As Honeypot Finance approaches the $HPOT Token Generation Event (TGE), we aim to maintain transparency with the community regarding the design of $HPOT and what makes it unique.

This market cycle has revealed a recurring issue in the DeFi space:

Most airdrops do not build communities; they create selling pressure.

Project failures are not due to weak products, but because their token mechanisms force users to sell.

Honeypot has been designed from day one to avoid this outcome.

The Airdrop Death Spiral (Why Token Design Fails)

Across multiple cycles, the same pattern repeats:

Over-Airdropping

Projects distribute large amounts of tokens to chase early metrics and mining activities.

Instant Dumping

Tokens are immediately sold—not due to a lack of belief, but because users have no other way to realize value.

Momentum Collapse

Liquidity dries up, prices fall, and long-term users lose confidence.

This is not a community issue; it is a token design issue.

Different Token Models: From Airdrops to Deflationary Yields

Honeypot has not positioned $HPOT as a short-term reward token, but has evolved it into a Deflationary Yield Engine—its price structure has been deliberately designed for long-term sustainability from the start.

Internally, this approach is referred to as the Pump Protocol—not driven by speculation, but by mechanisms that support sustainable value accumulation.

Our core design principle is simple:

Users should be able to realize true value without being forced to sell their tokens.

Token Entitlements Mechanism Explained

Earning Without Selling

Traditional airdrops directly distribute $HPOT, creating instant selling pressure.

Honeypot replaces this with the Token Entitlement Model, allowing users to realize value without having to sell $HPOT on the market.

How It Works

1) Token Entitlement

Users' points, participation, and usage behaviors will be converted into Token Entitlement—this is a claim to value, not a reward that can be directly sold.

2) Stablecoin Payouts

Based on TGE valuation, the protocol gradually distributes equivalent earnings in stablecoins rather than directly issuing $HPOT.

3) No Forced Selling

Since users receive stablecoins, there is no need to sell $HPOT to realize value.

4) Alignment of Users, Teams, and Investors

This structure applies equally to users, team members, and investors, ensuring long-term incentives remain aligned.

5) Deflationary by Design

When $HPOT is burned or locked to create value, the circulating supply decreases while real yields continue to flow in.

Ultimately forming a simple formula:

Real value flowing out → Supply decreases → Stronger price structure

$HPOT Token Distribution

Built for Long-Term Alignment

To keep the system clear and understandable, all early funding rounds are categorized under Investors, representing capital with long-term alignment.

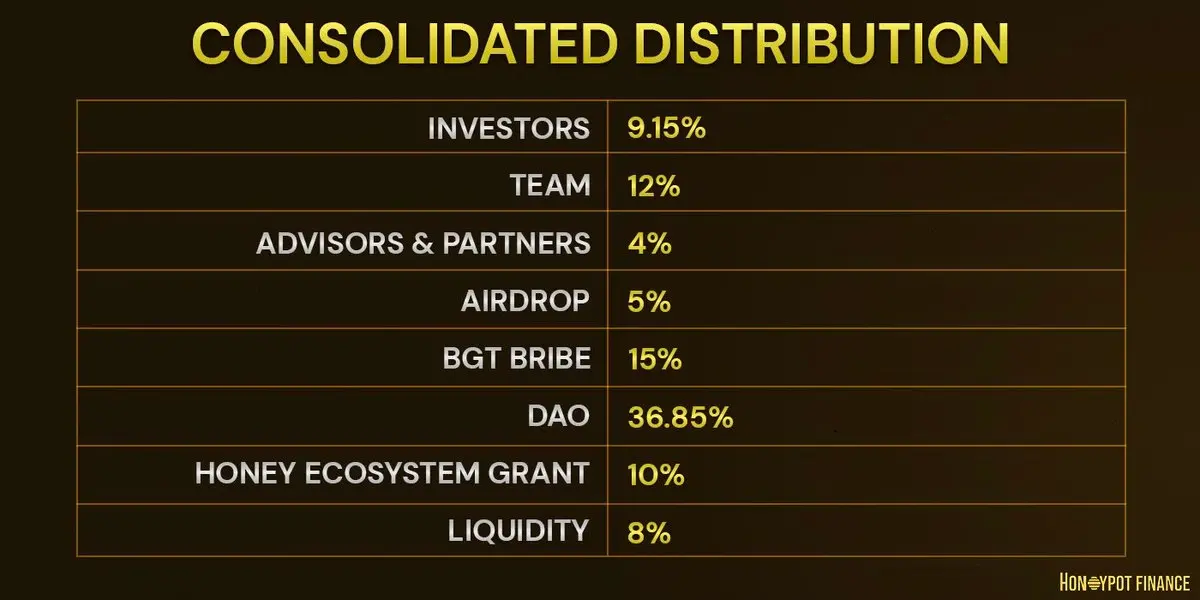

Consolidated Distribution Structure

Signals Conveyed by This Token Structure

- Investors (9.15%): Capital supports growth but does not dominate supply or governance.

- DAO (36.85%): Long-term ownership and protocol governance are at the core.

- Incentive Engine (23%): BGT Bribes and liquidity distribution efficiently drive the flywheel.

- Airdrop (5%): Sufficient to reward users while controlled to avoid market impact.

- Honey Ecosystem Grant (10%): Ensures the ecosystem continues to develop beyond a single product.

How the $HPOT Buyback Mechanism Works

Real Revenue, Real Demand

Honeypot's token design is built on real products, not speculation.

Protocol revenue sources include:

- Honeypot Perpetuals

- Vault strategies co-developed with partners

- Future roadmap products

These revenues flow into the All-in-One Vault, which is responsible for:

- Funding stablecoin payouts

- Executing $HPOT buybacks

- Supporting long-term deflationary mechanisms

One example is the Vault co-developed with Dirac Finance, whose yield strategy directly creates buy pressure for $HPOT through buybacks.

Additionally, some trading revenue from Honeypot Perp DEX will also be used to buy back $HPOT from the market.

$HPOT Token Flywheel

In addition to the built-in deflationary mechanism,

The system forms a closed loop through the following:

User activity → Protocol revenue → $HPOT buyback → Supply decreases → Stronger incentives

Why This Is Crucial in the Current Market

In bear markets or early cycle environments, weak token structures quickly expose issues.

Honeypot's design goals are:

- Users receive real dollar value

- $HPOT avoids structural selling pressure

- Buy pressure comes from real product usage

- Scarcity is derived from revenue, not emissions

No Airdrop Death Spiral

No Mercenary Token Economic Models

Only a protocol capable of long-term compounding growth.

This is the evolution of Honeypot.

About Honeypot Finance

Honeypot Finance is an integrated one-stop liquidity hub dedicated to building the next generation of DeFi infrastructure. By combining AMM technology with omnichain liquidity and perpetual contract trading, Honeypot creates a seamless, scalable, institutional-grade ecosystem that enhances capital efficiency, cross-chain accessibility, and sustainable yield generation capabilities for users and protocols in the decentralized finance space.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。