Author: Eli5DeF

Compiled by: Yuliya, PANews

Driven by a "perfect storm" of supply scarcity, the booming artificial intelligence (AI) infrastructure, and the growing estrangement of central banks from the dollar, gold, silver, and copper are experiencing their hottest market since 1979.

This article will delve into over 40 research reports, distilling core insights and exploring future trends.

TL;DR

Data Perspective: From 2025 to date, gold prices have risen by 72%, silver by 120%, and copper by 40%, marking the first time in 45 years that all three have reached historical highs simultaneously.

Core Argument: This is not a cyclical rebound but a fundamental shift in the global valuation logic of hard assets.

Investment Opportunity: In 2025, the return rate of silver mining ETFs could reach 195%, and this trading cycle is not yet over.

Risk Warning: The conclusion of peace agreements, the emergence of material substitutes, and short-term market corrections could lead to price pullbacks of 20% to 40%.

From AI to Energy, Gold, Silver, and Copper Become the New "Three Horsemen"

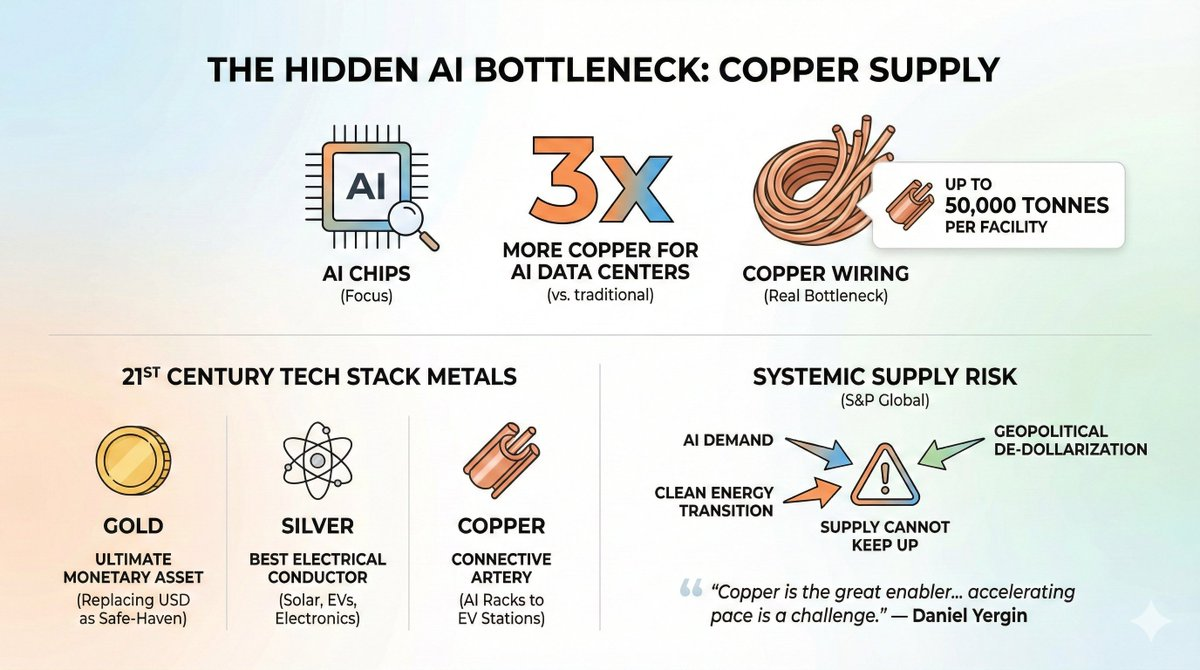

Currently, everyone's attention is focused on AI chips, but the real supply bottleneck lies in the copper wires that connect these chips.

A striking statistic is that the amount of copper consumed by AI data centers is three times that of traditional data centers, with a single facility consuming up to 50,000 tons of copper. Microsoft's $500 billion "Stargate" project alone may consume more copper than the annual output of some small countries.

Moreover, the driving demand is not solely from AI. The entire technology stack of the 21st century is built on these three metals:

Gold: The ultimate monetary asset, replacing the dollar as the primary safe-haven tool during geopolitical crises.

Silver: The best conductive metal on Earth, essential for solar panels, electric vehicles, and electronic devices in data centers.

Copper: The "artery" connecting all electrification systems, ubiquitous from AI server racks to electric vehicle charging stations.

The convergence of three major trends—AI demand, the clean energy transition, and geopolitical "de-dollarization"—has created what S&P Global calls "systemic risk" in the global economy, with supply unable to keep pace with demand.

"Copper is the great enabler of electrification, but the acceleration of the electrification process is posing an increasingly severe challenge to copper supply."

— Daniel Yergin, Vice Chairman of S&P Global

This is not an exaggeration. Let's analyze the data one by one.

I. An Unsolvable Supply Crisis

Silver: A Supply Gap for the Fifth Consecutive Year

Since 2020, the silver market has never achieved supply-demand balance, and the situation is worsening.

From 2021 to 2025, the cumulative supply gap is close to 820 million ounces, nearly equivalent to an entire year's global production. Silver inventories on the London Metal Exchange (LME) have plummeted by 75% from their peak in 2019. In October 2025, silver prices briefly reached a historical high of $54.24 per ounce before retreating.

Why can't supply keep up?

A little-known secret in the silver mining industry is that 70% of its output is produced as a byproduct of gold, copper, lead, and zinc mining. This means that when the market needs more silver, it cannot simply mine more silver; the mining of the primary metals must also be economically viable to drive an increase in silver output. Currently, this is not the case.

Primary silver mines also face numerous challenges: declining ore grades, a severe lack of investment in exploration over the past decade, and environmental, social, and governance (ESG) and permitting obstacles, which could delay the launch of new projects by over ten years.

The Silver Institute bluntly states: "Investment in silver mines has been insufficient over the past decade."

Copper: Systemic Risk

If silver's situation is concerning, copper's issues are a matter of survival.

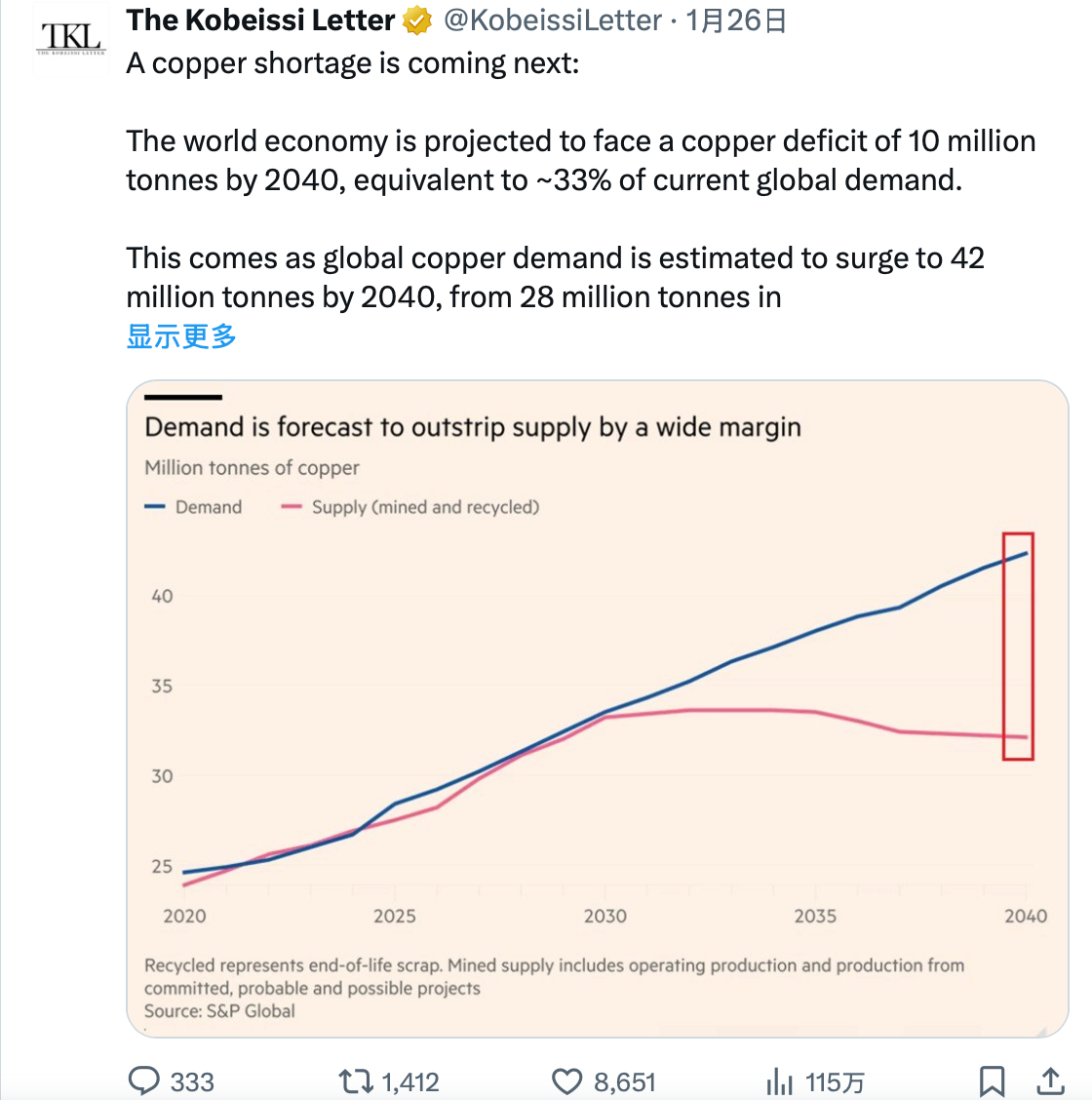

S&P Global's report in January 2026 predicts that global copper demand will soar by 50% by 2040, increasing from 28 million tons to 42 million tons. Meanwhile, supply growth is expected to flatten or even decline.

By 2040, the copper supply gap is projected to reach 10 million tons, equivalent to nearly 40% of current global production.

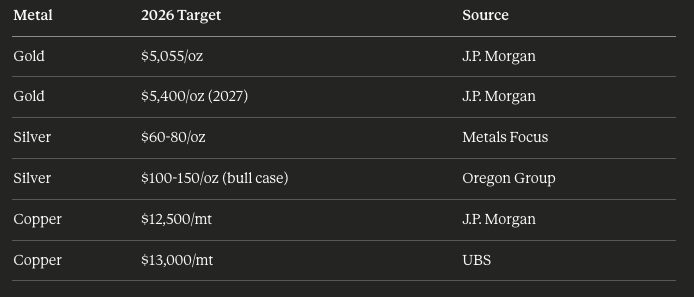

J.P. Morgan predicts that in 2026 alone, the refined copper market will face a shortfall of 330,000 tons, with prices potentially reaching $12,500 per ton by mid-year.

What is driving demand?

Three major macro trends are converging:

AI Infrastructure: Half of the GDP growth in the U.S. in 2025 will come from AI-related spending, including data centers, chips, and power systems. A hyperscale AI facility requires 27 to 33 tons of copper per megawatt of capacity. The data behind this is stark: global data center electricity demand is expected to grow from 2% of total global electricity consumption to 9% by 2050.

Clean Energy Transition: The copper usage in electric vehicles is 2.9 times that of internal combustion engine vehicles, with each car using about 60 kilograms more copper. The annual new installed capacity of solar panels has exceeded 500 gigawatts (GW), and each gigawatt of solar panels, inverters, and grid connections requires thousands of tons of copper.

Grid Modernization: The process of delivering electricity to AI data centers actually consumes more copper than the data centers themselves. Upgrades to the grid, transmission lines, substations, etc., are all heavily reliant on copper.

Why can't supply keep up?

New copper mines take 10 to 15 years from discovery to production, and there are currently very few projects in the development stage. A series of significant disruptions in 2025 have exacerbated the shortage—landslides at the Grasberg mine, the second-largest copper mine in the world, issues at the Kamoa-Kakula copper mine in the Democratic Republic of the Congo, and drought at the El Teniente copper mine in Chile.

The "Resolution Copper" project in the U.S. could have become one of the largest domestic sources of copper, but it has been stalled due to legal disputes involving sacred sites of the Apache tribe, with at least ten years until production.

As one analyst pointed out: "Mining companies are vigorously promoting a compelling long-term shortage story—the market has bought into it. But belief and fundamentals are not the same thing."

However, for now, the fundamentals do indeed support this belief.

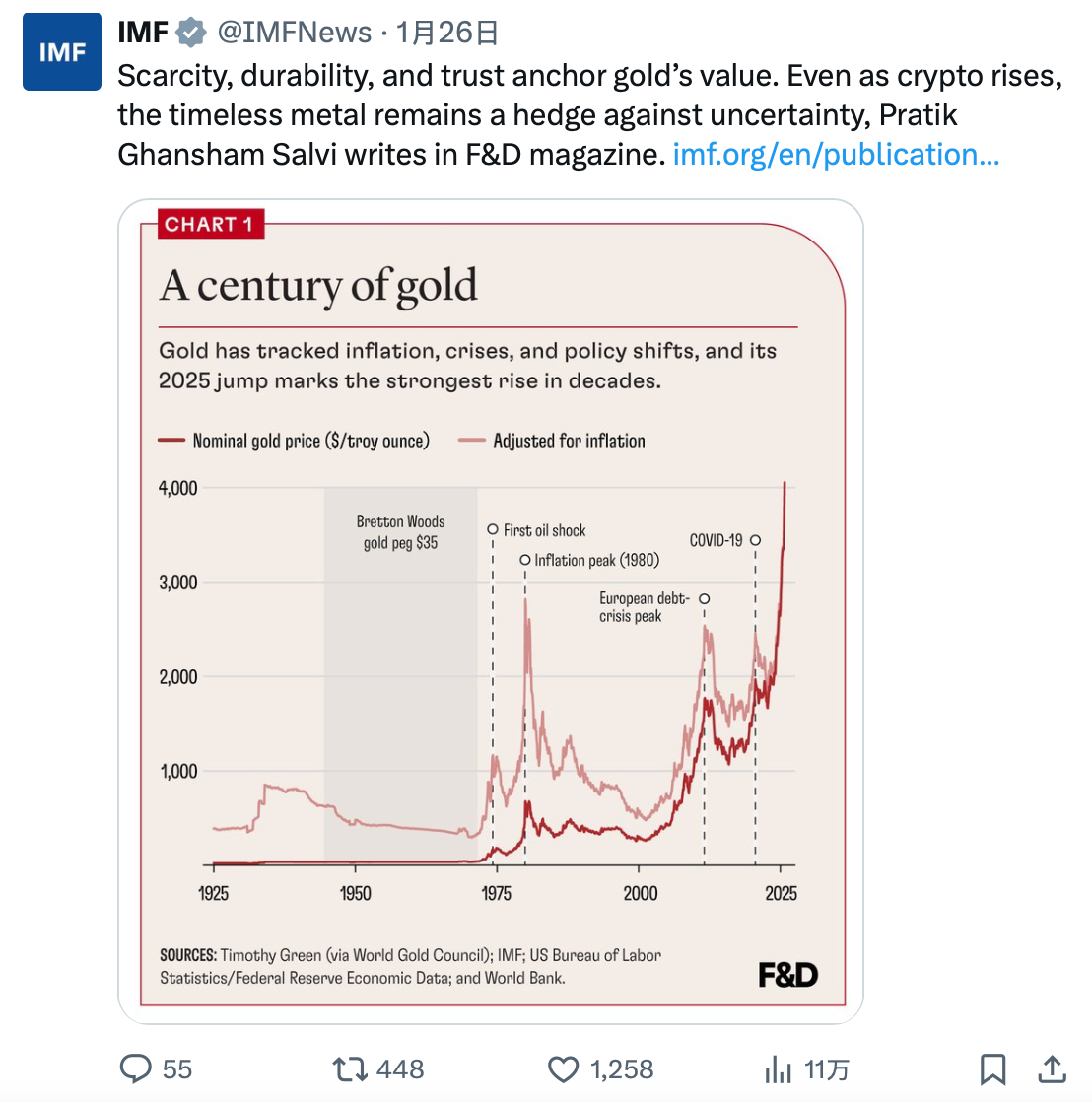

Gold: The Central Bank's Hedge Tool

The situation for gold is different. There is no industrial supply crisis; gold production is relatively stable, with an annual output of about 3,000 tons.

The real change lies in who is buying.

Since Russia's invasion of Ukraine in 2022 and the freezing of its foreign exchange reserves, central banks have been accumulating gold at an unprecedented pace. For three consecutive years, the annual gold purchases by global central banks have exceeded 1,000 tons, more than double the pre-COVID average.

China alone has increased its gold holdings for 13 consecutive months while reducing its holdings of U.S. Treasury bonds to the lowest level in 17 years (down to $688 billion by the end of 2024).

This is not speculative behavior but a structural shift in how sovereign wealth managers think about reserve assets.

Data from the World Gold Council shows that gold's share of total global financial assets has risen to 2.8%, the highest level since 2010. J.P. Morgan predicts that central bank gold purchases will remain at 755 tons in 2026, with gold prices potentially reaching $5,055 per ounce in the fourth quarter.

A catalyst that has not been widely discussed is:

Before 2022, the dollar was the primary safe-haven asset during geopolitical crises. But that has changed. During the Venezuelan crisis in 2025—when the U.S. captured Nicolás Maduro—gold prices soared while the dollar exchange rate remained virtually unchanged.

Gold has replaced the dollar as the market's preferred safe-haven asset during rising geopolitical risks.

II. Unforeseen AI Demand

For readers focused on the tech sector, the following content will be particularly engaging.

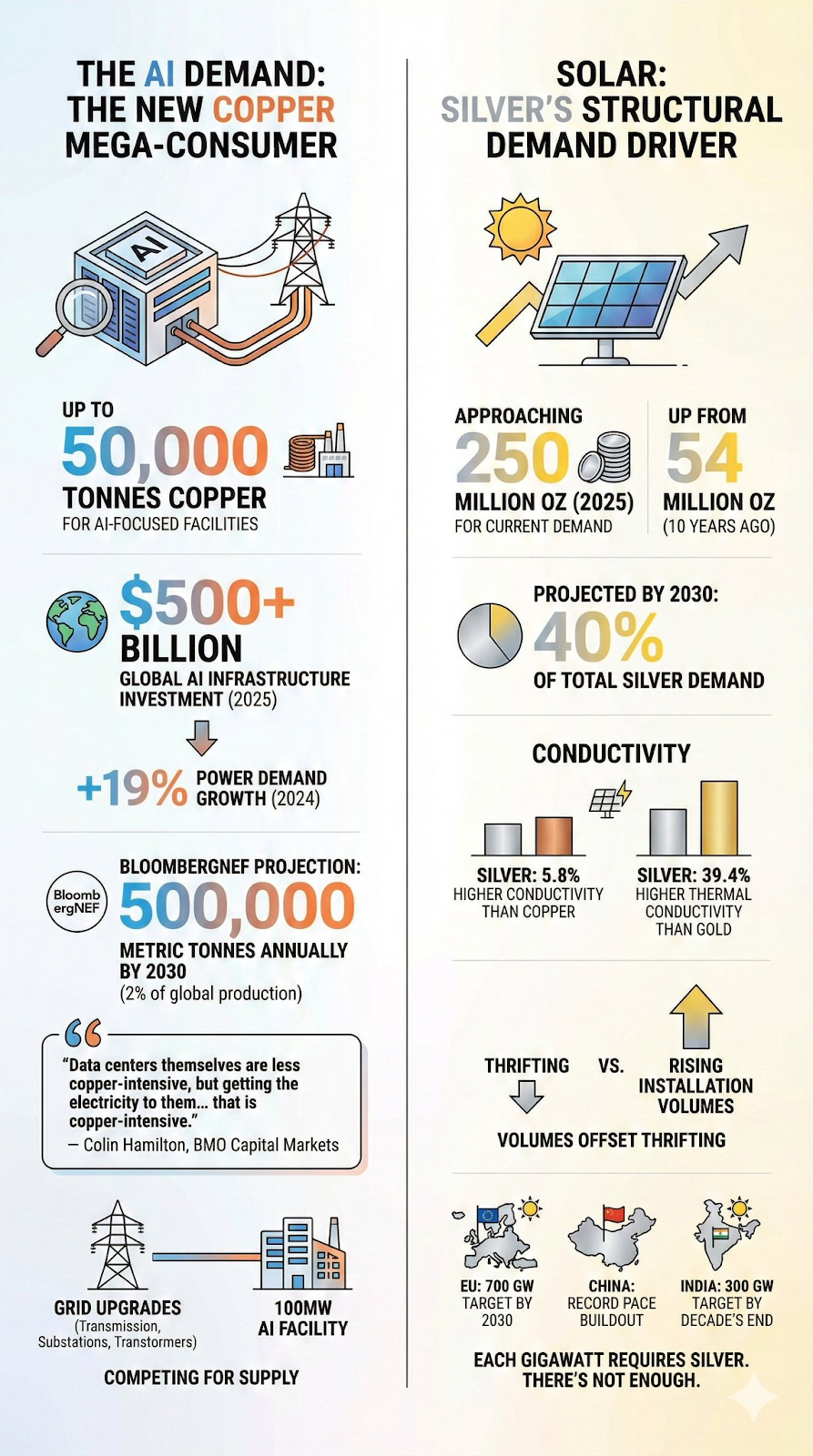

Data Centers: The New Copper Consumption Giants

Traditional data centers are already significant copper consumers, relying on copper for power distribution, cooling systems, and network infrastructure. AI data centers, however, exist on an entirely different scale.

Relevant data includes:

A typical hyperscale data center uses 2,000 to 3,000 tons of copper.

AI-focused facilities can use up to 50,000 tons of copper.

In 2025, global AI infrastructure investment will exceed $500 billion.

In 2024 alone, electricity demand from data centers is expected to grow by 19%, compared to an 8% increase in 2022.

BloombergNEF predicts that by 2030, data centers could consume 500,000 tons of copper annually, accounting for about 2% of global production, whereas this ratio was nearly zero a decade ago.

But the real demand does not come from within the data centers; it lies in the grid infrastructure needed to power them.

"The copper intensity of the data centers themselves is gradually decreasing, but the process of delivering electricity to the data centers is extremely copper-intensive." — Colin Hamilton, BMO Capital Markets

Each 100-megawatt (MW) AI facility requires massive grid upgrades, including transmission lines, substations, and transformers, all of which are competing for limited copper supplies.

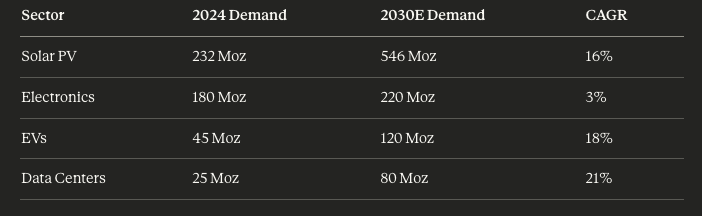

Solar Energy: The Structural Demand Driver for Silver

The solar photovoltaic industry has completely transformed the silver market. A decade ago, the solar industry consumed 54 million ounces of silver annually. By 2025, this figure is expected to approach 250 million ounces and is still growing.

It is predicted that by 2030, the solar industry could account for 40% of total global silver demand.

Silver's exceptional conductivity (5.8% higher than copper) and thermal conductivity (39.4% higher than gold) make it irreplaceable in efficient applications. Although solar panel manufacturers are striving to "economize on silver," meaning reducing the silver content per panel, the continuous increase in installed capacity completely offsets the savings from these efforts.

The EU aims to achieve 700 gigawatts (GW) of solar installed capacity by 2030; China continues its construction at an unprecedented pace; India plans to reach a solar target of 300 GW by the end of this decade.

Every gigawatt of installed capacity requires silver, while silver supply is tight.

III. Geopolitical Catalysts

"De-dollarization" is Real

The Russia-Ukraine war has not only disrupted commodity supplies but has also triggered a fundamental rethinking among sovereign wealth managers regarding reserve asset allocation.

When Western countries froze Russia's foreign exchange reserves in 2022, all central banks took note. The message conveyed was that dollar-denominated assets are at risk of confiscation.

Countries' responses have been very clear:

China: Reduced its holdings of U.S. Treasury bonds from $1.1 trillion in 2021 to $688 billion in 2024 while accumulating gold significantly.

India: Increased its gold ETF holdings by 40% in 2025.

Emerging Markets: Their levels of gold reserves are far below those of developed economies, indicating continued room for accumulation.

Since early 2022, the renminbi has depreciated by nearly 20%, making gold a more attractive store of value for Chinese savers and institutions.

Conflict Premium is Sticky

The traditional market view holds that once the headlines fade, the geopolitical premium in commodity prices quickly disappears. However, this is not the case now.

2025 witnessed multiple geopolitical hotspots:

Ongoing Russia-Ukraine conflict (since 2022)

Middle East tensions (Gaza, Iranian attacks, disruptions in Red Sea shipping)

Venezuelan crisis (U.S. captures Maduro)

Escalation of U.S.-China trade frictions (announcing a 50% tariff on copper)

Each event has reinforced gold's status as a safe haven. The cumulative effect is that even during relatively calm periods, a persistent premium has not dissipated.

Analysis from the World Gold Council shows that geopolitical risk accounted for about 60% of gold's return in 2025, the highest contribution ratio on record.

IV. Investment Logic

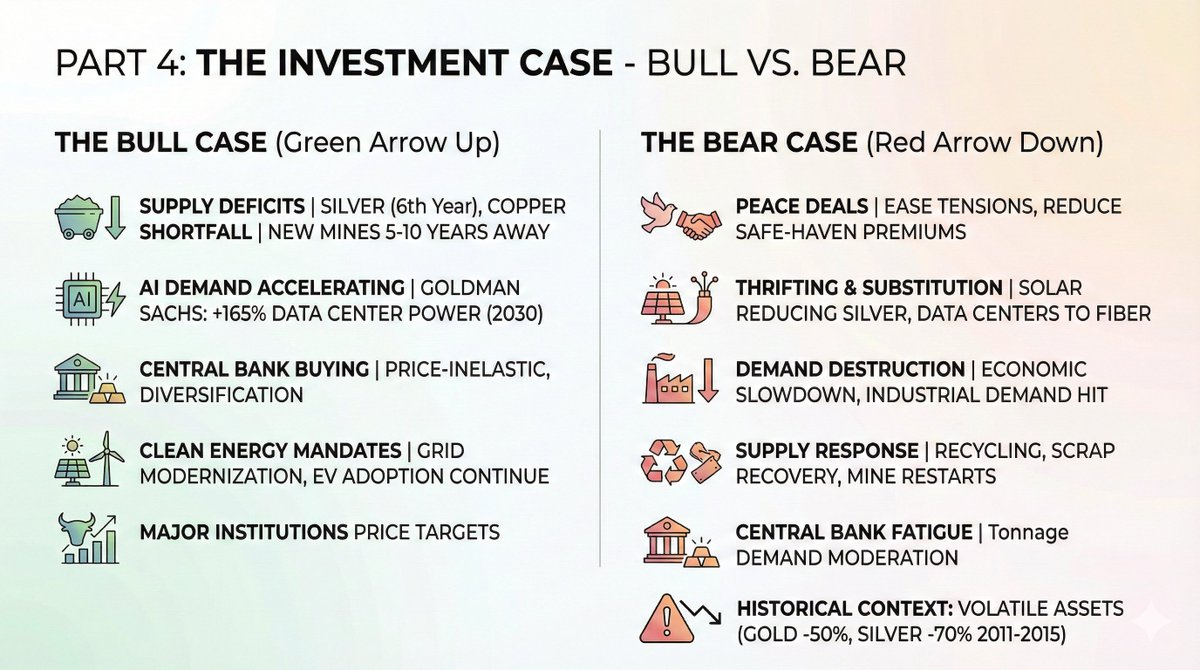

Bullish Reasons

Persistent structural drivers:

Ongoing supply deficits: Silver is expected to face its sixth consecutive deficit year in 2026. The copper shortage is widening. New mine supplies take 5 to 10 years to come online.

Accelerating AI demand: Goldman Sachs predicts that electricity demand from data centers will grow by 165% by 2030. Every watt of power requires copper.

Continued central bank purchases: Even if gold prices exceed $4,000 per ounce, central banks are not sensitive to price. The urgent need for diversification outweighs sensitivity to short-term prices.

Clean energy directives remain effective: Despite changes in the political landscape, global grid modernization and the proliferation of electric vehicles continue.

Price targets from major institutions:

Bearish Reasons

Before investors decide to enter the market in large volumes, potential risks need to be considered:

Peace Agreements: Easing of tensions in Ukraine, cooling in the Middle East, or a thaw in U.S.-China trade relations could significantly reduce the safe-haven premium.

Conservation and Substitution: Solar manufacturers are actively reducing silver usage. Data centers are shifting some applications to fiber optics. These trends will accelerate during high prices.

Demand Destruction: An economic slowdown could severely impact industrial demand. Remember: 60% of silver demand comes from industrial use.

Supply Response: High prices will stimulate recycling, scrap recovery, and the restart of marginal mines. Some of the "deficit" may be compensated by above-ground inventories.

Central Bank Fatigue: When gold prices exceed $4,000 per ounce, central banks need to purchase fewer tons to achieve the same dollar allocation target. Ton demand may slow.

Historical Context: After the post-financial crisis rebound, gold prices fell by 50% between 2011 and 2015, while silver plummeted by 70%. These are all high-volatility assets.

How to Position

Investment tools categorized by risk preference:

Selected ETFs:

1. Physical Exposure:

$GLD (SPDR Gold Shares) — The largest and most liquid gold ETF.

$SLV (iShares Silver Trust) — The most liquid silver ETF.

$PSLV (Sprott Physical Silver) — Redeemable for physical gold and silver.

2. Mining Exposure:

$GDX (VanEck Gold Miners) — Major gold miners, up 166% year-to-date in 2025.

$SILJ (Amplify Junior Silver Miners) — Junior silver miners, up 195% year-to-date in 2025.

$COPX (Global X Copper Miners) — Broad exposure to copper miners, up 80% year-to-date in 2025.

3. Notable Stocks:

Wheaton Precious Metals ($WPM) — Operates on a "streaming" model, with lower operational risk.

Pan American Silver ($PAAS) — The largest silver-focused producer.

Freeport-McMoRan ($FCX) — Blue-chip level copper exposure.

4. DeFi Perspective: For investors preferring on-chain exposure:

PAXG (Paxos Gold) — A token pegged 1:1 to physical gold, usable in DeFi.

XAUT (Tether Gold) — Institutional-grade tokenized gold.

Trade HIP-3 on HyperliquidX to long/short commodities.

These tools make it possible to implement yield strategies on gold positions within DeFi protocols, which physical gold and silver cannot achieve.

Risk Warning

It is essential to candidly consider potential risks:

Volatility Risk: These are not stablecoins. During the 2011-2015 correction, gold fell by 50%, and silver by 70%. Therefore, position management is crucial.

Timing Risk: This rebound is already historic. Entering after gold has risen 72% and silver 120% means paying a high price.

Liquidity Risk: During market stress, liquidity in junior mining stocks may be poor. When investors most need to exit, bid-ask spreads will widen.

Operational Risk: Mining companies face risks such as cost overruns, permitting delays, labor disputes, and resource nationalism. ETFs can reduce but not eliminate these risks.

Macro Risk: Scenarios of declining inflation and rising real interest rates could pressure gold prices.

Conclusion

The bullish logic for gold, silver, and copper is not based on speculation but on mathematics.

Demand is structurally higher: AI infrastructure, clean energy, and central bank de-dollarization are not cyclical trends but structural shifts with tailwinds lasting a decade.

Supply is structurally constrained: New mines take over 10 years to come online, existing mines are facing declining grades, and recycling cannot fill the gap.

The market is beginning to price this in. In 2025, mining ETFs have significantly outperformed physical metals, signaling that mature capital is positioning for a sustained strength in commodities.

This is not just a trade; it is a transformation in the world’s valuation system for hard assets against the backdrop of AI infrastructure development, energy transition, and fiat currency depreciation.

The window of opportunity has opened, but it will eventually close.

Investors should adjust their positions accordingly. NFA + DYOR.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。