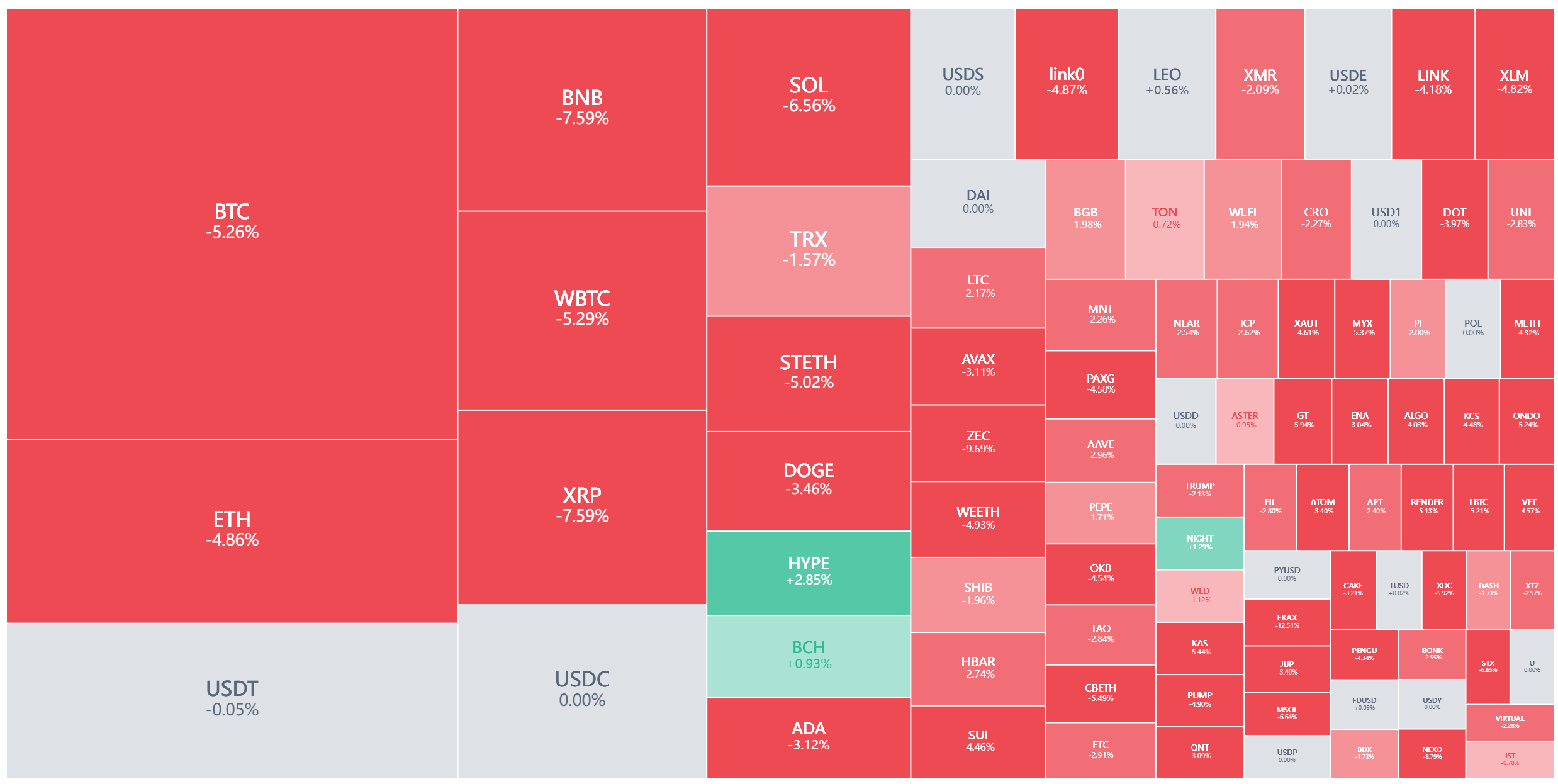

In the past 24 hours, the market has seen liquidations reach as high as $659 million. Notable investor Michael Burry wrote on social media, "The nauseating scenario is now within reach." The price of Bitcoin has dropped over 40% from its historical high in 2025, hitting a new low not seen in 15 months.

A storm sweeping through the cryptocurrency market is escalating. Bitcoin briefly fell below the $73,000 mark, erasing all gains since Trump was re-elected in November 2024.

Forbes reported that this significant correction has raised concerns in the market about a new round of "deep declines" in crypto assets.

1. Market Collapse

● The crypto market has experienced a severe sell-off. Over the past week, the price of Bitcoin has dropped about 10%, briefly falling below the $80,000 mark, with the latest low reaching $71,000. Market panic has spread rapidly, with liquidations in the cryptocurrency market reaching $659 million in a single day, of which Bitcoin long positions accounted for about $234 million, becoming the main source of liquidations.

● In this round of declines, Bitcoin has shown an unsettling correlation with tech stocks. Long promoted as "digital gold," Bitcoin has not exhibited the characteristics of a safe-haven asset during this crisis, instead falling in sync with high-risk tech stocks.

● The market's panic has reached a peak. According to data, the current market fear index is only 15, indicating that market sentiment is in extreme fear.

2. Bearish Warnings

● "Big Short" Michael Burry has issued a stern warning, stating that Bitcoin breaking through several key technical levels could trigger a chain reaction, leading to massive value evaporation. Burry pointed out that Bitcoin has proven to be a "purely speculative asset" and has not established the hedging properties against currency devaluation like precious metals such as gold and silver.

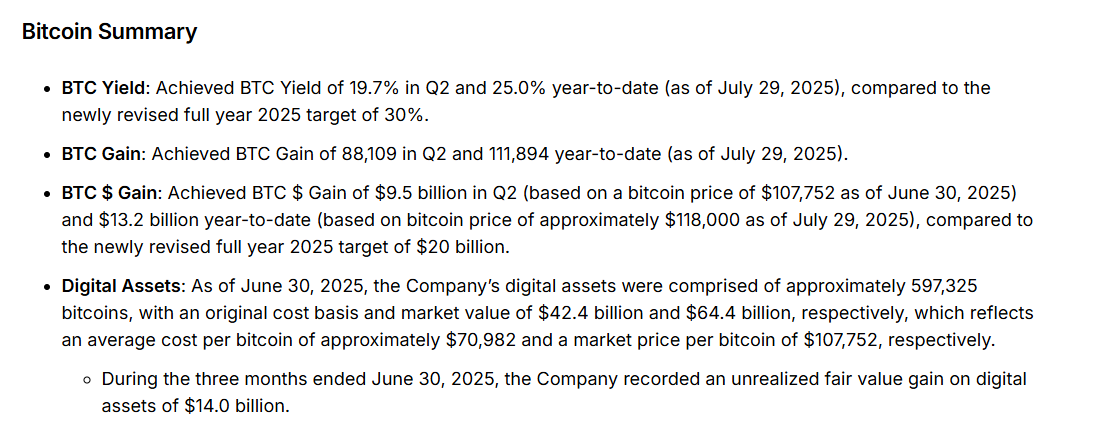

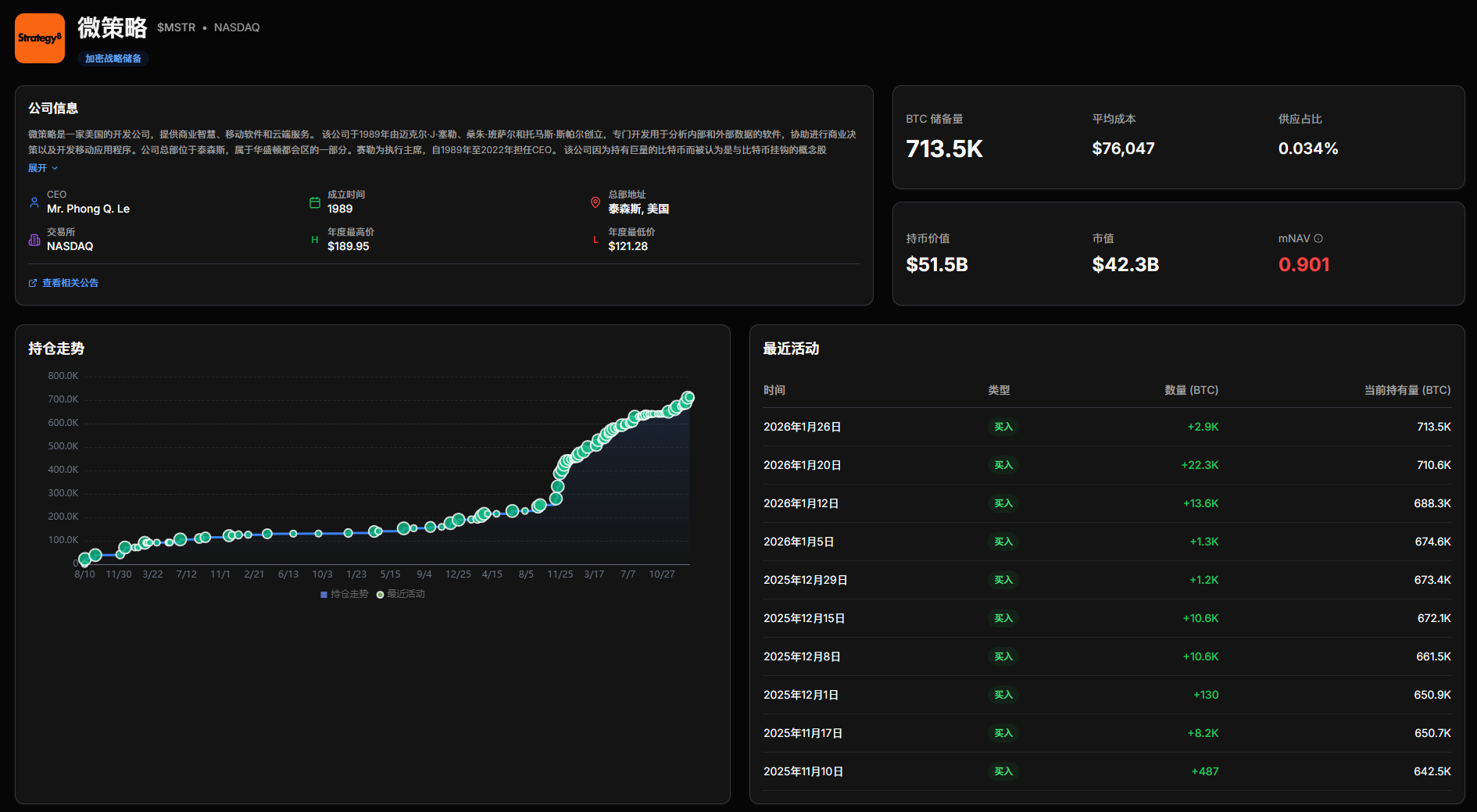

● The investor who successfully predicted the 2008 financial crisis believes that if Bitcoin drops another 10%, one of the most aggressive Bitcoin "corporate treasury" companies, Strategy, could face billions in unrealized losses, with financing channels potentially being nearly closed off by the market.

● Burry's warnings are gaining broader attention. In a recent analysis, he noted that the correlation between Bitcoin and the S&P 500 has recently approached 0.50, indicating that its linkage to the traditional stock market is strengthening.

3. Chain Reaction

● Corporate Bitcoin holders are facing increasing pressure. Nearly 200 publicly traded companies hold Bitcoin, and the Bitcoin assets in their financial reports must be valued at market price. If Bitcoin prices continue to fall, corporate risk management departments will begin to recommend that companies sell their Bitcoin assets.

● As Bitcoin continues to decline, this pressure may spread to the broader market. Burry warned that Bitcoin breaking through critical levels could force corporate risk management departments to sell assets, affecting derivative markets such as "tokenized precious metal futures."

● Galaxy Digital's research director Alex Thorn pointed out that Bitcoin is structurally weak and lacks short-term catalysts, and may further drop to around $58,000 near the 200-week moving average.

● Mining companies are also facing serious risks. Burry warned that if Bitcoin falls to $50,000, mining companies could face mass bankruptcies, and tokenized metal futures lacking physical support could "fall into a black hole with no buyers."

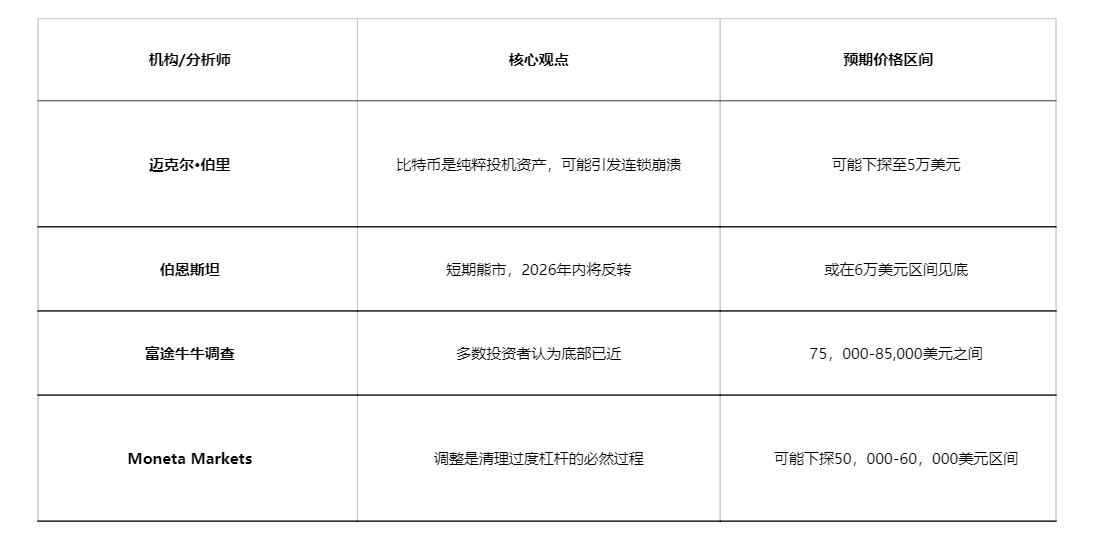

4. Institutional Bull-Bear Showdown

There is a significant divergence in market judgments about the future. Institutional investors and analysts have contrasting views.

● Michael Burry and other bears believe that the plunge in Bitcoin may just be the beginning, with prices potentially dropping to $50,000.

● In contrast, institutions like Bernstein are relatively optimistic, believing that the crypto market is still in a short-term bear cycle but expects a reversal within 2026.

● A survey by Futu Niu Niu shows that most respondents believe the bottom price for BTC in 2026 will be between $75,000 and $85,000.

5. Technical Indicator Signals

● Although market sentiment is low, some technical indicators have begun to send positive signals. The well-known ahr999 indicator has fallen below 0.5 for the first time since October 2023. Historically, when the ahr999 indicator is below 0.45, it is considered a low-price buying zone.

● Meanwhile, glassnode data shows that the on-chain cost of Bitcoin across the network is $55,900, meaning that if Bitcoin falls below this level, the purchase price will be lower than the average cost across the entire network.

● This data corroborates the CVDD model of well-known analyst Willy Woo, which indicates that Bitcoin's "iron bottom" is around $45,000.

6. Identity Crisis

● The fundamental issue Bitcoin faces goes beyond price fluctuations, touching on its core identity crisis as an asset. When "digital gold" plummets alongside physical gold, the market must reconsider the essence of Bitcoin.

● Pimco managing director Pramol Dhawan believes that the notion of Bitcoin as digital gold is no longer valid, and its price drop indicates that it is "not a currency revolution."

● Bitcoin's close ties to the current U.S. government are becoming a double-edged sword. The crypto-friendly policies implemented by the Trump administration last year propelled Bitcoin to a historical high, but ongoing tariff threats and strained international relations have severely dampened market enthusiasm for cryptocurrency investments.

7. Market Turning Point

● Some analysts believe that the current adjustment in the crypto market is a necessary process to clear excessive leverage. Moneta Markets Forex states that deep washouts may provide a more cost-effective value opportunity for long-term investors after the leverage bubble is cleared.

● On-chain data shows that large holders are accumulating Bitcoin during the price decline, contrasting with the narrative of panic selling, indicating confidence in the long-term trajectory.

● Institutional investors' views on Bitcoin are also changing. According to State Street Global Advisors, 94% of institutional investors see blockchain technology as a long-term value proposition, and 70% of institutions believe Bitcoin is currently undervalued.

The holdings of the well-known Bitcoin hoarder Strategy are also worth noting. As of February 2, its average holding cost is about $76,040, which historically has been viewed as a bottom range when below this cost line. Bitcoin's movements in the past 24 hours have been like a thrilling financial drama, with prices rebounding slightly after breaking key support levels, ultimately finding temporary balance above $76,000.

Meanwhile, the predictive market sentiment has undergone a dramatic reversal. Just a week ago, the market widely believed that Bitcoin had over a 70% chance of hitting $100,000, but now traders are betting on a 75% chance that Bitcoin will first drop to $69,000.

In the context of crypto assets being re-priced as "high-risk assets," Bitcoin's short-term movements will still heavily depend on macroeconomic conditions and changes in market sentiment. LMAX Group CEO David Mercer pointed out that the current market is experiencing "collateral tightening," with the speed of risk diffusion outpacing the support system, leading to significantly amplified volatility.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。