Written by: Vaidik Mandloi

Translated by: Block unicorn

Preface

Last week, the New York Stock Exchange (NYSE) announced plans to build a 24/7 blockchain-based tokenized securities trading platform. At first glance, this seems like just another headline about "traditional finance adopting blockchain." For those who have been following the cryptocurrency space over the past few years, tokenized stocks, on-chain settlement, and stablecoin financing are already familiar concepts.

However, this announcement is not aimed at testing new technology but rather at challenging market areas that have rarely changed.

The stock market still operates with fixed trading hours and delayed settlement mechanisms, primarily because this system has effectively managed risk for decades. Trades occur within a brief time window, while clearing and settlement happen afterward. A significant amount of capital remains idle between trading and settlement to absorb counterparty risk. While this system is stable, it also suffers from slow speeds, high costs, and increasing disconnection from the global flow of capital.

The NYSE's proposed solution directly challenges this structure, reshaping how the market handles time. A trading venue that never closes, settlement times closer to execution times, fewer periods where prices stop updating but risk exposure still exists—all these point in the same direction.

Unlike cryptocurrency markets built under different constraints, traditional stock markets can pause trading or delay settlement. In contrast, cryptocurrency markets operate continuously—pricing, execution, and settlement occur in real-time, reflecting risk immediately rather than being processed later. While this design has its own shortcomings, it eliminates the inefficiencies associated with the time-based systems that traditional markets still rely on.

The NYSE is currently attempting to incorporate elements of continuous trading into a regulated environment while retaining the safeguards that maintain stability in the stock market. This article will delve into the actual operational model of the NYSE and why it is more than just an eye-catching headline.

Why This Is Not "Just Another Tokenization Announcement"

The focus of the NYSE announcement is not on tokenization itself. Tokenized stocks have existed in various forms for years, but most have ended in failure. What sets this announcement apart is who the initiators of the tokenization are and what level they are addressing.

Past attempts to launch tokenized stocks aimed to replicate stocks outside the core market, such as FTX's tokenized stocks, Securitize's tokenized equity products, and synthetic equity products built on protocols like Mirror and Synthetix. These products traded in different market venues at different times and relied on price data from markets that often closed. As a result, they struggled to achieve sustained liquidity and were mostly used as niche access products rather than core market tools.

These early attempts occurred outside the primary stock market. They did not change how stocks are issued, how trading and settlement occur, nor did they alter the risk management methods within the actual pricing system.

However, the NYSE is addressing this issue from within. It is not launching parallel products but adjusting trading and settlement methods within a regulated exchange. The securities themselves remain unchanged, but their trading and settlement methods will evolve over time.

The most important part of this announcement is the decision to combine continuous trading with on-chain settlement. Either of these changes could be implemented independently. The NYSE could have extended trading hours without introducing blockchain or attempted token issuance without affecting trading hours. However, the NYSE ultimately chose to bundle both together. This indicates that the NYSE's focus is not on the convenience of trading or user experience but on how risk exposure and capital operate when the market runs continuously.

A significant portion of today's market infrastructure is built to address the so-called "time gap." When the market closes, trading stops, but positions remain open. Even if prices no longer change, risks and exposures still exist. To manage these time gaps, brokers and clearing institutions require collateral and safety buffer funds, which remain locked until settlement is complete. While this process is stable, its efficiency diminishes as market trading speeds increase, global participation rises, and more trading activity occurs outside local trading hours.

Continuous market operation and faster settlement speeds can shorten this gap. Risks can be addressed as they arise rather than being deferred overnight or over several days. This does not eliminate risk but reduces the length of time capital remains idle merely to cover time uncertainties. This is also the issue the NYSE is striving to address.

This is why the financing method based on stablecoins is integrated into this model.

Today, cash and securities circulate through different systems and often follow different timelines, leading to delays and additional coordination work. Using on-chain cash allows both parties in a transaction to synchronize without waiting for external payment systems. Combined with continuous trading, this is crucial for a global market where information and investors are active around the clock. Prices can adjust in real-time when news is released, rather than being adjusted at the next market opening hours several hours later. However, whether this will improve market performance under stress remains unclear, and this is where the true significance of these changes lies.

Changes Happening Within the Market

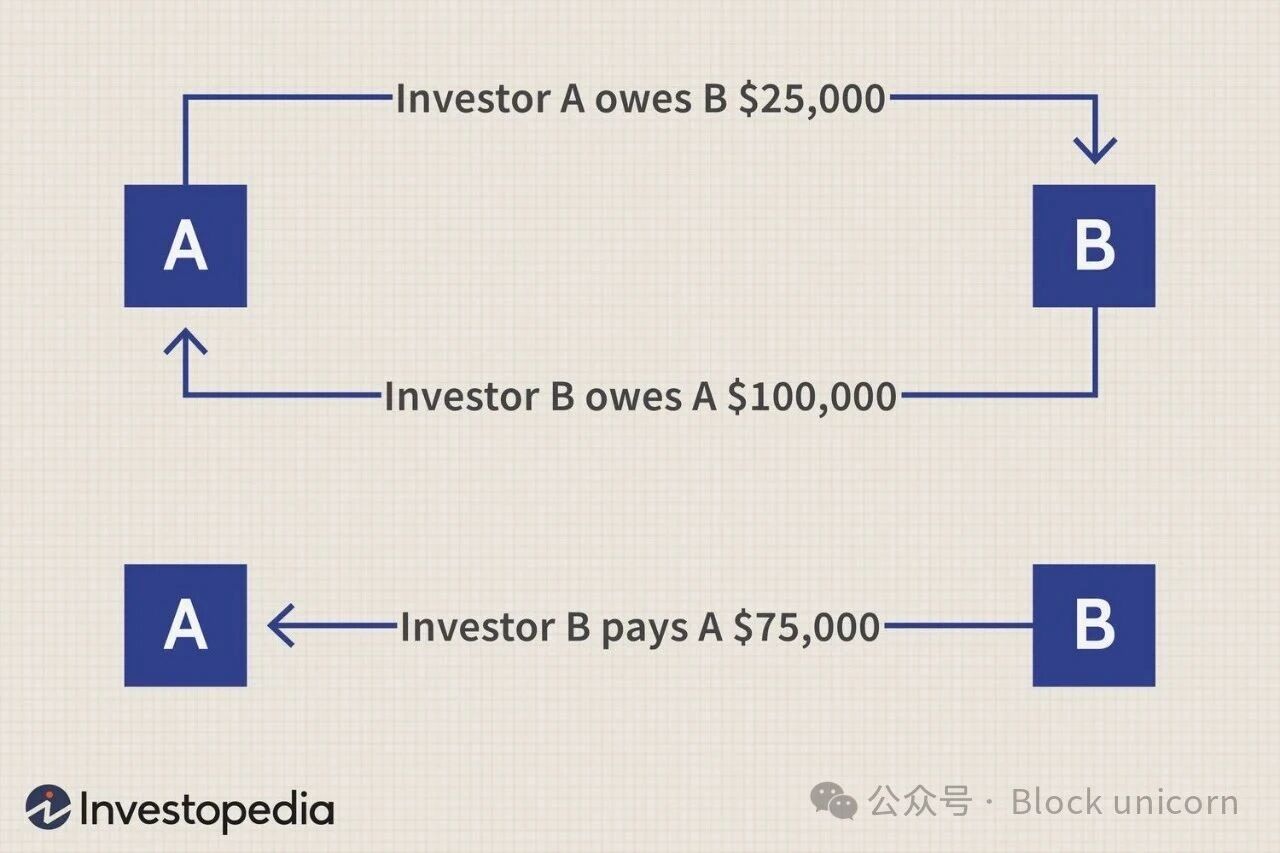

One simple yet significant consequence of the NYSE's proposed plan is reflected in the behind-the-scenes trading clearing and settlement methods. Today's stock market heavily relies on net settlement. Millions of trades offset each other before settlement, reducing the cash and collateral required for trading. This method works well in a system based on fixed trading hours and delayed settlement, but it also relies on time gaps for efficient operation.

Continuous trading and faster settlement speeds change the way trades are cleared. When trades settle faster, the opportunity to offset a large volume of trading activity through end-of-day net settlement diminishes. This means that some efficiencies brought by batch trading will decrease. Therefore, brokers, clearing members, and liquidity providers need to manage funds and risk exposures throughout the trading day rather than relying on overnight settlement processes to absorb and disperse risk.

Market makers and large intermediaries will be the first to adapt to this change. Under the current model, they can hold inventory and adjust positions based on predictable settlement cycles. As settlement speeds increase and trading continues, position turnover accelerates, and funds need to be in place more quickly. Companies that have already adopted automation, real-time risk checks, and flexible liquidity will find it easier to cope with this situation. In contrast, other companies face stricter constraints, as there is less time to rebalance positions or rely on overnight settlement.

Short selling and securities lending also face the same pressures. Currently, borrowing stocks, positioning inventory, and resolving settlement issues typically require multiple steps and time windows. When settlement deadlines shorten, these steps compress, making it harder to postpone delivery failures, and borrowing costs and availability will adapt to market changes more quickly.

The most important aspect here is that most impacts are felt behind the scenes. Retail users may not notice significant changes at the interface level, but institutions providing liquidity and capital positions face stricter time constraints. Some friction points are eliminated, while others become harder to ignore. Time can no longer compensate for mistakes as it once did; the system must remain synchronized throughout the trading day rather than adjusting afterward.

Subsequent Second-Order Effects

Once the market no longer relies on time as a buffer, a different set of constraints begins to take effect. This is first reflected in how large institutions reuse capital internally. Today, the same balance sheet can support positions across multiple settlement cycles because, over time, debts will ultimately offset each other. However, as settlement cycles tighten, this reuse becomes more challenging. Capital must be in place earlier and more precisely, which will quietly change internal capital allocation decisions, limit the use of leverage, and alter how liquidity is priced during periods of market volatility.

Another consequence is the way volatility propagates. In batch-processed markets, risk often accumulates during off-hours and is then released at predictable moments, such as openings or closings. When trading and settlement continue, this accumulation effect no longer applies. Price fluctuations will be dispersed throughout the entire time period rather than concentrated in specific time windows. This does not make the market calmer, but it does make volatility harder to predict and manage, and more difficult to address with old strategies that rely on pauses, resets, or downtime.

This also affects the coordination between different markets. Today, a significant portion of price discovery occurs not through primary stock trading venues but through futures, ETFs, and other proxy tools, primarily because the underlying markets are closed. When primary trading venues remain open and accelerate settlement speeds, the importance of these workaround methods diminishes. Arbitrage opportunities will flow back to primary markets, altering the liquidity patterns of derivatives and reducing the need to hedge risks through indirect tools.

Finally, this changes the role of the exchanges themselves. Exchanges are no longer just order matchers but are more involved in risk coordination. This increases the responsibility of exchanges during stress events and shortens the distance between trading infrastructure and risk management.

In summary, these impacts explain why, even if this move does not immediately change the market's appearance or atmosphere, it is crucial. Its effects will gradually manifest in how capital is reused, how volatility spreads over time, the shift of arbitrage activities back to primary trading venues, and how balance sheets are managed under stricter constraints. These are not short-term improvements or superficial upgrades but structural changes that reshape the internal incentive mechanisms of the system. Once the market begins to operate in this way, reversing these changes will be much more difficult than initially adopting them.

In today's market structure, delays and multi-layered intermediaries act as buffers when problems arise, allowing issues to surface later, losses to be absorbed gradually, and responsibilities to be distributed over time and institutions. However, as timelines shorten, this buffering effect begins to weaken. Funding and risk decisions are increasingly close to the execution stage. The space to cover up mistakes or defer consequences is shrinking, so failures will manifest earlier and be easier to trace back.

The NYSE is testing whether a large, regulated market can operate normally under these conditions without relying on delayed trading to manage risk. The reduction in time between trading and settlement means there is less room for adjusting positions, dispersing funds, or handling issues afterward. This change forces problems to surface during normal trading processes rather than being postponed to subsequent processes, thereby clearly exposing the market's weaknesses.

That's all for today; see you in the next article!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。