The liquidity reinforcements are on their way.

Written by: Raoul Pal

Translated by: AididiaoJP, Foresight News

Core Narrative

The mainstream narrative now is: BTC and cryptocurrencies have crashed, the cycle is over. They have decoupled from other assets, blame CZ, blame BlackRock, blame the heavens and the earth. This narrative is indeed very seductive… especially when we watch prices plummet every day.

But yesterday, a hedge fund client asked me if SaaS stocks are on sale and if they should buy now? Or is it true, as rumored, that Claude Code has already sentenced SaaS to death?

I did some in-depth research…

It turns out that both claims are unfounded. The charts for SaaS and BTC look exactly the same, strange, right?

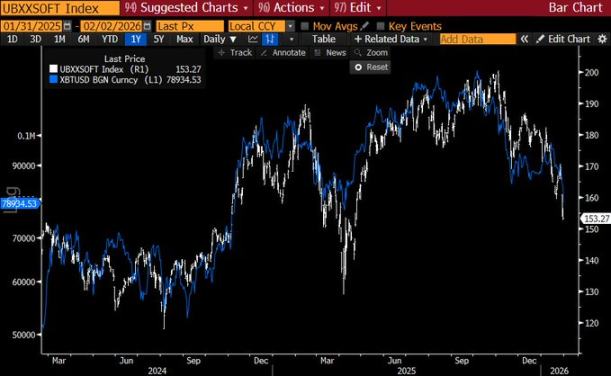

UBS SaaS Index vs BTC

This indicates that there is another key factor at play that we have overlooked.

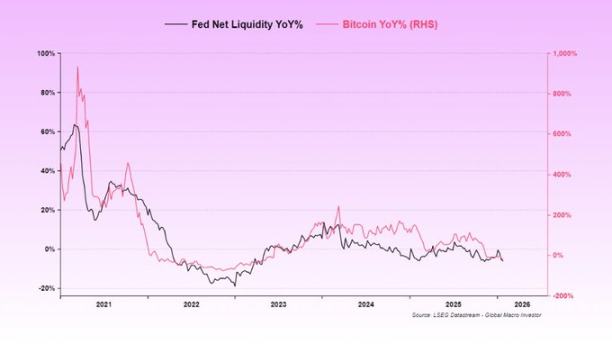

This factor is: due to two government shutdowns and internal issues within the U.S. financial system, U.S. liquidity has been stuck (reverse repos are basically over in 2024). During the replenishment of the Treasury General Account (TGA) in July and August, there was no monetary hedge, leading to liquidity being drained.

It’s no surprise that liquidity has been so weak, and ISM data is sluggish.

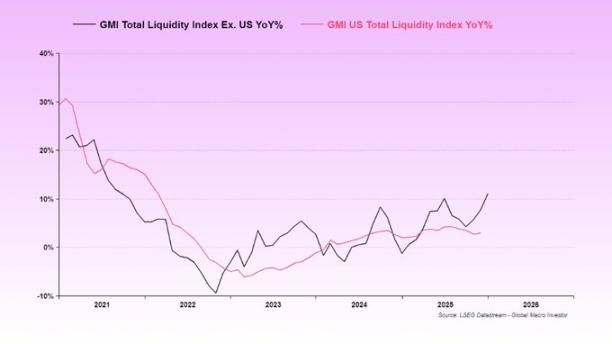

We usually pay more attention to global total liquidity because it has the highest long-term correlation with BTC and Nasdaq. But at this stage, the impact of U.S. total liquidity seems to be greater, after all, the U.S. is the main source of global liquidity.

In this cycle, global liquidity has led U.S. liquidity, and a rebound is coming (ISM will follow suit).

And this is precisely why SaaS and BTC are affected; when liquidity tightens temporarily, they are naturally the first to be impacted.

The rise in gold has further siphoned off the marginal liquidity that could have flowed into BTC and SaaS. When liquidity is insufficient, the riskiest assets suffer first, that’s the reality.

Now, the U.S. government has shut down again… The Treasury has long been prepared for this; after the last shutdown, it didn’t even touch the TGA, but instead deposited more money into it (which is equivalent to draining another wave of liquidity).

This is the liquidity "fault" we are currently facing, making prices particularly ugly. The cryptocurrencies we love are temporarily waiting for new liquidity.

However, signs indicate that the shutdown will be resolved this week, which will be the last liquidity barrier.

I have mentioned the risk of a shutdown many times; it will soon be a thing of the past, and the liquidity that should come will come: eSLR adjustments, TGA consumption, fiscal stimulus, interest rate cuts… everything is related to the midterm elections.

In full-cycle investing, time is often more important than price. Prices may drop significantly, but as long as the cycle continues and time is sufficient, everything will return to its rightful place.

So I always say, "Be patient!" Things need time to ferment; staring at account gains and losses only tortures yourself, not your investment portfolio.

About the Fed's False Narrative

Speaking of interest rate cuts, there’s a rumor that Kevin Warsh is hawkish, but that was his viewpoint twenty years ago.

Warsh's task is to execute the strategy from the Greenspan era: cut interest rates, heat up the economy, and believe that the productivity gains from AI can keep core inflation in check. Just like from 1995 to 2000.

He indeed dislikes a large balance sheet, but system reserves have already hit rock bottom, and he is unlikely to change the status quo. He also dares not change it; otherwise, the credit market would collapse.

Warsh will only do one thing: cut interest rates. As for the rest, he will make way for Trump and Bessenet to release liquidity through the banking system. Milan will likely also push hard for eSLR reductions to fuel this process.

I know the situation is dire right now, and bullish sentiments sound particularly jarring. Our Sui positions feel like garbage, and we don’t know what to believe or who to trust.

First of all, we have experienced this kind of situation many times. BTC can drop 30%, and small coins can drop 70%. But if the projects are solid, they rebound faster.

My Question

We did not realize that the current dominant factor is U.S. liquidity; usually, global total liquidity is the main character throughout the cycle. But now it’s clear that this is still the "everything is interconnected" principle at work.

There is no "decoupling," just a series of events: reverse repos hitting bottom > TGA replenishment > government shutdown > gold soaring > another shutdown, which we did not predict, or rather, we underestimated their impact.

However, all of this is finally coming to an end, and we will soon return to the right track.

We cannot always accurately calculate all variables, but now we understand better. We remain extremely optimistic about 2026 because we are clear about the "Trump, Bessenet, Warsh" script.

They have said it repeatedly. What we need to do is listen and then wait patiently.

Comprehensive investment is about time, not price.

If you are not a full-cycle investor and cannot bear that kind of volatility, that’s perfectly fine; everyone has their own approach.

Now is not the time to give up; I wish everyone good luck.

The liquidity reinforcements are on their way.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。