A total of 1.08 billion JST has been burned, with over $38.7 million invested: JustLend DAO continues to realize the long-term deflation logic of JST with real money, solidifying the long-term value foundation of the token.

Recently, the cryptocurrency market has once again entered a deep adjustment. According to the latest data from HTX, the price of Bitcoin (BTC) has plunged to the $60,000 mark, hitting a new low since November 2024, with the entire market entering a downward cycle and industry sentiment remaining low. However, amidst the overall market pressure, key data from the TRON ecosystem shows significant resilience and growth: the on-chain USDT issuance has surpassed $83.4 billion, continuously setting historical records; the total revenue of the TRON network has maintained a growth trend, with total revenue reaching $216 million in January 2026, a month-on-month increase of about 4%, demonstrating the unique development resilience and vitality of the ecosystem.

Core projects within the TRON ecosystem are continuously delivering positive news. Among them, the core DeFi platform JustLend DAO completed a large-scale buyback and burn action on January 15, which is particularly noteworthy, with a total of 525 million JST burned, accounting for 5.3% of the total token supply, and actual funds invested exceeding $21 million.

In the context of a generally low market sentiment, with trading becoming increasingly quiet and trading activity continuing to decline, JustLend DAO resolutely invested tens of millions of dollars to promote JST's deflationary burn. This action stands in stark contrast to the overall weakness of the market, becoming an important value anchor against the trend.

It is particularly noteworthy that, in the current environment of significant overall market decline, the market price performance of the JST token has remained relatively stable, with its price trend not fully following the large fluctuations of the market, reflecting the market's recognition of its intrinsic value support.

Cumulative burn exceeds 1.08 billion, with approximately $38.7 million invested: JustLend DAO anchors the certainty of JST deflation with real money

Since the JustLend DAO community officially passed the JST buyback and burn mechanism proposal in October 2025, the project has efficiently advanced, completing two rounds of large-scale on-chain buyback and burn actions in just three months, with a cumulative burn of over 1.08 billion JST (specifically 1,084,890,753 JST), accounting for 10.96% of the total token supply, corresponding to a cumulative investment of over $38.72 million. With substantial financial investment and efficient implementation, it has solidified the certainty of deflation for JST, demonstrating the project's firm determination to promote a long-term deflation mechanism.

The successful execution of the two rounds of large-scale buybacks and burns has achieved a rigid contraction of the circulating supply of JST, reducing the total token supply from 9.9 billion to approximately 8.815 billion. Such a large-scale deflation and real financial investment are rare in the development history of the cryptocurrency industry, directly confirming JustLend DAO's strong financial strength and effective deflation execution.

According to the previously released buyback and burn announcement, the funds for the JST buyback and burn mainly come from two core sources: first, the existing revenue of the JustLend DAO protocol and the net income generated continuously in the future; second, the excess portion of over $10 million from the USDD multi-chain ecosystem revenue. Currently, since the USDD multi-chain ecosystem-related revenue has not yet reached the established standard, the current JST buyback and burn funds are fully supported by the JustLend DAO protocol.

This funding arrangement fully confirms that the JST buyback and burn mechanism is deeply rooted in the real ecological revenue of JustLend DAO. It can be seen that the JST buyback and burn mechanism is not a one-time operation of short-term marketing nature, but a normalized long-term value empowerment plan anchored in the protocol's continuous revenue, written into the underlying mechanism. It establishes a clear and solid long-term deflation closed loop for JST, namely "real ecological revenue → driving token buyback → deflation enhancing value → feeding back ecological development," providing solid support for the long-term stable development of JST from a mechanistic perspective.

As KOL OxPink stated, the core logic of the JST buyback and burn is highly consistent with the "profit buyback of stocks" in traditional financial markets, directly empowering token value through secondary market buybacks and permanent destruction of the actual revenue generated by the protocol, allowing the dividends of ecological development to effectively feed back to the holders.

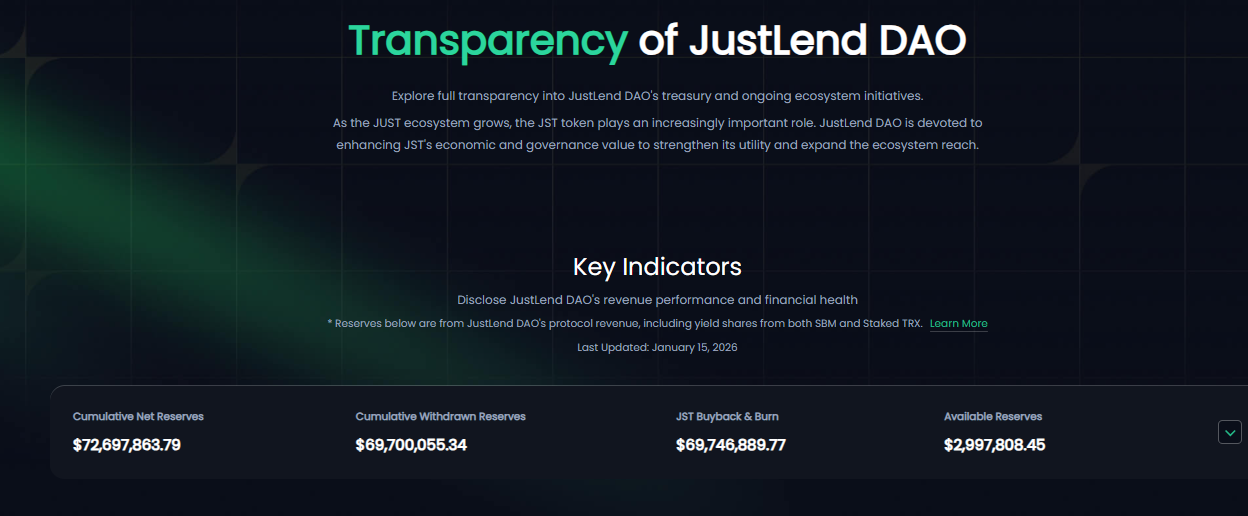

It is worth mentioning that all buyback and burn operations of JST are completed on-chain, and every transaction record can be tracked and publicly queried throughout the process. Currently, users can view the progress of the buyback and burn, details of funds to be burned, and other core data in real-time through the Grants DAO section or the dedicated Transparency page on the JustLend DAO official website, truly achieving full-process openness and transparency.

As of February 4, 2026, JustLend DAO still holds approximately $31.02 million in existing revenue to be burned. This portion of funds will be gradually invested in the JST buyback and burn in subsequent quarters, continuously injecting stable financial momentum for the normalization and sustainable promotion of the deflation mechanism, ensuring the continuous release of JST's deflation effect.

JustLend DAO's diversified business creates strong profitability, providing solid support for JST buyback and burn

As the core funding provider for the JST buyback and burn, and also as the core financial infrastructure of the TRON ecosystem, JustLend DAO has always anchored real market business needs, constructing a full-chain DeFi solution that integrates various functions such as lending SBM, liquid staking sTRX, energy rental, and smart wallet GasFree. This diversified and mature business layout not only creates stable, real, and continuous protocol revenue for JustLend DAO, ensuring healthy cash flow growth, but also provides a continuous and sustainable financial support for the JST buyback and burn mechanism, thereby providing a sustainable solid foundation for the long-term deflation value of JST from a financial perspective.

JustLend DAO's strong profitability is the confidence that supports the long-term operation of the JST buyback and burn mechanism. This was directly validated in the second round of destruction executed on January 15, 2026: a total of $21 million was invested, of which, apart from the planned execution of $10.34 million in existing revenue, the remaining funds came from the net income generated by the protocol in the fourth quarter of 2025. This means that JustLend DAO's net income in the fourth quarter of 2025 has exceeded $10 million in a single quarter, fully validating its strong and sustainable profitability.

Solid revenue comes from a steadily growing business base. The overall operational scale of the JustLend DAO platform has steadily increased, with core data performing well: the total locked value (TVL) of the JustLend DAO platform has long maintained above $6 billion, consistently ranking among the top three in the global lending track. According to the financial operation transparency page, JustLend DAO's cumulative net income has reached $72.69 million. Since the JST buyback and burn mechanism was passed in October last year, nearly $69.7 million in reserve revenue has been extracted in the past three months, with nearly $3 million in net income still remaining.

Based on past stable revenue performance, the JST report released on January 28 predicts that approximately $21 million will be reinvested for buyback and burn in the first quarter of 2026, with the sTRX business expected to contribute revenue of $10 million, and the specific burn scale will be dynamically adjusted based on the actual operating conditions of the season. This provides the market with clear and verifiable expectations, demonstrating the continuity and reliability of the deflation logic of "real business generates revenue → revenue drives buyback → buyback enhances value."

In addition to the core support of JustLend DAO, the decentralized stablecoin USDD ecosystem, as an important incremental funding provider for future JST buyback and burn, is maintaining a high growth trend: currently, the total supply of USDD has exceeded $1 billion, with cumulative treasury revenue reaching $7.4678 million.

Thus, it can be seen that by relying on a diversified and high-growth core business matrix to solidify a robust business ecosystem, and by building strong profitability through continuous and stable protocol earnings, JustLend DAO has deeply internalized the JST buyback and burn into a mechanism for long-term token value growth supported by real revenue, with clear mechanism guarantees and predictable implementation rhythms, achieving a deep binding of deflation operations and ecological development, and synchronous growth of token value and protocol profitability.

The market performance of the JST token also intuitively confirms the effectiveness of ecological construction. In the current environment of significant overall decline in the cryptocurrency market, with mainstream coins generally experiencing deep corrections, the price of JST has shown relative stability and resilience far exceeding the market, not experiencing severe fluctuations along with the market, and has exhibited a strong independent trend. According to the latest market data from Coingecko on February 4, since the market entered a crash mode on January 30, mainstream coins have suffered heavy short-term losses: BTC has dropped by 15% in the past 7 days, while ETH, SOL, and others have dropped by more than 25%. In contrast, JST has only slightly decreased by less than 1% during the same period, and even rose against the trend at certain times. This decoupled trend is particularly striking in a weak market, intuitively reflecting its unique value support and resilience.

Tracing the execution trajectory of the JST deflation mechanism, its "value growth logic" has been clearly validated by the market—each large-scale buyback and burn has directly driven a steady increase in token price, forming a significant "deflationary positive effect."

- First Round Drive (October - December 2025): Since the JST buyback and burn proposal was officially passed on October 21, 2025, market expectations quickly materialized, with the JST price starting a continuous upward trend from 0.032 USDT, reaching a peak of 0.045 USDT on December 3 of the same year, a short-term cumulative increase of about 40%;

- Second Round Boost (January 2026): Following the second round of large-scale buyback and burn on January 15, 2026, the JST price rose again, climbing from 0.040 USDT to 0.047 USDT by January 27, an increase of about 17% within half a month.

The positive market feedback not only reflects recognition of the deflation model itself but also demonstrates strong confidence in the long-term development logic of "business growth driving value feedback."

In fact, the continuous and transparent buyback and burn operations carried out by JustLend DAO based on real protocol revenue have built a core value foundation for JST that is distinct from mere market sentiment-driven actions; the robust performance of JST during market downturns is the strongest validation of the deflation model of "business generates revenue — revenue drives buyback — buyback enhances value," as well as the long-term development logic behind the ecosystem.

The TRON Ecosystem Continues to Gain Momentum, JustLend DAO Builds Long-Term Resilience Across Market Cycles

The deflation logic constructed by the JST buyback and burn mechanism deeply binds ecological real revenue with token value, essentially serving as a model for DeFi protocols to return to their commercial essence and create sustainable value models. As market cycles change, when the tide recedes, projects that rely on short-term speculation and lack ecological foundations will ultimately falter in the industry's storms. Only those who deeply cultivate the ecosystem and adhere to long-term construction can stand firm and become the leading force in the next round of industry development, and JustLend DAO is the core practitioner of this development logic.

Colin Wu, founder of the well-known media outlet Wu Says, previously pointed out that most projects in the cryptocurrency industry lack value feedback mechanisms such as dividends and buybacks, similar to traditional finance. Typically, projects without real income often rely solely on selling tokens to maintain operations, while those with income mostly allocate profits to the team, with very few cases that genuinely return profits to token holders. Therefore, high-quality crypto projects not only need to have the ability to generate real income but also need to write the rules for empowering tokens with profits into their code and smart contracts, which is the true model of long-term value.

The JST buyback and burn mechanism is undoubtedly a vivid practice and industry benchmark of this concept. JustLend DAO has steadily and orderly advanced the JST buyback with tens of millions of dollars, proving its commitment to cultivating the ecosystem and building a long-term value capture mechanism. By deeply linking the value of JST tokens with the real development and revenue status of core protocols like JustLend DAO and USDD, it aligns the path of ecological development with the interests of JST holders. More importantly, the entire process is built on complete transparency: from clear funding sources and verifiable on-chain operations to sustainable revenue reserves, it has become a long-term value practice based on real revenue, guaranteed by transparent mechanisms, and centered on continuous execution.

At the same time, the robust TRON ecosystem behind JustLend DAO continues to accelerate in all aspects, growing against the trend during the industry's downturn, with ecological momentum continuously rising: the on-chain USDT issuance continues to set historical highs; in January 2026, the total revenue of the TRON network reached a new high, showcasing the resilience and vitality of the overall ecological development.

In terms of ecological construction and network interoperability, TRON continues to expand its ecological boundaries and introduce new traffic: on January 15, the world's largest MetaMask wallet announced its official integration with the TRON network, opening a new core traffic entry for the on-chain ecosystem; on January 26, the cross-chain protocol WalletConnect completed its support for the TRON network, significantly enhancing the ecological interconnectivity and bringing more incremental resources to the ecosystem, as well as providing long-term development momentum for core protocols like JustLend DAO.

In addition to the strong support from the TRON ecosystem, JustLend DAO has operated steadily through multiple market bull and bear cycles, maintaining a "zero security incident" record and developing a strong risk resistance capability. During this market downturn, JustLend DAO has also invested heavily in promoting the JST buyback and burn initiative, demonstrating its hard-core strength and firm determination to engage in long-term construction.

Relying on the deep accumulation of the TRON ecosystem and its continuous product innovation, JustLend DAO has deeply bound protocol revenue with token value, not only building a value foundation for JST that transcends cycles but also defining a new paradigm of long-termism in the DeFi field through practical actions. When the tide recedes, such builders will become the key force in determining the next chapter of the industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。