Author: The Kobeissi Letter

Translation: @Golden Finance xz

What has happened in the crypto market?

Since October 11, the crypto market has dropped by 50%, with a market cap evaporating by $2.2 trillion. Bitcoin has officially retraced all gains made after the U.S. presidential election, currently down 10% from when Trump was elected.

What is the reason for the crash? We will analyze it for you in this article.

As of today, 8:00 AM Eastern Time, Bitcoin has completely retraced its gains after the 2024 U.S. election. However, the fundamentals of cryptocurrencies have not actually changed significantly over the past 60 days. This is precisely why many investors feel confused.

If the fundamentals have not changed, why has the cryptocurrency market crashed?

To answer this question, we need to trace back to October 11.

The recent peak of the cryptocurrency market occurred on October 6, and just four days later, on October 10, the market experienced a historic liquidation shock of $19.5 billion.

Some structural change seems to have occurred on that day. Since then, the market has not truly recovered.

Subsequently, from November 15 to January 15, Bitcoin entered a complete sideways consolidation phase. However, the market would still occasionally experience brief liquidations accompanied by bidirectional "gaps." This again confirms signs of a structural collapse in the crypto market. Ultimately, the sideways range was broken downward on January 16.

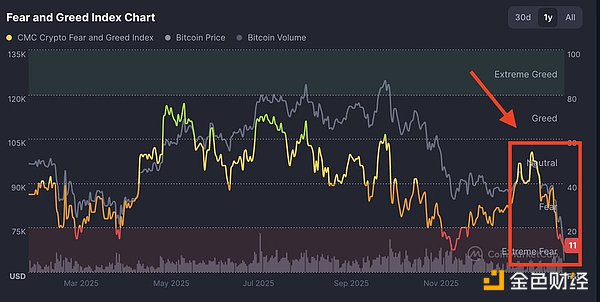

As the price trend worsened, market sentiment also declined in tandem. If there is one lesson to be learned from past crypto cycles, it is that: sentiment is the key to everything. As shown in the chart below, since October 11, market sentiment has almost declined in a straight line, and even technical rebounds have failed to reverse the trend.

The result is a severe vicious cycle: from liquidation to deteriorating sentiment, both reinforcing each other in a continuous loop. Since January 24, $10 billion worth of leveraged positions have been forcibly liquidated. This is equivalent to about 55% of the historic liquidation scale on October 11.

It can be said that this is a structural decline.

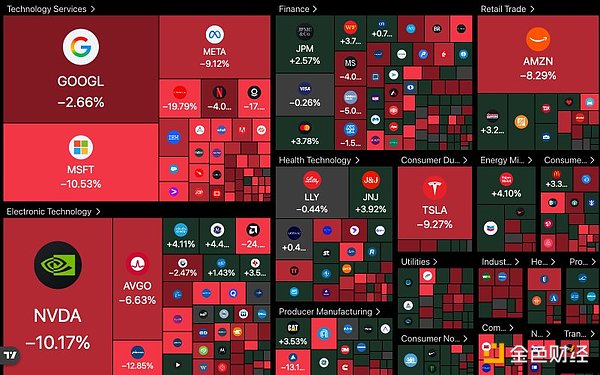

Further evidence that this decline has structural characteristics is that: selling pressure is spreading to other asset classes. Despite strong performance and little change in fundamentals, large tech stocks are also plummeting sharply. The liquidation-style "gaps" in the cryptocurrency market have spread to the stock market.

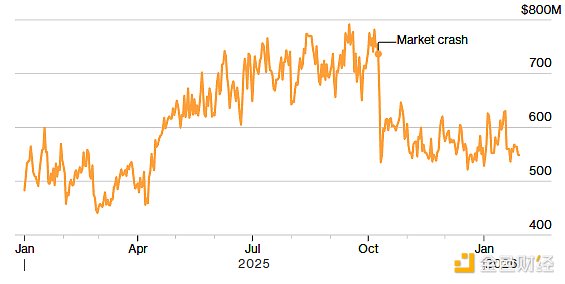

Market depth provides more evidence that this round of decline is essentially a liquidity-driven structural crisis. Bitcoin's market depth (the amount of available funds to accommodate large orders) is still over 30% lower than its peak in October last year. The last time a similar situation occurred was after the FTX collapse in 2022.

Today's decline is particularly noteworthy, with Bitcoin dropping over $9,000 and selling pressure continuing unabated. During this period, Bitcoin has repeatedly plummeted by more than $2,000 within minutes. This seems to indicate that there may be large traders (or institutional investors) concentrating on selling/closing positions during today's trading session.

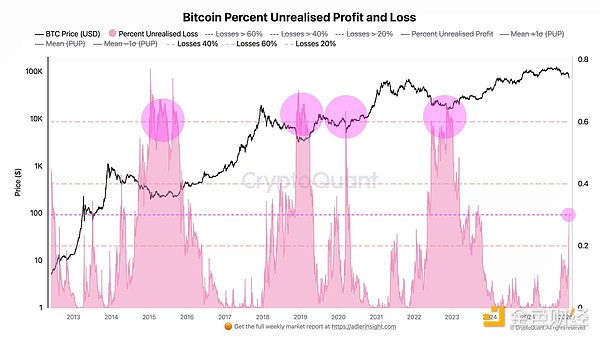

Therefore, the question evolves to: When will cryptocurrencies hit the bottom?

The answer lies in the timing of the recovery of structural liquidity. This requires a complete clearing of prices and leverage, as well as a dual combination of market sentiment reaching extreme pessimism. Currently, we seem to be approaching this critical point.

Extreme volatility will continue to exist as market uncertainty intensifies again. The macroeconomic landscape is changing, and stocks, commodities, bonds, and cryptocurrencies will all fluctuate accordingly.

Ultimately, Bitcoin and the entire cryptocurrency market are no strangers to drops of over 50%. If we extend the time dimension far enough, every bear market and crash will eventually become a minor fluctuation on statistical charts.

We remain optimistic about Bitcoin's long-term prospects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。