For Ethereum, this directional correction has maintained its credibility by "acknowledging reality" rather than "defending outdated assumptions."

Written by: YQ

Translated by: Saoirse, Foresight News

Since 2015, I have been deeply engaged in research on scaling technologies, exploring all technical iteration solutions from sharding, Plasma, application chains (App Chains) to Rollup. I have collaborated extensively with every mainstream Rollup technology stack and team in the ecosystem. Therefore, when Vitalik publishes content that fundamentally reshapes our understanding of Layer 2 (L2), I always pay special attention. The post he published on February 3rd is such a key piece of content.

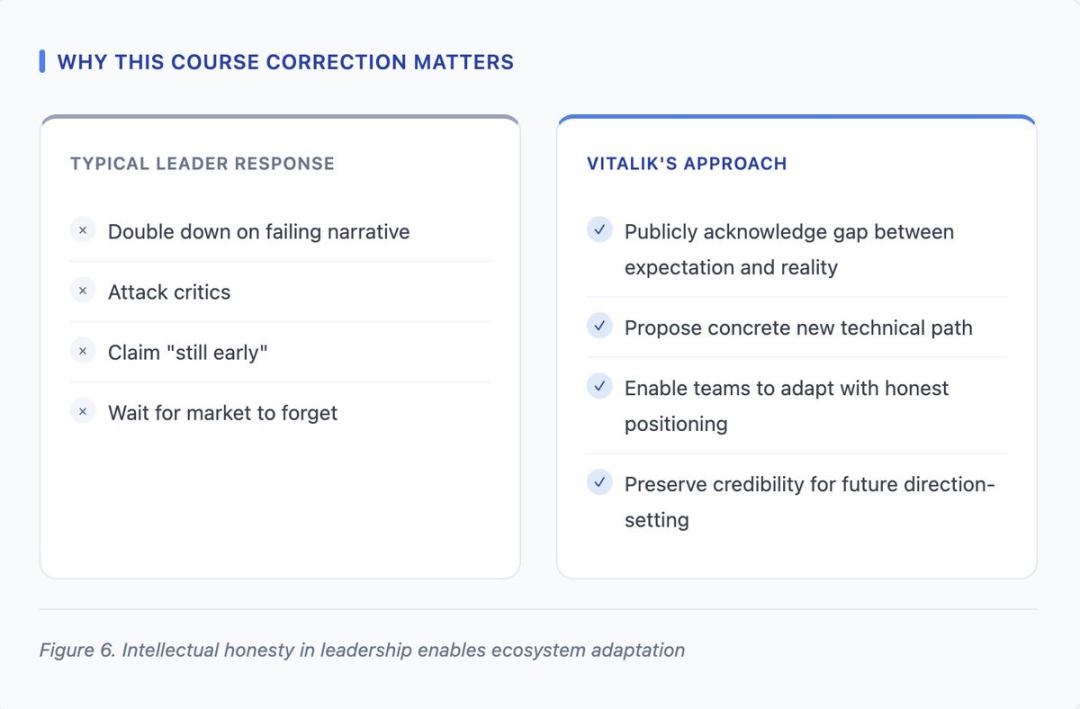

What Vitalik did is not easy—acknowledging that the core assumptions of 2020 have not been realized as expected. This kind of honesty is something most leaders tend to avoid. The roadmap centered around "Rollup" was based on the premise that "L2 would serve as Ethereum's 'branded sharding'." However, four years of market data have presented a different picture: L2 has evolved into platforms with independent economic incentive mechanisms, and the scaling speed of Ethereum Layer 1 has far exceeded expectations. The original concept has long been disconnected from reality.

In fact, continuing to defend the old narrative would have been the easier choice—such as forcibly pushing teams towards a vision that the market has already rejected. But this is by no means a reflection of excellent leadership. The truly wise approach is to acknowledge the gap between expectations and reality, propose a new direction, and move towards a brighter future. This post does exactly that.

Vitalik's Actual Diagnosis

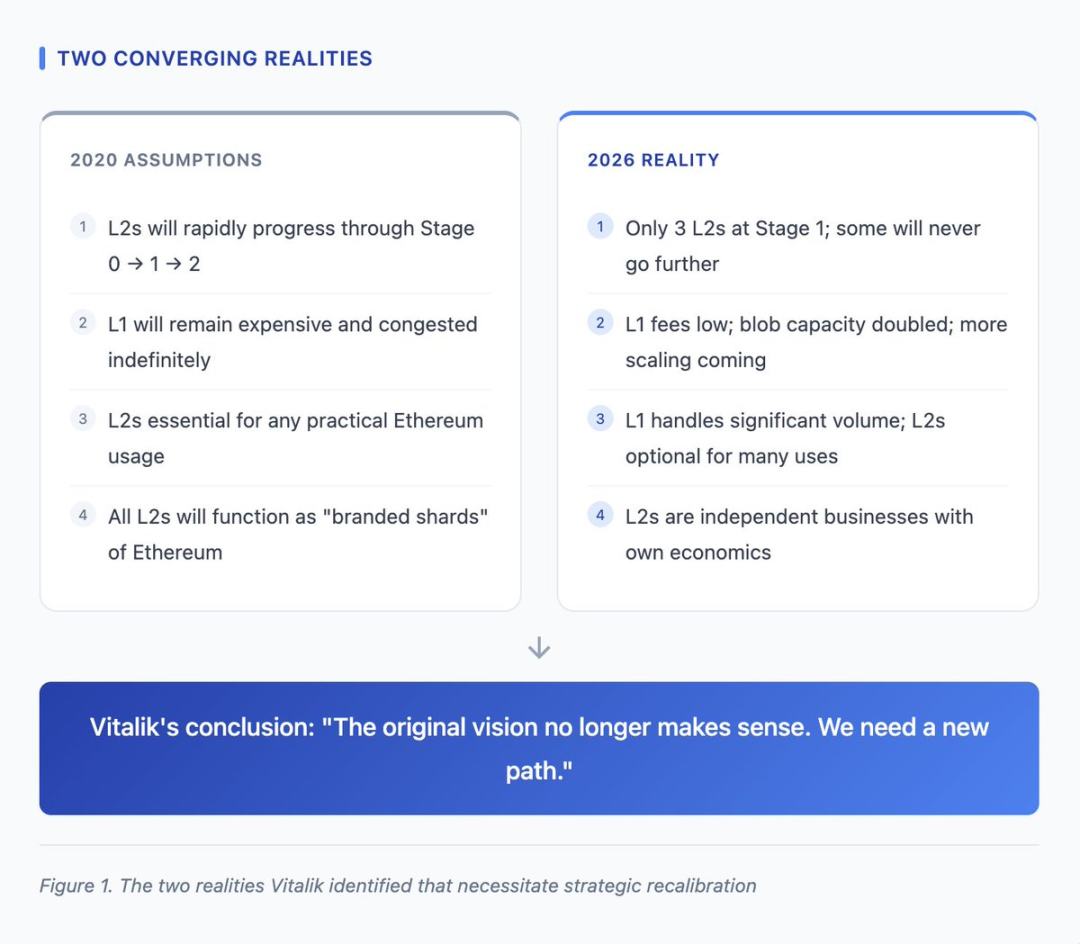

The post points out two core realities that urgently need strategic adjustment:

First, the decentralization process of L2 is far slower than expected. Currently, only three mainstream L2s (Arbitrum, OP Mainnet, Base) have reached the first stage of decentralization; some L2 teams have explicitly stated that due to regulatory requirements or business model constraints, they may never pursue complete decentralization. This is not a "failure" on a moral level, but a reflection of economic reality— for L2 operators, sequencer revenue is the core business model.

Second, Ethereum L1 has achieved significant scaling. Currently, L1 fees are low, the Pectra upgrade has doubled the data block capacity, and plans are in place to continue increasing the Gas limit by 2026. When the Rollup roadmap was initially designed, "L1 costs are high, and the network is congested" was a basic premise; today, this premise no longer holds. L1 can now handle a large number of transactions at reasonable costs, which has transformed the value proposition of L2 from a "necessary guarantee of availability" to an "optional solution for specific use cases."

The two realities that Vitalik pointed out that need strategic adjustment

Reconstructing the Trust Spectrum

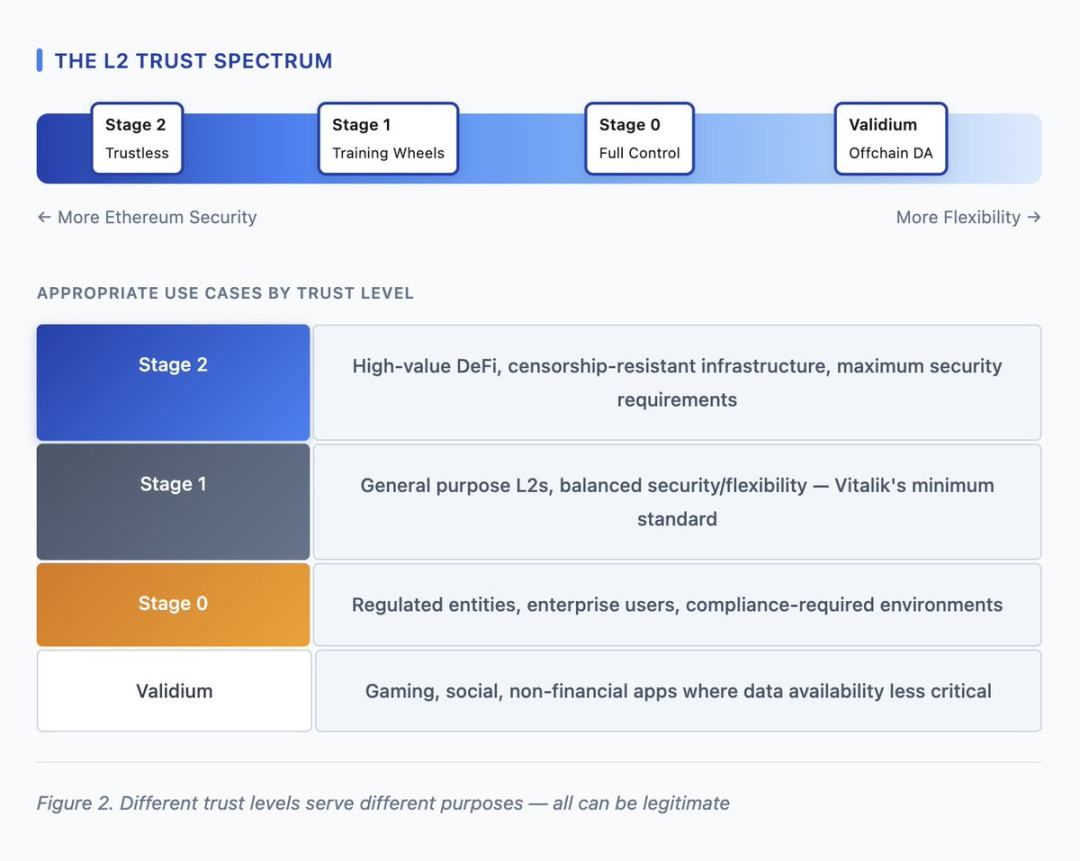

Vitalik's core conceptual contribution is liberating L2 from the framework of "a single category, unified obligations" and redefining it as "a diverse existence within the trust spectrum." The previous metaphor of "branded sharding" assumed that all L2s needed to pursue second-stage decentralization and, as extensions of Ethereum, bear the same value and security commitments as L1. The new framework acknowledges that different L2s have different uses, and for projects with specific needs, zero-stage or first-stage decentralization can be a reasonable endpoint.

The strategic significance of this reconstruction lies in breaking the implicit judgment that "L2s that do not pursue complete decentralization are failures." For example, an L2 that serves institutional clients and needs to have asset freezing capabilities is not a "defective Arbitrum," but rather a "differentiated product for different markets." By recognizing this "trust spectrum," Vitalik allows L2s to honestly position themselves without having to make commitments to "decentralization" that lack economic motivation.

Different trust levels correspond to different uses—all levels can reasonably exist

Classification table of trust levels for Ethereum L2

Native Rollup Precompilation Proposal

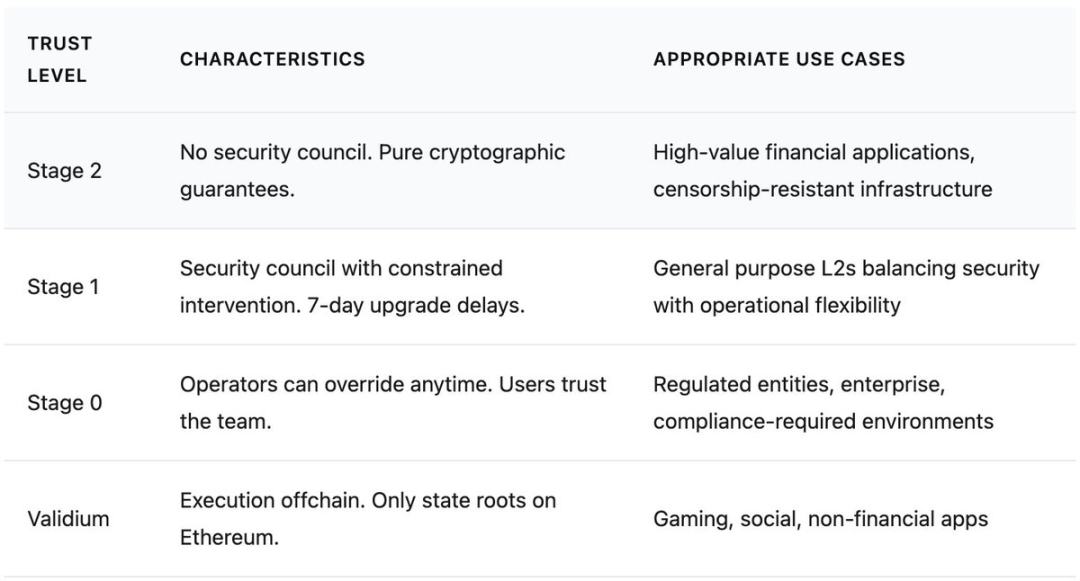

The technical core of Vitalik's post is the "native Rollup precompilation" proposal. Currently, each L2 needs to independently build a system to "prove state transitions to Ethereum": Optimistic Rollup uses fraud proofs with a 7-day challenge period, while ZK Rollup uses validity proofs based on custom circuits. These implementations not only require independent audits but may also have vulnerabilities, and when Ethereum hard forks lead to changes in EVM (Ethereum Virtual Machine) behavior, they need to be updated synchronously. This "fragmented" state brings security risks and maintenance burdens to the entire ecosystem.

The "native Rollup precompilation" proposal directly embeds the function of "validating EVM execution" into Ethereum. At that point, each L2 will no longer need to maintain custom provers but can simply call this shared infrastructure. Its advantages are significant: only one codebase needs to be audited (rather than dozens), it can automatically adapt to Ethereum upgrades, and once the precompilation functionality is validated in practice, it may even eliminate the need for security committees.

Comparison of the architecture of Ethereum native Rollup precompilation before and after

Synchronizing Composability Vision

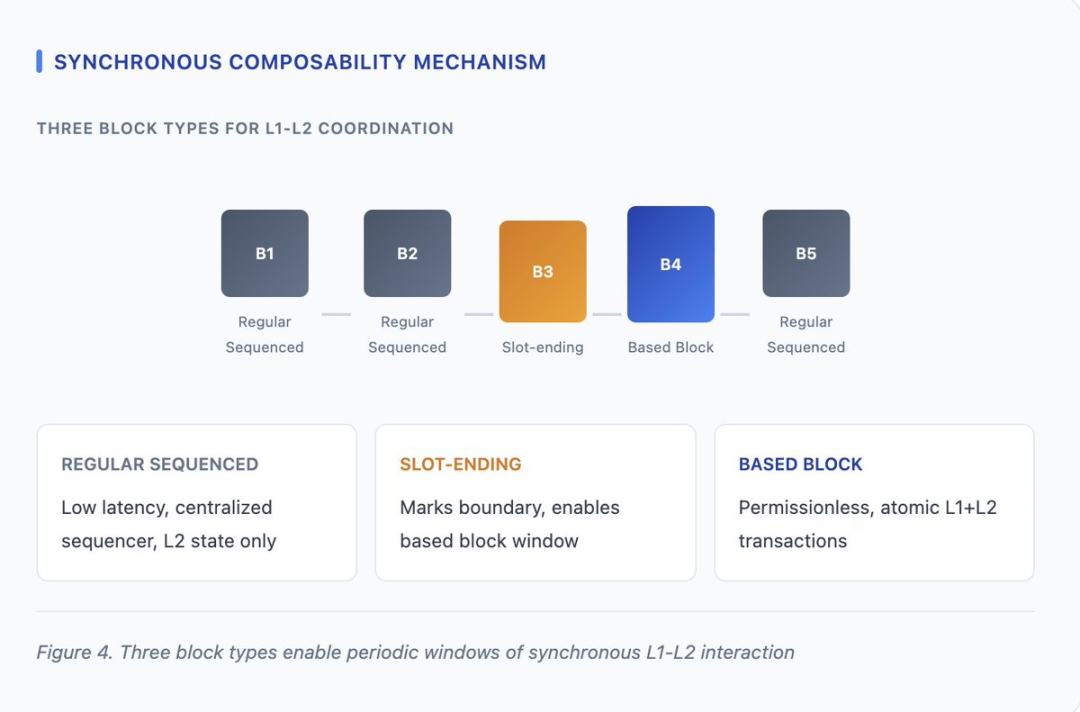

In his post on ethresear.ch, Vitalik elaborated on a mechanism to achieve "synchronized composability" between L1 and L2. Currently, transferring assets or executing logic across L1 and L2 either requires waiting for final confirmation (Optimistic Rollup takes 7 days, ZK Rollup takes several hours) or relies on fast bridges that carry counterparty risks. "Synchronized composability" allows transactions to "atomically use L1 and L2 states"—reading and writing data across layers in the same transaction, either fully succeeding or fully rolling back.

This mechanism designs three types of blocks:

- Regular ordering blocks: used to handle low-latency L2 transactions;

- Slot end blocks: mark the boundaries of time windows;

- Base blocks: can be built without permission after the slot end block is generated.

During the window period of the base block, any block builder can create blocks that interact with both L1 and L2 states.

The three types of blocks support periodic synchronized interactions between L1 and L2

Responses from L2 Teams

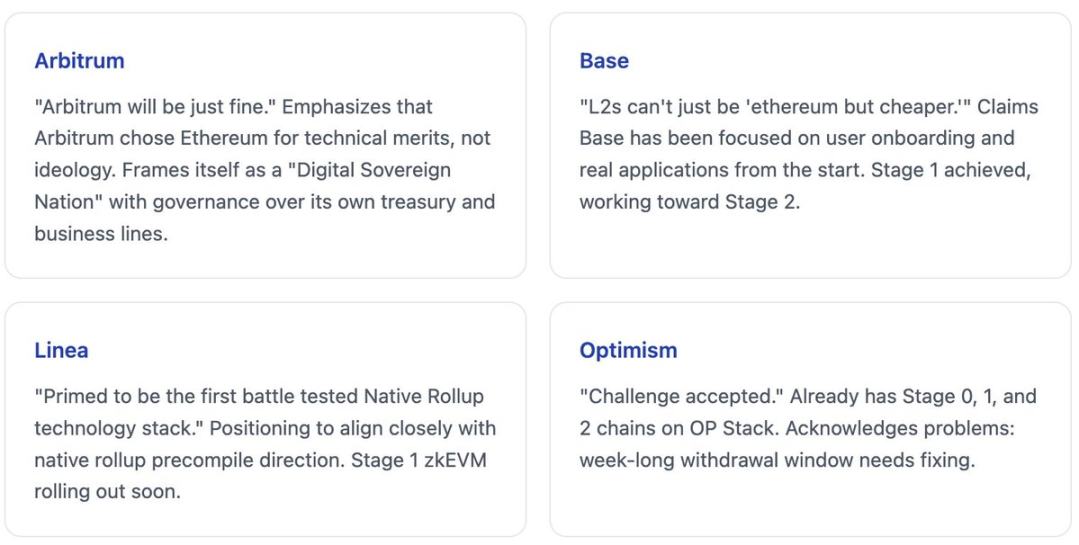

Mainstream L2 teams responded within hours, and their responses exhibited a healthy strategic diversity—this is precisely the effect that Vitalik's "trust spectrum" framework aims to achieve: different teams can choose different positions without pretending to move towards the same endpoint.

Differentiated responses from four mainstream Ethereum L2 projects to Vitalik's "L2 reset" proposal

This diversity of responses is healthy:

- Arbitrum: emphasizes independence and self-sufficiency;

- Base: focuses on applications and users;

- Linea: closely aligns with the native Rollup direction proposed by Vitalik;

- Optimism: acknowledges current challenges while claiming to continue pushing for improvements.

There is no right or wrong in these positions; they are simply strategic choices for different market segments—which is precisely the rationality recognized by the "trust spectrum" framework.

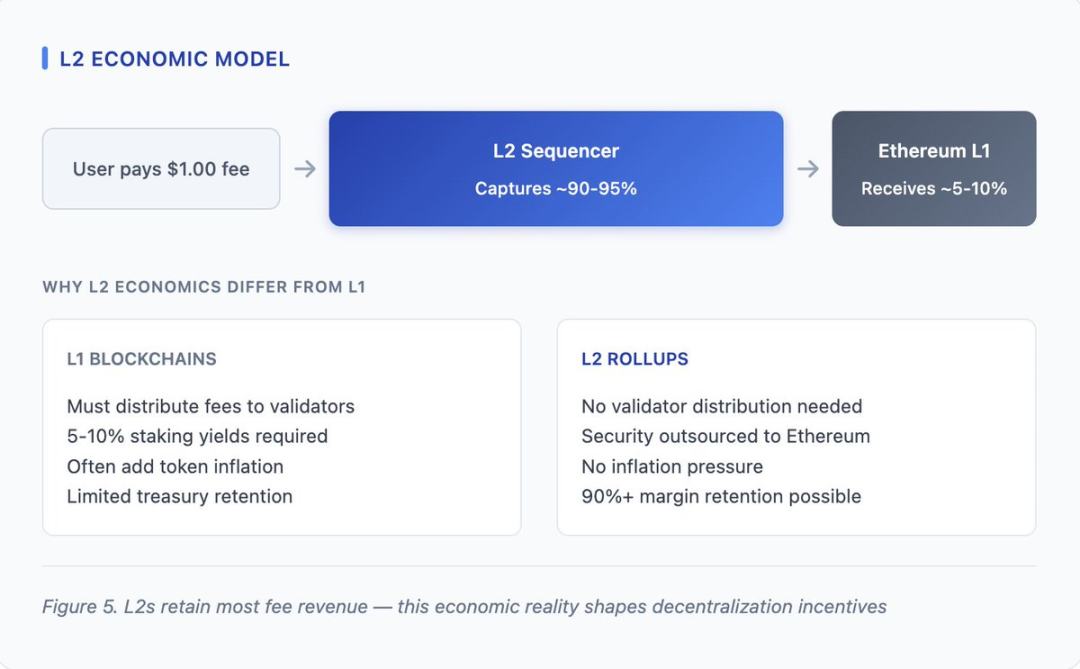

The Economic Reality of L2 Acknowledged by Vitalik

One of the important significances of Vitalik's post is the implicit acknowledgment of the economic attributes of L2. When he mentions that "some L2s may 'never exceed the first stage of decentralization' due to 'regulatory demands' (which require retaining ultimate control)," he is essentially acknowledging that L2s are not idealized "branded sharding," but rather commercial entities with legitimate economic interests. Sequencer revenue is real, and regulatory compliance requirements are real—expecting L2s to abandon these interests to conform to ideology has been unrealistic from the start.

L2 retains most fee revenue—this economic reality determines the direction of decentralization incentives

The Future Path Outlined by Vitalik

Vitalik's post does not merely stop at "diagnosing problems," but focuses more on "solving problems." He outlines several specific directions for those L2s that wish to maintain value in the context of continuous scaling of L1. These are not mandatory requirements but suggestions for paths to differentiation when "a cheaper Ethereum" is no longer the core competitive advantage.

Differentiated value directions for Ethereum L2

Rational honesty in leadership provides possibilities for adaptive development of the ecosystem

Conclusion

In February 2026, the post published by Vitalik Buterin marked a key recalibration of Ethereum's strategy towards L2. Its core insight is that L2 has evolved into independent platforms with legitimate economic interests, rather than "branded sharding" that must bear obligations to Ethereum. Vitalik did not resist this reality; instead, he proposed recognizing differentiated paths through the "trust spectrum," enhancing the collaborative efficiency of willing L1-L2 integrators through "native Rollup infrastructure," and achieving cross-layer interaction through a "synchronized composability mechanism"—thus embracing reality.

The responses from the L2 ecosystem exhibited a healthy diversity: Arbitrum emphasized independence, Base focused on applications, Linea aligned with the native Rollup direction, and Optimism acknowledged challenges while pushing for improvements. This diversity is precisely the expected outcome of the "trust spectrum" framework: different teams can pursue different strategies without pretending to be on the same path.

For Ethereum, this directional correction has maintained its credibility by "acknowledging reality" rather than "defending outdated assumptions." Considering the maturity of ZK-EVM technology, the relevant technical proposals are feasible; the strategic proposals create space for efficient evolution within the ecosystem. This is a manifestation of "adaptive leadership" in the tech field: recognizing that the environment has changed and proposing new paths, rather than stubbornly sticking to strategies that the market has already rejected.

Having been deeply involved in scaling research for ten years and operating a Rollup infrastructure company for four years, I have seen too many leaders refuse to adjust when facts change—the results are often unsatisfactory. Vitalik's choice this time was not easy: publicly acknowledging that the vision from 2020 needs updating. But it is the right choice. Clinging to narratives that the market has abandoned is of no benefit to anyone. The direction forward is much clearer now than it was a week ago—this in itself is highly valuable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。