Author: Delphi Digital

Compiled by: Hu Tao, ChainCatcher

Previously effective investment strategies are no longer working. Certain sectors are performing well, while the market as a whole is lagging. The result is a significant gap between actual returns and the widely expected profit models.

Part of the reason is market maturity, but other factors have also changed.

No Longer the Only Game in Town

For many years, cryptocurrency has been the preferred choice for speculative capital seeking risk-adjusted returns. That situation is no longer the case.

In 2024, private investment in generative artificial intelligence reached $35 billion, an 8.5-fold increase from 2022. In just the first quarter of 2025, robotics startups secured $2 billion in funding.

Today, for every additional dollar of liquidity, there are more growth assets competing for investment. Cryptocurrency is no longer just competing with other cryptocurrencies but is vying for speculative funds against all exponentially growing technologies.

This is reflected in the data. Over the past 24 months, crypto stocks have outperformed most altcoins. Institutional capital shows far greater interest in spot ETFs and stocks like Coinbase, Robinhood, and Galaxy than in the tokens themselves. Crypto stocks have effectively siphoned off some of the funds that would have flowed into altcoins.

The Infrastructure Layer is Being Commoditized

Meanwhile, the fat protocol thesis is breaking down.

This theory posits that infrastructure can capture value while applications remain lightweight and interchangeable. This theory holds when block space is scarce and protocols have pricing power. However, as DA (decentralized architecture) approaches zero, execution is distributed across Rollups and application chains, and MEV (market economic value) is abstracted by applications seeking to capture value, this theory becomes less tenable.

Real Economic Value (REV) is becoming the key metric for measuring value. The fees that users actually pay will flow back to token holders without diluting the tokens, which is the truly important metric.

Macroeconomic Environment and Cryptocurrency

The liquidity environment that has dominated the cryptocurrency dilemma for the past two years is reversing. Whether cryptocurrency will respond is another question.

Since 2022, the Federal Reserve has removed $2.4 trillion from the market and paused quantitative tightening (QT) last December. Coupled with interest rate cuts priced in through 2026, this marks the first net positive capital flow since early 2022.

The BTC/gold ratio is currently at a historical low. Gold liquidity indicators have surpassed two standard deviations, while Bitcoin's liquidity indicators are nearing bear market levels. The monthly relative strength index (RSI) for BTC/gold has also reached historically oversold levels.

There are many reasons for Bitcoin's poor performance: quantum crisis panic, large holder sell-offs, lack of market structure legislation, etc. However, the data points to a more fundamental reason. Currently, Bitcoin is negatively correlated with gold and Japanese 10-year government bonds, while gold is positively correlated with Japanese bonds. The price fluctuations of both gold and Japanese bonds are statistically significant, deviating more than 2-3 standard deviations from historical averages. When price fluctuations are this extreme, correlation patterns suggest that related assets should also exhibit abnormally weak performance.

Bitcoin has consistently lagged behind gold. Once the Japanese bond crisis eases and the Bank of Japan and the Federal Reserve find ways to stabilize arbitrage trades, the pressure on gold and commodities should lessen. This may be where Bitcoin's true opportunity lies.

Stablecoins are the Real Use Case

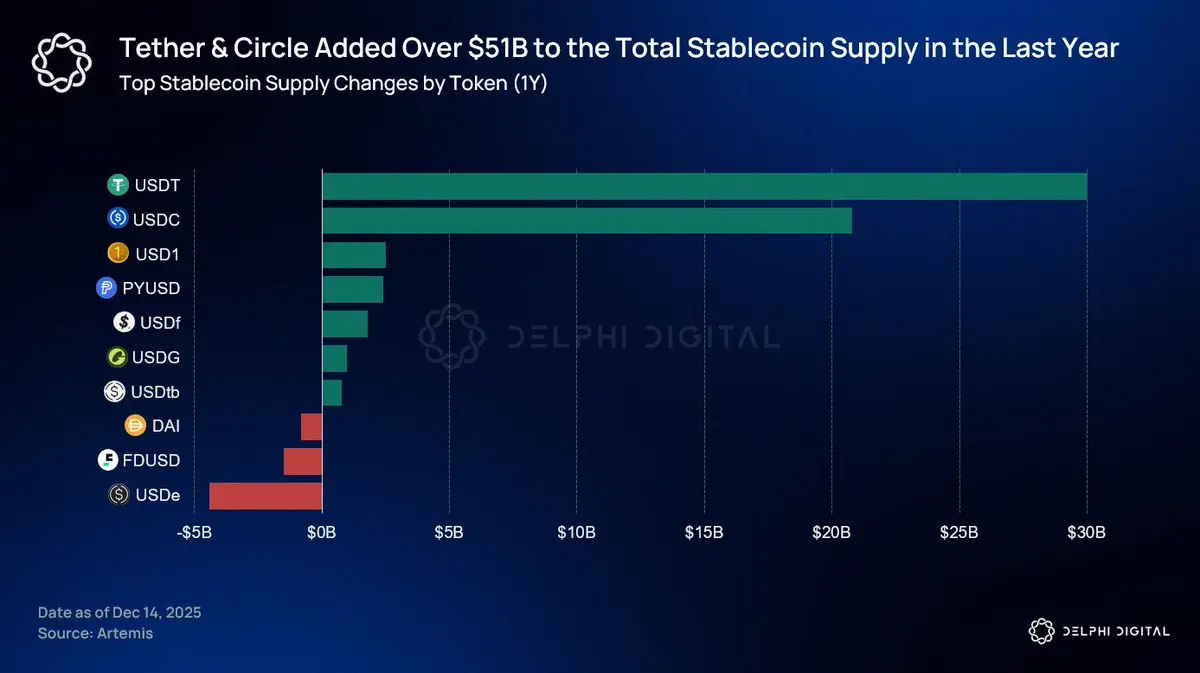

Stablecoins have become the largest use case in the cryptocurrency space. Adjusted monthly trading volume for stablecoins has surpassed that of PayPal and Visa. The total supply exceeds $304 billion, a 33% increase from last year. Stablecoin reserves currently hold about $133 billion in U.S. Treasuries, making them the 19th largest holder of government debt.

As a result, the entire payment system is being compressed. We are shifting from a model involving card organizations, acquiring banks, issuing banks, and settlement windows to programmable on-chain settlement. Stablecoins eliminate intermediaries, simplify reconciliation processes, and embed compliance as a native feature rather than an afterthought.

Value is Shifting to the Application Layer

If infrastructure is being commoditized and liquidity is returning, value may flow to applications that have user relationships.

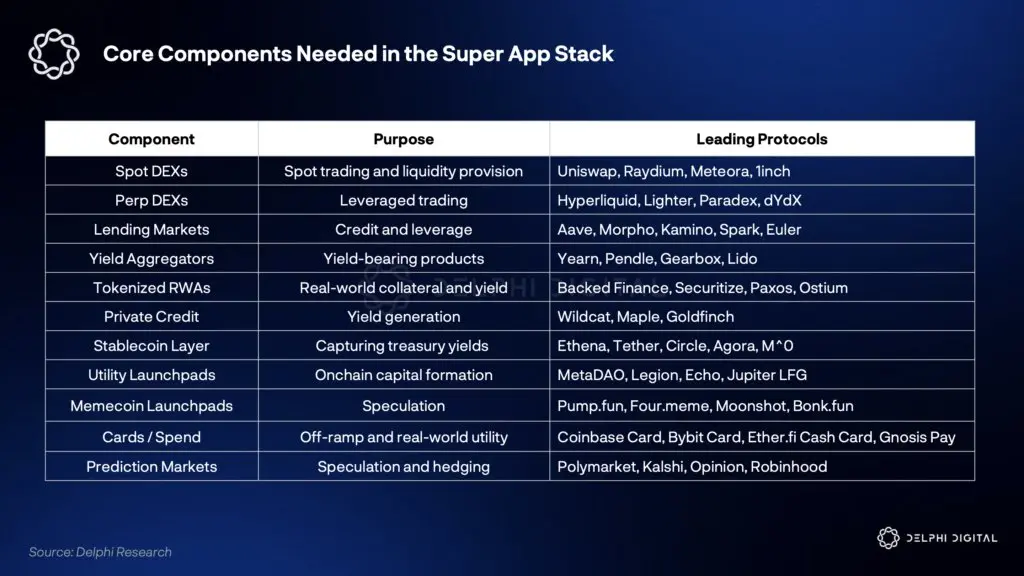

Coinbase, Robinhood, Binance, and Hyperliquid are all competing towards the same goal—the aggregation layer—from different starting points. Cryptocurrency has a structural advantage in this regard. When Block wanted to offer buy now, pay later (BNPL) services, they spent $29 billion to acquire Afterpay. A cryptocurrency super app can simply integrate Aave for lending and route trades through Hyperliquid to profit from building code without incurring acquisition costs.

The largest fintech companies are taking it a step further. They are no longer renting block space from existing chains but are building their own blockchains. Earlier this year, Stripe launched Tempo, a blockchain designed to enhance payment speed and utilize native stablecoin gas fees. Robinhood has also adopted a similar strategy, building an L2 blockchain for its tokenized stocks.

In previous cycles, there was little that could be done on-chain beyond directional token bets. Now, with prediction markets provided by Polymarket, on-chain credit, deep trading liquidity, and more, you can manage all financial matters through a single interface.

RWA is one of the key factors for the success of this technology. In January 2025, the value of on-chain tokenized stocks was about $15 million. Today, that number has exceeded $500 million. Anyone can store stocks in a self-custody wallet without needing to open a brokerage account.

The scale expansion of perpetual contracts is even faster. Platforms like Hyperliquid, Ostium, and Vest Exchange now offer leveraged exposure to stocks, indices, commodities, and forex. CFD brokers outside the U.S. see daily trading volumes in the hundreds of billions, and retail options trading increasingly reflects simple directional bets rather than volatility trading. For both of these uses, perpetual options are a more streamlined tool.

The result is that brokerage accounts are quietly being replaced by self-custody wallets. Stocks, cryptocurrencies, forex, and commodities are all consolidated in one interface. Settlement, margin, and custody rely entirely on cryptocurrency platforms.

The era of passively allocating "cryptocurrency" as an asset class is over.

Bitcoin is gradually separating itself from a macro asset class. Protocols that can effectively charge fees will continue to perform well, and this cannot be achieved through narrative alone. The stablecoin infrastructure is becoming the bridge between cryptocurrency and everything else.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。