HIP-4 opens a brand new Total Addressable Market (TAM) for HL and hosts it on the same platform.

Written by: @bedlamresearch

Translated by: AididiaoJP, Foresight News

HIP-4 was first proposed by @bedlamresearch in September 2025 and is currently being tested on the testnet.

HIP-4 allows @HyperliquidX (HL) to expand its support from perpetual contracts to binary markets, enabling HL to tap into one of the most active sectors in cryptocurrency: prediction markets (PMs).

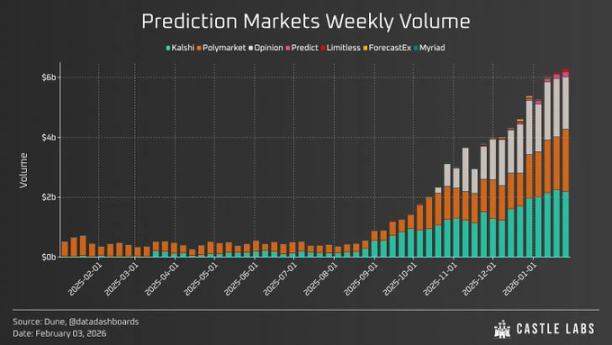

The trading volume of prediction markets speaks for itself: in the past month, their weekly trading volume has often exceeded $6 billion.

Currently, @Kalshi and @Polymarket have become the major players in this field, accounting for the vast majority of trading volume and open contracts in prediction markets. Even now, the top three players still account for over 97% of the total trading volume in this category. Therefore, HIP-4 will stimulate more competition in this landscape.

Data source: https://dune.com/datadashboards/prediction-markets

The role of HIP-4 is not limited to prediction markets: binary markets are entering the financial arena.

As @ericonomic stated:

“HIP-4 not only supports prediction markets (which is already a huge market) but also supports large-scale options trading. The biggest breakthrough of HIP-4 is that all transactions occur in the same environment, making many previously complex trading strategies possible. Previously, you might have needed to operate on at least 2-3 platforms (for example, betting on interest rate cuts in the prediction market while shorting BTC with the same collateral for hedging). Ultimately, all of this will lead to more fees, more revenue, and eventually translate into buying pressure for HYPE.”

Before HIP-4, users had to combine strategies across different platforms. Following the vision of “becoming the platform for all financial operations,” HL users can now perform all operations on a single platform.

@DanDeFiEd from @ryskfinance also pointed out that this is significant for builders:

“HL provides the core foundational components for builders to continue building on. This ‘infrastructure-first’ exchange is a first in the industry, clearly distinguishing Hyperliquid from centralized exchanges by attracting builders and promoting open finance. As a result, the market has already become mainstream due to its prediction capabilities—because it is easy to understand and powerful enough to create markets for almost everything. Launching it in the ecosystem where DeFi builders are most active is a significant move: shared accounts and collateral, complete composability, will bring new opportunities. Users can easily hedge binary outcomes with perpetual contracts from the same account, which is entirely foreseeable.”

Rysk is actively exploring how to integrate into this system to unlock new value for users and become an active participant in this new foundational component.

The above roughly outlines the potential of HIP-4 beyond prediction markets.

Next is the more interesting question—can it generate sufficient revenue to influence the development trajectory of HL through a brand new Total Addressable Market (TAM)?

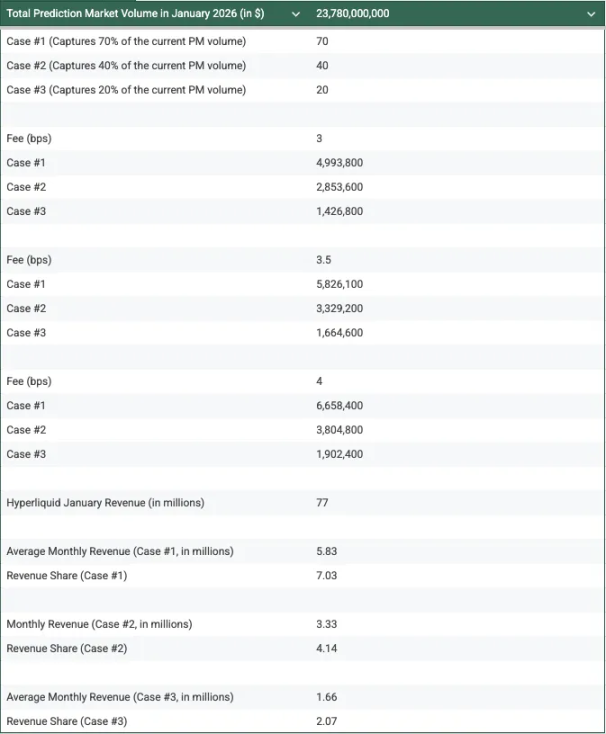

We estimate the contribution of HIP-4 to HYPE buying pressure and protocol revenue under different market share scenarios. Assuming HL can capture:

- 70% of prediction market trading volume

- 40% of prediction market trading volume

- 20% of prediction market trading volume

Last month, the total trading volume of prediction markets was $23.78 billion. For fees, we estimate 3-4 basis points.

We have analyzed the above three scenarios in a Google Sheet:

If you have different assumptions about rates or other scenarios, you can modify based on this table:

The estimated results are as follows:

- 70% trading volume → approximately $5.8 million in revenue

- 50% trading volume → approximately $3.3 million in revenue

- 20% trading volume → approximately $1.6 million in revenue

These revenues account for about 2-7% of Hyperliquid's current total revenue and could bring new funding flows for the protocol and HYPE buybacks.

Even if the above scenarios are somewhat optimistic (and may not be realized), this revenue is still insufficient to trigger a comprehensive re-evaluation of the market for HL or create significant buying pressure for HYPE.

However, it is important to note: the above analysis is only for prediction markets, while HIP-4 supports a broader range of binary markets.

Overall, HIP-4 opens a brand new Total Addressable Market (TAM) for HL and hosts it on the same platform.

Users can execute new strategies without leaving the platform.

For builders, this is a brand new foundational component that will drive new protocols, new developments, and overall ecosystem composability.

Currently, HIP-4 is still in the early stages, and many details have yet to be announced.

What we know is that the outcome market is still being debugged on the testnet, and development is ongoing.

USDH will serve as the pricing unit for the standard market and plans to eventually open the infrastructure to be permissionless, allowing anyone to deploy.

Hyperliquid is moving towards the goal of “being the home for all financial operations.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。