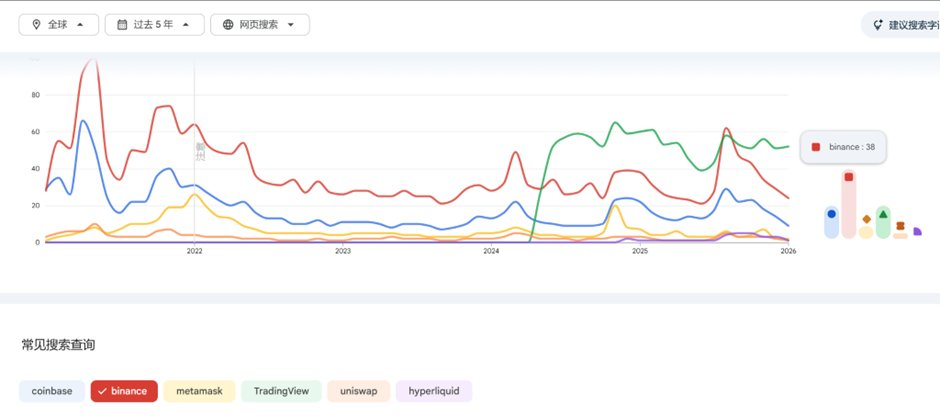

Through Google search trends, we can understand the actual demand for web users.

Undoubtedly, Binance remains in the top position.

Including leading CEXs, DEXs, wallets, and even comprehensive analysis platforms, Binance is the most searched platform.

Binance's overall data even surpasses that of comprehensive financial analysis platform TradingView. The previous data shows that the Android download volume of the Binance app is approximately 10 times that of TradingView.

These data collectively confirm a fact: Binance is the largest and most popular cryptocurrency product in terms of user numbers. The user behavior and ecological trends of Binance have strong representativeness and influence over the entire cryptocurrency market.

┈┈➤Binance's Path to Security and Compliance

╰┈✦Security

On the backend, Binance stores the vast majority of its assets in offline cold wallets, with a small portion of funds in hot wallets to protect user funds.

On the frontend, in addition to regular multi-factor authentication, hardware keys, and anti-phishing codes, many security technologies have been implemented. For example, AI technology is used to monitor abnormal trading behaviors and to keep an eye on unsafe addresses on the blockchain. When the system detects signs of remote logins, large suspicious withdrawals, account takeover, or transfers to unsafe addresses, Binance automatically triggers a forced lock or manual intervention.

……

In addition to technical preemptive measures and in-process controls, Binance has also established a $1 billion Asset Protection Fund (SAFU) for emergency assistance afterward.

╰┈✦Compliance

The essence of compliance remains the safety of user assets and risk avoidance.

As of January 2026, Binance holds licenses or has completed registrations in over 20 countries or regions, including Singapore, Japan, Thailand, Dubai, Pakistan, Australia, France, Italy, Spain, Sweden, Poland, and Lithuania.

Among them, the ADGM (Abu Dhabi Global Market), effective at the beginning of 2026, is a global license. ADGM is a financial center regulated by the FSRA (Financial Services Regulatory Authority), which strictly monitors the capital adequacy, asset segregation, and global market behavior of operating entities. The user rights and risk control of financial institutions under its regulation can be relatively effectively managed.

Since 2023, Binance has continuously deepened its layout in security and compliance, reducing the risk of direct contact with major categories of illegal funds by 96%.

5.4 million users have been protected from potential fraud and scam losses by Binance, recovering a total of $6.69 billion in losses.

┈┈➤Final Thoughts

CZ is not an ordinary participant at Davos; as the founder of Binance and a leading figure in crypto innovation, he is among the drivers reshaping the global financial landscape.

This directly benefits Binance's compliance operations and market expansion globally.

The benefits to Binance are, in fact, equivalent to benefits for the industry and users.

When CZ takes a seat as a guest at the Davos Forum, the significance transcends CZ and Binance themselves. At this moment, CZ represents not only Binance but also Bitcoin, cryptocurrencies, and the entire cryptocurrency industry. CZ's voice speaks for the entire cryptocurrency industry. CZ's trip to Davos marks the entry of the cryptocurrency industry into the mainstream stage of the world economy. Cryptocurrency is no longer niche; it is destined to be great.

CZ must really like the snow in Davos…

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。