The ADP employment report, which fell far short of expectations, presents a new challenge for Federal Reserve Chairman Jerome Powell, who was discussing the possibility of stabilization in the labor market just last week.

On the evening of February 3rd, Beijing time, the U.S. ADP released data showing that only 22,000 jobs were added in the private sector in January, far below the market expectation of 48,000 and even lower than the lowest prediction from all economists.

This report reveals a more severe employment picture than the surface numbers suggest. If not for the surge of 74,000 jobs in the education and healthcare services sector in a single month, the overall employment growth in the private sector would have fallen into negative territory, with professional and business services losing 57,000 jobs and manufacturing losing 8,000 jobs, indicating a spreading structural weakness.

1. Data Plummets

● The latest ADP employment data paints a worrying picture of the U.S. job market. In January, only 22,000 jobs were added in the private sector, a figure that is even below the lowest estimate from all economists surveyed by Bloomberg.

● Looking back at earlier data, the total number of jobs added in the U.S. for the entire year of 2025 has significantly decreased, with private sector job additions dropping to 398,000, compared to 771,000 in 2024. Industry data further reveals the structural and widespread nature of the problem. The financial services sector added 14,000 jobs, and the construction industry added 9,000 jobs, showing relatively stable performance.

● The main drag on overall performance comes from manufacturing, professional and business services, and large employers. Manufacturing has been laying off workers every month since March 2024, and professional and business services saw a significant reduction of 57,000 jobs in January.

2. Internal Hawk-Dove Divide

● There is a clear division of opinion within the Federal Reserve on how to handle the current economic data. Last week's Fed interest rate decision kept rates unchanged, but four new Reserve Bank presidents rotated into the committee, with most leaning hawkish.

● At the same time, two committee members believe a 25 basis point rate cut should be implemented. This division is also reflected in the official statement, which has a slightly hawkish tone, upgrading the description of U.S. economic activity from "moderate" to "robust."

● Fed Governor Michelle Bowman bluntly pointed out in a speech on January 30 that: "The labor market is becoming increasingly fragile. Over the past year, as the unemployment rate rises and wage employment levels stabilize, the condition of the labor market has gradually weakened."

● Bowman believes that private sector wage employment growth further slowed to about 30,000 jobs per month in the fourth quarter. She warned that the labor market may continue to deteriorate, and if businesses begin to reassess staffing needs due to weakened economic activity, layoffs could increase rapidly.

3. Political Factors Interference

● In addition to the complexity of the economic data itself, the Fed is also facing interference from the external political environment. The Trump administration's frequent interventions in Fed personnel and decision-making in 2025 have exacerbated divisions within the Fed and challenged its independence.

● However, the political impact goes beyond personnel changes. The partial government shutdown in early 2026 led to delays in the release of several key economic data by the Bureau of Labor Statistics.

● Bowman specifically mentioned in her speech that she is reluctant to draw significant signals from the latest data because the government shutdown introduced statistical noise. This uncertainty in data quality further complicates the Fed's decision-making.

4. Key Data Outlook

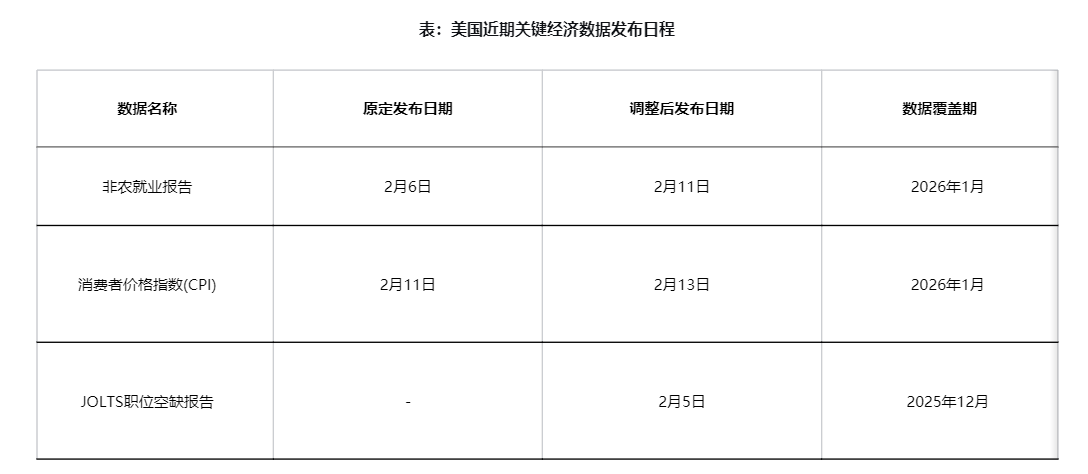

The next two weeks will be a crucial testing period for the state of the U.S. economy, with two key reports set to be released in quick succession. The U.S. Bureau of Labor Statistics has officially announced that the January non-farm payroll report will be released on February 11.

The consumer price index (CPI) report for January, originally scheduled for release on February 11, has been rescheduled to February 13. The close timing of these two reports will have a cumulative impact on the market.

It is worth noting that core CPI data has remained relatively stable over the past few months. In December 2025, the year-on-year core CPI was 2.6%, performing steadily compared to the forecast of 2.7% and the previous value of 2.6%. The overall CPI year-on-year remained at 2.7%.

5. Market Impact Analysis

The weak employment data has already had a direct impact on market expectations. The market currently anticipates that the Fed will cut rates at least once this year, with about an 83% probability of another rate cut.

● If the U.S. Supreme Court's ruling cancels previous reciprocal tariffs, and if control of the House changes after the midterm elections, thereby limiting fiscal stimulus, the U.S. economic growth rate and inflation rate could fall below 2% by the end of 2026, creating opportunities for further easing in 2027.

● From an asset allocation perspective, a moderate rate cut by the Fed is expected to support the performance of the U.S. economy and global financial markets, but may not significantly boost them. The U.S. Treasury yield curve is becoming steeper, with long-term U.S. Treasury yields facing rebound risks.

● Challenges to the Fed's independence may raise market expectations for future inflation; excessive fiscal expansion in the U.S. could further elevate term premiums. U.S. stocks are expected to perform positively in a moderate rate cut environment, but there are also high volatility risks.

6. Policy Path Outlook

In the face of complex economic data and political environments, how will the Fed's policy path evolve? Morgan Asset Management believes that the Fed may pause rate cuts at least in the first half of 2026.

● The meeting statement indicates that the committee believes the risks to its dual mandate are roughly balanced, and current policy is nearly at a neutral level. It is expected that inflation may re-accelerate, supported by fiscal stimulus spending and tariff costs, peaking around mid-2026.

● In 2026, the Fed may continue to cut rates 2-3 times, with the pace of cuts likely concentrated in the first half of the year. Against the backdrop of the U.S. job market being weaker than long-term trends and inflation being above target, the Fed's optimal strategy may be to calibrate rates near the "neutral rate."

● Bowman's views may best represent the balanced thinking within the Fed: "Monetary policy is not a predetermined path. At each FOMC meeting, my colleagues and I will assess new incoming data, the evolving outlook, and the balance of risks to our dual mandate goals (maximum employment and price stability)."

The temperature difference between labor market data and the Fed's statements is pushing this most important central bank in the world into a dilemma. On one side are potentially worsening employment data, and on the other is the still-to-be-confirmed downward trend in inflation.

Financial markets have already begun to price in at least one rate cut this year, with a probability as high as 83%. The non-farm data on February 11 and the CPI data on February 13 will provide Powell with the "more confidence" he needs, or conversely, become an excuse to delay rate cuts.

Regardless of the outcome, the Fed's decision-making is no longer merely about changes in interest rate numbers, but rather a litmus test for whether the U.S. economy can find a balance in the complex environment of intertwined political and business cycles.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。