The price of Bitcoin once fell below $70,000, and the fear index plummeted to 11. Amidst the market's wailing, ARK Fund and UBS Group were buying against the trend.

Recently, the cryptocurrency market has experienced severe fluctuations, with the price of Bitcoin dropping below the key psychological level of $70,000, reaching a new low since 2022. The fear index has dropped to 11, entering the "extreme fear" zone.

While retail investors are panic selling, some keen market observers have noticed that institutional investors are quietly positioning themselves.

1. Market Sentiment

● The market sentiment indicator has dropped to a freezing point. According to the latest data, the Bitcoin Fear and Greed Index has sharply fallen to 11 points, marking a new low since 2022 and officially entering the "extreme fear" zone.

● This value is close to historical extremes. Looking back at the FTX collapse in 2022, the index once fell to 8 points, when the price of Bitcoin hit a bottom of $16,000.

● The fear index in the 10-15 range is viewed by market veterans as the "extreme fear" area, which is also a potential signal for a bottom to form. Compared to yesterday's index of 14, the current 11 indicates further deterioration in market sentiment, but it also suggests that the market may be closer to a historical bottom.

2. Institutional Movements

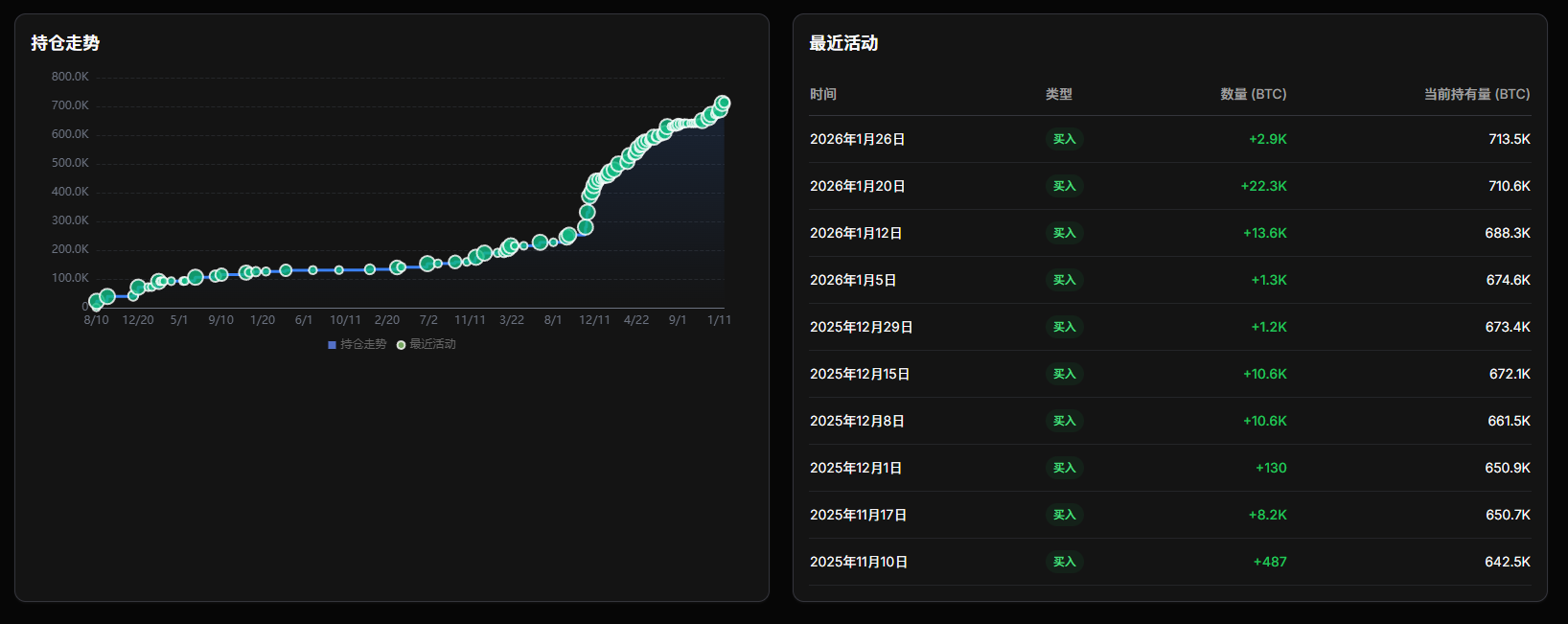

● In stark contrast to the panic selling by retail investors, some institutional investors are increasing their positions against the trend. The most representative example is ARK Investment Management, which continues to buy its ARKB ETF and Coinbase stock.

● At the same time, traditional financial institutions are also taking action. UBS Group has increased its position in MicroStrategy to $800 million. As the world's largest corporate holder of Bitcoin, MicroStrategy's stock is seen as a proxy investment for Bitcoin.

● This "retail panic selling, institutional strategic buying" pattern has historically often signaled that the market is nearing a bottom. During the FTX collapse in November 2022, when the fear index dropped to 8 points, MicroStrategy and ARK built positions at the $16,000 price level, and Bitcoin rebounded 45% within three months.

3. Capital Flows

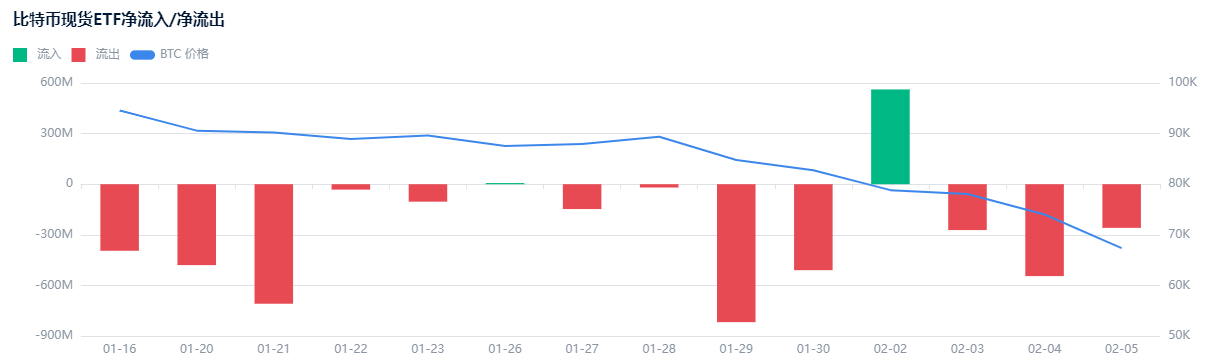

● Data shows that Bitcoin ETFs have seen net outflows for three consecutive weeks, totaling $2.9 billion. This figure may seem concerning, but a deeper analysis reveals structural characteristics of the capital flows.

● Notably, the outflows are primarily concentrated in passive ETF products, while actively managed institutions like ARK have been actively buying during the same period. This divergence indicates that the current outflows reflect the panic sentiment of retail investors rather than a denial of Bitcoin's long-term value by institutions.

● This phenomenon of "ETF capital outflows accompanied by institutional buying against the trend" is relatively rare in history and usually corresponds to market bottoming periods.

4. Leverage Liquidation

● The severe market fluctuations have led to large-scale liquidations. The latest data shows that the liquidation scale of long positions in various cryptocurrencies reached $1.703 billion in the past 24 hours, with over 400,000 people liquidated globally.

● In a market fluctuation at the end of January 2026, there was even an extreme situation where $2.367 billion was liquidated across the network within 12 hours, of which $2.22 billion was long liquidations.

● Large-scale liquidation events often mean that the most vulnerable leveraged longs in the market have been cleared out. When the fear index drops to extremely low levels, it usually indicates that all leveraged longs unable to withstand the pressure have been liquidated. The remaining market participants are mainly spot holders and long-term institutional funds, making the market structure healthier.

5. Accumulation Behavior

● In addition to traditional institutions, publicly listed companies are also continuously accumulating Bitcoin. Although the price of Bitcoin has dropped about 12% compared to a year ago, by 2026, corporate Bitcoin accumulation has not shown signs of slowing down. Nasdaq-listed American Bitcoin Corporation recently increased its Bitcoin holdings to 5,843 coins, an increase of 416 coins.

● Other companies in technology and traditional industries have also disclosed their Bitcoin allocations. AI data center company Hyperscale Data purchased 10 Bitcoins in the secondary market through its subsidiary, raising its total holdings to 560 coins.

● Healthcare provider SRx Health Solutions announced that it holds cryptocurrency assets, including Bitcoin and Ethereum, with a market value of $18 million.

6. Comprehensive Strategy

● When the above five signals appear simultaneously, experienced investors may consider adopting a phased accumulation strategy. A typical accumulation plan is: invest 30% of funds in the $70,000-$73,000 range; then invest another 30% when the price drops about 8% to $65,000; and finally invest 40% when the price drops another 15% to about $60,000.

● Risk control is equally important. It is recommended to set clear stop-loss conditions: when the total position incurs a loss exceeding 25%, consider liquidating and reassessing the market situation. Additionally, it is necessary to continuously monitor changes in institutional movements; if key institutions like ARK and UBS stop increasing their positions or start reducing them, the strategy should be adjusted immediately.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。