To secure a $100 million loan with a one-month term at a fixed interest rate of 5%, only $416,000 is needed to hedge against the spread risk, achieving an inherent leverage of 240 times.

Written by: Nico

Translated by: AididiaoJP, Foresight News

Current on-chain money market protocols (such as Aave, Morpho, Kamino, Euler) perform well in serving lenders, but due to the lack of fixed borrowing costs, they cannot cater to a broader group of borrowers, especially institutions. With only lenders being satisfied, growth has stagnated.

Peer-to-peer fixed rates are a natural solution from the perspective of money market protocols, while interest rate markets provide a capital-efficient alternative that is 240-500 times more effective.

Peer-to-peer fixed rates and interest rate markets are complementary and crucial for each other's prosperity.

Common Direction of Leading Protocols: Providing Fixed Rates for Borrowers

Looking at the roadmaps of leading protocols at the beginning of the year reveals insights into industry trends.

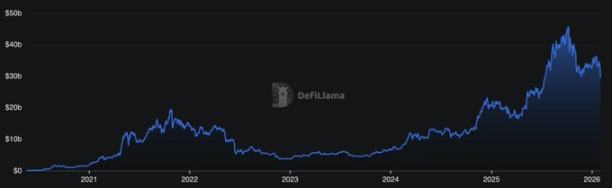

@Morpho, @kamino, and @eulerfinance are currently the leading projects in on-chain money markets, with a total locked value (TVL) reaching $10 billion. Reviewing their 2026 roadmaps, one common theme is exceptionally clear: fixed rates.

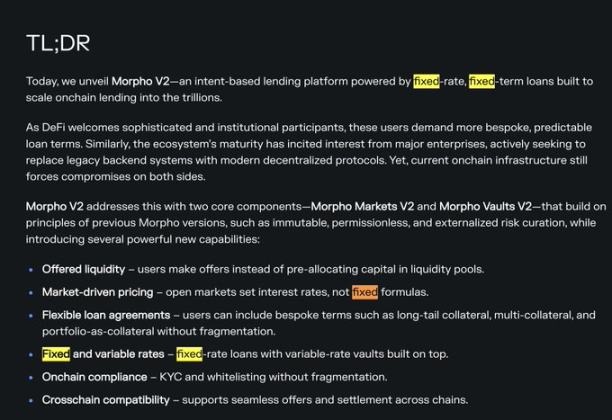

From Morpho: [1] Morpho V2 Briefing

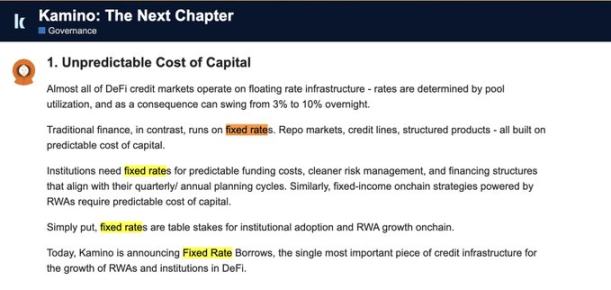

From Kamino: [2] Kamino 2026 Plan

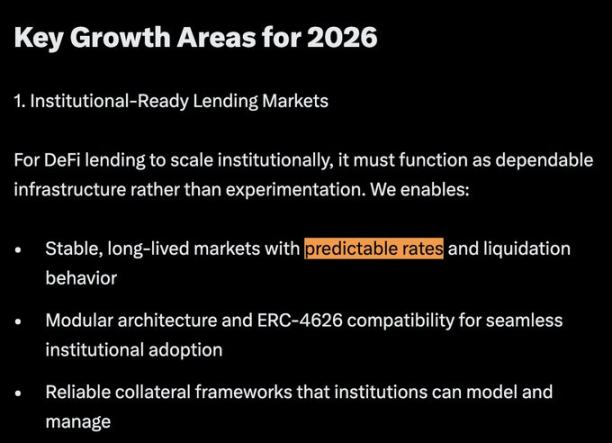

From Euler: [3] Euler 2026 Roadmap

In their 2026 announcements, the terms "fixed rate" or "predictable rate" appeared 37 times. This is the most frequently repeated term and is listed as a priority in all roadmaps.

Other high-frequency terms include: institutions, real-world assets, and credit.

What is happening behind this?

Early DeFi: Borrowers Did Not Care About Fixed Rates

Early DeFi was a paradise for builders but can be summarized for users in two words: rampant speculation and frequent hacks.

Rampant Speculation (2018-2024):

DeFi was like a "Mars casino" [4], disconnected from the real world. Liquidity was driven by early retail and speculation, with everyone chasing triple-digit annual yields. No one cared about fixed-rate borrowing.

The market was highly volatile, liquidity came and went quickly, and TVL fluctuated dramatically with sentiment. Not only was there little demand for fixed-rate borrowing, but there was even less demand for fixed-rate loans—lenders needed the flexibility to withdraw at any time, and no one wanted to lock up their money.

Frequent Hacks (2020-2022):

Hacking incidents were rampant, with even blue-chip protocols like Compound losing tens of millions due to governance vulnerabilities in 2021. During this period, DeFi vulnerabilities resulted in losses totaling billions of dollars, exacerbating institutions' concerns about smart contract risks.

As a result, institutions and wealthy individuals turned to off-chain channels like Celsius, BlockFi, Genesis, and Maple Finance for borrowing to avoid on-chain risks. At that time, there was no saying like "directly using Aave."

Turning Point: Pain Points Emerge, Product Advances

Although existing protocols tend to serve lenders, change requires "pain points" or "advancements" to drive it. In the past year and a half, both have emerged.

User Pain Point 1: Fixed Income Loop Strategies Frustrated

Traditional finance has many fixed income products, but DeFi only saw similar products emerge through protocols like Pendle in 2024.

However, when using these fixed income tokens for loop strategies, the volatile borrowing rates became a fatal flaw, with expected annual yields of 30-50% often being consumed by rate fluctuations. Frequent strategy adjustments also incurred multiple layers of fees, often resulting in negative returns. This indicates that as more reliance is placed on certainty in private credit on-chain, fixed rates become essential.

User Pain Point 2: Off-Chain Fixed Rates vs. On-Chain Floating Rate Premiums Widen

Lending protocols have successfully served lenders (flexible withdrawals, no KYC, easy to program), and on-chain lending liquidity has continued to grow, leading to a decline in floating borrowing rates [5].

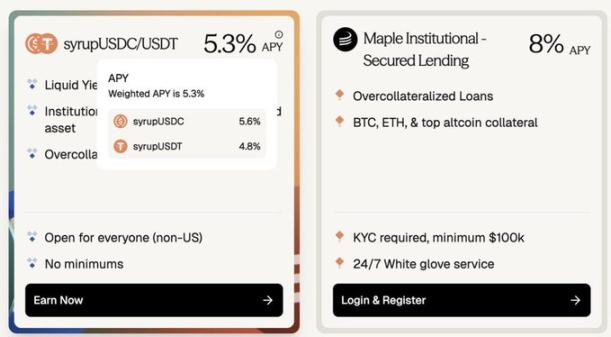

But this is irrelevant to institutions, which prefer fixed rates and are willing to pay a high premium for them. For example, the fixed rate from off-chain Maple Finance (about 8%) is approximately 180-400 basis points higher than the floating rate from on-chain Aave (about 3.5%) [6]. Institutions are paying a 60-100% premium for "certainty."

At the same time, with more lenders than borrowers, on-chain loan yields are being compressed, and protocol growth is hitting a ceiling.

Product Advances: DeFi Becomes the Default Lending Layer

On the other hand, the foundation for DeFi lending has been solidified: Morpho has become a major source of revenue for Coinbase, and Aave has become central to many protocols' treasuries and stablecoin applications. Liquidity continues to flow in.

As TVL grows and yields decline, various protocols are beginning to consider how to also become excellent "borrowing protocols" to serve borrowers and balance the bilateral market.

At the same time, protocol designs are becoming more modular (led by Morpho, Kamino, Euler), allowing for customized loans based on collateral, LTV, and other parameters, paving the way for new collateral types like Pendle PT, private credit, and real-world assets to go on-chain, further driving the demand for fixed rates.

The Path Forward for Mature DeFi: Money Markets + Interest Rate Markets

Core Market Gaps:

- Borrowers have a strong preference for fixed rates (currently satisfied off-chain)

- Lenders have a strong preference for floating rates + flexible withdrawals (currently satisfied on-chain)

Without bridging this gap, on-chain money markets will be unable to expand into a broader credit market. There are two complementary paths:

Path One: Peer-to-Peer (P2P) Fixed Rates Operated by Professional Managers

It's simple: a fixed-rate loan requires a corresponding fixed-rate loan of equal amount to match. Clean, but it requires 1:1 liquidity matching.

The problem is that retail investors are unwilling to participate directly: they want flexibility and lack the energy to assess numerous markets. Therefore, only pools of professional risk managers may participate, but even they can only participate partially, as they must also meet the immediate withdrawal demands of depositors.

This brings a tricky issue: when withdrawals surge and the treasury lacks liquidity due to funds being locked, there is no good mechanism to adjust (unlike money markets with utilization curves). If forced to sell fixed-rate loans at a discount in the secondary market, it could trigger a repayment crisis.

To solve this problem, risk managers would, like traditional banks, use the interest rate swap market to convert fixed rates into floating rates to hedge risks.

Path Two: Interest Rate Markets Based on Money Markets (Capital Efficiency King)

This method does not directly match borrowers and lenders. It matches: borrowers vs. capital willing to bear the "spread risk between fixed and floating rates."

Its capital efficiency is extremely high: for example, to secure a $100 million loan with a one-month term at a fixed interest rate of 5%, only about $416,000 in capital is needed to hedge against the spread risk, achieving an inherent leverage of 240 times.

While there is theoretically a risk of the hedging party being forcibly liquidated in extreme market conditions, this has never happened in the three-year history of Aave/Morpho. Through multi-layer risk control (margins, insurance funds), risks can be managed.

The trade-off is enticing: borrowers can obtain funds from well-established, highly liquid markets like Aave while enjoying capital efficiency that is 240-500 times higher than the P2P model. This mimics traditional finance: the $18 trillion daily interest rate swap transactions are the cornerstone of real credit.

Future Outlook: Connecting Markets, Expanding Credit

If you've made it this far, it's time to look forward to a more exciting future:

Interest Rate Markets Will Become Equally Important as Lending Protocols

They connect off-chain borrowing demand with on-chain lending supply, completing the market puzzle and becoming an indispensable part of on-chain money markets.

Interest Rate Markets Will Be the Pillar of Institutional Credit Expansion

Institutional credit (especially under-collateralized/unsecured) has a very high demand for certainty in capital costs. As private credit and real-world assets go on-chain, interest rate markets will become a key bridge connecting off-chain yields with on-chain capital. You can follow @capmoney_ to stay updated on the forefront of this field.

"Borrowing Consumption" Will Go Mainstream

Selling assets involves taxes, so the wealthy prefer "borrowing consumption" rather than "selling consumption." In the future, asset issuers and exchanges will have the incentive to issue credit cards that allow users to borrow against their assets for consumption. To achieve this fully self-custodied process, a decentralized interest rate market is essential.

@EtherFi's card business grew 525% last year, with a single-day peak processing amount of $1.2 million, leading the way in collateral-based consumer credit. It's worth a try!

Finally

Fixed rates are far from the only catalyst for growth; money markets also face many challenges (such as off-chain collateral oracle issues). The road ahead is long, but opportunities have arrived.

References:

[1] Morpho v2: https://morpho.org/blog/morpho-v2-liberating-the-potential-of-onchain-loans/

[2] Kamino The Next Chapter: https://gov.kamino.finance/t/kamino-the-next-chapter/864

[3] Euler's 2026 Roadmap: https://x.com/0xJHan/status/2014754594253848955

[4] Casino on Mars: https://www.paradigm.xyz/2023/09/casino-on-mars

[5] DefiLlama: Aave TVL https://defillama.com/protocol/aave

[6] Maple Finance Yield: https://maple.finance/app

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。