Written by: Cathy

In early 2026, an old book from nearly a decade ago suddenly surged into the WeChat reading hot list.

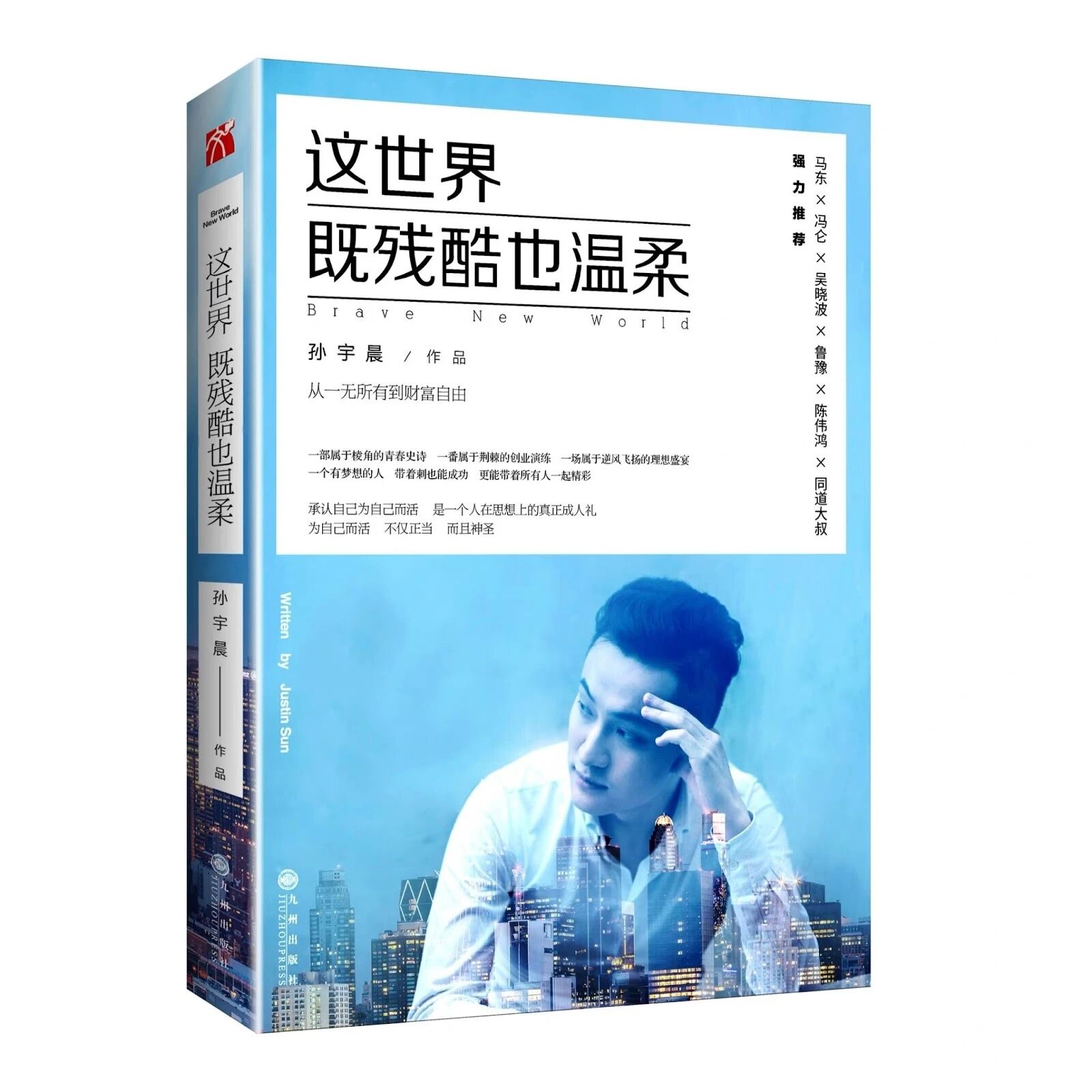

The book is titled "This World is Both Cruel and Gentle," authored by Sun Yuchen, published in 2017.

Sun Yuchen, who once became famous for his lunch with Buffett and sparked heated discussions due to a "last-minute cancellation."

What’s even more surprising is that this book is not being treated as a cautionary tale, but rather revered by young people as a "wealth prophecy book." The term "Sunism" emerged on social media. Bloggers, like archaeologists, sift through every sentence in the book, trying to unearth the secrets to wealth.

Once a controversial and troubled crypto entrepreneur, he has now become a subject of study for the youth.

This reversal is more dramatic than any business story.

The "Cruel" Validation of a Decade-Old Prophecy

The reason "Sunism" has gained traction lies in one term: justice of results.

In 2016, the mainstream narrative of wealth in Chinese society revolved around real estate. For young people at that time, buying a house was the only faith in asset appreciation.

However, Sun Yuchen rebelliously proposed in his book that young people should not be bound by houses but should invest all resources into the wave of mobile internet and emerging technologies.

What’s even more noteworthy is that he explicitly named three asset targets in the book: Nvidia, Tesla, and Bitcoin.

Looking back at this "shopping list" a decade later:

Tesla's stock price has experienced nearly a 20-fold increase; Nvidia has become one of the highest-valued companies globally; Bitcoin surged from hundreds of dollars to over $120,000; and what about real estate? Housing prices in first-tier cities have fallen back to levels from ten years ago, while liquidity in second and third-tier cities is almost locked up, leading to significant wealth shrinkage for the middle class.

When readers open this old book from ten years ago and see the names "Nvidia," "Tesla," and "Bitcoin" prominently written, the foresight is striking.

Although some may interpret the above results as "survivorship bias," many others will view it as "prophetic vision" in the face of the enormous wealth effect.

Sun Yuchen's rejection of real estate is not based on mere price predictions but on an understanding of "opportunity cost." In his view, for young people who lack assets and the "first pot of gold," liquidity is far more important than stability. Buying a house means locking up liquidity and bearing 30 years of debt, which directly stifles the possibility of trying high-risk, high-return paths.

In the context of "Sunism," houses are shackles of the old era, while the internet and blockchain are the arks of the new era.

Building a Billion-Dollar Empire

Many prophecies are just talk, but Sun Yuchen has proven himself with real money.

According to Bloomberg's Billionaires Index data for 2026, Sun Yuchen's personal net worth is approximately $10.8 billion. This wealth primarily comes from the TRON ecosystem, including holdings of TRX tokens and a series of cryptocurrency investment portfolios.

TRON is the cornerstone of this empire.

Despite some original controversies in its early days, TRON has been strategically precise—avoiding competition with Ethereum in DeFi innovation and instead focusing on transfer efficiency and low fees. Today, the TRON network is one of the largest USDT settlement layers globally. Due to its fast transfer speeds and low fees, a large number of users from developing countries and cross-border traders rely on the TRON protocol for capital flow.

This makes TRON not just a public chain but also a de facto "global important shadow banking clearing system."

In addition, Sun Yuchen integrated many well-known industry institutions and also issued several stablecoins, attempting to create credit and liquidity within the ecosystem.

However, what the followers of "Sunism" are most excited about is Sun Yuchen's "evergreen" constitution.

In the high-risk cryptocurrency industry, surviving long is harder than running fast. During the same period, industry giants like FTX's SBF went to prison for misappropriating funds, and Terra's Do Kwon was arrested due to the collapse of algorithmic stablecoins. Meanwhile, Sun Yuchen has survived the 2017 ICO frenzy, the 2018 bear market, the 2020 DeFi summer, the 2021 bull market, the collapse of FTX in 2022, and remains active at the table even during the recovery period in 2024.

"Surviving is winning." This has become the most powerful annotation of "Sunism."

The Ultimate Player in Attention Economy

"Sunism" is not just about what assets to buy, but also about how to leverage the attention economy to amplify asset value.

Sun Yuchen's marketing logic can be summarized in one sentence: attention is currency, conflict is traffic, and even negative fame is still fame.

He recognized the value of the influencer economy early on. In 2016, while serving as a member of the Political Consultative Conference in Panyu District, Guangzhou, he suggested that local governments should vigorously support the influencer economy, which would not only expand employment opportunities for local university students but also inject new "Internet+" genes into the local economy. Looking back at today's reality where everyone strives to become an influencer and regions crave positive traffic, Sun Yuchen once again provided a forward-looking suggestion a decade ago.

In 2019, he spent $4.568 million to win a charity lunch with Buffett. Buffett is a "mortal enemy" of Bitcoin, having called it "rat poison"; Sun Yuchen is a believer in Bitcoin. This natural dramatic conflict attracted global media attention.

In the view of "Sunism," the $4.56 million bought not a meal, but the front page headlines of the world's top financial media. Calculating by advertising costs, this investment has a very high return on investment.

In 2024, he spent $6.2 million to purchase the artist Cattelan's work "Comedian"—a banana taped to a wall—and publicly ate it.

A banana worth $6.2 million resonates with the logic of Bitcoin "creating value out of thin air." Eating the banana means not only possessing it but also ending it, internalizing it as part of his personal brand.

A more advanced operation is to boldly bet when no one is paying attention. At the end of 2024, he announced a $30 million investment in the crypto project World Liberty Financial, supported by the Trump family, becoming the largest investor in the project. The story circulating in the industry is that at that time, this project had visited nearly all industry giants, but only Sun Yuchen decisively stepped in.

In the business world, the boundaries of cooperation are often more flexible than imagined. Whether it’s engaging in dialogue with traditional finance or participating in the construction of political and business networks, as long as there’s a chance to win, Sun Yuchen will boldly go all in.

Why Are Young People Starting to Believe in "Sunism"?

The popularity of "Sunism" is not only a victory for Sun Yuchen but also a reflection of the changing spirit of the times.

For the past thirty years, the path to success in Chinese society has been linear: study hard, get into a good university, work for a big company or take the civil service exam, buy a house, get married, and rise in social class. However, this path has faced systemic challenges in recent years.

The expansion of graduate programs has led to degree inflation, and graduating from a prestigious school is no longer a guarantee of high salaries; layoffs in major internet companies have made the "35-year-old crisis" a Damocles sword hanging over everyone; young people who bought houses find that not only do they lack financial freedom, but they also face the pressure of property depreciation while carrying huge debts.

The step-by-step "long-termism" seems pale and powerless. Young people yearn for "counterattacks," desiring non-linear, explosive success.

"Sunism" precisely provides a non-linear model: not relying on family connections, not relying on seniority, but on cognition, on trends, and on daring to gamble.

A deeper change is the discrepancy between values and reality. Traditional business ethics emphasize "a gentleman loves wealth, and obtains it through the right means." But in reality, young people see honest people suffering while speculators prosper.

When Wang Xiaochuan and Sun Yuchen had a conversation years ago, the differences in their values were clear. A decade later, Wang Xiaochuan is still on a path of steady development—after Sogou was acquired by Tencent, he turned around to establish Baichuan Intelligence and entered the AI field. However, it is undeniable that in terms of the speed and scale of wealth accumulation, the two paths present starkly different results.

This comparison has led many young people to begin re-evaluating: in the current era, which path is more suitable for them—the traditional steady path or the radical all-in new economy path?

The "result-oriented" mindset is gradually gaining popularity among the younger generation. In their view, the speed and scale of wealth accumulation have become one of the important criteria for measuring success. This shift in values reflects the diversification of society's definition of "success"—respect for traditional paths as well as a yearning for emerging opportunities.

Conclusion

"Sunism" is not a rigorous academic theory but a set of extreme survival pragmatism.

Its core teachings include: extreme pessimism towards old assets, a comprehensive embrace of highly liquid digital assets; utilizing all means to gain attention and converting that attention into financial premiums; judging heroes by success or failure, with wealth being the ultimate cleanser of all controversies.

The resurgence of "This World is Both Cruel and Gentle" is a projection of the younger generation seeking hope amid change.

The insight is real: Sun Yuchen's advice on "All in on the Internet/blockchain" and "giving up on buying houses" objectively holds reference value. At the juncture of productivity iteration, aligning with trends is indeed the only opportunity for ordinary people to overtake.

The warning is equally real: "Sunism" overlooks survivorship bias and the enormous risks Sun Yuchen faced during his journey to success. For most ordinary people, the risks of mimicking his radical operations also need to be considered.

As the book title suggests, the world is cruel because it ruthlessly eliminates the laggards; the world is also gentle because it generously rewards those who dare to face the cruelty and dance with the rules.

Understanding "Sunism" may not mean becoming the next Sun Yuchen, but rather seeing the underlying logic of how this world operates—starting with no longer believing in the old stability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。