Original | Odaily Planet Daily (@OdailyChina**)

Author | Ethan (@ethanzhangweb3**)_

RWA Market Performance

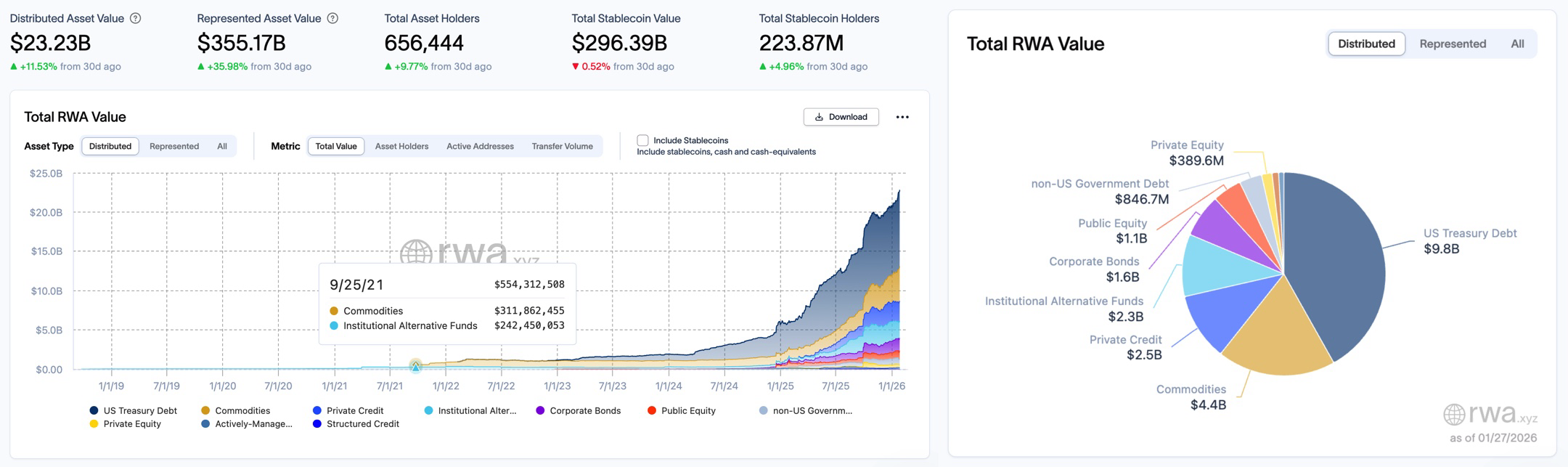

According to the rwa.xyz data dashboard, as of January 27, 2026, the total on-chain value of RWA (Distributed Asset Value) continues to rise steadily, increasing from $21.66 billion on January 20 to $23.23 billion, with a weekly increase of $760 million, an increase of 3.51%. The broader RWA market also saw a significant rebound, rising from $350.08 billion to $355.08 billion, an increase of $5 billion, with a growth rate of 1.43%. The total number of asset holders increased from 637,807 to 656,444, a net increase of 18,637 people in a week, representing a growth of 2.92%. Meanwhile, the stablecoin market maintained relatively steady growth, with the number of holders increasing from 223.34 million to 223.87 million, a growth of 0.23%; the market cap of stablecoins slightly rose from $299.64 billion to $299.964 billion, an increase of 0.1%.

In terms of asset structure, the dominant on-chain value of U.S. Treasury bonds remained unchanged at $9.1 billion. Commodity assets continued to perform strongly, growing from $4 billion to $4.2 billion, an increase of 5%. The non-U.S. government debt sector also continued to grow, rising from $8.319 billion to $8.491 billion, an increase of 2.07%. Public equity performance remained strong, increasing from $8.631 billion to $8.754 billion, a growth of 1.43%. Private equity saw a slight increase from $425.5 million to $429.3 million, continuing its growth. The private credit sector also remained stable, slightly rising from $2.5 billion to $2.55 billion. Institutional alternative funds saw a slight decline, decreasing from $2.3 billion to $2.2 billion.

Trend Analysis (Compared to Last Week)

During this period, the RWA market continued to show a healthy expansion trend, with stable growth in the total value of on-chain assets and a relatively balanced allocation trend in market structure. Capital flows gradually tilted towards medium to high-risk asset classes, particularly in commodities, non-U.S. government debt, and equity assets, indicating a market preference for medium-risk assets. The slight increases in private credit and private equity suggest that investors remain attentive to the stability of these asset types. The robust growth in stablecoin market cap and user base also lays a foundation for subsequent capital flows, further driving the market's reservoir effect, which is consistent with last week's situation.

Market Keywords: Market Expansion, Capital Risk Preference, Capital Diversion

Key Event Review

Tokenized Gold and Tokenized Silver Market Caps Hit New Highs

According to Coingecko data, as gold prices continue to rise, the total market cap of the tokenized gold sector has surpassed $5.27 billion, currently reaching $5,275,490,349, with a 24-hour increase of 1%; the market cap of the tokenized silver sector has also exceeded $400 million, currently at $439,598,206, with a 24-hour increase of 4.5%, both hitting new highs.

U.S. crypto asset regulation is accelerating, and the proposed crypto market structure bill, if passed, will clarify federal regulatory authority over digital assets, making cryptocurrencies easier to manage, track, and trade, potentially attracting more investors and enhancing token value. It is reported that crypto platforms like Coinbase and Kraken plan to comply with a registration system, while stablecoin issuers like Circle and Tether will need to meet bank-like regulatory requirements to ensure the safety of retail investors' assets. The subsequent process includes: obtaining approval from two Senate committees, passing a full Senate vote, returning to the House for final signing, and finally being signed by Trump. Overall, most crypto investors are unlikely to be affected in the short term, but in the long run, the bill is expected to provide a safer and more predictable trading environment while making compliance operations of crypto platforms more transparent.

Paul Chan: Hong Kong Expected to Issue Stablecoin Licenses Later This Year

Financial Secretary Paul Chan stated at the World Economic Forum annual meeting that Hong Kong is taking an active and prudent approach to developing digital assets and promoting market development based on the principles of equal activities, equal risks, and equal regulations. Since 2023, Hong Kong has issued licenses to 11 virtual asset trading platforms and expects to issue stablecoin licenses later this year. Additionally, the Hong Kong government has issued three batches of tokenized green bonds totaling approximately $2.1 billion and launched a regulatory sandbox to encourage application innovation.

Lee Chang-yong, attending the Asian Financial Forum in Hong Kong, stated that in light of market pressures, South Korean authorities have allowed domestic residents to invest in overseas-issued virtual assets, and the financial regulatory agency is considering establishing a new registration system to allow domestic institutions to issue virtual assets.

Lee Chang-yong pointed out that if a won-denominated stablecoin is introduced, its main use may focus on cross-border transactions, while tokenized deposits would be more suitable for domestic payment scenarios. However, he emphasized that there is still significant controversy surrounding stablecoins. The core concern is whether a won stablecoin could be used to circumvent capital flow management, especially when used in conjunction with U.S. dollar stablecoins.

He further stated that U.S. dollar stablecoins have a wide range of applications and low entry barriers, with related transaction costs significantly lower than directly using U.S. dollars. When exchange rate fluctuations trigger changes in market expectations, funds may quickly flow into U.S. dollar stablecoins, causing large-scale capital transfers; at the same time, the involvement of many non-bank institutions in stablecoin issuance significantly increases regulatory difficulty.

Additionally, Lee Chang-yong noted that South Korea has a highly developed fast payment system, so the advantages of retail central bank digital currency (CBDC) are limited. Currently, the central bank is advancing tokenized deposits and wholesale CBDC through multiple pilot projects to maintain the existing dual financial system.

Thailand SEC Releases Three-Year Strategic Plan, Will Launch Crypto ETF Regulatory Framework

The Thailand Securities and Exchange Commission (SEC) has released a three-year strategic plan for 2026-2028, focusing on developing a regulatory framework for crypto ETFs and promoting asset tokenization. Thailand SEC Secretary-General Pornanong Budsaratragoon stated that the plan aims to develop digital assets as a formal investment category and enhance local market competitiveness.

According to the plan, the Thailand SEC expects to issue regulatory guidelines for crypto ETFs early this year and explore issuing them in trust form. Meanwhile, the Thailand Futures Exchange (TFEX) is studying the launch of crypto futures trading. In terms of security regulation, the Thailand SEC intercepted 47,692 crypto mule accounts used for fraud in 2025 and handled over 12,000 investor inquiries. Currently, the market value of Thailand's digital asset market is approximately $3.19 billion, with an average daily trading volume of $95 million. Additionally, the Thai government has approved a capital gains tax exemption for crypto transactions conducted through authorized service providers from 2025 to 2029.

American Bankers Association Plans to Lobby Against Interest-Bearing Stablecoins

The American Bankers Association has listed "preventing stablecoins from generating yields" as a top lobbying goal for 2026. The association believes that interest-bearing stablecoins could become an alternative to bank deposits, potentially leading to trillions of dollars in funds flowing out of the traditional banking system, thereby weakening banks' lending capacity and jeopardizing their core role in the financial system.

In response, Circle CEO Jeremy Allaire countered at the Davos Forum, stating that concerns about stablecoin yields affecting bank deposits are "completely absurd," and pointed out that yields can enhance user stickiness, and that in the future, stablecoins will become a necessary payment system for AI agents conducting large-scale transactions. Opponents argue that this move aims to protect bank interests, limit fintech innovation, and put the U.S. dollar at a disadvantage in competition with China's digital yuan. Opinion: NYSE's Security Tokenization Plan More Like "Concept Packaging," Lacking Key Detail Support

Fortune magazine analyst Omid Malekan stated that the NYSE's large tokenization plan is merely an empty promise dressed in innovation, emphasizing that 24/7 trading and instant settlement are not unique to blockchain, as existing centralized systems can achieve this technically. The real resistance comes from the interests of existing intermediaries and business partners, and there has been no disclosure of which blockchains and stablecoins the plan supports, as well as programming languages, virtual machines, and token standards. Considering that the NYSE's grand plan "awaits regulatory approval," the lack of such details is puzzling. The core advantage of public chains is not database efficiency, but permissionless global access and a financial architecture similar to bearer assets, which fundamentally conflicts with the NYSE's clearly reserved "qualified broker-dealer participation only" market structure.

Before next week's Senate Agriculture Committee hearing and debate on the crypto market structure bill, Democratic lawmakers have submitted multiple amendments to the bill.

One of the amendments aims to add the "Digital Asset Ethics Act" to the bill. This amendment would prohibit "regulated persons" such as the President, Vice President, and members of Congress from engaging in certain financial transactions involving digital assets. Bloomberg has estimated that Trump has profited approximately $1.4 billion from his cryptocurrency investments, including investments from DeFi and the stablecoin project World Liberty Financial. The Trump family also holds a 20% stake in the mining company American Bitcoin.

Other amendments include measures to prevent "digital asset self-service terminals" from conducting fraudulent transactions; and a requirement to delay the effectiveness of future cryptocurrency legislation until at least four members of the Commodity Futures Trading Commission (CFTC) are appointed. Currently, the CFTC has only one commissioner, while the maximum number of commissioners is five, making this issue a focal point of debate among some legislators.

Stablecoin Transfers Exceeded $35 Trillion Last Year, but Only 1% for Real-World Payments

A new report from consulting firm McKinsey and blockchain data company Artemis Analytics shows that over $35 trillion was transferred on the blockchain using stablecoins last year, but only about 1% of that was for real-world payments. The analysis estimates that only $380 billion of the activity reflected actual payments, such as payments to suppliers, remittances, or payroll. This accounts for approximately 0.02% of the total global payments, while McKinsey estimates that the total global payments exceed $200 trillion annually.

Tether officially announced that Tether Gold holds over half of the entire gold stablecoin market share, with key metrics at the end of Q4 2025:

Total physical gold reserves: 520,089.350 ounces (troy ounces)

Total circulating XAU₮ tokens: 520,089.300000 XAUT

Gold reserves: 1:1, with each XAUT token backed by one troy ounce of physical gold.

Total market cap: $2,246,458,120

Tokens sold: 409,217.640000 XAUT

Tokens available for sale: 110,871.660000 XAUT

Tech-driven financial services company Capital One has agreed to acquire fintech company Brex for cash and stock (50% each), with a transaction valuation of $5.15 billion, integrating it into its commercial banking and payment business. The deal is expected to close in mid-2026, with Franceschi continuing to lead Brex within Capital One's commercial banking and payment operations.

Brex had previously announced plans to launch a native stablecoin instant payment feature.

China Pacific Insurance Investment Management (Hong Kong) Co., Ltd. (CPIC IMHK) announced the establishment of a reality world asset (RWA) tokenization fund in collaboration with Hivemind Capital, with an initial target set at $500 million. The specific amount will depend on market conditions, demand from institutions and other non-retail qualified investors, and approval from relevant regulatory authorities. The two companies are committed to combining on-chain investment infrastructure with established asset management practices to provide transparent, compliant, and institutionalized tokenized investment products.

Blockchain infrastructure company Zerohash is negotiating to raise $250 million at a $1.5 billion valuation; however, Zerohash has not yet responded to requests for comment on this matter. As discussions are still ongoing, the amount may change. Zerohash raised $104 million in a D-2 round of financing led by Interactive Brokers last October, achieving a valuation of $1 billion. The company, founded in 2017, provides APIs and embeddable developer tools that enable financial institutions and fintech companies to deliver cryptocurrency, stablecoins, and tokenized products.

As AI nearly "dominated" the World Economic Forum 2026 annual meeting, virtual currencies, which once gained immense popularity in Davos, returned to the spotlight. Representatives from traditional banks and regulatory agencies, along with crypto industry leaders, engaged in a sharp debate on whether tokenization is on the verge of an explosion, how digital currencies reshape sovereign boundaries, and the foundational trust of the financial system:

Coinbase CEO Brian Armstrong pointed out that tokenization addresses the efficiency challenges of the financial system, enabling real-time settlement and reducing costs, but its core strength lies in "democratizing access to investment."

Euroclear CEO Valérie Urbain views tokenization as an "evolution of financial markets and securities" that could shorten issuance cycles and reduce costs for issuers, potentially helping the market "reach a broader range of investors" and play a role in "financial inclusion."

François Villeroy de Galhau, Governor of the Bank of France, believes that increasing investment opportunities must be accompanied by an enhancement in financial literacy; otherwise, tokenization could turn into a disaster.

Bill Winters, CEO of Standard Chartered Group, candidly stated that while achieving tokenization of the vast majority of transactions by 2028 may seem optimistic, the direction that "the vast majority of assets will ultimately be settled digitally" is irreversible.

Ripple CEO Brad Garlinghouse quoted former Federal Reserve Chairman Ben Bernanke, stating that the government will not relinquish control over the money supply. Ripple's current strategy leans more towards building a bridge between traditional finance and decentralized finance rather than challenging sovereignty itself.

"1011 Insider Whale" agent Garrett Jin posted on the X platform, stating that in the context of de-dollarization, extending the debt cycle to help the U.S. resolve its debt issues seems unrealistic. Tokenizing U.S. stocks to drive stablecoin demand is a primary viable path for the U.S. to refinance its growing debt, as evidenced by BlackRock's push for RWA, against the backdrop of the continuous accumulation of U.S. debt. Since 2025, there have been rumors of the so-called "Mar-a-Lago Agreement," but this agreement has never been formally signed or implemented. Its core idea is to alleviate the burden of $36 trillion in U.S. federal debt. The reality is that U.S. debt continues to rise, and de-dollarization has not slowed down, with countries like Sweden, Denmark, and India reducing their holdings of U.S. Treasury bonds. If the U.S. wants to pay off old debts with new ones, the only realistic path is to issue more stablecoins to bring new global capital into U.S. Treasury bonds. To achieve large-scale operations, the solution is RWA, which involves putting U.S. stocks on-chain. Tokenizing the $68 trillion worth of U.S. stocks would significantly increase stablecoin demand and indirectly absorb debt pressure. This is why BlackRock, closely connected to the U.S. power center, is actively promoting RWA and on-chain stock trading. In this context, ETH will become the settlement layer for the global capital market due to real needs, and 2026 will be the "Year of RWA."

CZ: Future Outlook on Tokenization, Payments, and AI

CZ spoke at the "Financial New Era" panel discussion at the Davos World Economic Forum, stating, "The overall scale of trading platforms has surpassed last year. Currently, the crypto industry has two mature sectors: trading platforms and stablecoins. Looking ahead, I see three new directions:

First, tokenization is a very important direction. By tokenizing certain assets, governments can more efficiently address financial issues, enhance the operational efficiency of the financial system, and thereby promote the development of related industries and trading markets.

The second is payments. In the past, we have also tried crypto payments, but frankly, not many people actually used them. However, there is now a trend emerging: traditional payment methods are integrating with crypto technology. For example, users complete payments using cards like Visa and Mastercard, funds are deducted from their accounts, and merchants receive fiat currency, while the settlement and bridging occur through stablecoins and blockchain. This model is gradually being implemented and will definitely develop in the future.

The third direction is artificial intelligence (AI). He believes that the "native currency" of AI agents should naturally be cryptocurrency, as blockchain is currently the most suitable native technology interface for AI agents. Today's AI is not yet a true agent; they do not book flights, reserve restaurants, or complete payments directly for you. But once AI truly possesses the ability to act and transact, cryptocurrency will become its most natural and native method of payment and settlement.

Hot Project Updates

Ondo Finance (ONDO)

One-Sentence Introduction:

Ondo Finance is a decentralized finance protocol focused on structured financial products and the tokenization of real-world assets. Its goal is to provide users with fixed-income products, such as tokenized U.S. Treasury bonds or other financial instruments, through blockchain technology. Ondo Finance allows users to invest in low-risk, high-liquidity assets while maintaining decentralized transparency and security. Its token ONDO is used for protocol governance and incentive mechanisms, and the platform also supports cross-chain operations to expand its application scope within the DeFi ecosystem.

Latest Update:

On January 21, Ondo Finance announced that over 200 tokenized U.S. stocks and ETFs are now live on the Solana mainnet, bringing a complete traditional finance (TradFi) portfolio into the crypto space. More than 200 assets are available for Solana users to trade, including stocks from various industries, ETFs, market indices and sector funds, gold, silver, oil, strategic metals, government bonds, corporate bonds, leveraged and inverse ETFs, and more.

On January 24, according to official data, Ondo Finance's total locked value (TVL) has surpassed $2.5 billion, making it a leading platform for tokenized U.S. Treasury bonds and stocks globally. Ondo's TVL in the tokenized U.S. Treasury bond sector is approximately $2 billion, with the USDY product exceeding $1 billion in TVL, supporting global investors across nine chains; the flagship institutional fund OUSG has a TVL of over $770 million, covering funds from top asset management companies like Fidelity, BlackRock, and Franklin Templeton; the TVL for tokenized stocks exceeds $500 million, accounting for about 50% market share, with a cumulative trading volume of over $7 billion since its launch in September 2025, covering over 200 stocks.

MSX (STONKS)

One-Sentence Introduction:

MSX is a community-driven DeFi platform focused on tokenizing real-world assets (RWA) like U.S. stocks and facilitating on-chain trading. The platform achieves 1:1 physical custody and token issuance through a partnership with Fidelity. Users can mint stock tokens like AAPL.M and MSFT.M using stablecoins such as USDC, USDT, and USD1, and trade them around the clock on the Base blockchain. All transactions, minting, and redemption processes are executed by smart contracts, ensuring transparency, security, and auditability. MyStonks aims to bridge the gap between TradFi and DeFi, providing users with a high liquidity, low-barrier entry to on-chain investments in U.S. stocks, building a "Nasdaq of the crypto world."

Previous Updates:

On January 13, MSX released an announcement stating that it would change the fee structure for RWA spot trading. After the adjustment, the section changed from a "two-way fee" to a "one-sided fee." The specific execution standard is that the buying side will maintain a 0.3% fee, while the selling side's fee will be reduced to 0. This means that users will see a substantial 50% reduction in overall trading costs when completing a full trading loop of "buying + selling." This fee rate policy is now effective across the entire MSX platform, covering all listed RWA spot trading pairs.

Previously, MSX published a retrospective article for 2025 titled “Anchoring the Era Window, Building a New Ecosystem for On-Chain U.S. Stocks Together”, reviewing the achievements of the year.

Related Links

What is ESE? Why is it Key to the RWA Track?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。