Abstract

As financial institutions increasingly demand the digitization and cross-chain circulation of real-world assets (RWA), achieving secure and efficient cross-chain settlement has become a core issue. This paper systematically analyzes the architecture and security models of three major cross-chain protocols: LayerZero, Axelar, and Wormhole, assessing their compatibility in RWA settlement, matching, and liquidity support. It further dissects on-chain and off-chain settlement logic and proposes three types of feasible cross-chain settlement structures, including native cross-chain message settlement, dual SPV + custodial participation model, and atomic swap cross-chain. Real-world cases are presented to demonstrate the cross-chain operation processes and risk control mechanisms for real estate income rights, bills, and accounts receivable assets. Finally, the roles and responsibilities of institutional-level RWA in cross-chain operations are systematically outlined, providing actionable references for investors, exchanges, and custodial institutions.

Keywords: Cross-chain settlement, RWA assets, LayerZero, Axelar, Wormhole

01 Real Needs of Cross-chain RWA and Comparison Framework of Three Protocols

1.1 Core Cross-chain Pain Points and Real Constraints After RWA On-chain

In the process of real project implementation, it can be observed that most RWAs still follow the "single-chain issuance" logic in their initial design: after asset confirmation, the rights to debts, bills, real estate income rights, or accounts receivable are mapped as tokens and deployed on Ethereum or other EVM chains for issuance and primary circulation. This structure is feasible in the early validation phase, but once it enters institutional operation and secondary circulation, its limitations quickly magnify. First is the circulation cost issue; single-chain means liquidity is locked within a specific ecosystem, and asset allocation between different institutions, trading platforms, and custodial systems can only rely on cross-chain bridges, wrapped assets, or redemption and re-issuance. This not only adds gas costs, cross-chain fees, and liquidity occupation costs but also introduces new compliance and audit complexities. For RWA projects with single transaction scales in the tens of millions or even hundreds of millions of dollars, such structural friction costs are not marginal issues but core variables that directly affect asset turnover efficiency and overall yield models. Second is the settlement efficiency issue; many projects still rely on a semi-manual process of "on-chain trigger + off-chain confirmation + on-chain synchronization" during cross-chain phases, with settlement cycles often measured in days. This is particularly disadvantageous for bill-type, income rights-type, and accounts receivable-type RWAs, as the time cost of cash flow distribution and principal recovery is directly converted into credit costs and capital occupation costs. Third is the fragmentation issue at the institutional collaboration level; when issuers, custodians, settlement parties, and trading platforms are deployed on different chains and technical systems, asset ownership, status proof, and settlement responsibilities are dispersed across multiple systems, audit paths are artificially cut, and liquidity is thus fragmented. This severely undermines the "integrability" and "scalable circulation capability" that RWA should possess in institutional design. Against this backdrop, cross-chain is not merely a technical enhancement but a necessary condition for institutional-level RWA to truly enter multi-market circulation and multi-institution collaboration. However, the risks introduced by cross-chain also raise the overall standards of the settlement system.

For RWAs, cross-chain settlement is no longer just about whether messages can be successfully delivered; it must simultaneously meet four more finance and law-oriented hard requirements: first is finality, meaning that the settlement result on the target chain must constitute an irreversible or legally definitive state, rather than relying on the number of block confirmations to gradually "probabilistically converge"; second is verifiability, where any third party, including custodians, audit institutions, and regulatory bodies, should be able to independently verify the complete chain of cross-chain messages, asset minting and burning, redemption, and settlement; third is regulatory auditability, where the cross-chain structure must inherently support both on-chain and off-chain dual-track audits, allowing settlement actions to correspond one-to-one with legal contracts, custodial agreements, and accounting treatments; fourth is asset traceability, where the tokens corresponding to RWA and their cross-chain forms must always be traceable back to a single real asset source and a clear custodial entity, avoiding structural risks such as multiple wrapping, shadow assets on bridges, or overlapping ownership. From an institutional perspective, these requirements do not exist at the same level as "whether transactions are smooth and costs are low" in the DeFi context; what is truly focused on is whether the settlement possesses legal certainty, whether the responsible parties are clear, whether audits are reproducible, and whether assets always have the final redeemable capability. This also determines that if cross-chain infrastructure is to support RWA, it must be designed from the outset with "institutional-level security and compliance" as a premise, rather than aiming for general DeFi usability as the core goal.

1.2 Evaluation Framework: Why Choose LayerZero, Axelar, Wormhole

1.3 Underlying Architecture and Security Models of the Three Protocols

Thus, LayerZero's design philosophy is modular, configurable, extensible, and based on minimal trust assumptions, which aligns very well with the demands for high security, auditability, and cross-chain flexibility.

Typical Case (Hypothetical Practical Reference)

For example, an RWA project based on U.S. Treasury Bonds or high-rated bonds wishes to conduct cross-chain notifications between Ethereum and BNB Chain. Through LayerZero, the project can issue a "redemption request and asset destruction" on the Ethereum side, then relay the message to BNB Chain via oracles and relayers, and finally execute settlement, transfer, and distribution through the Endpoint contract on BNB Chain. Because the verification mechanism is modular and configurable, and the Endpoint contract is a publicly auditable contract, the entire process possesses finality, verifiability, and auditability, making it suitable for institutional-level RWA settlement needs.

Given that LayerZero callers can specify validator combinations, the security model can be flexibly adjusted according to asset scale, making it very suitable for high-value RWAs with high security audit requirements.

1.3.2 Axelar: PoS Validator Network + Audit-Friendly Message Routing

Protocol Architecture and Mechanism

Over the past two years, Axelar has gradually become one of the fastest-growing systems in terms of institutional adoption in cross-chain infrastructure, not primarily because of its cross-chain capabilities, but because it provides an auditable, reproducible, and regulatory-friendly responsibility chain. Unlike traditional bridges, Axelar is not a channel that relies on relays or single-point proofs, but a mechanism where a validator network elected through governance executes cross-chain confirmations. Therefore, cross-chain execution is no longer a black-box path but resembles a process of accounting adjustments on a ledger, with requests, validations, executions, and receipts, all of which can be verified.

In real projects, the importance of this structure far exceeds technical considerations. For instance, when a licensed custodian in Hong Kong conducts cross-chain debt redemption tests in 2024, they face not whether the technology can be implemented, but whether the final return path possesses reproducible logic. After a redemption request is submitted on the Ethereum side, it does not immediately trigger asset delivery but forms a cross-chain state instruction, which is then agreed upon by the validator network and sent to the Gateway contract on the target chain for fund release. The entire process, from request initiation to verification to execution, is recorded, allowing the custodian to clearly demonstrate the strict logical chain between the triggering event, confirmation conditions, and execution time point during the annual audit phase. More direct feedback comes from the institutional legal department, which believes that only such a traceable state landing can meet the real responsibility anchor points required by licensed financial institutions.

Another U.S. fund manager involved in a dual-chain income rights structure also mentioned that they initially evaluated peer-to-peer message bridges and centralized routing but ultimately abandoned them for a simple reason: once cross-chain execution relies on a single operator, the responsibility does not have a shareable structure, and risks cannot be broken down and explained within the compliance audit system. In contrast, under the Axelar framework, each cross-chain landing can correspond to the governance actions of the validator set and form a time window, meaning that the decision-making chain is publicly provable rather than relying on verbal explanations from operators. In their words, this mechanism is closer to financial audit language than engineering language.

It is worth noting that Axelar's cross-chain execution is not a one-time reversible action but has a delayed effect mechanism, meaning that certain protocol upgrades, permission changes, and validator key rotations must go through governance processes and be executed with a delay. This delay mechanism has become one of the important indicators for institutions to assess cross-chain security, as it provides a window for risks to be known before execution. If there are potential governance disputes in a cross-chain execution, the custodian can pause business cooperation before the upgrade is implemented, thus avoiding the migration of large assets in a disputed state. This has essential risk mitigation value in structured securities and fixed-income RWAs.

Returning to application scenarios, cross-chain is not about transforming assets from chain A to chain B, but about allowing different participants to synchronize ledger states according to business responsibilities, such as changes in income rights holders, confirmation of redemption requests, and release of pledge statuses. In previous off-chain processes, these actions relied on emails, system records, or internal vouchers of custodial systems, where both parties could modify records, and responsibilities could not be solidified. The cross-chain mechanism transforms state synchronization from message notifications into verifiable events, and what Axelar provides is to give this event chain-level consensus characteristics rather than relying on protocol relayers' self-signed confirmations.

During our research, we found that many projects choose Axelar not because of low costs or low development thresholds, but because in the future, when regulatory inspections may occur and audit trails need to be provided, it can turn cross-chain actions into behavior records with clear boundaries and attributable nodes. From an institutional perspective, this is the most difficult capability to replace in cross-chain, as it is not a technical innovation but a clarification of the responsibility structure.

In summary, Axelar is not the lightest or cheapest system in cross-chain infrastructure, but it aligns more closely with the current on-chain issuance logic based on real assets: verifiable, accountable, reproducible, and possessing a complete chain that can be explained to regulators. In scenarios involving debts, income distribution, and bill confirmation, this capability means that cross-chain is not a risk point but becomes a link that enhances compliance certainty, which is the core decision basis for institutions willing to migrate assets to cross-chain systems.

Current Status of the Protocol and Scale and Activity of the Ecosystem (Indicating Its Feasibility)

According to publicly available information, as of recently, Axelar has connected over 60 blockchains (including mainstream EVM chains, Cosmos ecosystem chains, etc.), with its smart contracts, SDKs, and API integrations exceeding 600. Additionally, it has been publicly disclosed that its network's cross-chain transaction volume and transaction count have reached a significant scale (specific values vary from multiple sources and over time, but can serve as a reference).

Typical Applications

A U.S. institutional custodian has partnered with Axelar to use the Axelar Gateway and Validator network to issue, distribute, and settle tokenized institutional bonds, bills, and accounts receivable across multiple chains (such as Ethereum, Polygon, BNB Chain, and Cosmos). Through Axelar GMP, the custodian can simultaneously broadcast redemption, dividend, income distribution, or state synchronization requests to custodial accounts on multiple chains, achieving cross-chain distribution, which is uniformly verified, consensus-driven, and transaction-signed by the Validator network, thereby ensuring the security, uniformity, and auditability of the cross-chain distribution/settlement process.

For RWA project parties, this solution based on a Validator network, universal messaging, audit-friendliness, and multi-chain connectivity is an ideal cross-chain infrastructure option that balances flexibility, scalability, and institutional-level security and compliance.

1.3.3 Repositioning of Wormhole's Security Model: Institutional Evolution from Multi-Signature Verification to ZK Light Clients

In the evolution of cross-chain infrastructure, Wormhole, as one of the earliest widely deployed cross-chain bridges and messaging protocols, has consistently attracted attention from the community and institutions. In its early days, Wormhole's verification security model primarily relied on a group of guardians/validator nodes known as Guardians, who confirmed cross-chain messages through multi-signatures (Guardians Committee). This verification mechanism has advantages in efficiency and ecological coverage but also brings the traditional risk of "trust assumptions concentrated on a group of validators," particularly in high-value asset scenarios where this model was considered to have systemic weaknesses.

In recent years, Wormhole has made significant adjustments to its security model and actively promoted the application of decentralization and zero-knowledge proof (ZK) technologies. The official ZK roadmap clearly states that by introducing ZK light clients and related proof systems, it will gradually reduce reliance on a single guardian network and enhance the degree of trustlessness in message verification. In this ZK roadmap and technical collaboration plan, Wormhole collaborates with multiple ZK cryptography teams to develop light client solutions that can "prove chain states without relying on traditional verification assumptions," aiming to integrate cryptographic proofs into the cross-chain message verification process, thereby strengthening the protocol's security and independent verification capabilities. Relevant official blogs and developer roadmaps can be found in the technical update materials released by the Wormhole Foundation.

Specifically, Wormhole's ZK verification advancement covers two directions: first, developing ZK light clients for Ethereum and other chains, allowing target chains to directly verify source chain state changes through cryptographic proofs without fully relying on guardian signatures; second, by funding and introducing ZK teams including Lurk Lab and Zpoken, promoting the construction of a more universal ZK proof system that plans to cover multiple chains (such as Aptos, Sui, NEAR, Cosmos, etc.), thereby achieving truly decentralized cross-chain verification. The collaboration between the Wormhole Foundation and the Succinct team is one clear direction of technical progress, aiming to replace or reinforce the original trust assumptions with zero-knowledge proofs, making the protocol's verification path closer to mathematical proof rather than single trust.

This development path indicates that Wormhole has not remained at the traditional Guardian multi-signature verification model but is actively exploring and integrating stronger cryptographic verification mechanisms. Once the ZK light clients and proof paths mature, they will improve the current situation on two levels: first, enhancing the security margins of cross-chain message transmission, allowing assets to cross chains without fully trusting a small range of validating nodes; second, increasing the protocol's composability and auditability, making settlement-related cross-chain messages possess a stronger verifiable foundation, thus more easily incorporated into institutional-level audit systems. This trend is seen in the industry as an important sign of the evolution of cross-chain protocols from "trust assumption-driven" to "evidence-driven."

At the same time, Wormhole still retains the traditional Guardian model as a foundational path and enhances the overall system resilience through ongoing ecological cooperation and governance decentralization efforts, such as launching the MultiGov governance framework on multiple EVM-compatible chains, allowing token holders to participate in governance decisions, thereby promoting the decentralization process of security and parameter updates. Although these traditional mechanisms have previously triggered security incidents due to single-point trust, they are still applied as important components of the protocol at this stage, while the new ZK technology route and community collaboration are introducing independent verification paths for the protocol.

Therefore, when evaluating Wormhole's suitability for institutional-level RWA structures, it cannot simply be positioned as a representative of multi-signature and PoA centralized models. The protocol's recent efforts in advancing ZK light clients and proof systems are changing this positioning. Specifically, the latest cross-chain security model construction no longer solely relies on the collective signatures of guardians but is developing towards stronger cryptographic proofs and trustless paths, which has practical significance for improving the independence and auditability of cross-chain settlement messages. However, based on current progress, this ZK verification capability is still in the gradual realization process, and its maturity and manufacturability require time to validate. Therefore, when adopting it in the main settlement path for high-value RWAs, it is necessary to comprehensively consider the current verification assurance level, maturity, and compliance audit requirements.

1.4 Matching Degree of the Three Protocols to Key Capabilities for RWA Settlement

After analyzing the architecture and security models of each protocol, this section evaluates their respective adaptability to institutional-level RWA settlement, circulation, and distribution through a comparison matrix of protocol security capabilities and RWA settlement needs.

From the perspective of institutional-level RWAs, the choice between LayerZero, Axelar, and Wormhole is essentially not about "which cross-chain protocol is better," but rather "which protocol's security model, responsibility structure, and settlement certainty can match the legal and financial order required by real assets." In high-value RWA scenarios, cross-chain is not merely a technical routing issue but an extension of settlement responsibility, asset finality, and audit reproducibility. Therefore, when cross-chain begins to undertake the core financial function of "asset state change," its security model must transition from fault-tolerant trust in the DeFi context to accountable trust in the institutional context.

From this standard, LayerZero and Axelar are clearly more adaptable for institutional-level cross-chain settlement and issuance structures than Wormhole. LayerZero's advantage lies not in its technical complexity but in its highly configurable verification path, meaning that project parties can design multi-validator, independent relayer, oracle, and DVN combination paths based on asset scale, legal responsibility structure, and audit requirements, transforming the judgment of "whether cross-chain is established" from single-point trust into an auditable, accountable, and traceable multi-layer verification system. For RWA projects that need to support redemption, settlement, cash flow distribution, and custodial proof, the value of this structure lies not in increasing success rates but in enabling each cross-chain action to be broken down into independent, verifiable responsibility units, thus meeting institutional requirements for finality and accountability.

Axelar represents another path that leans more towards financial infrastructure. Its consensus structure based on a PoS validator network brings cross-chain messages closer to a role akin to a "distributed settlement committee" in legal and compliance contexts. The validator admission mechanism, governance processes, upgrade delay mechanisms, and on-chain audit trails provide institutions with relatively clear responsibility anchors. This model is particularly important in scenarios requiring large-scale, multi-chain issuance and complex business logic interactions (such as income distribution, cross-chain redemption notifications, and state synchronization), as it not only addresses the message transmission issue but also resolves the institutional question of "who is responsible for the settlement results." For banks, custodians, auditors, and regulators, such a cross-chain system with governance structures and historical trajectories is clearly easier to incorporate into existing compliance frameworks than a purely technical bridge.

In contrast, Wormhole's architectural design is closer to a high-performance cross-chain communication network rather than a "cross-chain settlement infrastructure." Its Guardian signature model has clear advantages in efficiency, chain coverage, and cost control, which is the core reason for its widespread adoption in DeFi asset cross-chain, NFT cross-chain, and high-frequency asset migration. However, when directly used for high-value RWA cross-chain settlement or redemption paths, the centralized signature trust assumptions implied by its security model and the systemic risks exposed by historical attack events significantly amplify the institution's risk exposure. In the context of real assets, a single cross-chain failure does not merely mean financial loss; it may also imply legal liability disorder, asset ownership disputes, and broken audit trails, consequences that clearly exceed the risk tolerance of most institutions. Therefore, Wormhole is more suitable as a cross-chain channel for multi-chain circulation or low-value assets and should not bear the core settlement and redemption functions of high-value RWAs.

In scenarios with extremely high requirements for settlement finality, such as RWA structures involving principal repayment, cash flow distribution, custodial asset redemption, or compliance audit closure, both LayerZero V2 and Axelar exhibit greater institutional adaptability. Especially LayerZero, after reasonably configuring multiple validating nodes, independent relayers, oracles, and audited endpoint contracts, can maintain architectural flexibility while breaking down the cross-chain verification process into controllable, verifiable multi-layer structures, making it closer to a "composable settlement proof system" rather than a single technical bridge. This has irreplaceable value for projects that need to undergo external audits, custodial bank reviews, and regulatory checks.

From the perspective of business scalability and complex logic support capabilities, Axelar's Generalized Message Passing mechanism and validator network structure have clear advantages in cross-chain contract calls, state synchronization, and complex settlement process orchestration. For RWA projects that need to deploy issuance across multiple chains, handle multi-currency settlements simultaneously, and manage income distribution and redemption, Axelar is closer to a "cross-chain settlement bus" rather than a single-point bridging tool, and its systemic and governable nature makes it more sustainable in large structured issuances.

Overall, if the project scale reaches tens of millions to over a hundred million dollars and needs to meet requirements such as legal compliance, custodial integration, audit reproducibility, redemption certainty, and cross-chain asset traceability, both LayerZero (especially the V2 architecture) and Axelar should be regarded as higher-priority infrastructure options. They come with higher costs and more complex structures, but they offer stability in settlement and responsibility systems. If the project goal is to quickly establish a multi-chain circulation network, emphasizing secondary market trading depth with relatively lower requirements for asset scale and settlement certainty, then Wormhole still holds practical significance. However, its applicability should be strictly limited to low-value, high-liquidity, short-cycle assets and should not undertake the main settlement path for high-value assets.

In more mature institutional-level architectures, a single protocol often cannot cover all needs; therefore, a "multi-protocol hybrid structure" is a more practically feasible solution. A typical design is to assign core settlement, redemption, and high-value asset cross-chain responsibilities to LayerZero or Axelar, while secondary circulation, low-value asset transfers, or multi-chain distribution are handled by Wormhole or other high-performance bridges. The key is not the technical combination itself, but the need to clearly distinguish in legal structures and audit paths which cross-chain actions involve real asset ownership changes and which only involve the circulation of derivative tokens, strictly layering these two types of actions in contracts, custodial agreements, and information disclosures. Only under this premise can cross-chain architecture truly serve the financial attributes of RWAs, rather than forcing real assets to adapt to DeFi-style technical assumptions.

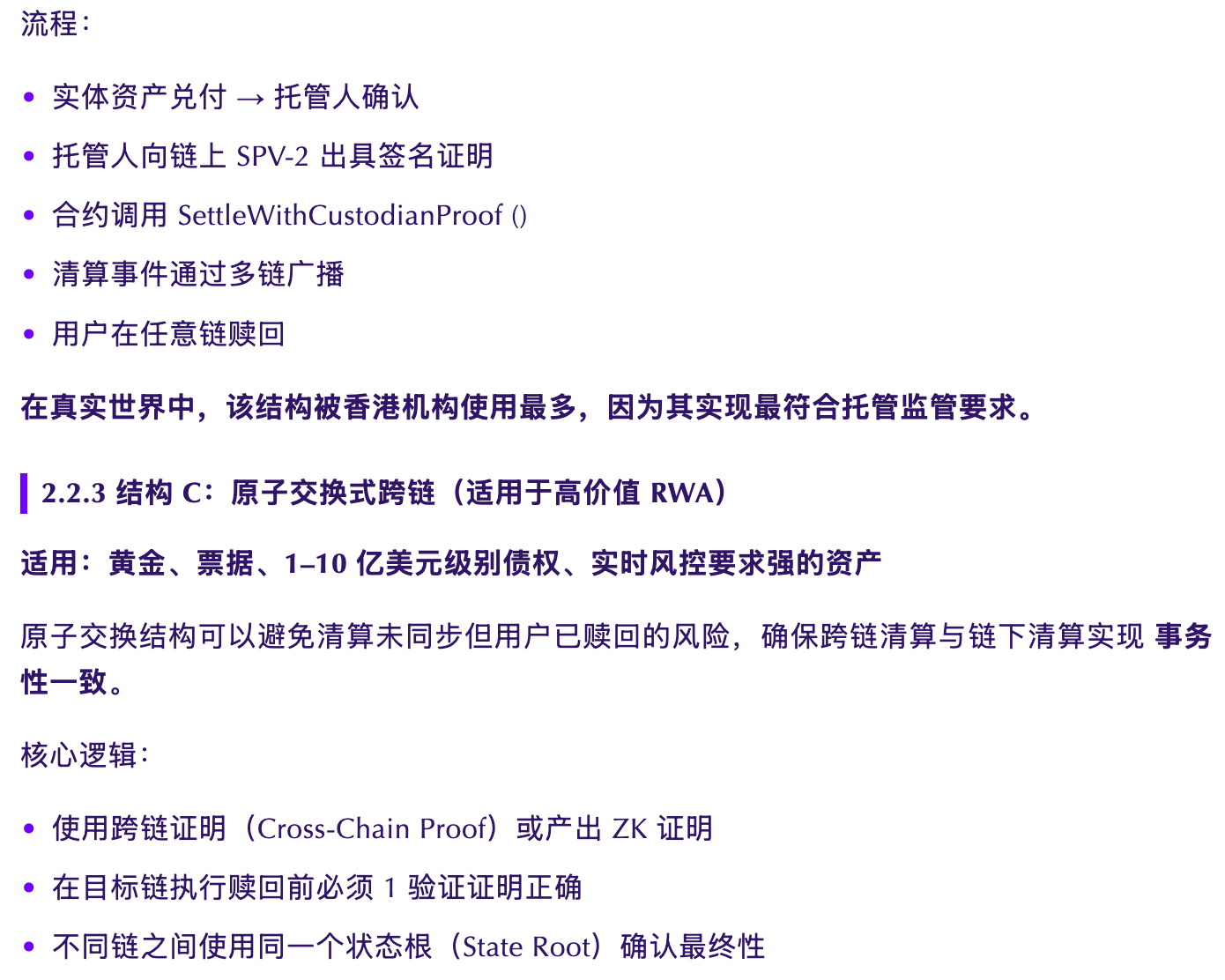

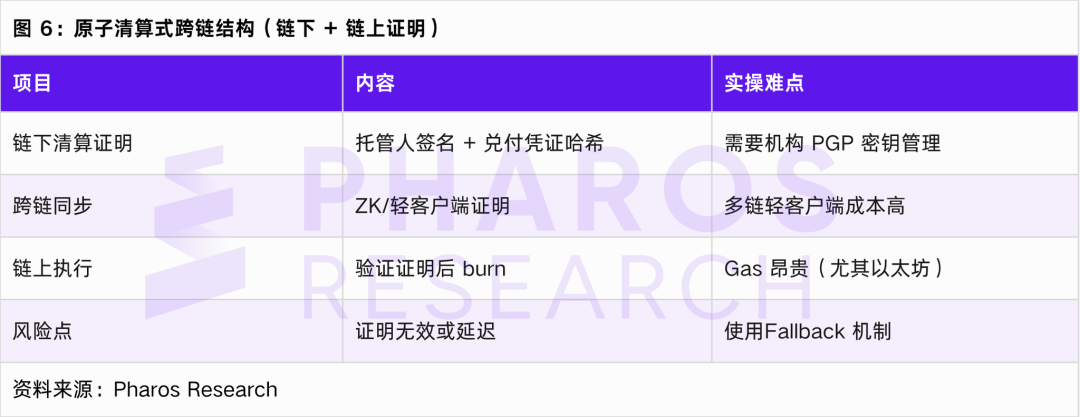

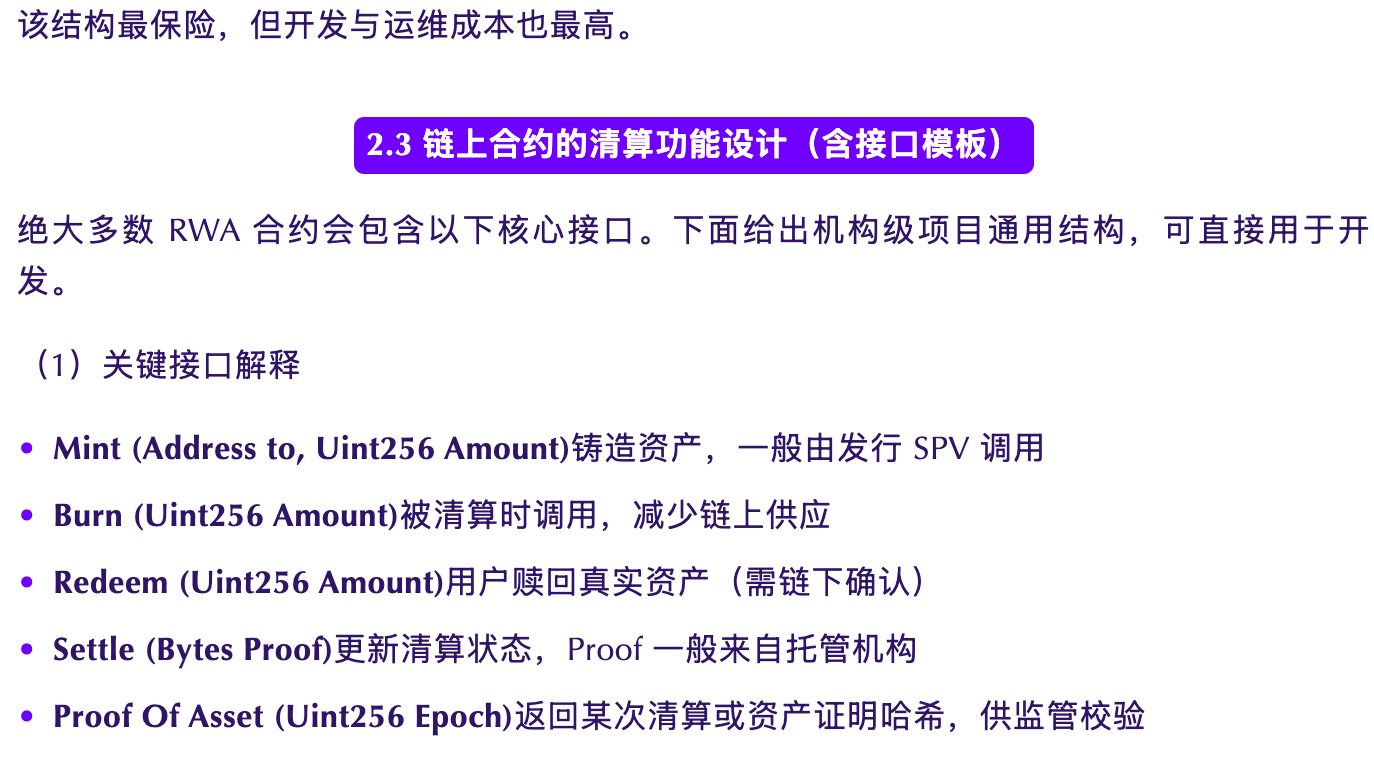

02. Structured Design of Cross-Chain RWA Settlement

The essence of cross-chain RWA is to maintain consistency, verifiability, and auditability between the real legal settlement of assets off-chain and the technical settlement records on-chain. In cross-chain scenarios, the settlement logic becomes more complex: a real asset may involve multi-chain circulation, cross-chain redemption, and off-chain custodial synchronization. Therefore, this chapter dissects the settlement structure from a practical perspective, providing directly usable templates for RWA asset parties, platform parties, and exchanges.

2.1 On-Chain and Off-Chain Logic Dissection of RWA Settlement

The core of RWA settlement lies in ensuring the consistency between the on-chain accounting state and the real-world asset delivery results. This consistency is not generated by on-chain actions themselves but originates from the mapping to the on-chain after the real-world settlement actions are completed. For institutional investors, they are more concerned about whether the responsible parties are clear, whether the settlement certificates can be externally audited, and whether the accounting state has a unique legal attribution. The real path often occurs first among custodial institutions, asset parties, and trustees, such as asset payment or debt extinguishment, and custodial confirmation after funds arrive; subsequently, the trustee updates the underlying ledger and forms off-chain settlement certificates, which serve as the basis for audit and regulatory judgments on whether the settlement is complete. Under this premise, on-chain contracts will execute redemption or cancellation and synchronize balance updates. The synchronization behavior in a cross-chain environment is not a re-settlement but a broadcast of already occurred events, aiming to form a single truth across different chains and avoid accounting forks.

In practical execution, a complete on-chain settlement action usually involves multiple actions such as redemption authorization, balance updates, contract destruction, and synchronization confirmation, but they all point to the same off-chain event, namely the completion of asset performance. The details most concerning to regulators and auditors are whether the final on-chain state corresponds one-to-one with the custodial ledger and can be reviewed at any time; if cross-chain synchronization is delayed, reversed, or missing, it will legally create accounting voids, which are key risk items in due diligence. For institutions, a more mature structure is to fix all triggering events, responsible parties, execution time points, and certificate numbers in the settlement process, ensuring that on-chain changes can always be traced back to a single legal certificate; in domestic and foreign compliance scenarios, this mechanism directly affects whether assets can be regarded as real income-generating assets rather than purely on-chain token activities.

Therefore, cross-chain RWA is not "cross-chain asset transfer" but "cross-chain synchronization of a single settlement event." The core judgment criteria are whether the final responsibility attribution is clear, whether the ledger is fully closed-loop, whether the certificates have audit traceability, and whether the on-chain and off-chain accounting changes are synchronously locked. For participants, this is both a compliance bottom line and the true reason for constraints on institutional allocation scale, rather than the commonly seen technical functional differences in the market.

2.2 Three Types of Implementable Cross-Chain Settlement Structures

These events are typically read directly by tools such as BigQuery, The Graph, and Nansen.

Case Study: Aave RWA Settlement Event Record

Aave's RWA module (such as participation in Centrifuge and Sablier collaboration) adopts: settlement events include NAV updates submitted off-chain by SPV.

Aave uses:

- Single-chain settlement + multi-chain mirroring

- Settlement events as the only trusted source (Source Of Truth)

This structure is highly valuable for cross-chain expansion.

2.4 Settlement Matching, Liquidity, and Market Making Strategies

The liquidity challenges of cross-chain RWA stem not only from the insufficient standardization of the assets themselves but also from the deep fragmentation in a multi-chain environment. For institutional issuers, designing reasonable settlement and market-making strategies is the core issue to ensure asset circulation and reproducible settlement. The traditional DeFi single-chain AMM model cannot be directly applied to institutional-level RWA due to the fact that trading high-value assets focuses not only on price discovery but also on settlement consistency, audit traceability, and legal validity.

Currently, in practice, the AMM model still holds value in low-volatility, stable-yield RWAs, such as small secondary market transactions and bill fragmentation pool trading. However, when asset values are high or point-to-point settlement is required, AMMs face two major bottlenecks: first, the depth of cross-chain liquidity pools is easily dispersed; second, during redemption or settlement, it is necessary to synchronize the states of multiple chains simultaneously, significantly increasing costs and risks. The order book model demonstrates stronger controllability and consistency advantages in such scenarios, especially suitable for mid-to-high-value assets and markets requiring professional institutional quotes. The order book can centralize liquidity on the main chain, making market maker risks more controllable, but it requires high demands on exchange infrastructure, and cross-chain matching also needs strong consistency guarantees.

The hybrid market-making model has become the most commonly adopted solution in institutional practice. In this structure, the main chain undertakes the core functions of order book matching and settlement, while the backup chain provides trading and liquidity support through AMM and ensures consistency of prices and settlement states between the main and backup chains through cross-chain oracles or message synchronization mechanisms. This model balances liquidity depth and consistency of cross-chain assets, allowing high-value RWAs to achieve multi-chain distribution and improved trading efficiency while ensuring legal and audit traceability. Exchanges like Vertex and SynFutures have successfully implemented this structure in their high-value debt token pools, demonstrating its replicability and feasibility.

From actual projects, the deployment of cross-chain RWA liquidity pools across ETH, BSC, and Arbitrum reflects the importance of role division between the main and backup chains. ETH, as the main chain, assumes settlement responsibilities, with its pool depth exceeding 80%, capable of meeting large redemption and institutional trading needs; Arbitrum, while actively trading, has limited depth and plays more of a secondary market liquidity role; BSC has the thinnest pool depth, and cross-chain synchronization occasionally experiences delays, further indicating that relying solely on low-cost chains for liquidity may introduce risks of settlement inconsistency. Thus, it can be concluded that the main chain, as the settlement chain, must achieve maximum liquidity, and the trading pools for multi-chain distribution must synchronize settlement states in real-time through cross-chain oracles or messaging systems; otherwise, inconsistencies in redemption and settlement may occur, affecting the legal and audit validity of the assets.

In institutional practice, the impact of different market-making strategies on cross-chain RWA can be summarized as follows: AMMs provide low-cost trading but have limited liquidity and settlement consistency; order books can ensure multi-chain depth and settlement consistency but have high infrastructure requirements; hybrid market-making strikes a balance between cost, liquidity, and consistency, becoming the preferred structure for high-value, institutional-level RWAs. This also validates the principle in cross-chain design that "asset finality takes precedence over trading convenience," ensuring that regardless of which chain the asset circulates on, its legal and audit attributes are not weakened.

03. Institutional-Level Cross-Chain RWA: Risk Control System and Compliance Implementation

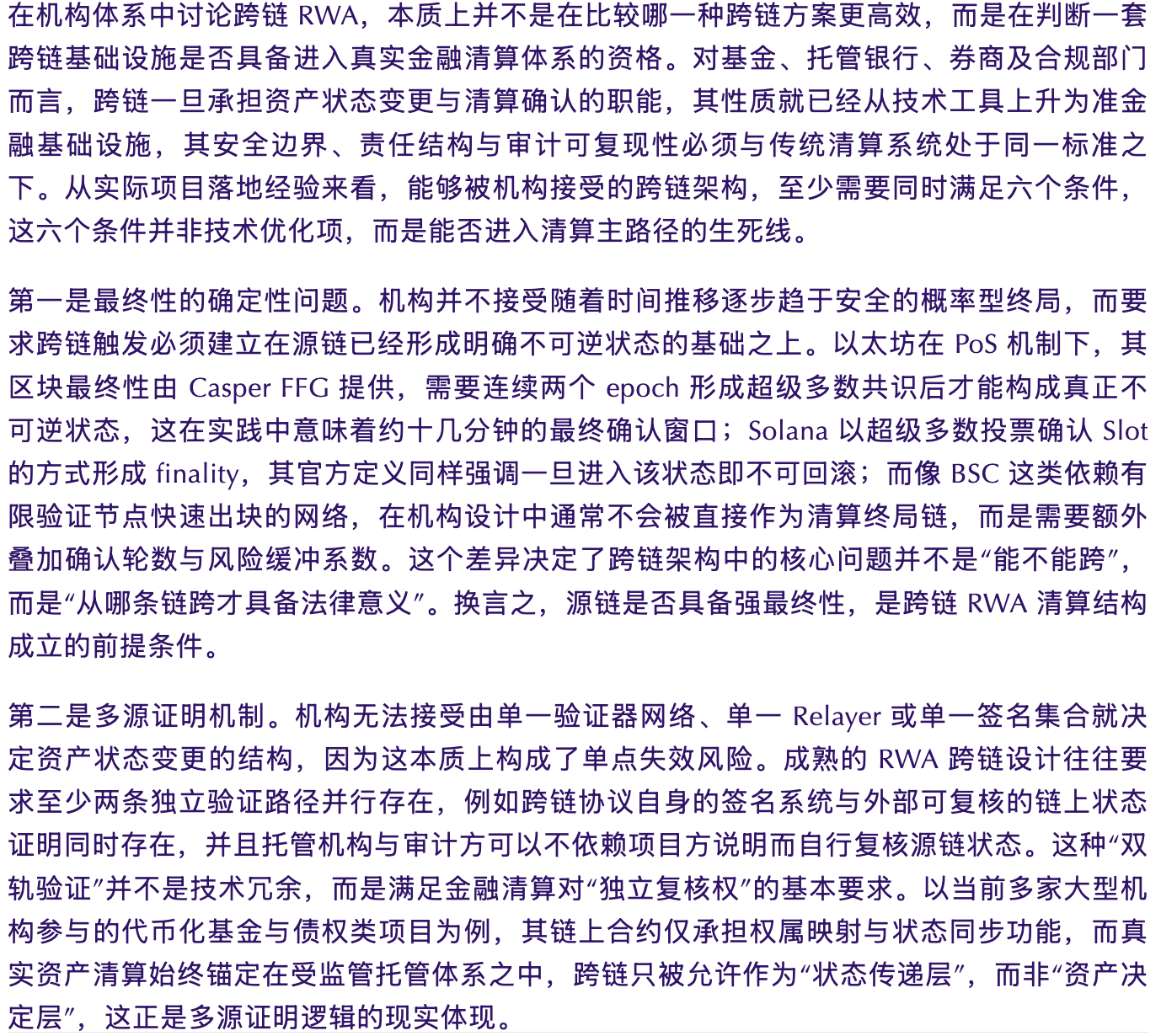

3.1 Six Non-Negotiable Conditions for Institutional-Level Cross-Chain RWA

Putting the above six points together, it can be seen that the core demand of institutions for cross-chain RWA is not in performance metrics but in settlement discipline. Settlement discipline essentially refers to whether finality is clear, whether responsibility can be attributed, whether processes are auditable, and whether failures can be rolled back. Only when cross-chain protocols achieve the same level of security in these four dimensions as traditional financial settlement systems can they qualify to upgrade from cross-chain communication tools to cross-chain settlement infrastructure. This is also why the number of cross-chain protocols that can truly enter the main settlement path in real institutional projects is extremely limited, while most protocols can only assume roles in circulation layers, distribution layers, or auxiliary synchronization layers. The fundamental reason lies not in the advanced level of technology but in whether they comply with the basic disciplines and risk boundaries that the financial system has long established for settlement systems.

3.2 Identification, Measurement, and Pricing of Cross-Chain Specific Risks

3.3 Global Regulatory Framework and Executable Requirements

In the United States, the core focus of regulation remains on the applicability of securities laws and custodial standards. The SEC's regulatory intensity regarding tokenized securities and the latest guidelines from NYDFS for custodial institutions concerning "customer asset segregation, third-party custody, and bankruptcy protection" mean that RWA projects issued in the U.S. market or primarily targeting U.S. clients must prioritize off-chain settlement and regulated custody as essential conditions. Recent official/industry opinions on custody and compliance emphasize stringent standards for customer asset segregation, auditing, and risk management, which directly influence the determination of "which party bears legal finality" in cross-chain settlement design and process arrangement. Meanwhile, the EU-level MiCA and DLT Pilot frameworks provide a more unified regulatory path for tokenized issuance, trading, and settlement within the EU, which means that cross-chain RWAs can leverage EU rules to achieve cross-border compliance and settlement pilots, thereby reducing legal risks associated with reliance on a single jurisdiction. Therefore, from the perspective of institutional project design and risk control, it is recommended to advance a "multi-jurisdiction parallel strategy, with Singapore/U.S./EU as the leading compliance backbone and Hong Kong as a regional market and settlement option" in subsequent compliance and business architecture—utilizing the institutional certainty and predictability of Singapore and the EU to meet global distribution and custody requirements, while retaining compliance custody and auditing capabilities in the U.S. market, and positioning Hong Kong as a regional circulation and business ecosystem entry point rather than a single preferred jurisdiction for cross-chain RWA.

3.4 Typical Cross-Chain RWA Project Case Studies

04. In-Depth Analysis of Typical Cross-Chain RWA Cases

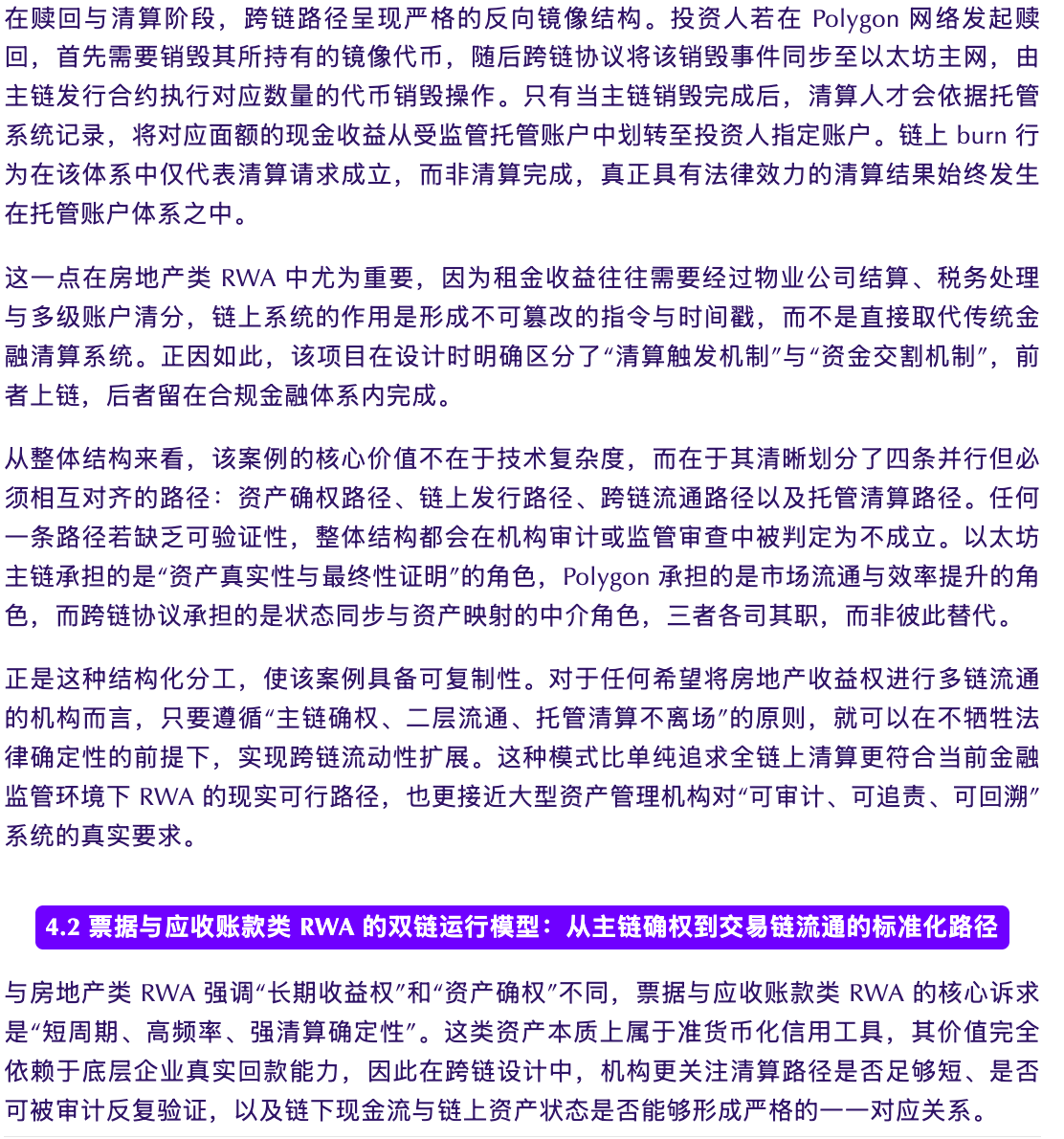

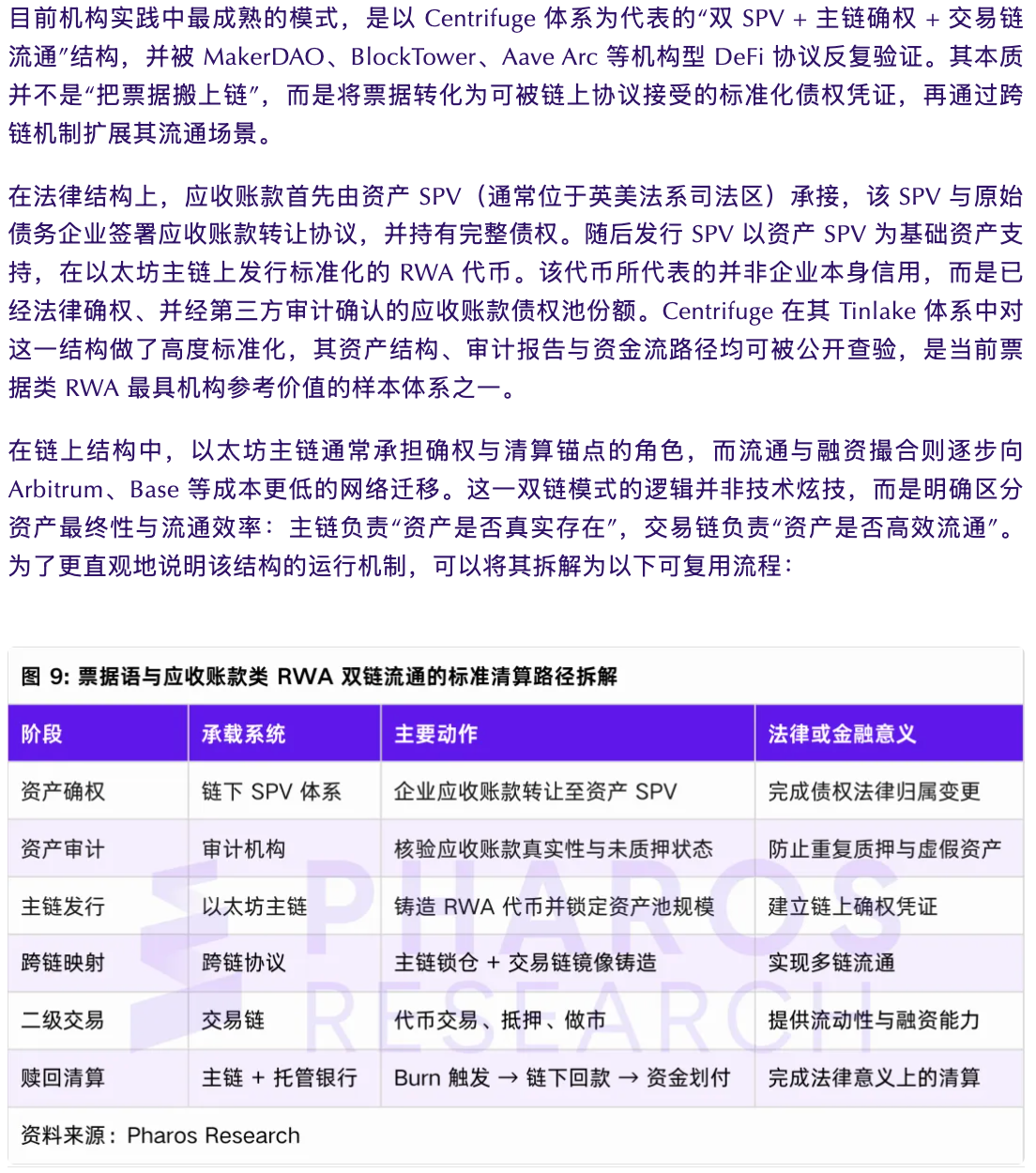

4.1 Cross-Chain Settlement Structure for Real Estate Income Rights RWA: A Practical Paradigm with ETH as the Certifying Main Chain and Polygon as the Circulation Layer

In practical operation, the institution also exposed several typical engineering issues, which constitute the practical value of this case. The first issue is the inconsistency in user experience and settlement costs caused by different chain gas costs. The transaction costs on Polygon and Arbitrum are significantly lower than those on Ethereum and BNB Chain, which directly affects users' choices of which chain to hold assets and conduct redemptions. The institution ultimately introduced a unified gas fee subsidy and hedging mechanism, absorbing cross-chain cost differences through the operational layer to avoid structural biases in asset allocation between chains. The second issue arises from the state compensation problem after cross-chain failures. When cross-chain messages fail to execute on the sub-chain, the source chain has already locked the assets, and without compensation logic, it can create a "hanging state." To address this, the institution specifically designed a "failure compensation queue," transferring all failed transactions into a mixed manual and automated processing flow, and ensuring through secondary verification that the total asset amount is not compromised. The third issue comes from the system upgrade and governance rhythm. The initial time lock setting for the cross-chain module was too short to meet the audit department's requirements for "upgrade pre-review," which was later extended to over 24 hours, requiring a complete audit impact assessment report before significant upgrades. This adjustment is not a technical requirement but a typical institutional risk control demand.

From the institutional perspective, the value of this case lies not in demonstrating how fast Axelar can run, but in proving whether cross-chain protocols can be integrated into a complete system of "asset certification, settlement, auditing, and accountability." The true role of Axelar in this project is to make multi-chain issuance no longer a black box operation but a verifiable system that can be understood by accountants, auditors, and compliance officers simultaneously.

This is also why Axelar is more commonly used as cross-chain settlement infrastructure in high-value RWA projects rather than merely as a cross-chain bridge tool. In the institutional context, its core significance lies in institutional interpretability rather than technical showmanship.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。