Author: Chloe, ChainCatcher

When the price of Bitcoin retraced 30% from its historical high and spot ETFs faced three consecutive months of net outflows, the world's largest Bitcoin strategic reserve company, Strategy, went against the trend and made a crazy investment of over $3.7 billion in a single month. At the same time, its stock price MSTR experienced a severe correction of over 60%, and its mNAV was adjusted from 2.4 to a rational range of 1.07. This article will analyze three future scenarios for Strategy under different market conditions, combining macro data and the current weak state of institutions, and question whether the best entry point for MSTR has arrived as the premium bubble disappears.

Strategy Goes Against the Trend, Purchasing Over $3.7 Billion in BTC in a Single Month

Since Bitcoin reached a historical high of $126,000 in October 2025, it has undergone a sharp retracement, currently falling to around $88,000, a drop of 30%. However, this correction has not shaken the resolve of Strategy, the world's largest Bitcoin reserve company, which has continued to buy aggressively at the beginning of 2026, demonstrating its high confidence in Bitcoin to the global market.

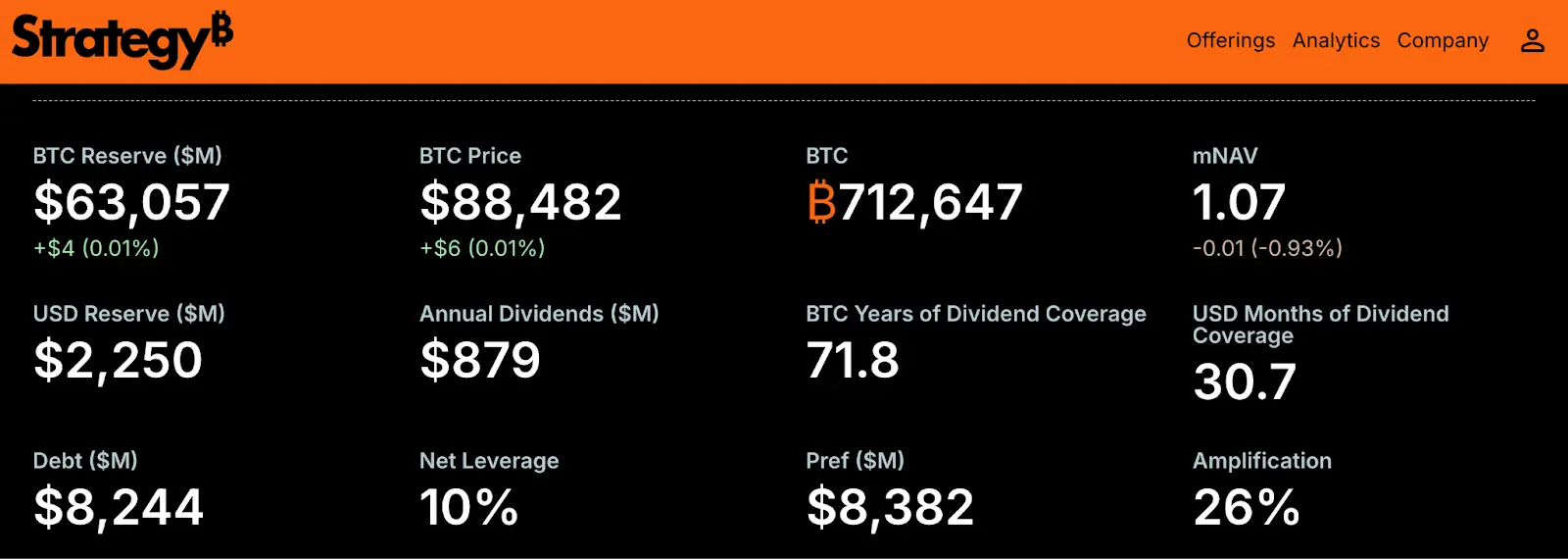

According to the Bitcoin Strategy Tracker data, Strategy purchased over 40,000 Bitcoins in January 2026 alone. Notably, between January 6 and January 20, within just two weeks, it accumulated purchases of 35,932 Bitcoins in two batches, with an average purchase price ranging from $91,500 to $95,300. Statistics show that Strategy's total investment in January reached as high as $3.7 billion; as of January 27, it had accumulated 712,647 Bitcoins on its balance sheet, with an overall average purchase cost of $76,038.

In addition to aggressively buying in the spot market, Strategy is also actively expanding its influence into the European market. Several financial institutions have launched leveraged products linked to Strategy (MSTR) on major exchanges in Europe, attempting to attract traditional capital from across the Atlantic. On the other hand, interest from top global financial institutions in holding MSTR has also shown significant growth, with funds under asset management giant Vanguard Group recently revealing holdings in Strategy stock; the Louisiana State Employees' Retirement System and Japan's financial giant Sumitomo Mitsui Trust Group have also reported including MSTR in their investment portfolios.

Structural Weakness in Bitcoin and Institutional Caution

However, Strategy's passionate buying and numerous positive news have not dispelled the overall chill in the market. For investors, the current macro data shows a clear demand gap:

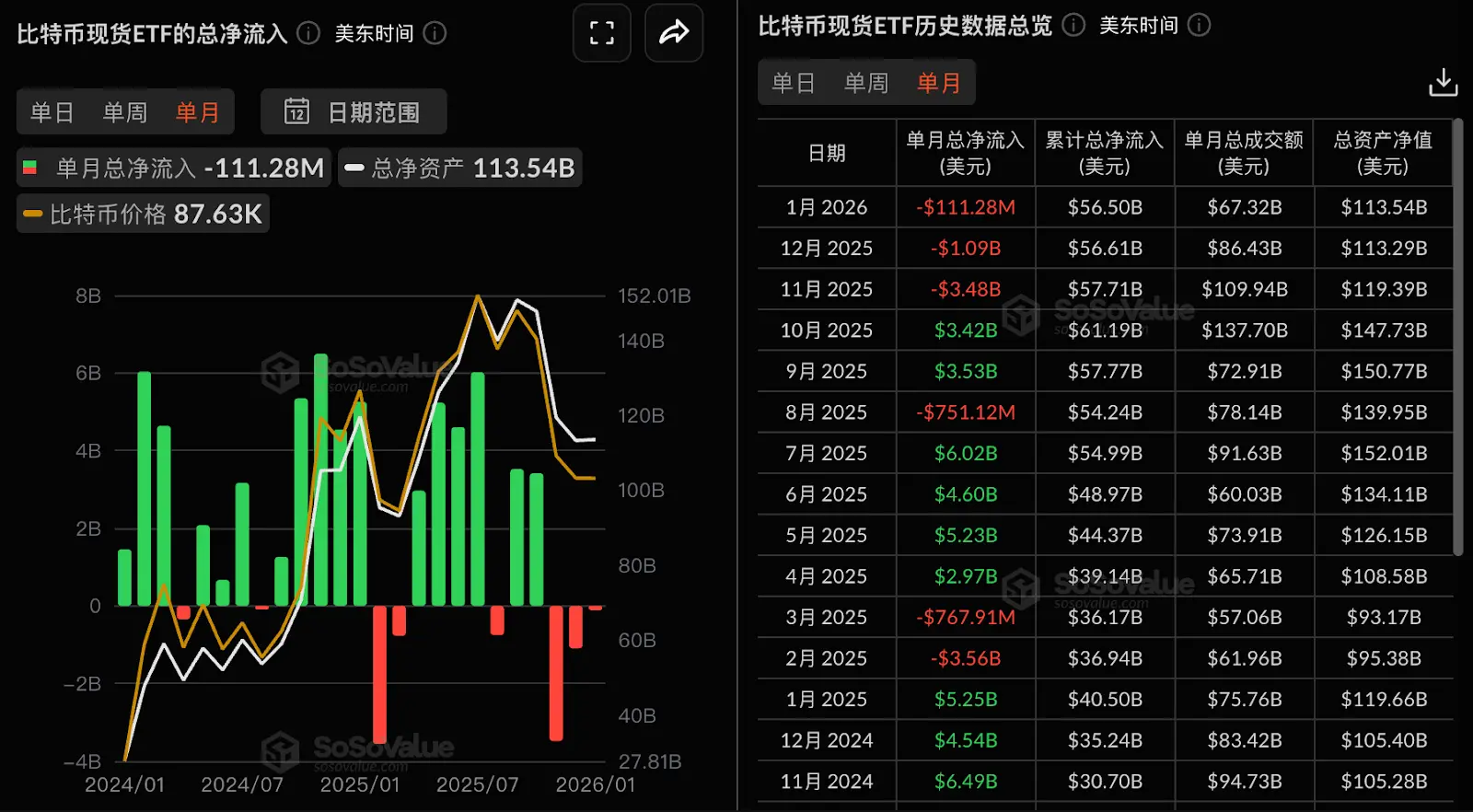

Bitcoin spot ETFs have seen three consecutive months of net outflows: Since November 2025, Bitcoin spot ETFs in the U.S. have been in a continuous state of bleeding for three months, including a net outflow of as much as $3.48 billion in November and $1.09 billion in December. Although the outflow rate slowed to $111 million in January 2026, the outflow trend has not ended. This indicates that mainstream Wall Street capital has continued to withdraw during this period, contrasting sharply with Strategy's counter-trend buying.

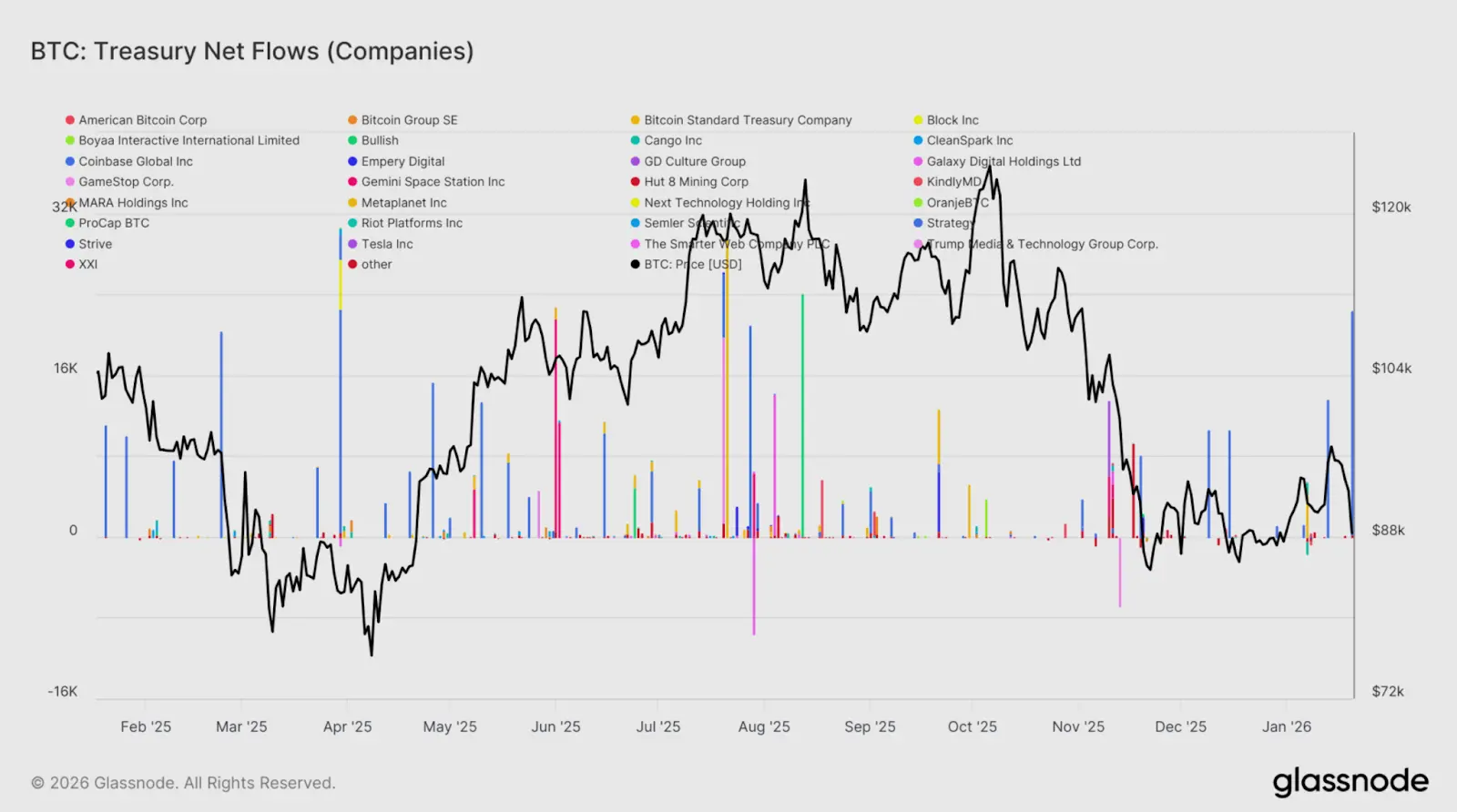

Scattered and uneven inflows into Bitcoin reserves: Glassnode reports that recent corporate capital inflows have mainly concentrated on event-driven trades rather than general capital accumulation. The chart below shows that buying has primarily been driven by Strategy, while other Bitcoin reserve companies have not made further purchases recently, contrasting sharply with the coordinated buying by multiple reserve companies from May to August 2025, which accelerated the trend.

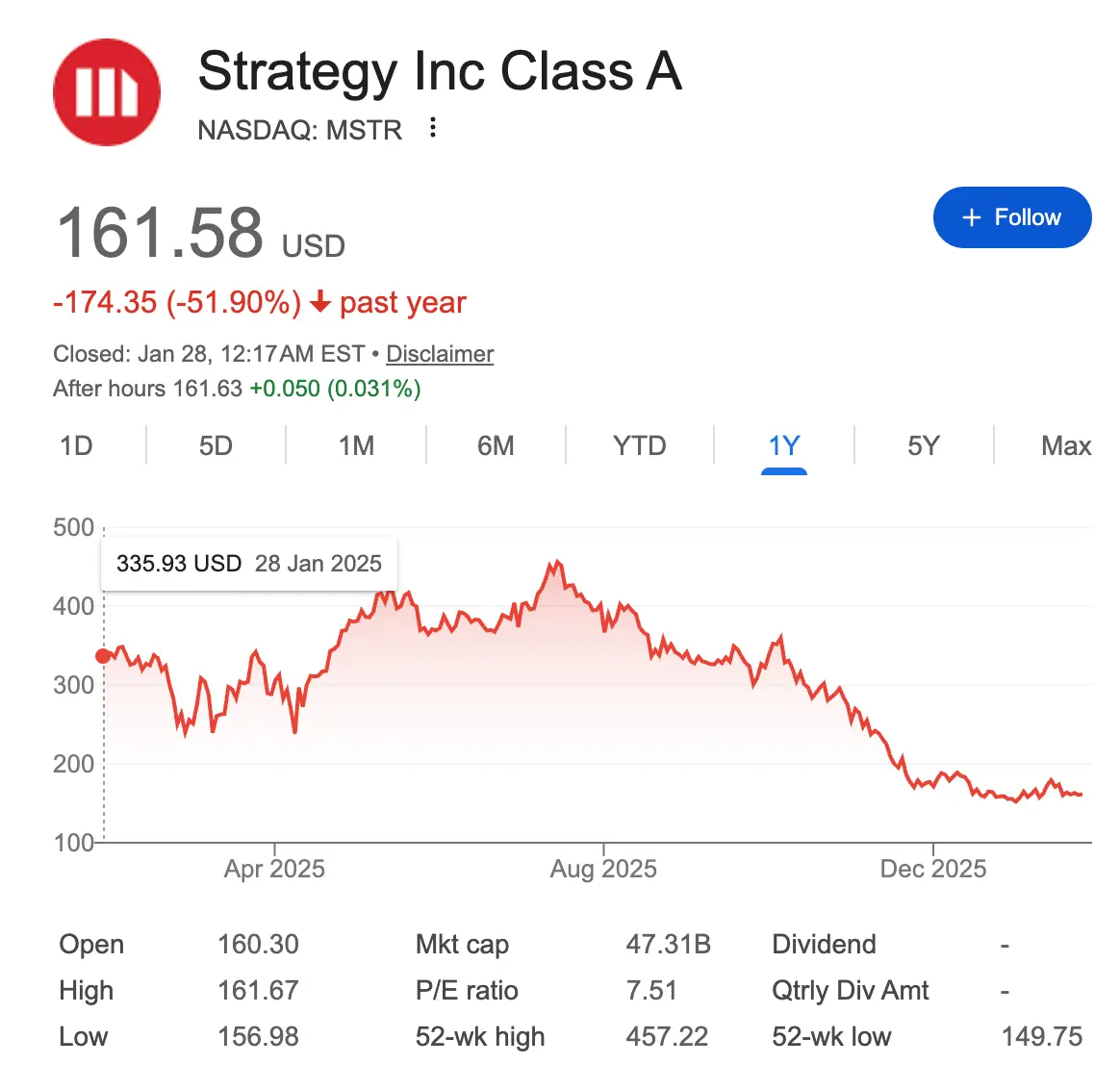

Additionally, a harsh reality can be observed: Bitcoin has fallen from a high of $126,000 to its current $88,000, a drop of about 30%; however, the stock price of Strategy (MSTR) has plummeted from a high of $457 last July to about $160 now, a drop of 65%, meaning that Strategy's decline is nearly double that of Bitcoin. The leverage tool that propelled the rise has turned into an "accelerator" for the stock price crash during the downturn.

MSTR's Premium Reset and Three Future Scenarios

After experiencing dual corrections in stock price and premium, the core question facing investors is: Is the current price of Strategy's MSTR stock at $160 an entry opportunity or the beginning of another collapse?

A key indicator is: the performance of Strategy's mNAV relative to its Bitcoin holdings. At the end of 2024, the market was willing to pay a premium of up to 2.4 times to hold MSTR; however, with the recent stock price drop of over 60%, this premium has significantly shrunk to 1.07 times. From a valuation perspective, this means that the emotional bubble in the market has been largely squeezed, and the current stock price is very close to its asset floor price, providing a more cost-effective entry point for long-term bullish investors in Bitcoin.

However, Strategy's debt risk cannot be ignored. As of early 2026, the company's perpetual preferred equity has reached $8.36 billion, surpassing its $8.21 billion in convertible debt. Although this shift eliminates the refinancing pressure of debt maturity, it also brings about ongoing cash outflows. Strategy currently holds about $2.25 billion in cash reserves, while its annual dividend and interest obligations are approximately $876 million.

At the current spending rate, the company has about two and a half years of financial buffer. A more critical test will come in September 2027, when its $1.01 billion "put option" on the 2028 notes may require cash payment, depending on the stock price performance at that time.

At the same time, we can summarize the following three scenarios for the future market based on Forbes' perspective:

Scenario One (Base Assumption): If Bitcoin maintains a sideways trend in the range of $85,000 to $100,000, the market will enter a period of patience testing. Limited by the uncertainty of macroeconomic policies, geopolitical turmoil, and the lack of new large institutional groups for coordinated buying, Strategy's premium is expected to remain low, with the stock price projected to fluctuate between $150 and $250.

Scenario Two (Optimistic Expectation): If Bitcoin breaks through the $100,000 mark and attempts to reach $150,000, Strategy is likely to restart its "leveraged long" engine. According to Canaccord Genuity and Bernstein's analysis, the target price could return to above $450. For investors seeking excess returns, Strategy remains the most powerful leveraged Bitcoin investment target in the current capital market.

Scenario Three (Pessimistic Expectation): This is the situation that critics like Peter Schiff are most worried about. If the price of Bitcoin falls below $80,000, or even approaches the average cost line of $76,000, the company will find it difficult to maintain its buying power through low-cost financing tools; more severely, the accumulated dividends on perpetual preferred stock will face enormous financial pressure, potentially triggering a vicious cycle of asset value and financing capability trampling each other.

Market "Consensus" is in a Fragile Period; Whether to Go Long Depends on Investors' Risk Appetite

Should one go long on Strategy (MSTR) now? The argument for going long is that the premium has reset (mNAV has dropped from a high of 2.4 to 1.07), and the risk has been relatively released. If one believes that Bitcoin below $100,000 represents a serious "value mismatch," then Strategy is the best leverage for amplifying profits.

On the other hand, the conservative viewpoint is that the uncertainty of macroeconomic policies, geopolitical turmoil, continued outflows from ETFs, and corporate caution indicate that the market "consensus" is in a fragile period. If Strategy is left to fight alone, it may struggle against the overall macro gravitational pull, potentially only providing a bottoming effect.

Ultimately, the answer still depends on investors' risk appetite. For those who believe that digital gold will eventually prevail, this is an entry opportunity after the premium reduction; but for those seeking stable capital, maintaining neutrality until seeing Wall Street institutions shift back to net inflows may be a more rational choice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。