Kalshi and Polymarket's offline events are a microcosm of the fierce competition in the prediction market.

Written by: Maher, Foresight News

Who would have thought that the competition between the online prediction market giants Kalshi and Polymarket has spread from purely online to offline?

On February 4th at 12 PM, Kalshi distributed free groceries to residents at 84 West 3rd Avenue in New York City, with a maximum of $50 per person.

Kalshi's CEO Tarek Mansour stated, "We believe in free markets," and it is evident that this initiative promotes the concept of prediction markets to the public through tangible benefits.

The highlight of the event lies in its clever marketing strategy. Firstly, it is directly linked to current economic hot topics—rising inflation and living costs have become pain points for the American public. By providing free groceries, Kalshi not only offers immediate value but also positions itself as an "event contract exchange," allowing users to trade on events in politics, economics, sports, and more.

For example, users can predict grocery price fluctuations or changes in economic indicators on the platform, thus transforming the offline experience into online participation. Secondly, the event was held in New York, a high-density, high-consumption city, maximizing exposure. Officially released videos show that the moment the event opened was like "Christmas reappearing," with crowds pouring in.

This event had a low barrier to entry: no app download was required to participate; shoppers simply had to visit the store, and Kalshi would cover the bill. This not only lowered the entry barrier for users but also reinforced the platform's approachable image.

In contrast to Kalshi's short-term promotion, Polymarket's offline event is more long-term and ambitious.

On February 4th, Polymarket announced it would open a "free grocery store" in New York, located at 7 Madison Avenue, with plans to officially open on February 12th. The store is supported by groceries from the Food Bank for New York City, and the project is set to break ground by the end of 2025, with a lease agreement already signed. Additionally, Polymarket has donated $1 million to address safety issues.

Polymarket's announcement coincided with Kalshi's event on the same day, even overlapping in opening times, which is seen as a direct response.

The highlight of Polymarket's event is its innovation and emphasis on social responsibility. Firstly, this is not a one-time promotion but a permanent store where users can obtain groceries for free, addressing food security issues in New York. Secondly, this aligns closely with the platform's core philosophy of revealing truths and allocating resources through prediction markets.

Polymarket founder Shayne Coplan stated that this move is an expansion of the platform from online to offline, aiming to "make prediction markets accessible."

Polymarket incorporates its logo's signature blue into the store, with a simple yet stylish interior design. Compared to Kalshi's $50 limit, Polymarket's free model is more attractive and is expected to reach a larger low-income demographic.

Competition Between the Two Major Platforms

Kalshi and Polymarket's offline events are a microcosm of the fierce competition in the prediction market.

Kalshi uses U.S. compliance as a moat, expanding its territory by integrating with various Web3 wallets like Phantom and partnering with Coinbase to extend its business to all 50 states in the U.S. Coinbase users can trade prediction market contracts with a minimum threshold of just $1. In January of this year, Kalshi officially announced that its annual trading volume surpassed $100 billion.

Polymarket is not only strengthening cooperation with crypto-native players like Jupiter and Phantom but also expanding traffic channels by sponsoring events such as the Hollywood Golden Globe Awards.

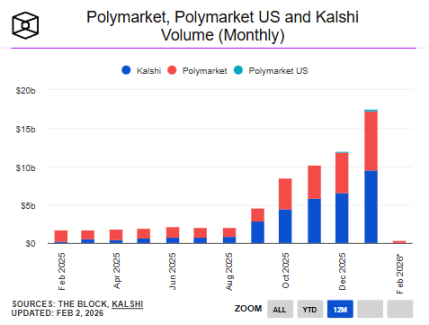

However, the latest data shows that its market share is still being eroded by Kalshi.

To make matters worse, Polymarket is facing troublesome regulatory issues.

In January, Ukraine banned Polymarket, as the current legal framework in Ukraine does not recognize prediction markets. Portuguese regulators have ordered Polymarket to cease operations in the country.

In February, a court in Nevada, USA, issued a temporary restraining order prohibiting Polymarket from providing event contract services to residents of Nevada before a preliminary hearing on February 11th.

Additionally, many regions in the Asia-Pacific view Polymarket as a gambling platform and have blocked its platform IP.

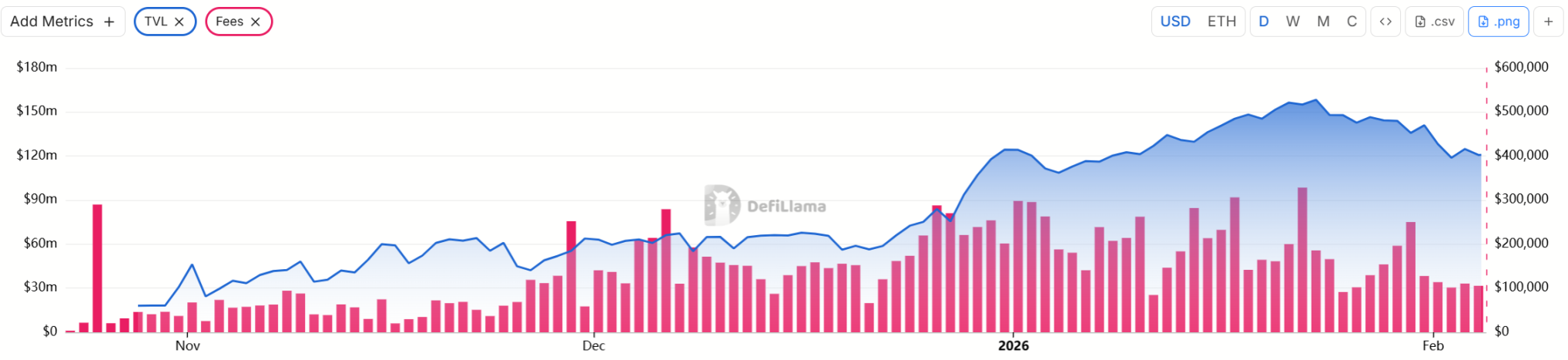

Another Binance-backed competitor is also eyeing the market; Opinion completed tens of millions of dollars in financing by December 2025, and under the expectation of airdrop incentives, the platform's trading volume exceeded $5 billion in just one month, with daily fee income exceeding $100,000.

Meanwhile, various exchanges, DEXs, and traditional finance are also laying out plans for prediction markets.

Bloomberg reported that Crypto.com announced on Tuesday that it would launch a dedicated prediction market platform called OG a few days before the Super Bowl. Its co-founder and CEO Kris Marszalek stated that its event contract business has grown 40 times week-over-week over the past six months, making the launch of a standalone product necessary. Another crypto trading platform, Kraken, plans to launch prediction market services in 2026, with its global consumer business head Mark Greenberg revealing this plan on the Crypto World program.

Robinhood launched its prediction market even before Trump's election and plans to introduce more new event contracts for prediction markets. In October 2025, Robinhood CEO Vlad Tenev stated in an interview with Bloomberg that its prediction market segment is currently one of the fastest-growing segments and one of its nine business lines generating over $100 million in annual revenue.

The leading derivatives DEX Hyperliquid is also testing a native prediction market on its testnet. Hyperliquid stated that HyperCore will support outcome trading (HIP-4). Outcome trading is a fully collateralized contract that settles within a fixed range. It is a universal foundational trading component suitable for applications such as prediction markets and bounded options.

It features non-linear, time-limited contracts, providing a form of derivative trading that does not involve leverage or liquidation, and can be combined with portfolio margin and HyperEVM. Currently, this feature is still in development and is only being tested on the testnet. Once the technical development is complete, Hyperliquid will deploy a standardized market priced in USDH.

The opening of stores by Kalshi and Polymarket is not just marketing; it is a battle for user attention.

Wars, political events, character elections, and sports competitions are drawing global users online, with 24/7 uninterrupted global betting, disputes over rules, wealth stories, and insider trading unfolding simultaneously, with only money and brains remaining awake. Perhaps future popular events like the World Cup and the U.S. elections will continue to drive the trading volume and visibility of prediction markets to new heights.

Until the outcome is decided, no competitor can afford to be complacent.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。