Author: Crypto Weituo

The explosive growth of the US stock market, especially in the AI sector, over the past year is evident, with AI-related stocks in the QQQ rising nearly 30% within a year. The Trump administration has repeatedly stated that the development of AI will bring about significant deflation and drive economic prosperity.

However, for ordinary people, this prosperity feels extremely unreal:

- Unemployment rates are continuously rising, not just in the US, but in various countries;

- Although economic data may not fully reflect it, almost every country's civilians can personally feel the widespread increase in prices;

- Commodity currencies do not lie: the Thai Baht has risen over 10% this year (with a correlation to gold of 0.88), and the Chilean Peso has risen over 12% (with a correlation to copper of 0.8).

Perhaps as an ordinary person, your feelings are correct.

The US Stock Market Hasn't Really Increased

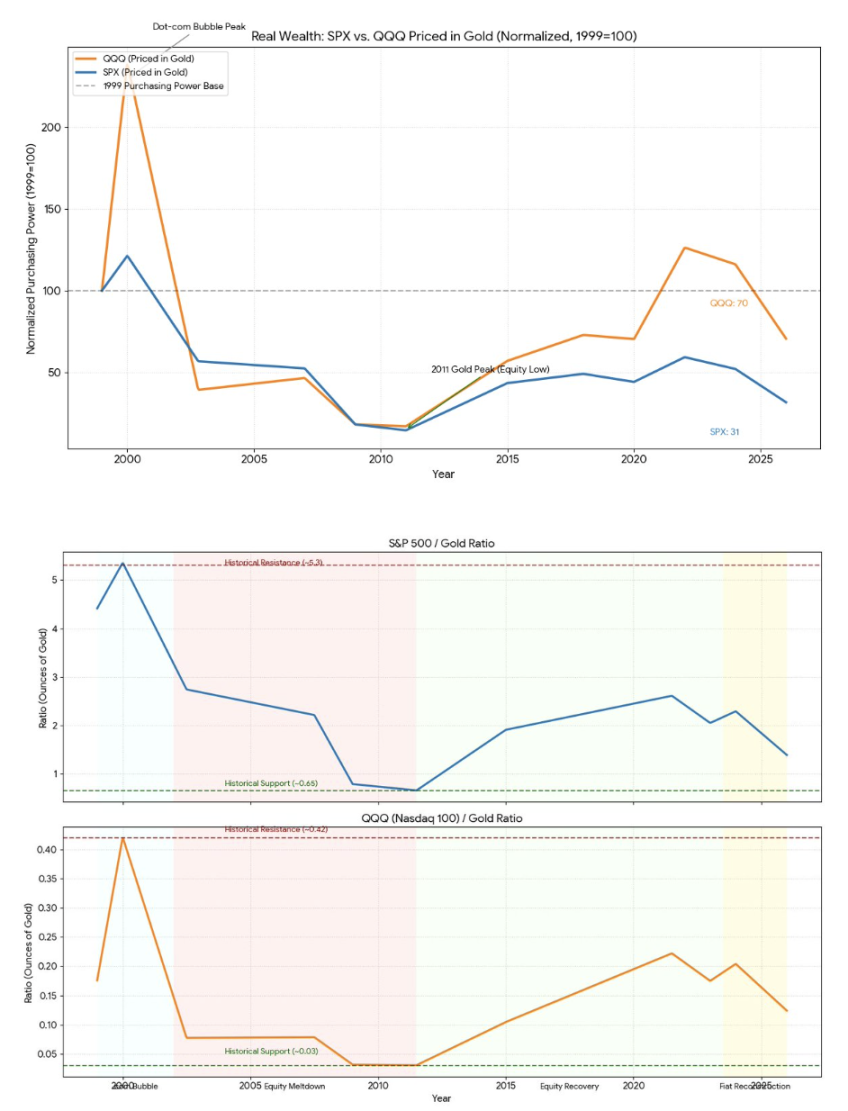

If you compare the SPX and QQQ, which represent the US stock market's leading and emerging AI sectors, with gold, you will discover a completely different reality:

From March 1999, when QQQ was born, the comparison of QQQ and SPX with gold purchasing power; the top image is based on purchasing power at the time of QQQ's inception, and the bottom image is based on the SPX/gold and QQQ/gold ratios.

It reveals a truth that many overlook: although the US stock market has seen significant gains over the past 27 years, when measured against gold, most investors' purchasing power has not returned to the levels of 1999.

This can be roughly divided into four periods:

1. Dot Com Bubble Period (1999-2002):

This was an extreme overextension of fiat currency credit regarding the "productivity miracle fantasy."

Ratio performance:

- SPX/Gold: Encountered an epic resistance level around 5.5 (1 share of the S&P exchanges for 5.5 ounces of gold).

- QQQ/Gold: Touched a historical ceiling of 0.40.

The final outcome was a decline in purchasing power against gold of 80% from the peak in 2000 to the end of 2002 for SPX/QQQ.

2. US Stock Market Collapse and Golden Decade (2003 - 2011)

The financial crisis (2008) erupted, leading to a collapse of global confidence in fiat currency, with funds flooding into gold as a safe haven.

- During this phase, SPX/Gold broke through multiple supports, ultimately finding historical support in the 0.6 - 0.7 range.

- QQQ/Gold: Bottomed out around 0.03 (this was the cheapest moment for tech stocks relative to gold).

Although nominal prices of US stocks began to rebound after 2009, because gold prices rose faster (to $1900), the "gold purchasing power" of US stocks did not truly bottom out until 2011.

3. US Stock Market Recovery / Tech Premium Period (2012 - 2023)

An era of low interest rates and quantitative easing. The growth rate of tech giants represented by FAANG finally outpaced the speed of the money printing machine.

However, with 20 years of experience, we come to a simple realization: this "productivity fantasy" has some self-limiting nature and does not seem to be linked to "productivity" itself.

- SPX/Gold: Attempted to return to the resistance level of 2.5 but failed multiple times.

- QQQ/Gold: Performed strongly, rising from 0.03 to 0.25, but this 0.25 became a key resistance range for the decade.

4. Trump Era Fiat Currency System Reconstruction (2024 - 2026)

With Trump's administration reconstructing the relationships between the US, its allies, and other countries, the US actively broke many assumptions underlying international trade and monetary order. The global fiat currency system, established after 1971, is entering a reconstruction phase, and commodities may be monetized.

- Gold price: $5,000 / oz

- SPX/Gold ratio: Falling back to 1.39

- QQQ/Gold ratio: Falling back to 0.12

In simple terms, US stocks priced in dollars are at new highs, but when priced in gold, US stocks have not increased and are even testing support levels downward.

The Real Illusion and "False" Progress

Ray Dalio once said that the essence of the central bank fiat currency system is to replace limited hard currency with infinitely printed paper money, allowing governments to avoid bankruptcy on an accounting level; if they can't pay back, they just print more money. This essentially means borrowing from the future at the cost of plundering the purchasing power of the next generation. In the past, it was a run on gold; now, the run is to buy commodities.

"If you devalue currency, then everything goes up."

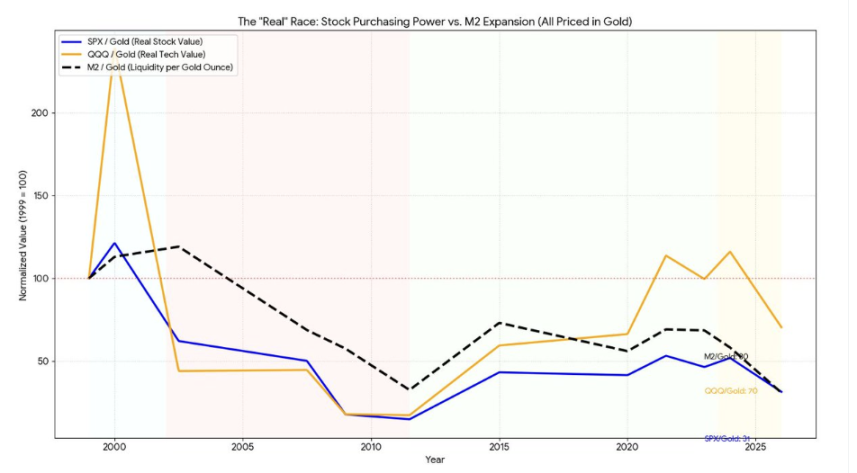

One of the best measures of actual currency devaluation is the growth rate of M2. If we incorporate the M2 growth rate into the historical performance of SPX and QQQ:

This chart has three lines:

- Black dashed line: Represents the M2/Gold exchange rate. This is the Federal Reserve's money printing machine. You can see it has been declining, indicating that the dollar has devalued by 69% relative to gold.

- Blue solid line: SPX500/Gold exchange rate. Represents "ordinary US stocks." It reflects the real purchasing power of the S&P 500 priced in gold. This line almost overlaps with the black dashed line.

- Orange solid line: QQQ/Gold. Represents "tech growth." It has outperformed the black dashed line but is still below the levels of 1999.

This means that compared to 1999, which was 27 years ago:

- The dollar has devalued by 69% against gold.

- SPX has devalued by 68%.

- QQQ has devalued by 30%.

Or conversely:

Almost 99% of SPX's growth is merely due to dollar premium, while 60-70% of QQQ's growth is due to dollar premium, with only about 30% being real technological productivity progress.

Currently, the growth rate of gold has already surpassed the combined speed of M2 money printing and stock market growth. If the purchasing power of the dollar is halved during the fiat currency system reconstruction cycle, it will offset all the growth brought by AI technological progress.

The idea that the stock market will always rise is an illusion; only the part that outpaces M2 is the real purchasing power gained. The devaluation speed of all your assets is far faster than you think.

By the way, the M2 growth rate of the dollar over the past year (YoY) is 4.6%, while China's is 8.5%.

The monetization of commodities is real and happening.

Humanity Can Live Without a Future, But Will Never Stop Plundering

Technological Explosion is the Premature Child of Fiat Currency Leverage

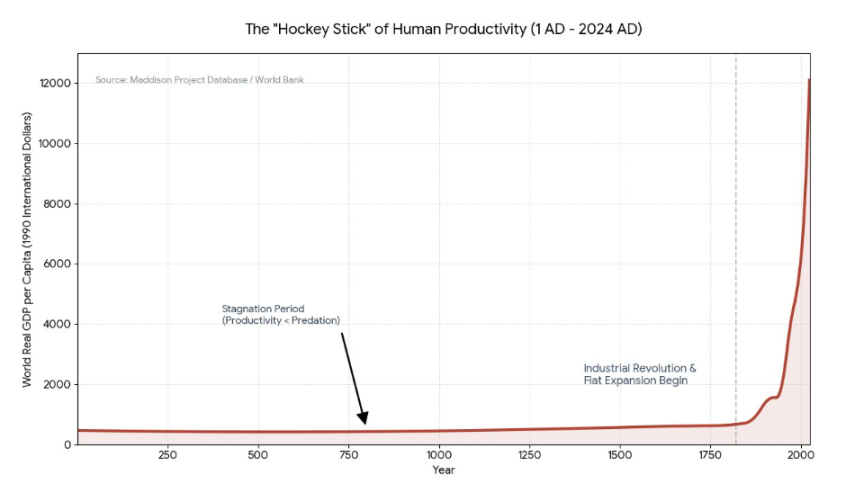

For thousands of years before the 19th century, human civilization experienced very slow technological progress, but social structures, power hierarchies, and population reproduction remained highly stable. It wasn't until the 19th century that a large-scale explosion of productivity and the rise of the middle class emerged during the gold standard era. However, this was not purely a technological miracle but was highly synchronized with the credit expansion from the gold standard to the fiat currency system.

This illustrates two truths:

- The underlying color of technological explosion: The so-called technological explosion largely stems from financial leverage overextending the future.

- The non-necessity of development: Development is far from a basic need of human civilization. Even if financial leverage breaks, humanity merely returns to its long-term norm—a low-efficiency but extremely stable "long cycle of stability."

Plundering is the Norm, Production is the Premium

If you are familiar with the first principles of thermodynamics, "production" is essentially entropy reduction (transforming disordered resources into ordered wealth through technological means), which requires enormous energy and information; while "plundering" is essentially energy transfer (directly acquiring others' ordered wealth through violence or contracts).

The efficiency of plundering far exceeds that of production. The so-called "progress" of the past two hundred years is essentially a strategic optimization of the fiat currency system: interest groups discovered that rather than directly seizing existing wealth, it is better to induce all of humanity into a "productivity competition" through money printing, thus creating a larger base for plundering.

When AI Productivity Threatens the Plundering Agreement

If AI cannot serve the core goal of "amplifying the plundering base," then AI can be allowed to fail:

- Threat to finance: If AI leads to extreme deflation (very low prices, devaluation of labor), the finances of sovereign states operating on "inflation and debt" will completely collapse—because heavy debts must be diluted by devalued currency.

- Threat to power: If AI makes individuals too powerful, thus detaching them from centralized distribution systems, the chains of power will become ineffective.

When the surplus of "production" threatens the foundation of "plundering," interest groups will have ample motivation to ensure the failure of the AI revolution or to delay it indefinitely.

Debt Clock and Ultimate Zero-Sum

Currently, the total global debt has reached more than three times GDP. This means that the productivity enhancement brought by AI (TFP growth rate) must reach unprecedented exponential levels to barely offset the insane growth of debt interest.

However, in the face of AI, the traditional logic of "war clearing" has already failed.

- Change in asset attributes: Core assets are no longer land and factories, but fragile and invisible algorithms, computing power, and data.

- Winner-takes-all prisoner's dilemma: In previous wars, after determining winners and losers, the victors established order (such as the Bretton Woods system), and the losers integrated into the system, jointly producing under new productivity standards. In the case of AI, it is "winner-takes-all"—once a country achieves intergenerational leadership in AGI, other countries and even the vast majority of the population have no reason to exist.

Therefore, countries prefer to choose inefficient "sovereign fragmentation" rather than accept the high-risk "intelligent dependency."

Ultimately, whether from an individual or ruling perspective, there will be a tendency to delay the arrival of AI's full potential:

- For individuals: Any AGI without sovereignty could mean "loss of property rights" and a dark future of being endlessly harvested.

- For regimes: Unless they can find a "new agreement" that can maintain control and repay debts in a deflationary environment, they will never wish for AI productivity to be rapidly released.

Betting on AI's "Death," What Exactly Are You Betting On?

Essentially, you are betting on three things:

1. Shorting the Race Between "Exponential Growth of Credit" and "Linear Growth of Productivity"

The essence of the fiat currency system is debt. To maintain this system, nominal GDP growth must consistently outpace debt interest over the long term. If the productivity improvements brought by AI cannot elevate GDP to exponential levels, the result will be the death of the monetary system, replaced by non-sovereign commodities.

2. Going Long on Hard Assets and Anti-Fragile Assets

Going long: Gold, Bitcoin, scarce minerals, energy infrastructure—these are physical and mathematically defined "entropy-reducing assets."

Going short: Long-term sovereign bonds, paper contracts, social welfare promises—these are credit assets based on future tax revenues.

3. Shorting Organizational Efficiency

Even if AI generates technology, human political organizations, distribution systems, and bureaucratic structures will hinder the conversion of these technologies into actual tax revenues and economic growth, thus failing to fill the debt black hole.

In summary, what ultimately determines whether you place a bet is your answer to the following question:

Is money printing faster, or is GDP growth driven by AI's production faster?

Betting on AI losing means you are betting against physical laws and the mathematics of debt; betting on AI winning means you are betting on technological singularity and the luck of human evolution.

Currently, the speed of the money printing machine (M2) remains a resistance level that AI cannot temporarily surpass.

Conclusion

Given the current situation, the vast majority of us may not live to see the day we reach the legal retirement age, or rather, before that day, the existence of most of us may have already become economically irrelevant.

Since the long-term future's promise to everyone has already vanished, let's enter the arena now and join the great macro game.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。