Author: Web3 Research of Go2Mars

This article aims to provide an analytical framework to help understand that the current "value regression" is not a helpless end to a bear market, but rather a necessary pain before the birth of the next generation of trusted financial infrastructure.

In the past two years, the crypto industry has witnessed Bitcoin transition from a speculative asset and cyclical benchmark, a reservoir during monetary easing, to now becoming a non-sovereign macro anchor asset and a strategic reserve option; stablecoins have also evolved from being a medium for crypto speculation to now becoming a healthy on-chain dollar, facilitating cross-border on-chain payment settlements, and providing a low-threshold channel for the world to access dollars.

In stark contrast, the altcoin market has seen the vast majority of crypto projects being disproven, with some projects' former glory unlikely to reappear. More broadly, many projects have drowned in the preparatory stage due to the industry's bleakness.

As the tide of liquidity recedes, speculative narratives are becoming increasingly scarce and dull. However, I believe this is a normal transformation cycle in the blockchain industry, a healthy phase of liquidation for the crypto bubble and fantasies, and the crypto industry will gradually emerge from the gloom after hitting the bottom.

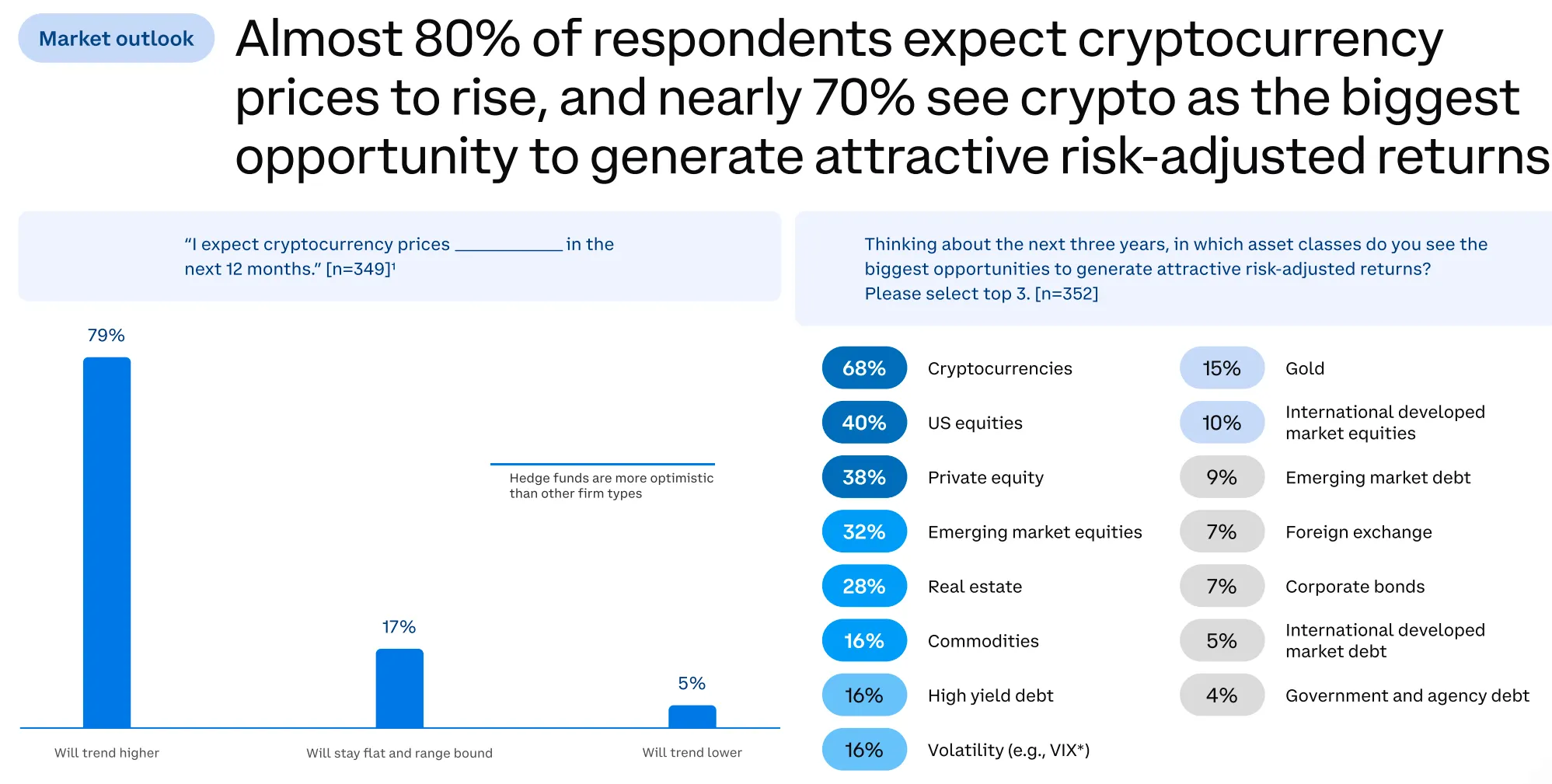

Institutional investors have significantly increased their confidence in the crypto industry by 2026. According to a survey by Ernst & Young (EY) in 2025, nearly 80% of respondents expect cryptocurrency prices to rise, and nearly 70% view it as the greatest opportunity to obtain attractive risk-adjusted returns.

1.The Emergence of Blockchain-Native Finance

1.1 Beyond RWA: From "Auxiliary Tool" to "Core of Credit Efficiency"

The essence of RWA (Real World Assets) remains to package assets and debts from the traditional financial system onto the blockchain. This model can serve as an auxiliary tool for traditional finance, but in reality, the functions of blockchain extend far beyond this. The essence of financial competition is not the scale of funds, but "credit efficiency."

On the surface, the competition in the financial system is about:

(1) The amount of capital

(2) The level of interest rates

(3) The size of the market

But the deeper logic is: whether a system can organize credit at a lower cost, with less friction and less abuse. Whoever can produce, price, and settle credit more efficiently will have a long-term advantage.

1.2 The Flaws of Traditional Finance: "Personalized + Power-Based" Credit Model

In the traditional system, credit relies on:

(1) Central banks

(2) Commercial banks

(3) Government backing

(4) Legal and violent enforcement.

This brings a fundamental problem: credit is not neutral but can be manipulated. Whoever holds power can decide the flow of funds, enjoy funding, and socialize losses.

1.3 Locking Power into Rules: "Trustless" Collaboration

The spirit of blockchain is to establish a system that allows people to collaborate without the need for trust.

Blockchain constructs a new trust model through:

(1) Cryptography

(2) Consensus mechanisms

(3) Immutable ledgers

It locks power into rules, transforming ownership from permissioned to factual. It embeds the "worst human nature hypothesis" into the system itself, creating a trustworthy order even in the presence of human issues. This is a dimensional blow to the traditional credit system.

The true advantage of blockchain lies in its reconstruction of the way credit is organized at the underlying institutional level. The spirit of blockchain determines the form of the institution, the form of the institution determines the efficiency of the mechanism, and the efficiency of the mechanism ultimately manifests as advantages in cost, speed, and accessibility at the user level.

(1) Lower financial service costs

(2) Higher efficiency in financial service speed

(3) Elimination of geographical access and some thresholds

1.4 Path: From DeFi Starting Point to Compliance Road of Legislative Explosion

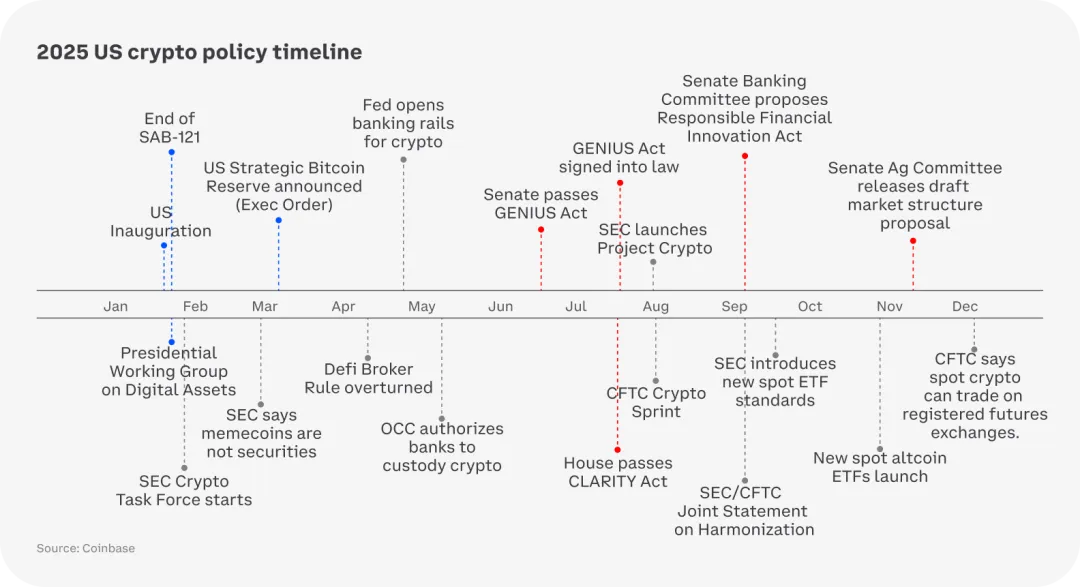

Cryptocurrency has transitioned from a 'scam' to mainstream traditional financial institutions' large-scale participation. During this period, attempts at on-chain native finance and the push for legal regulation have been ongoing. The rise of DeFi products in the summer of 2021, the earliest legislative attempts at the congressional level for cryptocurrency assets starting in 2023, the mainstream narrative of RWA in 2024, and the "year of legislative explosion" in 2025, all point to the hope of seeing the true starting point of on-chain finance in 2026.

https://transak.com/blog/the-clarity-act#the-clarity-act-timeline

2025 U.S. Government Legislative Timeline for the Cryptocurrency Industry

2. The Value Regression of Tokens

In the early stages of the crypto industry, a large number of tokens achieved astonishing market value growth without any real earnings or even a clear path to value capture.

Why did early tokens rise without "real earnings"?

2.1 Market Pricing is Not Cash Flow, but "Future Credit"

In the early days of the industry, the core pricing basis for tokens was not:

Dividends, earnings, buybacks

But rather future credit:

The possibility of becoming infrastructure in the future

The potential to capture value in the future

The potential to be recognized by institutions, users, and capital in the future

Tokens are more like an "option on future institutional status and network effects." The conditions for exercising this option are the collective cognition and belief of the market.

During the industry's explosive period, as long as enough participants believed in a narrative—believing that this public chain would become the next financial settlement layer, believing that this DeFi protocol could capture the liquidity of the ecosystem, believing that its team and community had the capability to modify the token economics to achieve value capture at some point in the future—then this shared belief itself would become a "self-fulfilling prophecy."

Capital would flow in based on this belief, driving up prices; and the rising prices would, in turn, reinforce the belief, attracting more capital. In this reflexive cycle, tokens would preemptively realize the value of that "future credit" option. It is essentially a game about attention, consensus, and coordination, with tokens serving as the chips in this game, and the option value determined by the level of participation and fervor in the game.

2.2 Narrative Dividends and Cognitive Disparity Driving Early Super Premiums

In the past few years, blockchain narratives have remained highly novel:

Financial infrastructure narratives (DeFi Primitive): Terra, Uniswap, Synthetix, Curve

Applicative narratives: NFT, SocialFi, GameFi

Platform narratives: Layer 2, public chains

Blockchain interconnectivity infrastructure: Cosmos, Polkadot

Web3 middleware infrastructure narratives: Oracles, cross-chain bridges, sequencers, modular wallets, and account abstraction

These narratives themselves can generate cognitive dividends, attracting incremental funds. New narratives naturally have an advantage at the cognitive level because they create "attention asymmetry + understanding asymmetry," thus generating early pricing advantages.

1 Attention Scarcity Effect

Human attention is extremely limited.

When a narrative is "first appearing": it is more easily noticed and amplified by media, KOLs, and capital. Uniswap broke the traditional understanding that there is no liquidity without market makers with extremely low cognitive costs, showing that prices can be determined by an x*y=k formula. This "counterintuitive yet explainable" model generates a strong memory and dissemination effect.

2 Cognitive Framework Vacuum

When a field is new:

1) There is no unified valuation model

2) There are no precedents of success/failure

3) There is no "reasonable price anchor." CosmosHub succeeded for many years as the "golden shovel" for Cosmos ecosystem projects precisely because it lacked fundamentals.

In an environment of macro liquidity flooding, the process of participants flowing into the crypto market combined with the early narrative dividends led to a period where we began to witness the brilliance of various projects in 2021. Many capable young people realized their wealth freedom through the cryptocurrency market.

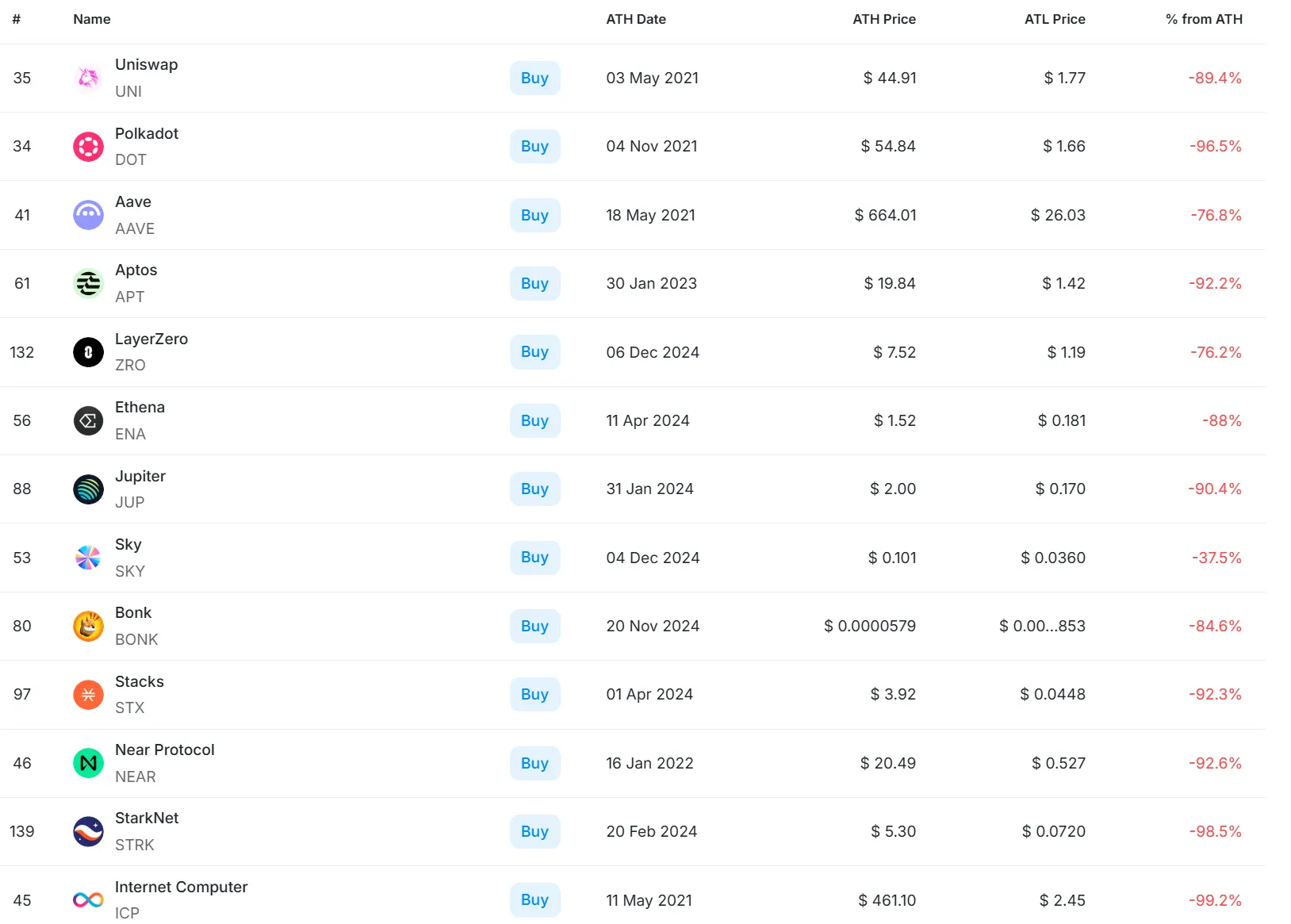

However, the current macro liquidity and market conditions can no longer sustain the previous speculative frenzy. The vast majority of narratives have been disproven, and most tokens have either gone to zero or are close to it.

Current cryptocurrency participants are gradually realizing that the vast majority of "air tokens" truly only have short-term market gaming value without actual value support.

Future cryptocurrency projects that wish to gain investors' 'faith' need to present products that can generate long-term profits and tokens that capture value.

The market has begun to punish inflation and empty narratives over the past few years. Those who chose outdated narratives and relatively inferior token economics have seen their funds gradually shift from many long-term optimistic investors willing to provide liquidity.

The current price drop of the top 150 cryptocurrency tokens relative to their highest prices across various narrative tracks.

Currently, from both macro liquidity conditions and market structure perspectives, this speculative pricing framework centered on narratives and expectations is difficult to sustain. As the monetary environment tightens, risk appetite declines, and narrative liquidity is structurally diluted, many narratives that were highly anticipated by the market over the past few years are gradually being disproven. The prices of most tokens lacking real product capabilities and sustainable business models have shown long-term downward trends, with some projects even approaching zero.

In a globally highly loose macro liquidity environment, risk appetite significantly increased, leading many market participants to flood into the crypto asset market. This process, combined with the early narratives that were not fully understood, resulted in a rapid expansion of market capitalization for many crypto projects in a short time.

During this phase, the crypto market essentially provided a venue for cognitive leaders to quickly monetize their information advantages and judgment. Some capable early participants thus achieved wealth freedom.

Against this backdrop, market participants' understanding of crypto assets is undergoing a structural transformation. More and more investors are beginning to realize that the vast majority of tokens relying solely on short-term emotions and gaming logic have value only during specific speculative phases.

If future crypto projects wish to regain long-term trust from investors, they must prove their ability to generate stable and sustainable product revenue and effectively capture protocol value through clear token economic design.

In fact, over the past few years, the market has begun to systematically punish high inflation, weak value capture, and lagging narrative-driven token models. In this process, pricing power has gradually shifted from "future credit" and vague expectations to assessments of real fundamentals, profitability, and cash flow sustainability. The crypto asset market is transitioning from the early narrative-driven phase to a phase of more fundamental pricing.

3 Privacy is Transitioning from "Marginal Function" to "Core Infrastructure"

In the early stages of the crypto industry, privacy was more viewed as an ideological appeal or niche function:

Anonymous transactions, anti-censorship, personal freedom. These demands do exist, but for a long time, they have not become core indicators of competition in mainstream blockchain.

3.1 From an Investment Perspective, the Privacy Track Meets the Characteristics of the Trend of Blockchain Development

Strongly correlated with institutional adoption and legislation by various governments, privacy is transitioning from "full anonymity" to "composable and auditable," which is a real-world necessity.

Strong network effects + high migration costs make it difficult to replicate and commoditize.

As crypto assets gradually move towards Real-World Finance, the positioning of privacy has undergone a fundamental shift: privacy is no longer a question of "whether it is needed," but rather "whether it is available."

As a16z pointed out in its 2026 outlook:

Privacy is the one feature that’s critical for the world’s finance to move onchain — and also the one feature that most blockchains lack.

Privacy is evolving from a supplementary capability to a decisive moat in chain-level competition.

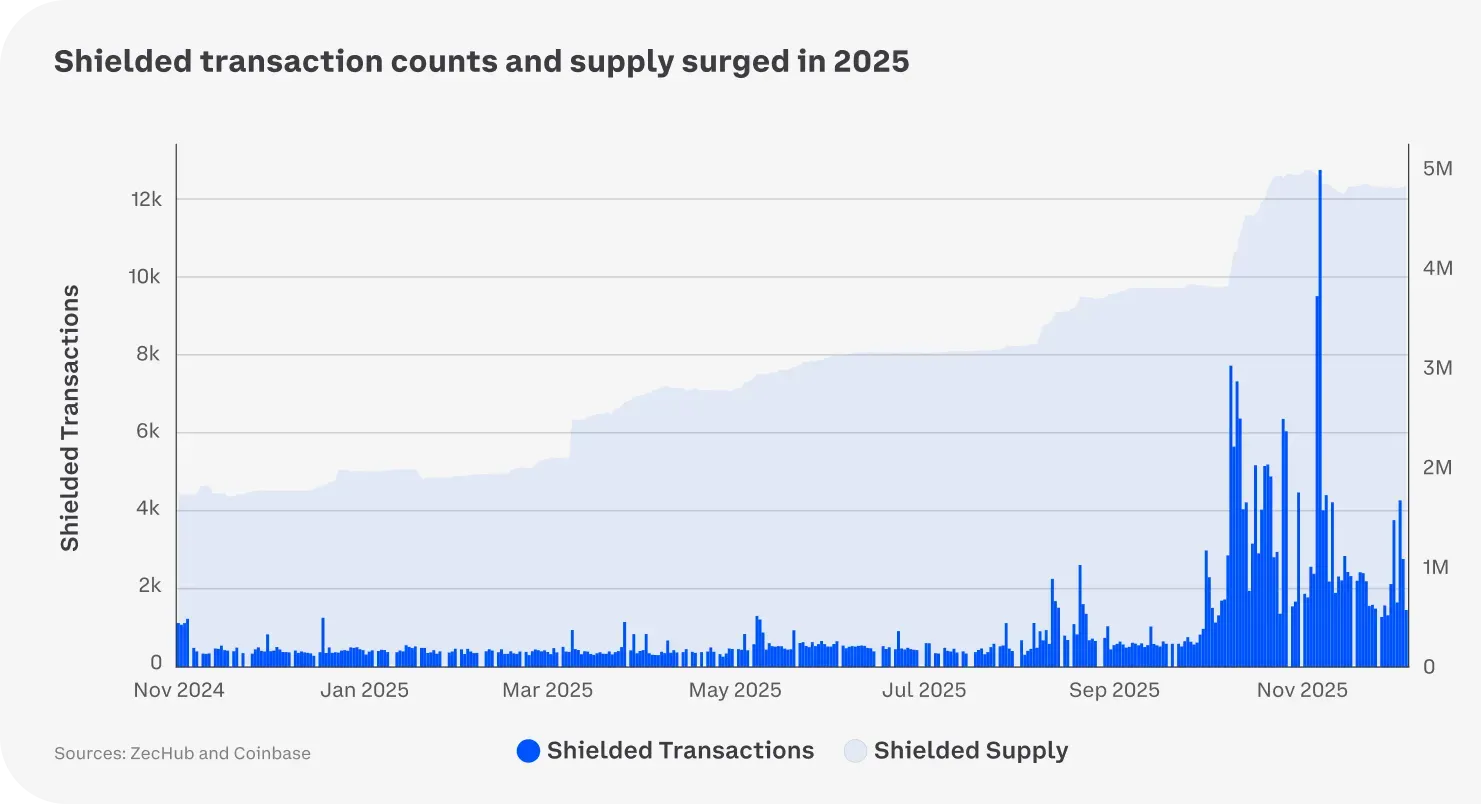

Privacy transaction volume began to enter a rapid growth phase starting Q4 2025.

3.2 Why is Privacy a Necessary Condition for "Financial Onchain"?

Real-world finance cannot operate on a "completely transparent" ledger.

The transparency of public blockchains was an advantage in the early days, but it has become a fatal flaw in real financial scenarios:

1) Companies cannot publicly disclose all trading counterparts and cash flows.

2) Institutions cannot expose positions, trading strategies, or capital structures.

3) Users cannot accept permanently traceable asset behavior histories.

Therefore: without privacy, on-chain can only support speculation; with privacy, on-chain can support finance. This is also why stablecoins, RWA, and institutional DeFi inevitably point towards privacy layers after reaching a certain stage of development.

Compared to ordinary public chains, public chains with privacy enhance user state on-chain by hiding transaction amounts, account relationships, and behavioral paths, making it difficult to replicate or easily migrate, thus significantly increasing migration costs and potential exposure risks.

People are extremely sensitive to privacy breaches, so once they enter the privacy ecosystem, they tend to maintain the status quo and complete as many financial activities as possible on the same chain.

This "user stickiness," combined with network effects, creates a winner-takes-most structure for privacy chains: the larger the ecosystem, the more users and funds it can attract, forming a positive feedback loop.

At the same time, privacy introduces barriers of incomplete information games and weak cross-chain connections, making advantages difficult to replicate or replace by other chains. Overall, privacy is not only a functional difference but also a core mechanism for changing market structure, locking in value, and forming long-term competitive advantages. Therefore, in the future, a few high-quality privacy chains are likely to dominate the important infrastructure and trading ecosystem of the crypto market.

Privacy is moving from the ideological margins of cryptocurrency to the core position of financial infrastructure. In an era where performance competition fails and narrative dividends fade, privacy may become one of the strongest and most enduring moats in the blockchain world.

4. The Integration of AI and Blockchain: From "Pseudo-Combination" to "True Paradigm"

In past cycles, "AI + Crypto" has appeared multiple times as a speculative narrative. Most of these attempts have been superficial: either awkwardly wrapping AI in a Web3 shell to create "AI computing power tokens" with no real demand, or simply viewing blockchain as a storage tool for AI data. This "pseudo-combination" essentially involves a shallow stitching together of two transformative technologies without addressing their complementary core—AI lacks a credible economic and collaborative layer, while blockchain lacks intelligence and adaptability.

However, in 2026, we are witnessing this integration elevate from a "marketing concept" to a "fundamental paradigm." The core transformation lies in: AI is no longer just an application on blockchain but is becoming the "intelligent layer" of blockchain protocols; at the same time, blockchain is no longer just a tool for AI but is evolving into the "trust and settlement layer" for AI agents to participate in social and economic activities on a large scale. This integration will unfold along two profound directions:

4.1 AI as the "Intelligent Engine" of the Protocol Layer

Future blockchain protocols will embed AI as a core component, enabling dynamic optimization and self-management capabilities:

1) In DeFi: Lending protocols can utilize AI models to analyze on-chain/off-chain data in real-time, dynamically adjusting interest rates and liquidation thresholds to achieve global optimization of risk and capital efficiency.

2) In security and governance: AI can serve as a real-time monitoring "on-chain immune system" for smart contract vulnerabilities and detecting abnormal trading patterns. In DAO governance, AI agents can automate complex resolutions or simulate the long-term impacts of proposals, assisting humans in making more informed decisions.

4.2 Blockchain as the "Institutional Foundation" of the AI Economy

As vast numbers of AI agents begin to replace humans in trading, collaboration, and value creation, they require a native, trustworthy, and automated "machine economy" environment. This is where blockchain's irreplaceable advantages lie:

1) Identity and Trust (KYA): Traditional "Know Your Customer" (KYC) cannot apply to machines. Blockchain can establish an immutable identity, reputation, and historical record system for each AI agent through cryptographic credentials, achieving "Know Your Agent," which is a prerequisite for large-scale machine collaboration.

2) Payments and Settlements: High-frequency, small-value, 24/7 micro-payments between AI agents (such as paying for data fees, API call fees) require a permissionless, globally settled payment track. Crypto-native currencies and smart contracts provide the perfect foundational layer for building this machine-native finance.

3) Data and Value Rights: Blockchain can ensure that the data used to train AI has transparent sources and clear copyrights, and through tokenization, data contributors can directly capture value, thus building a more equitable and efficient trusted data market than the current centralized model.

4.3 How Will This Change Industry Rules?

This deep integration essentially answers a fundamental question: in a future world with an increasing density of intelligent agents, how will value be generated, circulated, and secured? The answer points to a composite ecosystem where blockchain provides the institutional framework and AI drives economic growth. This is not just a technological combination but an innovation in economic and governance models. It allows the crypto industry to break free from the singular narrative of "financial speculation" and truly anchor itself in the core engine driving the next productivity revolution.

5. 2026 New Year Outlook: Change the Game, Earn Steadily

In simple terms, the crypto industry is undergoing a fundamental transformation. The previous approach of becoming wealthy through storytelling and concept hype is no longer viable; 2026 will mark the beginning of a pragmatic new phase.

5.1 Old Methods Fail, New Rules Emerge

The market has demonstrated through action: tokens that merely paint grand visions and print money endlessly will be ruthlessly discarded.

People are increasingly valuing whether a project truly has revenue, users, and can make money.

It's like the tide receding, revealing who has been swimming naked.

Now that the tide has gone out, the industry has reached an age where it must put on clothes and get to work.

5.2 Predictions for the Development Direction of Cryptocurrency in the New Phase

The four major trends discussed in this article collectively signify that a profound systemic migration in the crypto industry is entering a substantial phase. The year 2026 will be a critical starting point for this migration.

Institutional Layer (Blockchain-Native Finance): Reconstructing credit through code and consensus, providing a foundational framework with lower costs, less friction, and more open access. The "compliance path" in the U.S. is an inevitable process of new institutional requirements being recognized by the mainstream.

Asset Layer (Token Value Regression): Tokens will move past this extreme speculative "premium call option" phase and gradually become more "stock-like." Their value will increasingly depend on the project's real profitability rather than extravagant stories.

Security Layer (Privacy as Core Infrastructure): As on-chain begins to handle real business and finance, privacy will transform from an "optional accessory" to "core infrastructure." Privacy becomes a prerequisite for safeguarding business secrets and complex financial logic on-chain, key to unlocking blockchain's potential.

Intelligent Layer (AI and Blockchain Integration): Blockchain provides a trusted economic layer for AI agents, while AI makes blockchain protocols smarter. The "machine economy" born from the integration of the two will be the core of future growth.

For investors, this means a shift in logic: from chasing short-term narratives to identifying builders of long-term structural pillars. As regulation clarifies and assessments become more rational, the industry will emerge from the ruins of valuation disillusionment and enter a construction cycle that solidifies the foundation for a digital future. The noisy "gold rush" is cooling down, while the silent "city building" is just beginning. In 2026, we may stand at a healthier and more sustainable new starting point.

Disclaimer

The content of this article is written by the G2M team and is intended as a market analysis and trend discussion based on publicly available information. It does not constitute any form of investment advice or financial advisory opinion.

Not Investment Advice: All views, predictions, and analyses in this article are for research purposes only and are for reference. The cryptocurrency and digital asset markets are highly volatile, and investments carry significant risks, including the loss of principal. Before making any investment decisions, you should independently assess your financial situation and risk tolerance and seek the advice of a professional independent financial advisor.

Risk Warning: The cryptocurrency industry faces various uncertainties, including technological evolution, market competition, regulatory policy changes, and cybersecurity risks. Past performance does not guarantee future results. Any projects, technologies, or assets mentioned in this article do not guarantee their future performance or safety.

Information Sources: This article strives to reference and cite publicly available information and research from reliable sources, but we make no express or implied guarantees regarding its accuracy, completeness, or timeliness. Market information changes rapidly; please verify the latest situation before making decisions.

Conflict of Interest Disclosure: The authors and publishers of this article may have no interest in the projects, institutions, or assets mentioned in the text, and may or may not hold the assets mentioned. The publication of this article does not constitute any conflict of interest.

Copyright Notice: The copyright of this article belongs to the G2M team. Unauthorized reproduction, excerpting, or use for other commercial purposes is prohibited. Reasonable citations for academic exchange purposes are welcome, please indicate the source.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。