Written by: Philip Gradwell, Vice President of Tether Economics

Translated by: Saoirse, Foresight News

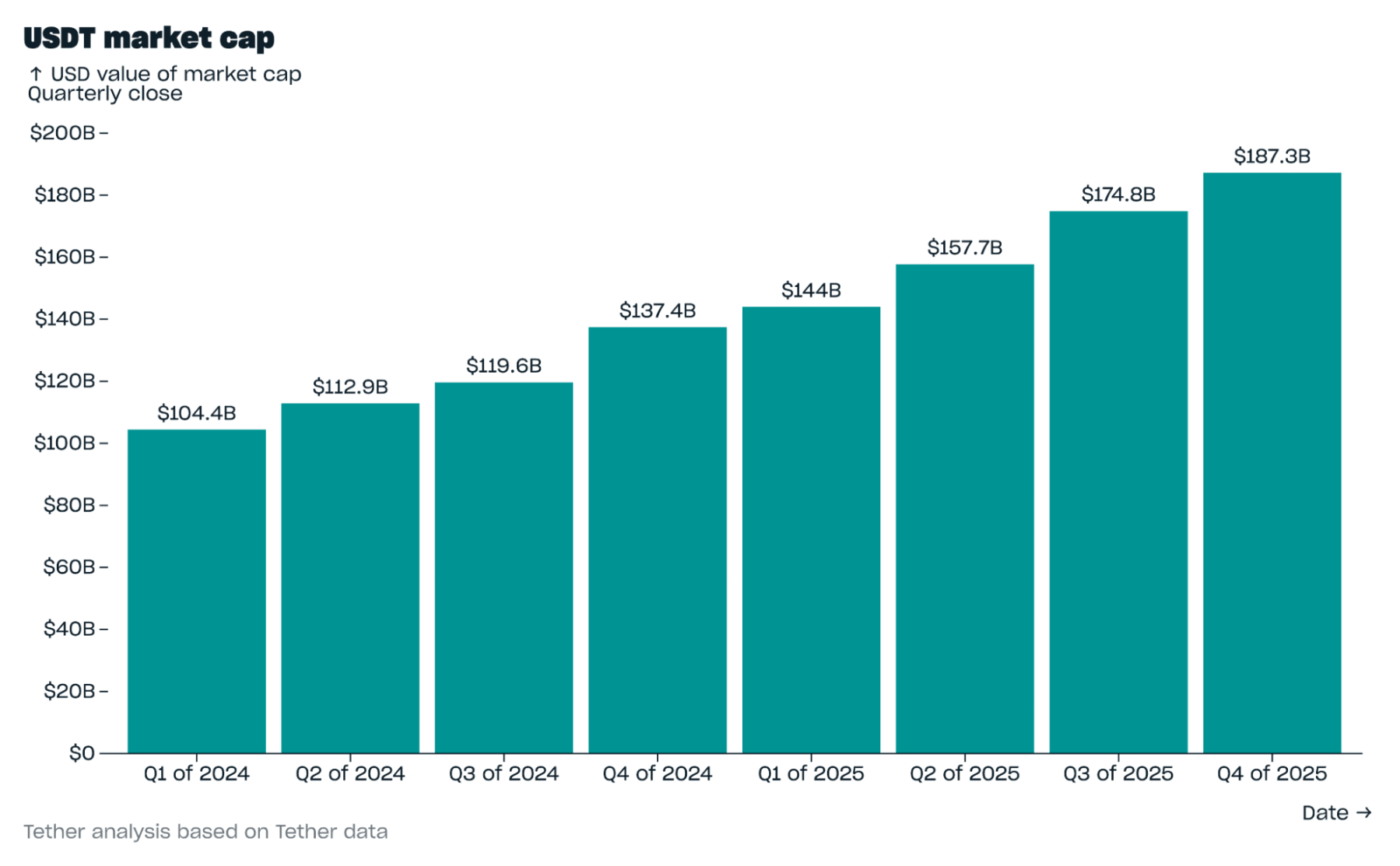

USDT reached multiple new highs in Q4 2025, as follows:

- Market capitalization reached $187.3 billion;

- Achieved over 30 million user growth for the eighth consecutive quarter;

- The number of on-chain wallets holding USDT saw the largest quarterly increase;

- Monthly active on-chain users reached an all-time high;

- Both the number of on-chain transfers and the value of transfers hit historical records.

At the same time, the cryptocurrency liquidation chain reaction that occurred on October 10, 2025, caused the growth rate of the stablecoin ecosystem to slow down. From October 10, 2025, to February 1, 2026, the total market capitalization of cryptocurrencies fell by more than one-third, while during this period, the market capitalization of USDT grew by 3.5%; in contrast, the market capitalizations of the second and third largest stablecoins fell by 2.6% and 57%, respectively.

The continued growth of USDT relies not only on the cryptocurrency market but also on various application scenarios outside the market. Data clearly shows that users tend to use USDT as a stablecoin that can both store wealth and facilitate transactions.

These conclusions are primarily based on Tether's analysis of blockchain data (also known as on-chain data). The on-chain data of 75 stablecoins across 15 blockchains comes from two institutions, Chainalysis and Artemis.

Market Capitalization

In Q4 2025, USDT's market capitalization increased by $12.4 billion, reaching $187.3 billion. The month-on-month growth rate in October was 4.9%, but its growth rate slowed after the cryptocurrency liquidation wave on October 10.

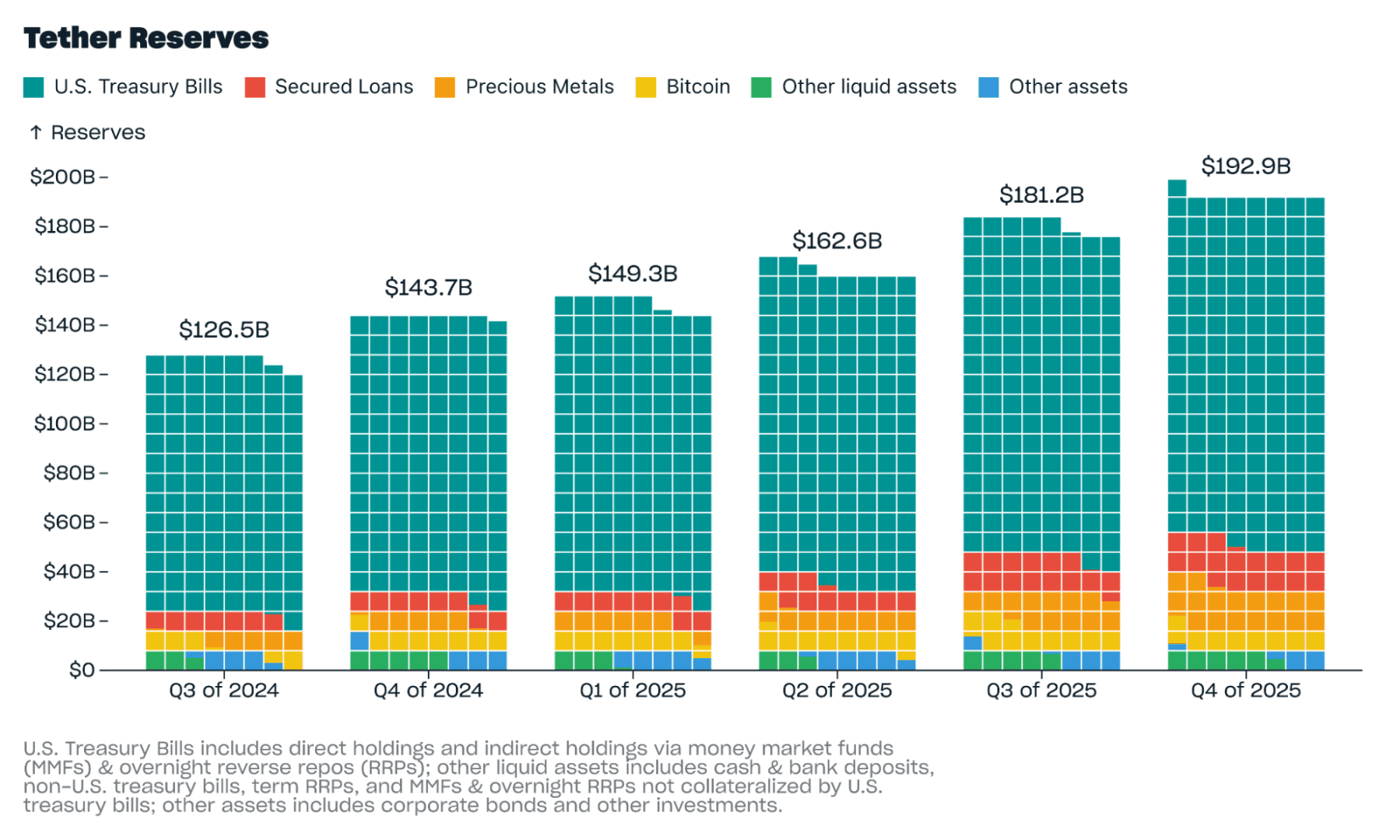

Reserves

In Q4 2025, Tether's total reserves increased by $11.7 billion, reaching $192.9 billion, with net assets (the portion where assets exceed liabilities) amounting to $6.3 billion. The total reserves include 96,184 bitcoins (with an increase of 9,850 in Q4) and 127.5 metric tons of gold (with an increase of 21.9 metric tons in Q4).

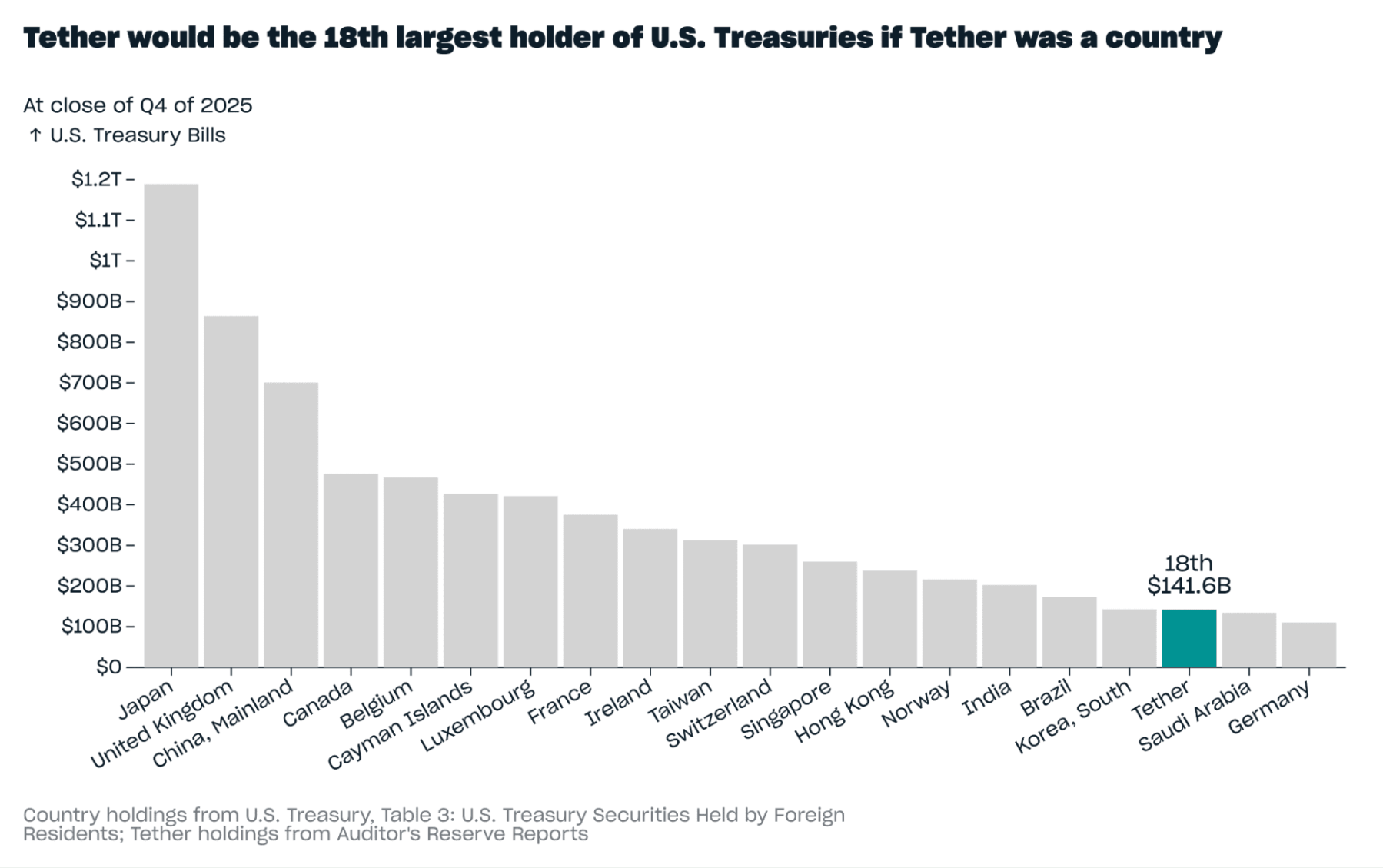

In Q4, Tether's total holdings of U.S. Treasury bonds increased by $6.5 billion, reaching $141.6 billion. If Tether were considered a "country," its holdings of U.S. Treasury bonds would rank 18th globally, surpassing Saudi Arabia and Germany.

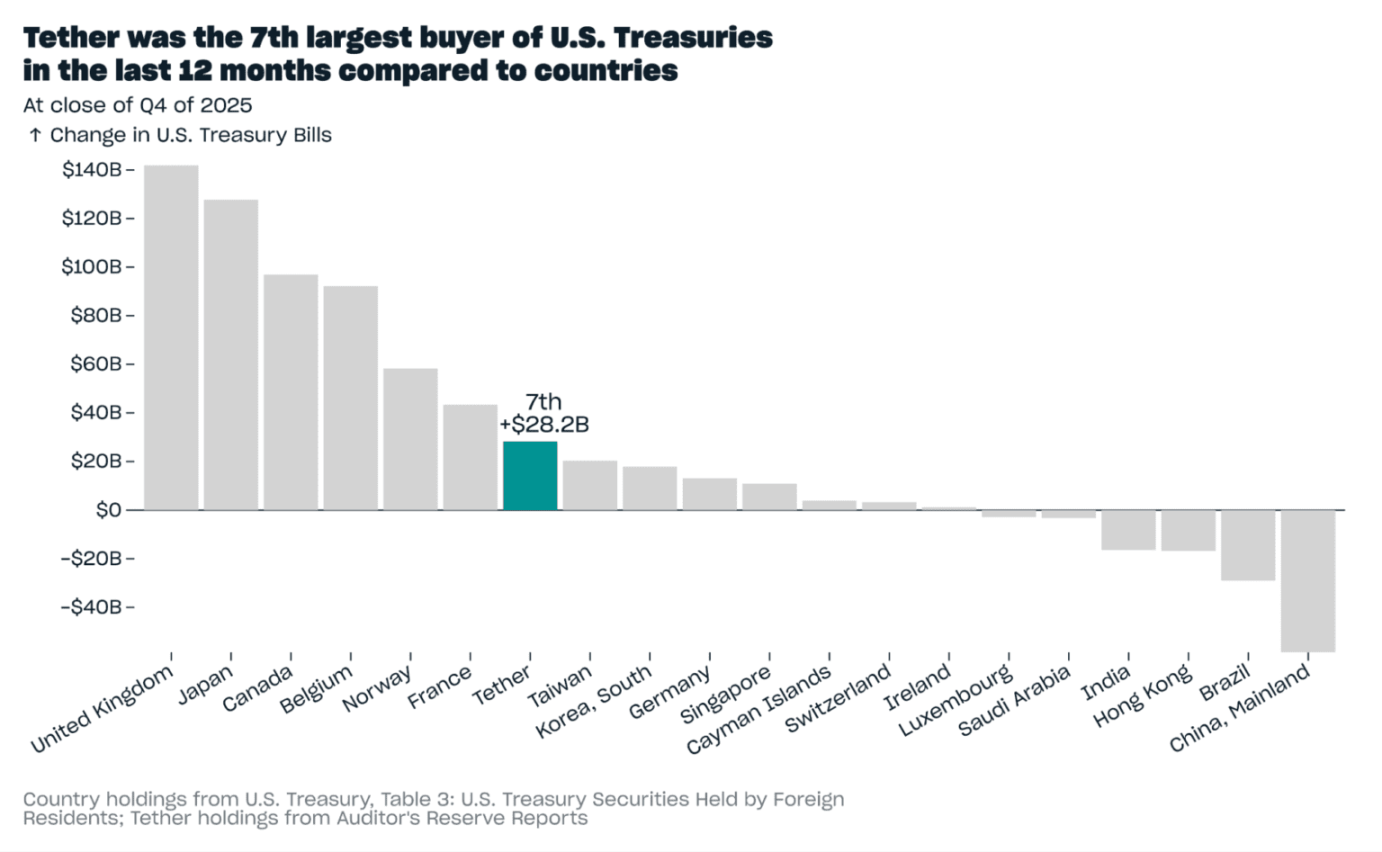

In 2025, Tether increased its holdings of U.S. Treasury bonds by a total of $28.2 billion. Over the past 12 months, compared to the increases by various countries, Tether has become the seventh largest buyer of U.S. Treasury bonds, with purchases exceeding those of Taiwan and South Korea.

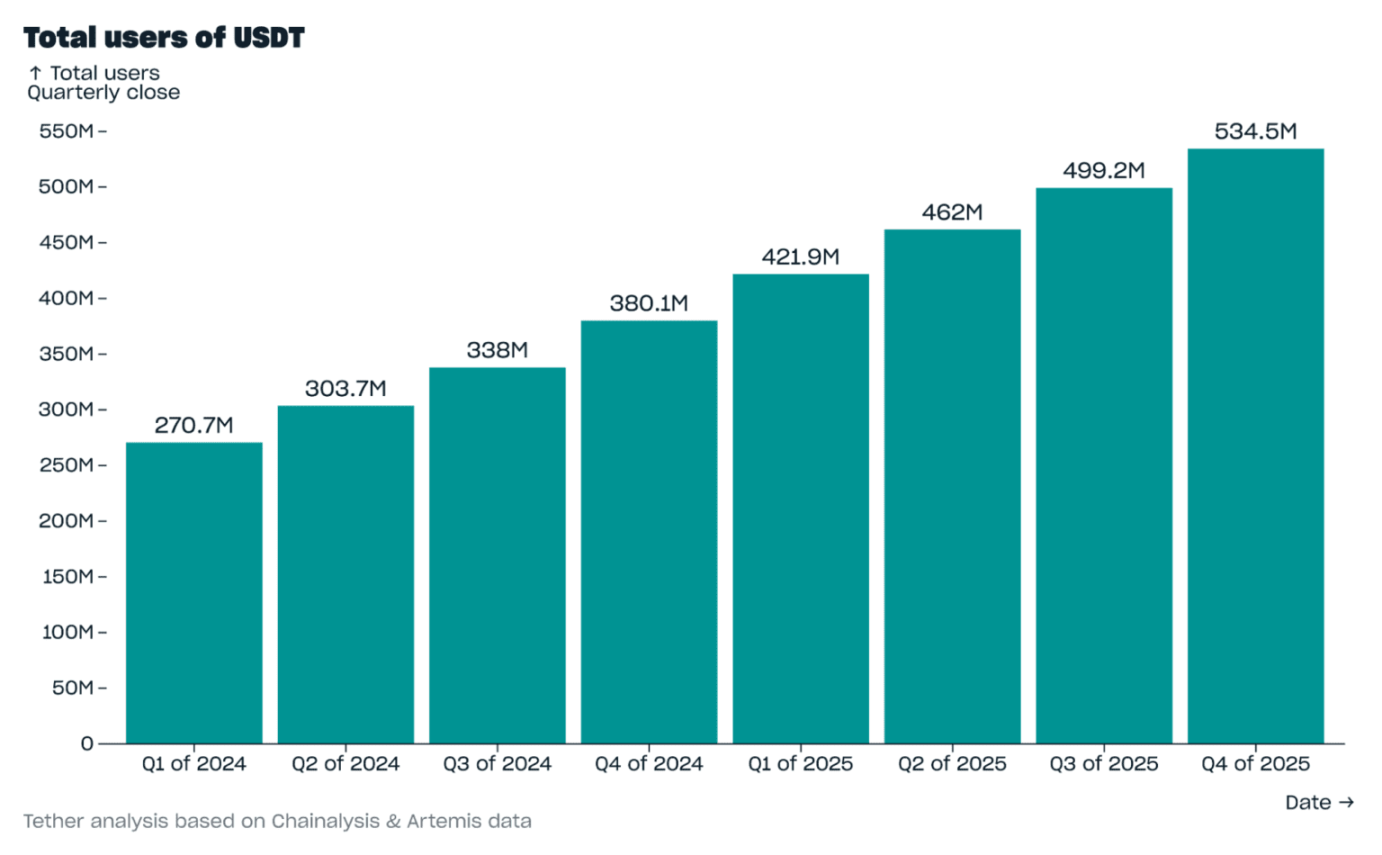

Total Users

In Q4 2025, the estimated total number of USDT users increased by 35.2 million, reaching 534.5 million, marking the eighth consecutive quarter of over 30 million user growth. The user count here includes two parts: one is on-chain wallet users (those who have received USDT and held it for at least 24 hours); the other is the estimated number of users receiving USDT on centralized service platforms (such as cryptocurrency exchanges).

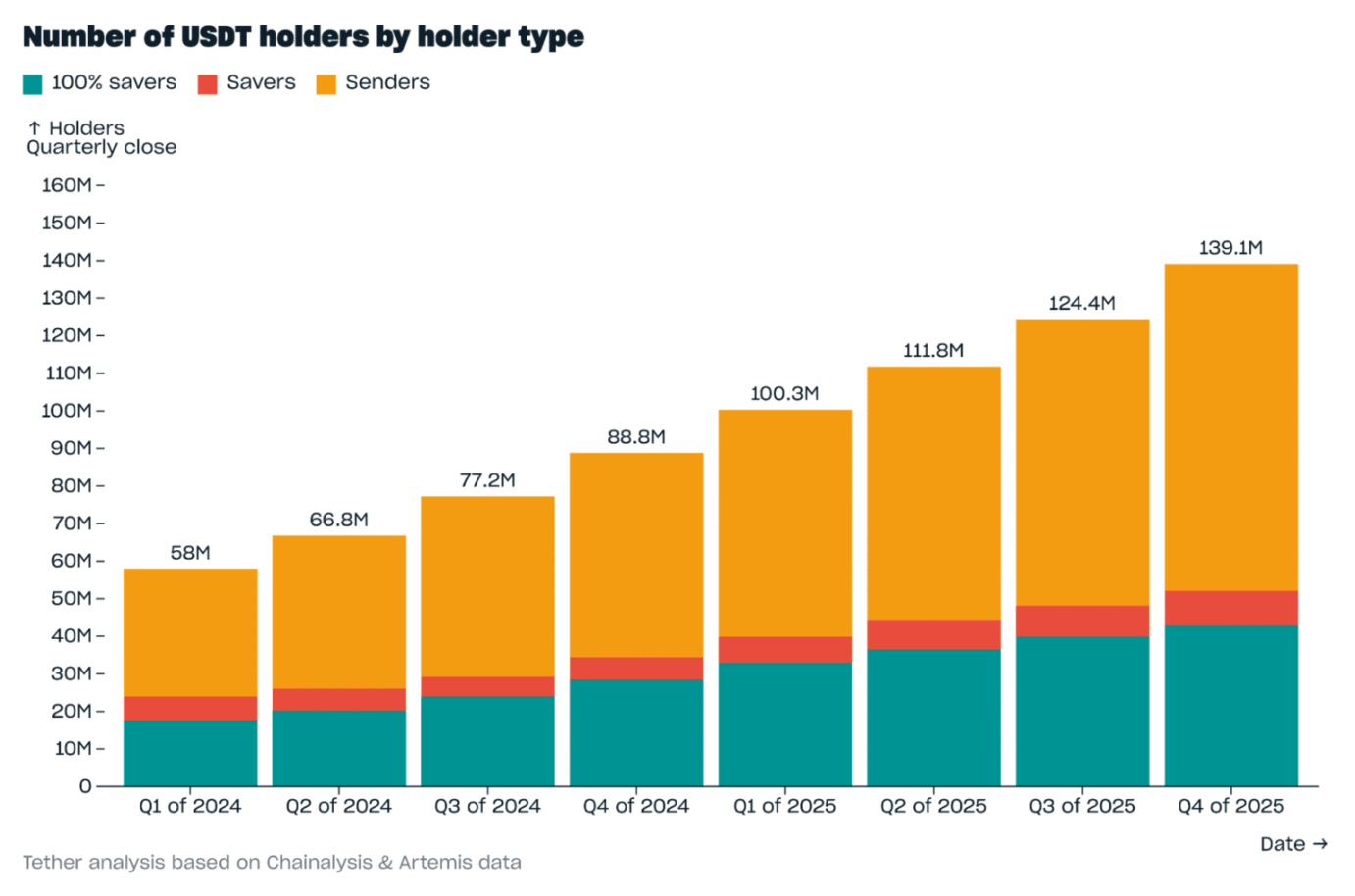

On-Chain Holders

In Q4 2025, the number of on-chain wallet users holding USDT increased by 14.7 million, totaling 139.1 million, setting a record for single-quarter growth. The number of wallets holding USDT accounts for 70.7% of all wallets holding stablecoins. In addition to on-chain wallet users, it is estimated that over 100 million users hold USDT on centralized service platforms such as exchanges.

The structure of USDT on-chain holders remains relatively stable, distributed as follows:

- "Fully Savings" holders (wallet users who retain all USDT received) account for 30.8%;

- "Savings" holders (wallet users who retain an average of less than 100% but more than 2/3 of USDT received) account for 6.7%;

- "Transfer" holders (wallet users who retain an average of less than 2/3 of USDT received) account for 62.6%.

Compared to all other stablecoins, USDT has a higher proportion of "Savings" and "Fully Savings" holders (USDT at 37.5%, while other stablecoins overall at 30%). Among all stablecoin savings wallets, 75.1% choose to hold USDT, indicating that USDT remains the preferred stablecoin for wealth storage among users.

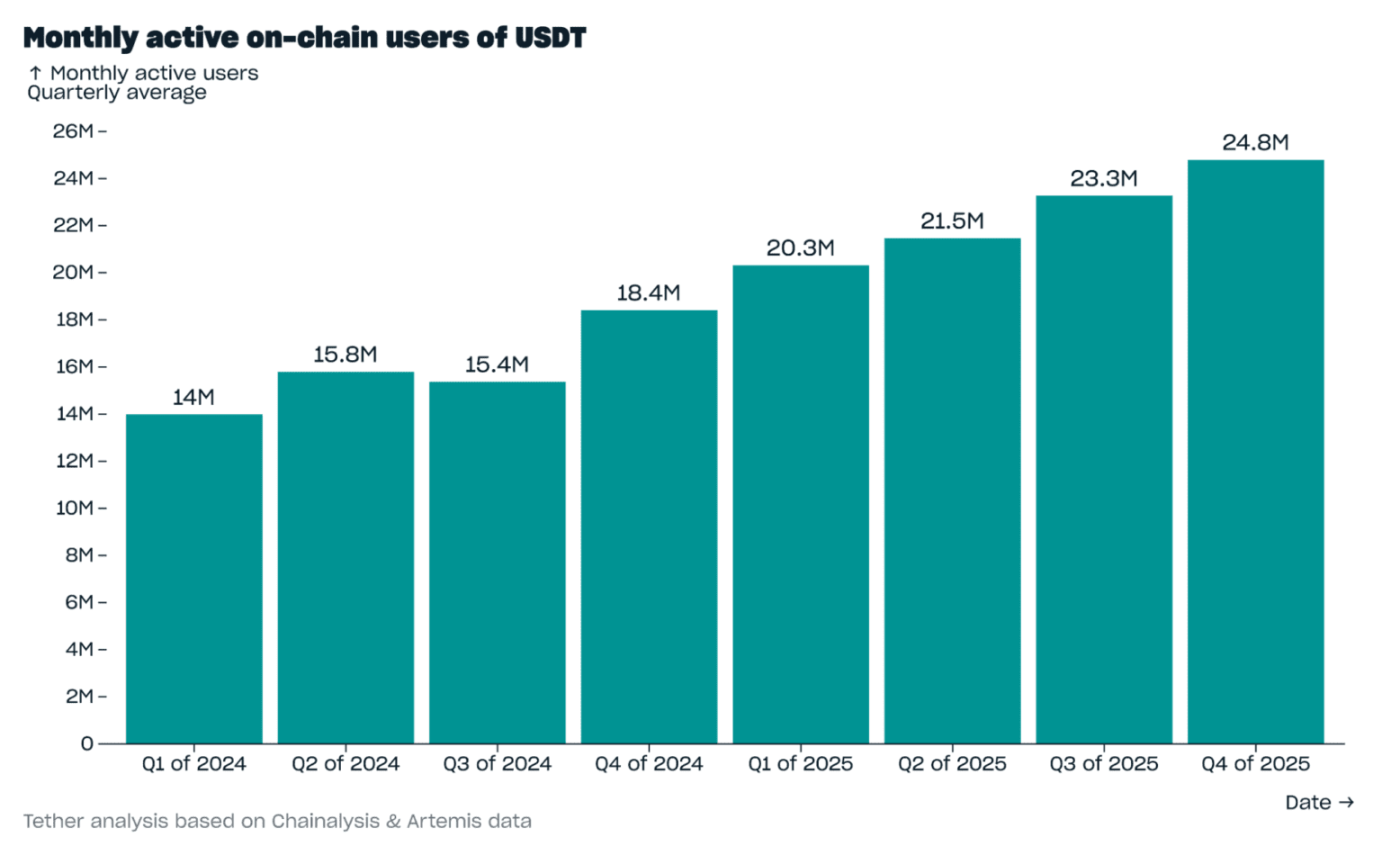

On-Chain Active Users

In Q4 2025, the average monthly active on-chain users of USDT (wallet users who received USDT at least once in a 30-day rolling period) reached 24.8 million, setting a new historical high, indicating a continuous increase in user activity for USDT. This number accounts for 68.4% of the total monthly active users of all stablecoins.

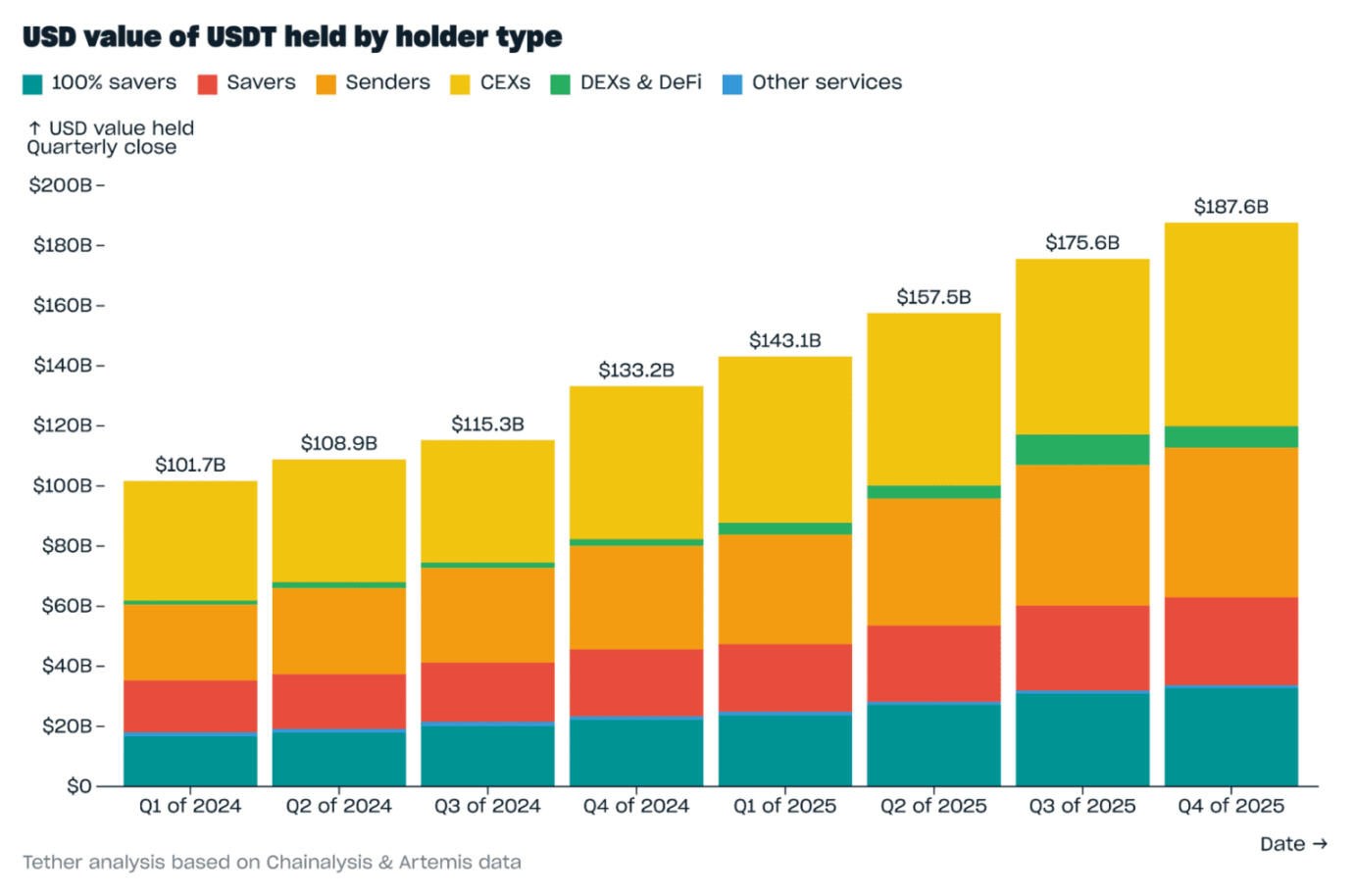

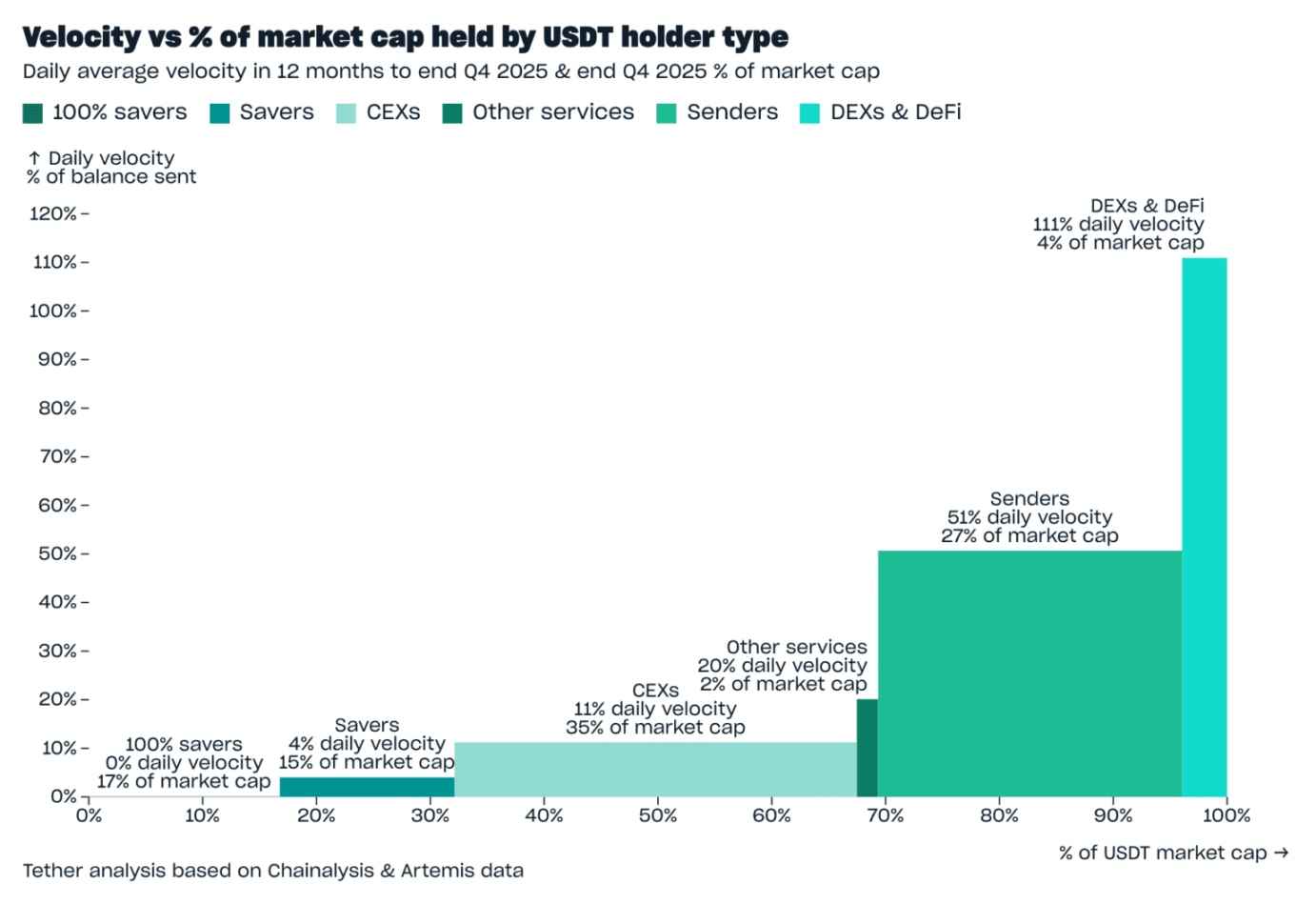

Distribution of Holdings by Different Types of Users

As of the end of Q4 2025, 36% of USDT holdings were concentrated in centralized exchanges (CEX), an increase of 2.8 percentage points from the end of Q3. This change is partly due to the decrease in USDT holdings on decentralized exchanges (DEX) and decentralized finance (DeFi) platforms following the cryptocurrency liquidation wave on October 10: in Q4, USDT holdings on DEX and DeFi platforms decreased by $3 billion (a 2 percentage point drop), down to $7.1 billion, accounting for 3.8% of total USDT holdings.

The second highest holding proportion is from savings-type users, accounting for 33%, with "Fully Savings" users holding 17.4% and other "Savings" users holding 15.6%. In Q4, savings-type users' USDT holdings increased by $2.9 billion, reaching a total of $62.1 billion by the end of the quarter. As mentioned earlier, USDT not only attracts the most savings-type users but also has the highest stored dollar value: among all stablecoins' savings value, USDT accounts for 59.9%; if we exclude wallets with holdings exceeding $10 million (which are mostly cold wallets of exchanges), USDT's share rises to 77.3%.

"Transfer" users rank third in holding proportion, at 26.5% by the end of Q4. This proportion remained relatively stable from Q3 to Q4, and "Transfer" users' holdings increased by $2.2 billion, reflecting the continuous improvement in USDT's liquidity in transaction-related application scenarios.

It should be noted that the total holding scale reported here is slightly higher than USDT's market capitalization because the total holdings include USDT that has not yet been issued from the Tether treasury, while the market capitalization only accounts for USDT in net circulation.

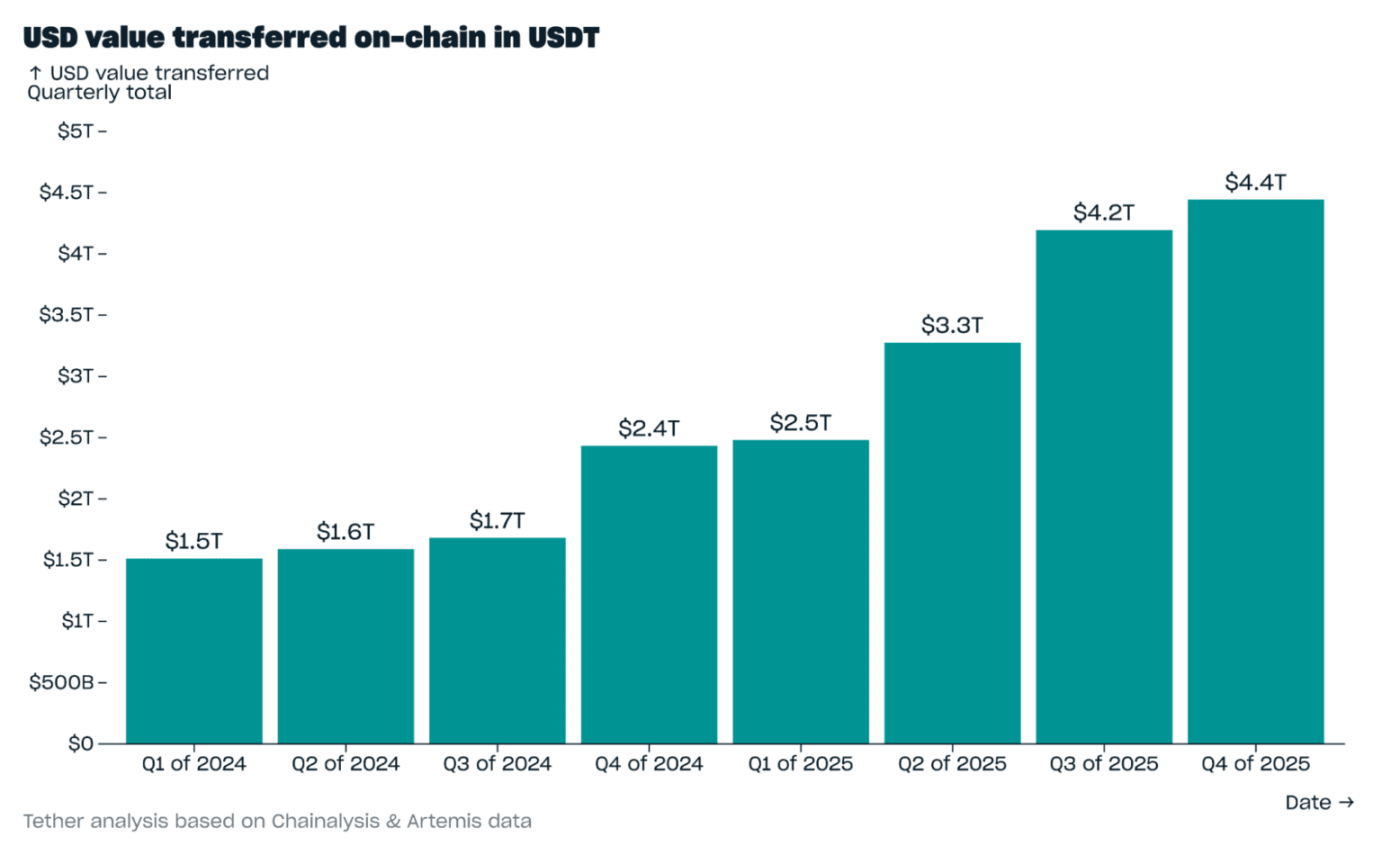

On-Chain Transfer Dollar Value

In Q4 2025, the quarterly on-chain transfer dollar value of USDT increased by $248.6 billion, reaching $4.4 trillion, setting a new historical high. Of this $4.4 trillion in total quarterly transfers, $2.8 trillion (63.6%) were transfers involving only USDT, while $1.6 trillion (36.4%) were transfers involving multiple assets (these transfers typically occur in DeFi exchange scenarios).

In single-asset transfers involving stablecoins, USDT's value share is 65.9%; in multi-asset transfers involving stablecoins, USDT's value share is 34.6%. This data indicates that USDT remains the preferred stablecoin for value transfer among users, while other stablecoins are more often used in value exchange scenarios, with USDT frequently being the exchange target.

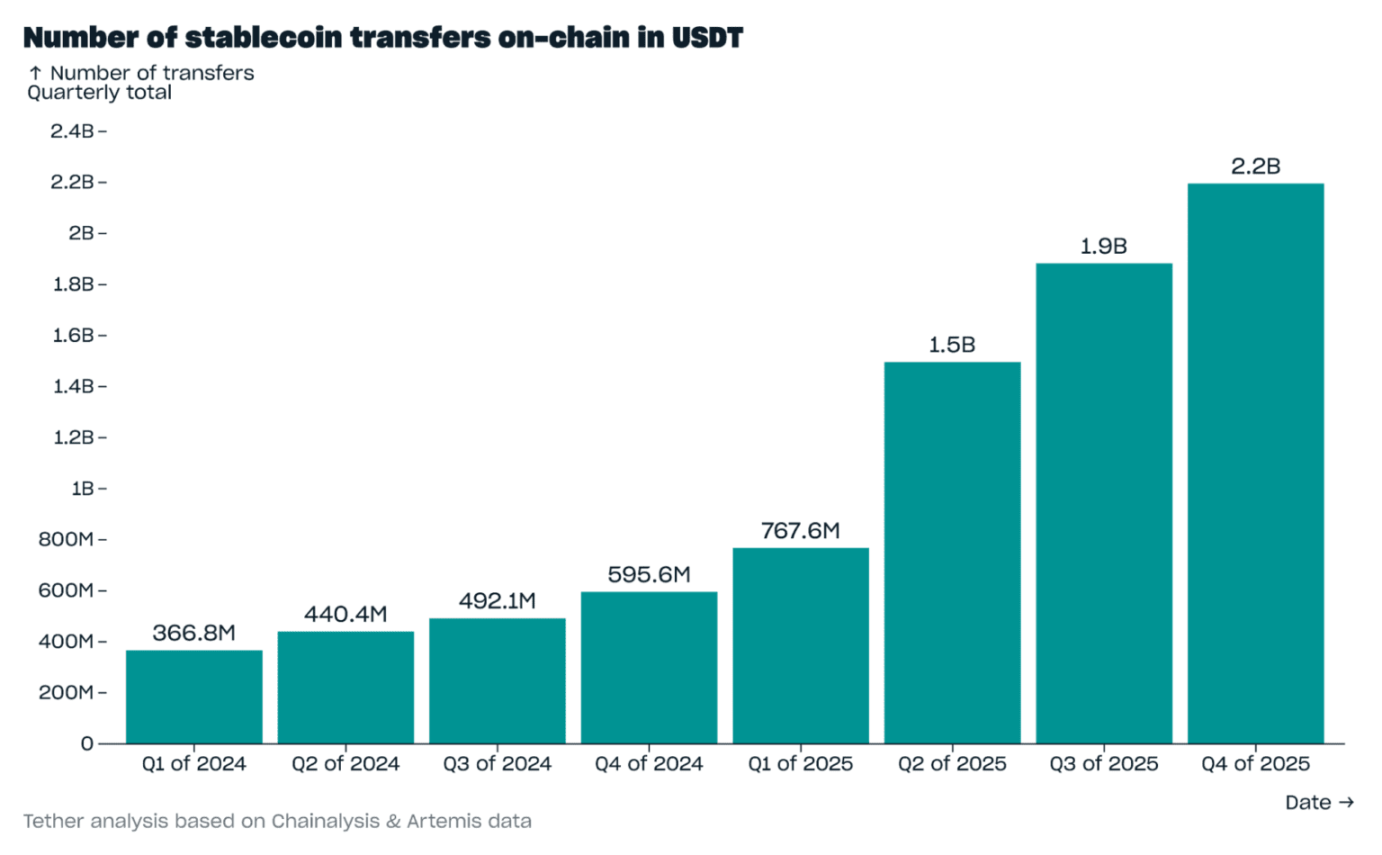

On-Chain Transfer Count

In Q4 2025, the quarterly on-chain transfer count of USDT increased by 313.1 million, reaching 2.2 billion, setting a new historical high. In this total of 2.2 billion quarterly transfers:

- Transfers with amounts below $1,000 accounted for 1.94 billion, or 88.2%;

- Transfers with amounts between $1,000 and $100,000 accounted for 256 million, or 11.6%;

- Transfers with amounts exceeding $100,000 accounted for 4.6 million, or 0.2%.

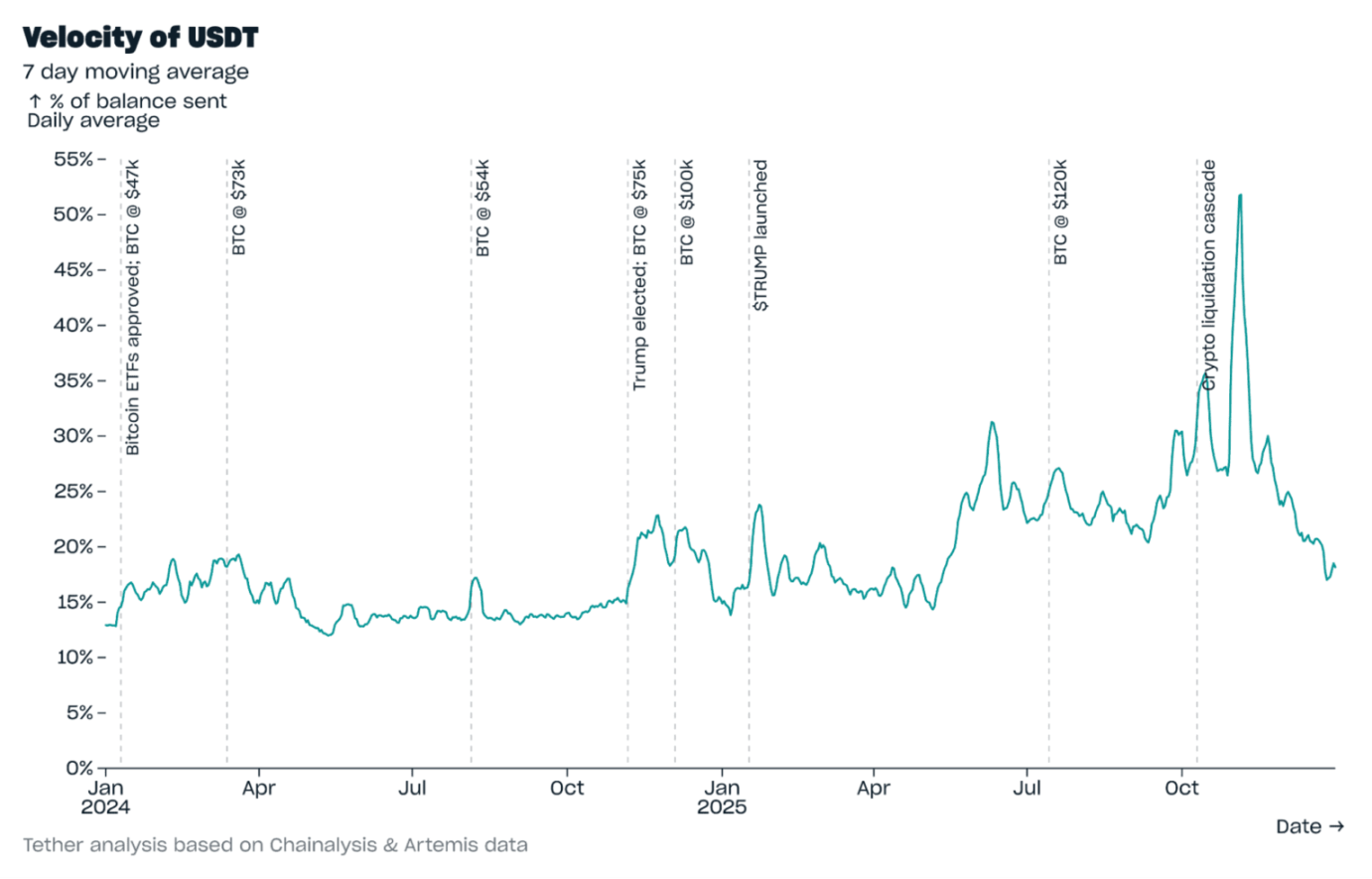

Circulation Velocity

As of the end of Q4 2025, the circulation velocity of USDT (the percentage of daily transfer amount to total holdings) calculated on a 7-day moving average was 18.2%. This value is lower than the peak of 51.8% on November 5 (driven by a surge in DeFi activity) and is similar to levels before Q2 2025 (when Bitcoin prices were comparable to those in this quarter).

In Q4, the average circulation velocity of USDT was 28%, significantly lower than the 151% circulation velocity of the second-largest stablecoin by market capitalization. The relatively low circulation velocity of USDT indicates a stronger user base stickiness and higher stability, and as discussed later, its application scenarios are also more diverse.

The circulation velocity of USDT naturally varies depending on the application scenario: users holding USDT for savings purposes have a lower circulation velocity (as they typically choose to hold rather than transfer). The circulation velocity for "Fully Savings" users is naturally 0, while the average daily circulation velocity for "Savings" users in 2025 was 4%.

The on-chain circulation velocity for centralized exchanges is also low, with an average daily circulation velocity of 11% in 2025. This is because users holding USDT on exchanges may use it for both savings and trading — but as will be mentioned in the next section, the trading volume on exchanges is recorded on centralized order books rather than on the blockchain, so the amount of USDT transferred out of centralized exchanges via the blockchain is relatively low compared to the USDT holdings within the exchanges.

High circulation velocity application scenarios for USDT include:

- "Transfer" wallets: with an average daily circulation velocity of 51% in 2025, these wallets transfer USDT for various purposes, including payments, remittances, and transferring funds between different exchanges;

- DEX and DeFi platforms: with an average daily circulation velocity of 111% in 2025, these scenarios typically have very high circulation velocities because DEX transactions are recorded on the blockchain, and users may conduct multiple transactions in a single day, ultimately leading to a circulation velocity exceeding 100%.

Of USDT's market capitalization, 67% is distributed in low circulation velocity scenarios, while 33% is distributed in high circulation velocity scenarios. This distribution ensures stability through low circulation velocity scenarios while providing liquidity through high circulation velocity scenarios.

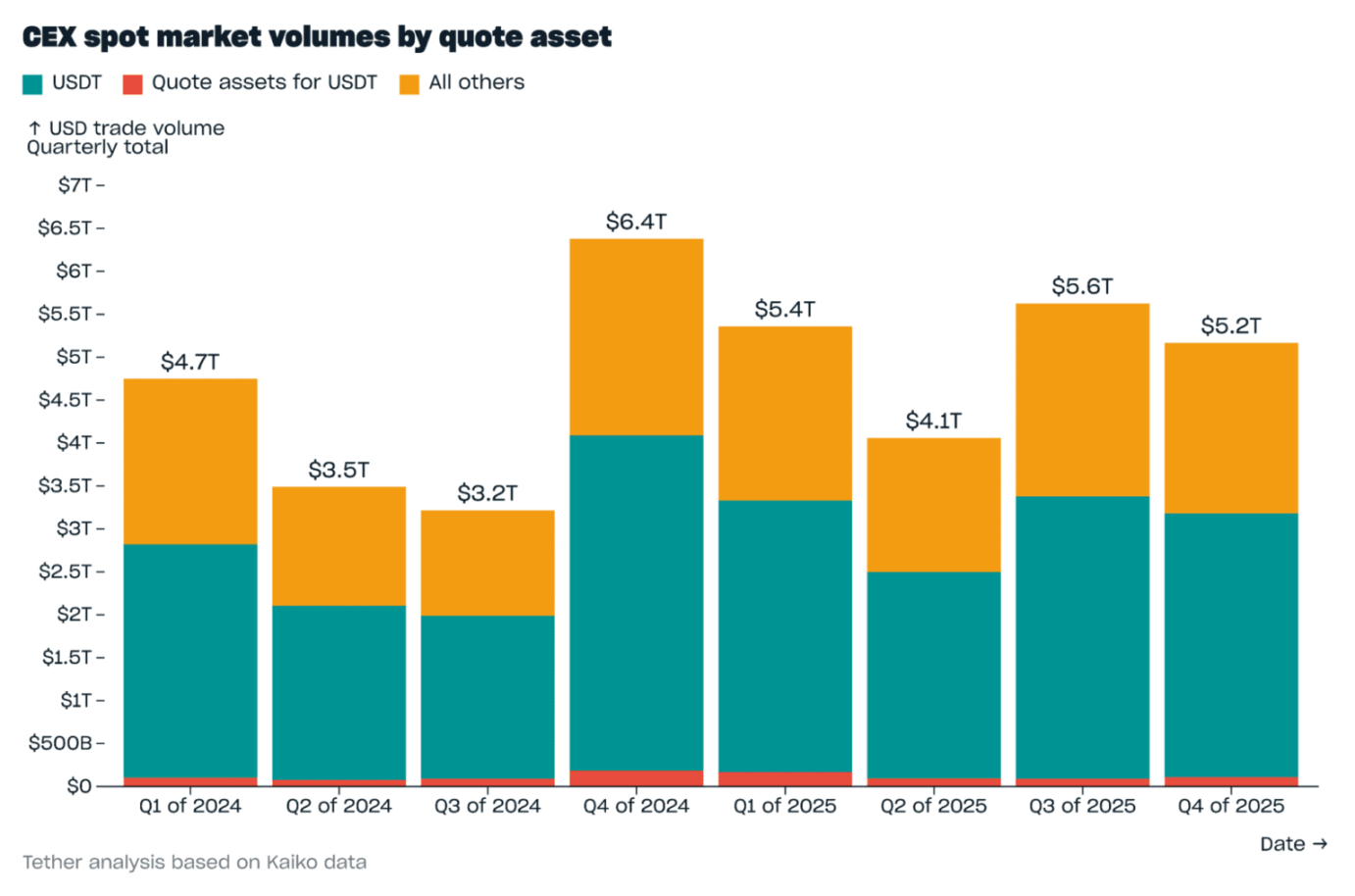

Spot Market

In Q4 2025, the USDT spot trading volume on centralized exchanges was $3.2 trillion, with 96.5% quoted in USDT and the remainder quoted in other assets against USDT. Due to the impact of the cryptocurrency liquidation wave on October 10, trading volume decreased by 5.9% compared to Q3. However, since the trading volume of all other assets decreased by 11.5% compared to Q3, USDT's share of the total spot market trading volume actually increased by 1.5 percentage points, reaching 61.5%.

In Q4, the number of USDT spot trades was 14.1 billion, accounting for 80% of all spot trades in that quarter.

Conclusion

In Q4 2025, USDT set multiple historical highs, although growth slowed after the cryptocurrency liquidation wave on October 10. However, data indicates that the cryptocurrency market is not the only driving force behind USDT's growth.

Compared to other stablecoins, users show a significantly higher preference for saving with USDT (USDT accounts for 75% of all stablecoin savings wallets; in wallets with savings values below $10 million, USDT accounts for 77%), providing a stable and low circulation velocity demand source for USDT.

In high circulation velocity trading medium application scenarios, USDT also leads: in single-asset transfer values involving stablecoins, USDT accounts for 65.9%; while in multi-asset transfer values involving stablecoins, USDT accounts for 34.6%. This phenomenon indicates that USDT remains the preferred stablecoin for value transfer among users, while other stablecoins are more often used for value exchange (with USDT frequently being the exchange target). These high circulation velocity application scenarios provide ample liquidity for USDT, ensuring its widespread availability and acceptance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。