Author: Chloe, ChainCatcher

As the cryptocurrency industry enters a stage of intense competition, the role of centralized exchanges has evolved from merely being asset matching tools to becoming a super-large ecosystem that integrates information flow, social interaction, and trade execution.

Among them, Binance Square is a hallmark of this trend, successfully building a traffic closed loop based on content and trading. This article will deeply analyze its strategic value from three dimensions: product evolution logic, traffic moat, and absolute advantages of low-friction conversion, exploring its positioning in the competitive landscape of centralized exchanges and the advantages and transformative logic it brings to Binance's development strategy.

The Evolution Trilogy of Binance Square

The development of Binance Square (Binance Squard) has not been achieved overnight. By observing its development trajectory, one can clearly see how Binance has gradually guided users from "external information acquisition" to "internal transaction retention."

Phase One (2022 - 2023): Binance Feed - Information Aggregation

The predecessor of Binance Square was Binance Feed, with the core strategy being "integrating information to shorten the decision-making path for users' trading." The goal of this phase was to ensure that users could obtain sufficient information and news to assist their trading decisions within the Binance app, reducing the chances of users flowing to external platforms.

During this phase, ordinary users could not create content on Binance Feed and needed official invitations or approvals to join, resulting in a platform primarily populated by institutional media and a few KOLs, with Binance providing traffic distribution as the main reward.

Phase Two (2023 - 2025): Binance Square - Establishing a Social Network Ecosystem

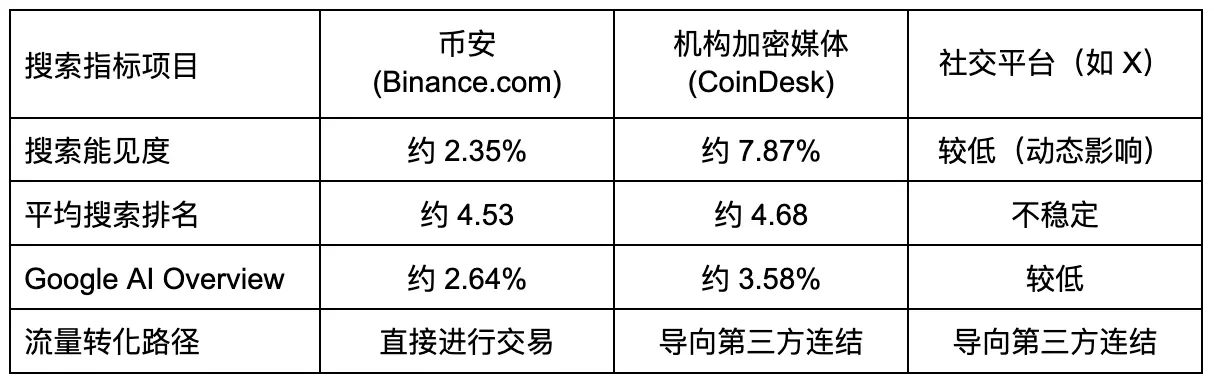

After being renamed "Binance Square," the platform shifted to fully open content generation to users. This transformation marked Binance's official transition from a tool-based application to a "crypto social portal." Through the ranking system of the "Influencer Leaderboard," creators were given direct rewards or platform traffic weight, attracting a large number of creators to join. The visibility of Binance Square in Google search, ranking at 4.5, reflects the scale of its content, which typically requires a large volume of content and high domain authority to achieve.

On the other hand, Binance Square introduced a system that allows creators to share profits from user transactions, which not only incentivized content production but also initially formed a traffic closed loop from "content reading" to "trading behavior."

Phase Three (Current Phase): Creator Center - Ecological Integration and Trading Conversion

In January, Binance Square launched the "Creator Center (CreatorPad)," with a significant update being the removal of the "Influencer Leaderboard" ranking system, replaced by a points leaderboard tied to specific Web3 projects. This means Binance is no longer solely pursuing an increase in general traffic but is instead seeking precise conversions.

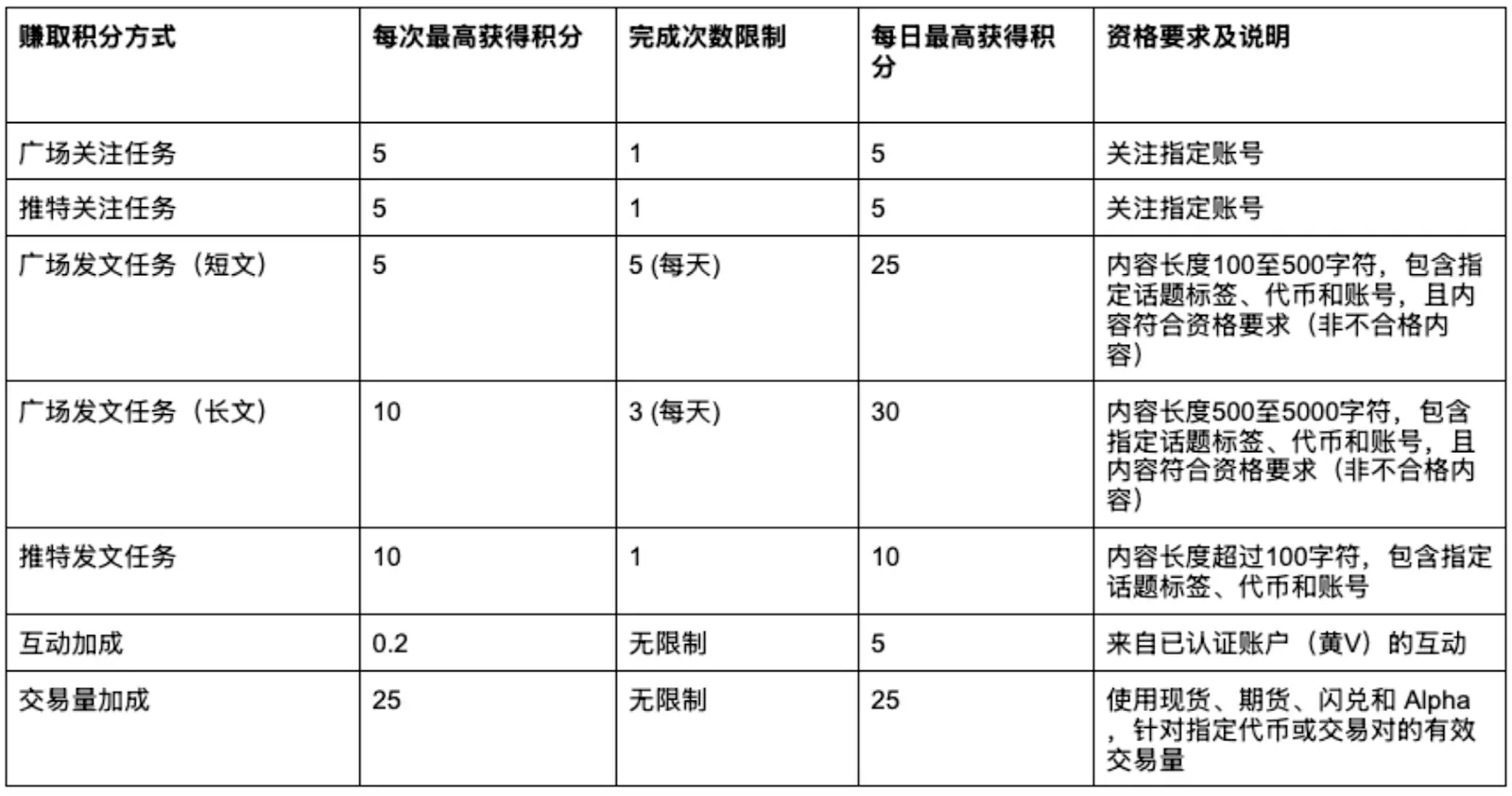

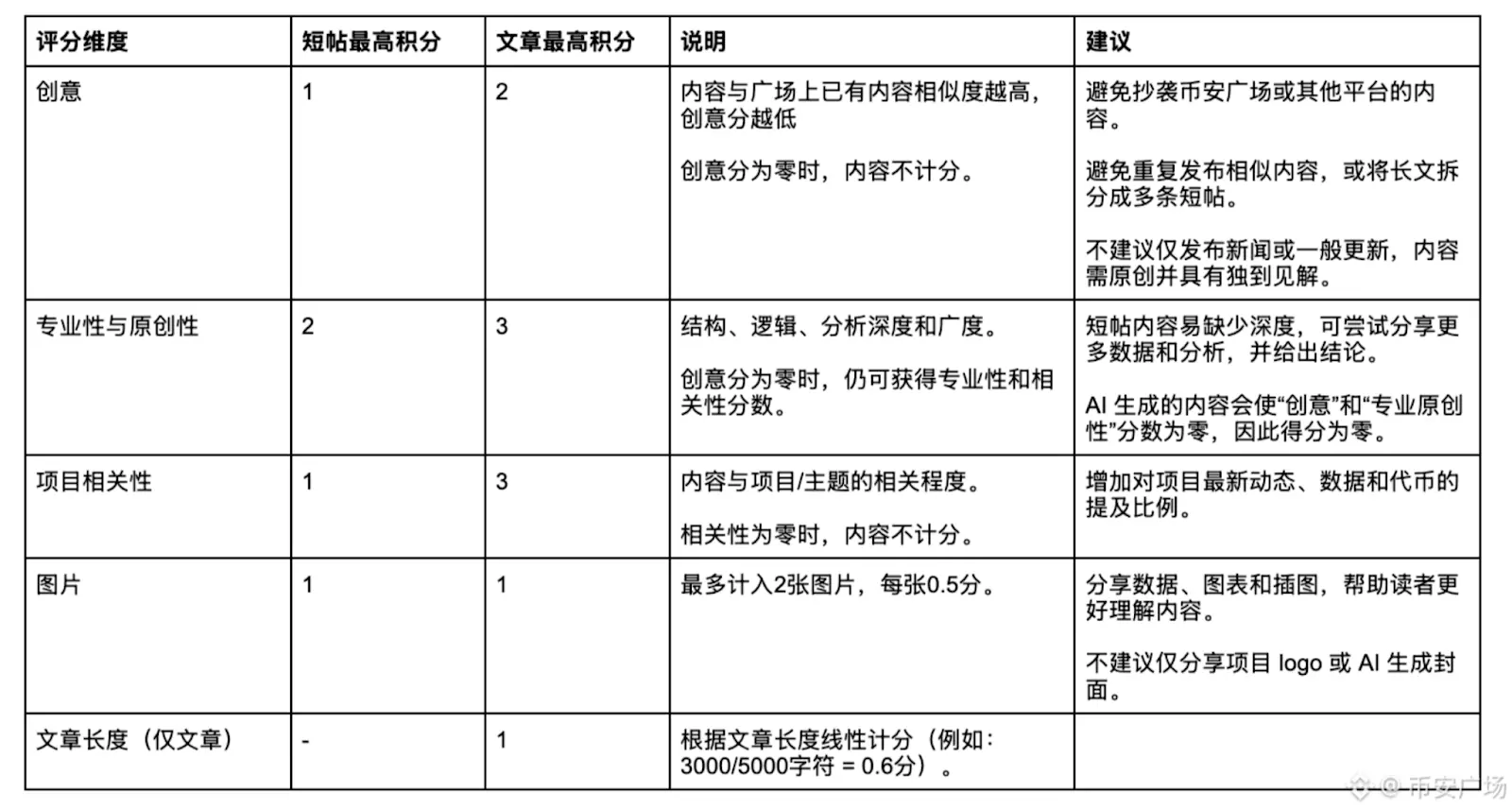

Creators' content must be linked to designated tokens or activities, and through a task-oriented mechanism, the value of the content is directly converted into participation and trading volume for specific projects. It is worth mentioning that Binance Square also began to regulate the quality of creators' content at this stage; if a large amount of AI-generated content, duplication, or plagiarism is detected, scores will be downgraded, and even reward eligibility may be lost.

High Domain Authority and Traffic Moat

The value of Binance Square lies not only in the activity of internal creators but also in its control over global traffic entry points. According to Artedfact, Binance holds up to 50% of the traffic share in the cryptocurrency market and has achieved over 100 million indexed pages, providing a solid foundation for its domain authority.

When users input keywords in Google, such as "Bitcoin buying guide," "Ethereum latest price analysis," or specific long-tail keywords, Binance Square's high-authority domain often occupies the first page of search results.

The table below summarizes Binance's competitive advantages in search results for cryptocurrency-related keywords (search visibility comparison table, data sourced from NewzDash):

It can be said that the massive user-generated content of Binance Square has become excellent nourishment for search engine optimization. Every in-depth analysis and every discussion tag increases Binance's chances of being discovered in search engines. This strategy not only reduces Binance's reliance on paid traffic but also cuts off the flow that could have gone to independent media or competitors, locking potential users within Binance's domain.

Content-Based One-Stop Trading Closed Loop

The core product advantage of Binance Square lies in minimizing the friction from "generating interest" to "completing a transaction."

On traditional social media platforms, users' behavioral paths are often fragmented and jumpy: from reading Alpha information, exiting the app, opening the exchange, searching for tokens, to setting orders, each step carries the risk of user loss. In Binance Square, real-time market cards and trading buttons for related tokens are directly embedded in the information flow, providing users with a "watch and buy" experience, capturing users' trading instincts during emotional fluctuations, thereby enhancing users' trading desire and the platform's trading volume.

A creator who operates on both X and Binance Square, @dajingou1, recently mentioned a key difference: 100 views on Binance Square are worth far more than 10,000 views on X. Although X has an astonishing daily active user count, the proportion of crypto users is extremely low; in contrast, Binance has over 280 million registered users globally, and all Square users are 100% KYC-verified traders. This means that every click corresponds precisely to potential investors with immediate trading capabilities.

This data closed loop gives the platform and users a high degree of investment stickiness. By tracking clicks, reading duration, and attention preferences, Binance can more accurately outline users' investment habits than any external platform, shortening the investment path for platform users.

The "Quality War" of the Creator Ecosystem: Mechanism Reform and Content Governance

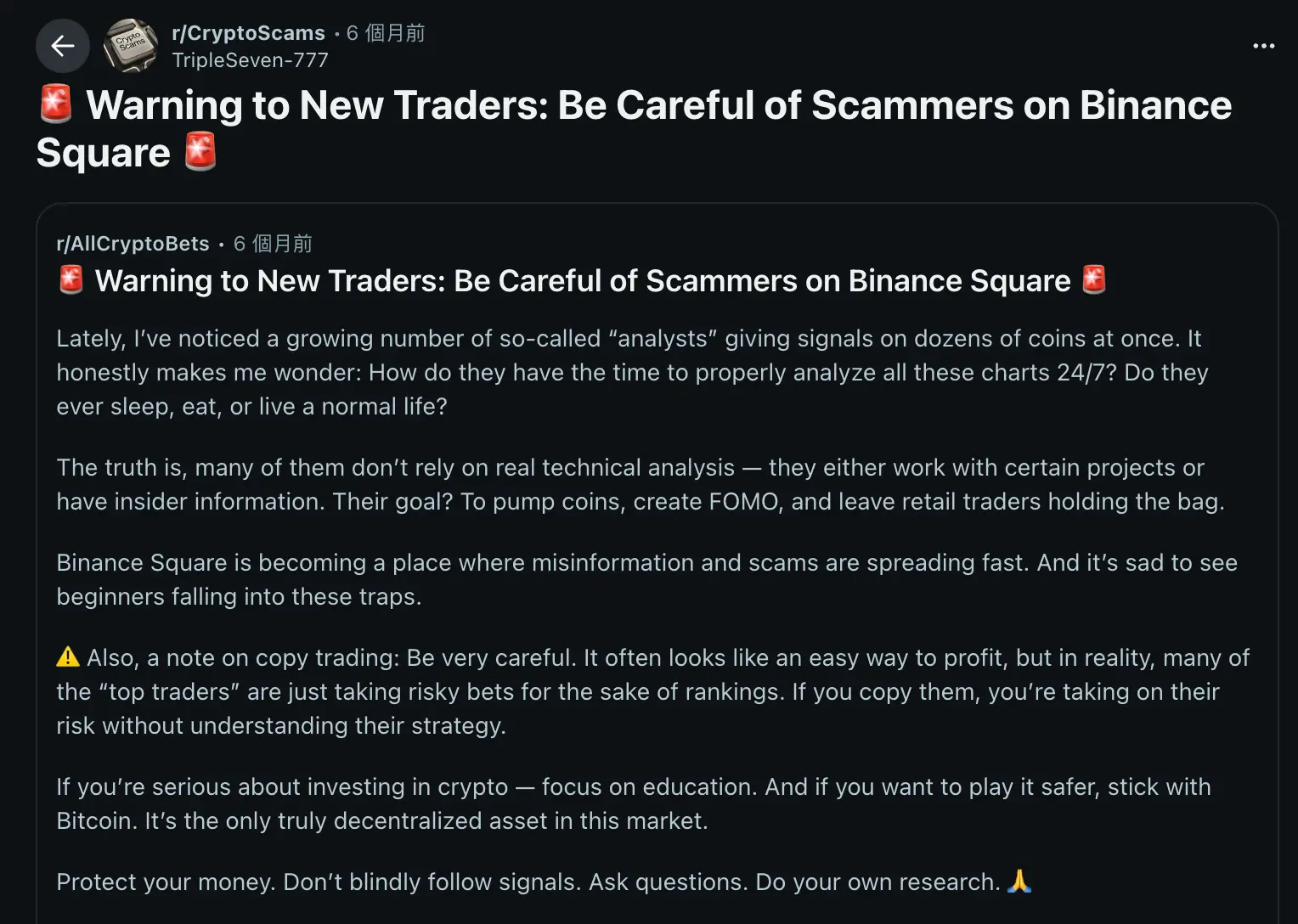

However, the rapid expansion of Binance Square has also come at a cost. In the second half of 2025, it faced a severe "noise" challenge. According to discussions on Reddit, the initial design of the Influencer Leaderboard ranking system overly emphasized interaction data (likes and shares), leading to several negative phenomena on the platform. Firstly, there was an overflow of AI-generated content, with creators using AI to produce a large volume of shallow, homogenized articles to gain points; additionally, there was emotional agitation and noise, where extreme headlines and emotional calls drowned out rational in-depth analysis.

In response to these issues, Binance made significant adjustments to its mechanisms in January 2026. A new scoring mechanism was introduced to lower scores for detected AI-generated content. At the same time, strict limits on the number of posts were set (e.g., a maximum of 5 content tweets within 30 minutes), and severe penalties were imposed for duplication or plagiarism.

It can be observed that Binance is attempting to shift the competitive dimension from quantity back to quality. By manually screening high-quality opinions and optimizing algorithms, the platform aims to reshape the credibility of content and prevent the Square from becoming a meaningless battleground of words.

The Warring States Era of Social Finance

Although Binance currently leads in traffic scale and search engine authority, "the integration of social and trading" has become a consensus among top trading platforms. Exchanges like OKX and Bitget are challenging Binance with differentiated strategies. Meanwhile, X, leveraging its natural advantage as the "source of cryptocurrency narratives," is attempting to penetrate the financial trading layer from the upstream of traffic.

First is OKX Feed, which aims to break the boundaries between centralized exchanges and the decentralized world. Its OKX Feed feature aggregates discussions, mainstream news, and social sentiment from X, deeply integrating with its Web3 wallet. After reading news, users can seamlessly switch to the on-chain trading interface, achieving a complete closed loop from "news discovery" to "on-chain application."

Next is Bitget Insights, which deeply binds user-generated content with its core product "copy trading." Unlike Binance Square, which focuses on broad information distribution, Bitget emphasizes execution; creators can directly attach their trading strategies while publishing market analyses, allowing users to follow operations with just one click. This model positions creators as trading mentors, enabling the commercial value of content to be realized in a very short path.

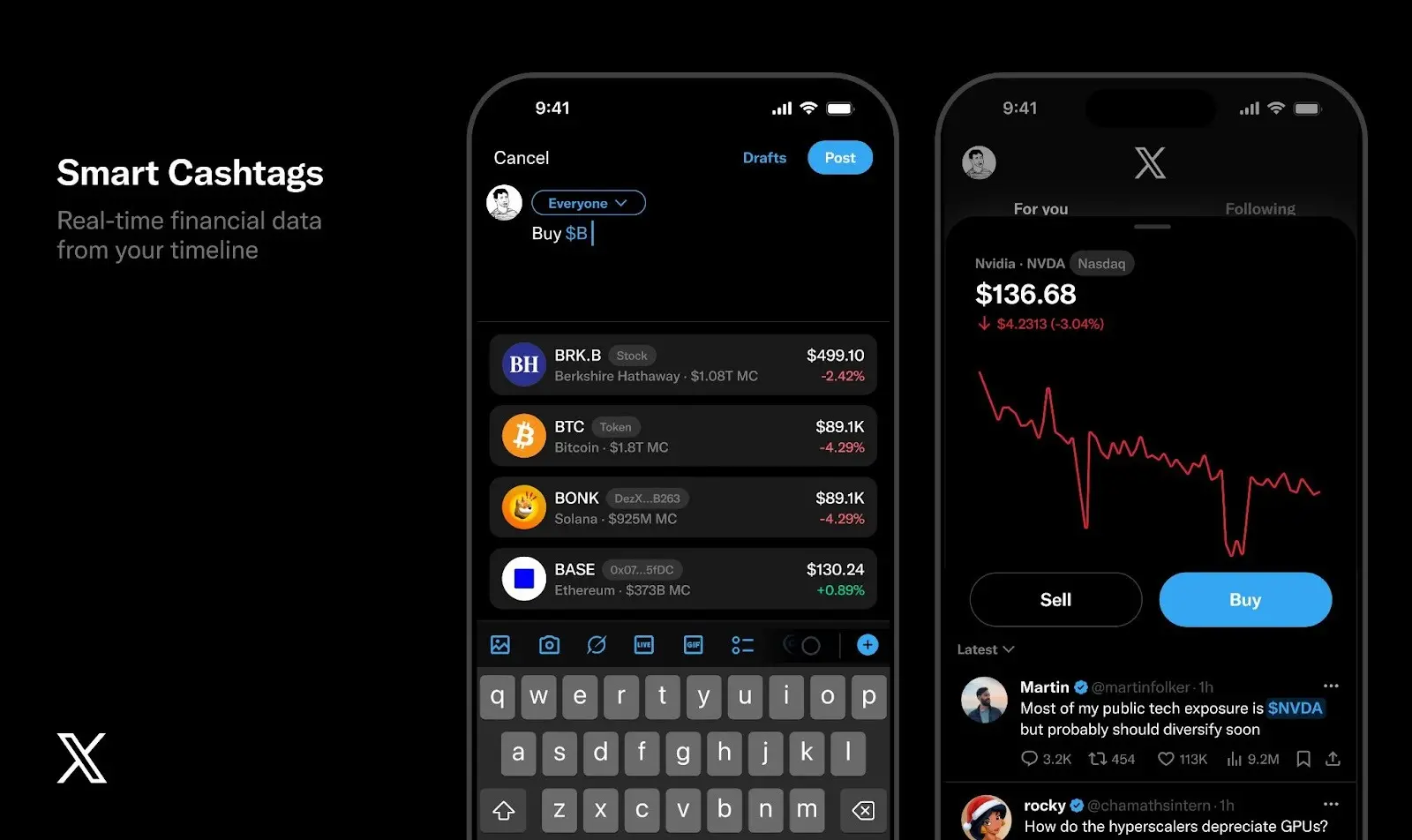

In this competition, external threats are also significant. Nikita, the product manager of X, announced last month the development of the "smart asset tagging" feature, which allows users to precisely specify a token or even a smart contract address when posting, presenting real-time market data directly on the timeline. Its long-term strategy is to enable users to complete investment transactions without leaving the social platform. This poses a survival competition for all exchanges' content platforms regarding "the source of traffic."

However, X's current dilemma lies in the slow global compliance progress of payment and trading functions due to financial regulations in various countries; on the other hand, Binance's dilemma is its strong tool attributes, making it difficult to generate culturally impactful narratives.

Conclusion: The Blurring of Exchanges' Roles in the Industry and the Reconstruction of Boundaries Between Infrastructure and Trading Intervention

However, the emergence of Binance Square essentially blurs a long-standing line in the cryptocurrency industry: should exchanges focus on providing neutral infrastructure, or should they actively intervene and shape users' decision-making scenarios?

From the perspective of product evolution, Binance's answer is very clear. When the cost of acquiring traffic rises and user attention becomes extremely scarce, "waiting for users to come in with clear trading intentions" is no longer sufficient. The platform must embed the "trading button" at the moment users generate interest and assist them in completing transactions painlessly. This is the core value of Binance Square: not to create demand out of thin air, but to systematically shorten the path from cognition to action through scenario design.

However, when exchanges begin to operate like social platforms, with algorithms determining "which content is seen" and "which trades are facilitated," can the platform maintain neutrality at the tool level? Furthermore, when creators' earnings are directly tied to the trading volume of specific tokens, does their independence in content production still exist?

What Binance Square represents is the transition of centralized exchanges from "passive matchmakers" to "active promoters of trading." In this process, the platform has gained unprecedented control over traffic and conversion efficiency but also bears the responsibility of a more complex ecological balance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。