Written by: imToken

If a year ago, someone told you that gold would quickly rise to $5000/ounce, most people's first reaction would probably be that it's fanciful thinking.

But that is indeed the case. In just half a month, the gold market has surged like a runaway horse, continuously tearing through historical thresholds of $4700, $4800, and $4900/ounce, heading towards the moment of collective market attention at $5000 with almost no looking back.

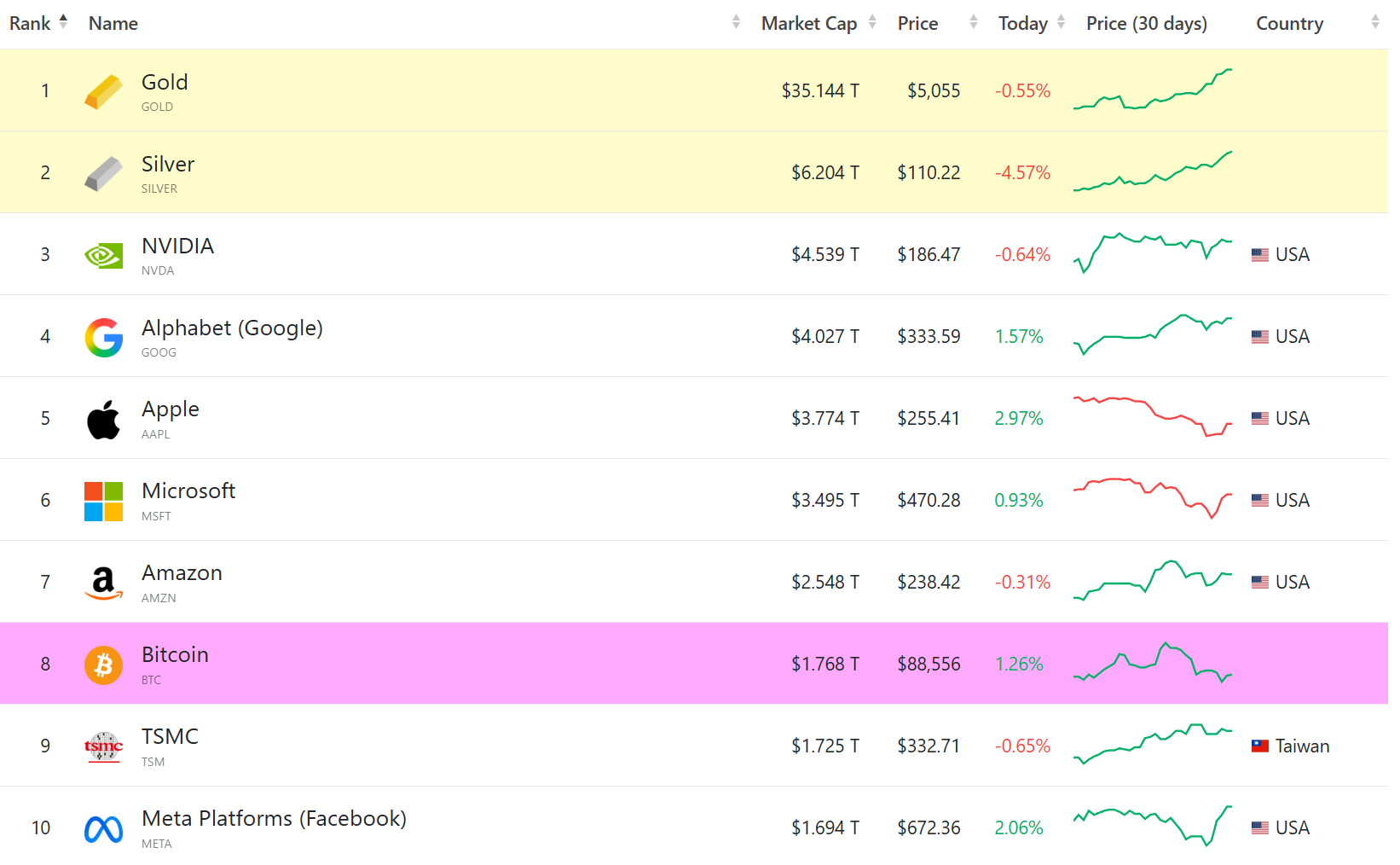

Source: companiesmarketcap.com

It can be said that after repeated validations of global macro uncertainties, gold has returned to its most familiar position—as a consensus asset that does not rely on any single sovereign commitment.

However, at the same time, a more practical question is emerging: As the consensus around gold returns, has the traditional way of holding it become inadequate to meet the demands of the digital age?

1. The Inevitability of Macro Cycles: The "Old King" Returns to the Throne

From a longer macro cycle perspective, this round of gold's upward trend is not a short-term speculation, but a structural return against the backdrop of macro uncertainty and a weakening dollar:

Geopolitical risks have extended from Russia-Ukraine to key resource and shipping areas in the Middle East and Latin America; the global trade system has been repeatedly interrupted by tariffs, sanctions, and policy games; the U.S. fiscal deficit continues to expand, and the long-term stability of the dollar's credit is being discussed more frequently. In such an environment, the market will undoubtedly accelerate its search for a value anchor that does not rely on the credit of any single country and does not require endorsement from others.

From this perspective, gold does not need to prove that it can generate returns; it only needs to repeatedly prove one thing: in an era of credit uncertainty, it still exists.

This also somewhat explains why in this cycle, BTC, which was once expected to be the "digital gold," has not fully taken on the same consensus role—at least in terms of macro hedging, the choice of funds has already provided an answer, which will not be elaborated here (see further reading: “From the De-trusted BTC to Tokenized Gold, Who is the Real 'Digital Gold'?”).

However, the return of the gold consensus does not mean that all problems have been solved. After all, for a long time, investors have had to choose between two imperfect holding methods.

The first is physical gold, which is safe enough and sovereignly complete, but has almost no liquidity. Storing gold bars in a safe means high storage, theft prevention, and transfer costs, and also means it can hardly participate in real-time trading and daily use.

The recent phenomenon of "difficult to find a safe deposit box" in many banks precisely illustrates that this contradiction is being amplified, indicating that more and more people want to hold gold in their own hands, but the reality does not always cooperate.

The second is paper gold or gold ETFs, which to some extent compensate for the physical holding threshold of gold. For example, paper gold products issued by banks or brokerage systems essentially represent a debt claim against financial institutions, giving you a settlement promise backed by the account system.

But the problem is that this liquidity itself is not complete—the liquidity provided by paper gold and gold ETFs is merely locked within a single financial system; it can be bought and sold under a specific bank, exchange, or clearing rules, but cannot freely circulate outside this system.

This means it cannot be split or combined, nor can it collaborate across systems with other assets, let alone be directly used in different scenarios; it can only be considered "account liquidity," rather than true asset liquidity.

The first gold investment product I owned, "Tencent Micro Gold," was like this. From this perspective, paper gold has not truly solved the liquidity problem of gold; it has merely temporarily replaced the inconvenience of physical form with counterparty credit.

Ultimately, safety, liquidity, and sovereignty have long been in a state of difficult coexistence, and in a highly digitalized and cross-border era, such trade-offs are becoming increasingly unsatisfactory.

It is against this backdrop that tokenized gold has begun to enter more people's vision.

2. Tokenized Gold: Returning "Complete Liquidity" to the Asset Itself

Tokenized gold, represented by Tether's XAUt (Tether Gold), attempts to address not just the superficial issue of "making gold easier to hold/trade," which paper gold can also do, but a more fundamental proposition:

How to allow gold to achieve complete liquidity and combinability equivalent to that of crypto assets, without sacrificing the "real gold backing" of gold?

If we take XAUt as an example and break down its design logic, we find that it is not radical; it can even be described as quite traditional and restrained: each XAUt corresponds to 1 ounce of physical gold stored in the London vault, and the physical gold is kept in a professional vault that is auditable and verifiable, while tokenized gold holders have a claim to the underlying gold.

This design does not introduce complex financial engineering, nor does it attempt to amplify gold's attributes through algorithms or credit expansion; rather, it deliberately maintains respect for traditional gold logic—first ensuring the existence of the physical gold attribute, then discussing the changes brought by digitization.

Ultimately, tokenized gold like XAUt and PAXG is not about "creating a new narrative for gold," but about repackaging the oldest asset form using blockchain technology. So in this sense, XAUt is more like "digital real gold," rather than a speculative derivative in the crypto world.

At the same time, a more important change is that the liquidity hierarchy of gold has fundamentally shifted. As mentioned earlier, in the traditional system, whether it is paper gold or gold ETFs, the so-called liquidity is essentially account liquidity—it exists within a specific bank, brokerage, or clearing system and can only be bought and sold and settled within established boundaries.

In contrast, the liquidity of XAUt is directly attached to the asset itself. Once gold is mapped as an on-chain token, it naturally possesses the basic attributes of crypto assets, allowing it to be freely transferred, split, and combined, and to circulate between different protocols and applications without needing to obtain permission from any centralized institution.

This means that for the first time, gold no longer relies on "accounts" to prove its liquidity; instead, it circulates freely in the form of the asset itself, globally 24/7. In the on-chain environment, XAUt is no longer just a "tradable gold token," but a fundamental asset unit that can be recognized, called upon, and combined by other protocols:

- It can be freely exchanged with stablecoins and other assets;

- It can be included in more complex asset allocation and combination strategies;

- It can even serve as a value carrier, participating in consumption and payment scenarios;

This is precisely the part of "liquidity" that paper gold has always been unable to provide.

3. From "On-Chain" to "Usable": The True Watershed of Digital Real Gold

For this reason, if tokenized gold only completes the step of "going on-chain," it is far from reaching the finish line.

The true watershed lies in whether this "digital real gold" can truly be easily held, managed, and traded by users, and even used as "currency" for consumption and payment? This returns to the argument mentioned earlier: if tokenized gold is merely a string of code on the chain, ultimately still encapsulated within centralized platforms or a single entry point, then it is no different from paper gold.

In this context, the significance of lightweight self-custody solutions like imToken Web begins to emerge. Taking the exploration of imToken Web as an example, it allows users to access their tokenized gold and other crypto assets through a browser—like opening a webpage, instantly managing their assets on any device.

Moreover, in a self-custody environment, the private keys are fully controlled by the user; your gold does not exist on any service provider's server but is genuinely anchored in a blockchain address.

Additionally, thanks to the interoperability of Web3 infrastructure, XAUt is no longer a heavy metal sleeping in a safe. It can be flexibly purchased as a small asset and can, when needed, release the purchasing power of gold in real-time into global consumption scenarios through payment tools like imToken Card.

Source: imToken Web

In short, in the Web3 environment, XAUt can not only be traded but also combined and exchanged with other assets, and even connect to payment and consumption scenarios.

When gold finally possesses both high certainty of value storage and modern usage potential, it has truly completed the leap from "old-fashioned safe-haven asset" to "future currency."

After all, as a consensus that can span millennia, gold is essentially not outdated; what is outdated is the way of holding it.

So when gold enters the on-chain world in the form of XAUt and returns to personal control through self-custody environments like imToken Web, what it continues is not a new narrative, but a logic that transcends time:

In an uncertain world, true value is to rely as little as possible on the promises of others.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。