Under the "interest rate cuts + balance sheet reduction" monetary policy of the Federal Reserve, funds will flow into more efficient industries.

For cryptocurrency, U.S.-friendly projects/tokens are likely to perform better.

XRP is likely to be one of the ecosystems with strong potential, after all, XRP is a project that has won against the SEC.

┈┈➤ Potential of the XRP Ecosystem

╰┈✦ Underestimation in the Chinese-speaking Region

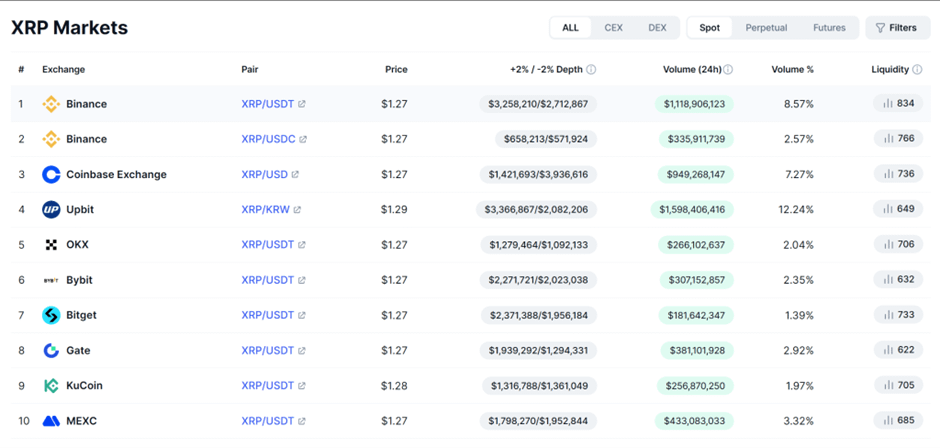

The trading volume and depth of XRP on Binance are relatively average, but XRP is more active in the Coinbase and Upbit markets. Especially on Upbit, the trading depth and volume of XRP in the last 24 hours are about 10 times that of Binance.

╰┈✦ Inflow of ETF Funds

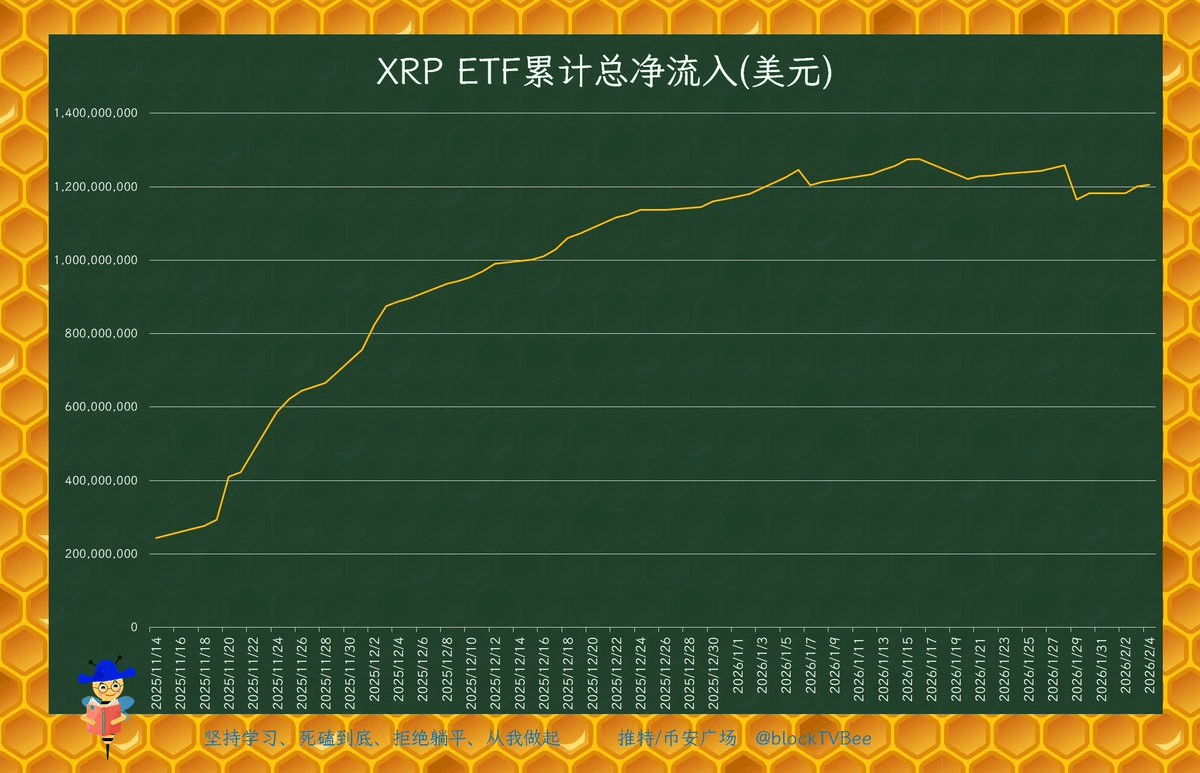

Many may not have noticed that the U.S. XRP ETF has already been approved and was listed in November last year, with issuers including Canary, Franklin, 21Shares, Grayscale, and Bitwise.

Moreover, the net inflow of funds into the XRP ETF is second only to BTC and ETH, surpassing SOL. As of February 5, the net inflow of funds into the U.S. XRP ETF reached $1.21 billion. Since its listing on November 14, despite the ongoing market decline, the XRP ETF has generally maintained a net inflow of funds, with only 4 days of net outflow and the rest being net inflow.

╰┈✦ Potential of TVL

XRP Ledger (XRPL), as a decentralized open-source ecosystem under Ripple, was developed in 2012 by the founder of Ripple. The core positioning of XRPL is to provide fast and low-cost infrastructure for global financial payments.

From 2024 to 2025, the TVL of XRPL is expected to grow significantly.

Even when not compared to EVM-compatible chains like Ethereum and BSC, or the thriving MEME ecosystem of Solana, the TVL share of the XRP Ledger ecosystem is still quite low compared to Cardano (ADA).

This indicates that there may be certain potential in the on-chain ecosystem of XRP.

According to Defillama, there are a total of 19 DeFi protocols on the XRP Ledger. These include RWA, DeFi, CeDeFi, and cross-chain bridges.

It can be seen that the on-chain infrastructure of XRP is already taking shape, especially with RWA applications holding a higher market share.

┈┈➤ Demand for XRPfi

DeFi is essentially a decentralized, transparent, and fair market based on blockchain that provides liquidity derivative markets.

In 2026, Yi Lihua used protocols like AAVE to stake ETH loans and then purchase ETH, creating a cycle of leverage. Although this is a high-risk behavior, it also reflects the market's demand for DeFi products.

╰┈✦ General Liquidity Demand

The DeFi ecosystem of EVM chains like Ethereum and BSC is already very mature. Meanwhile, BTCfi is also rapidly emerging.

Since its launch at the end of 2024, Babylon's TVL has grown rapidly, currently at $3.801 billion, accounting for 0.2887% of BTC's market value.

Lombard currently has a TVL of $1.027 billion, accounting for 0.0779% of BTC's market value.

The data from BTCfi suggests that for high market cap and liquid tokens, there is indeed a demand for DeFi on-chain. BTCfi allows BTC holders to obtain short-term financing while holding BTC. This type of demand has been confirmed across many valuable tokens or public chain coins like BTC, ETH, BNB, and SOL.

As the 4th largest by market cap and 3rd in ETF rankings, XRP has trading demand in both the secondary market and the ETF market, especially with greater liquidity demand in the secondary market. This indicates that there is also demand in the XRPfi space.

╰┈✦ Payment-Related Demand

The biggest difference between XRP and other tokens is that, in addition to the decentralized XRP Ledger public chain, XRP also has an institutional payment system—RippleNet.

Approximately 300 institutions globally use RippleNet, covering countries and regions such as Japan, Malaysia, Thailand, the United States, Canada, the United Kingdom, Spain, France, Brazil, and the UAE. About 40% of these institutions use XRP for payments and settlements.

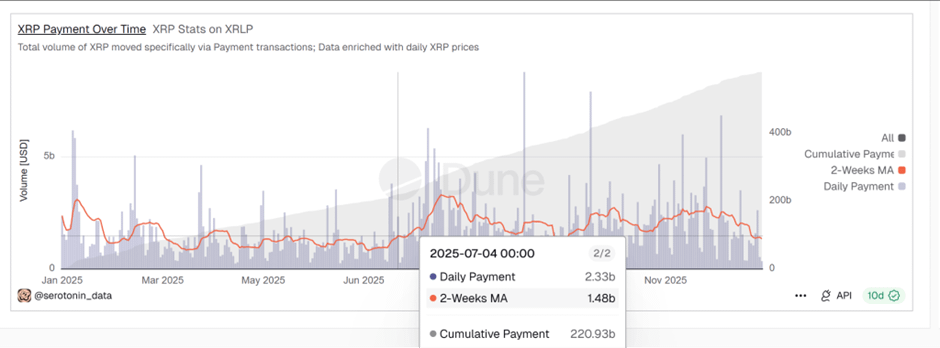

Dune data shows that the average daily XRP payments in 2025 are around $1.5 billion. The total payments for the year 2025 are approximately $600 billion.

When institutions use XRP for payments, the amount of XRP paid is calculated based on the real-time price of XRP in USD terms.

Therefore, institutions may buy XRP at the time of payment or may purchase XRP in advance before making payments. Regardless of the situation, although XRP's volatility is relatively lower than that of other tokens, there still exists an arbitrage opportunity, and this arbitrage motivation creates new demand for XRPfi.

╰┈✦ RWA Demand

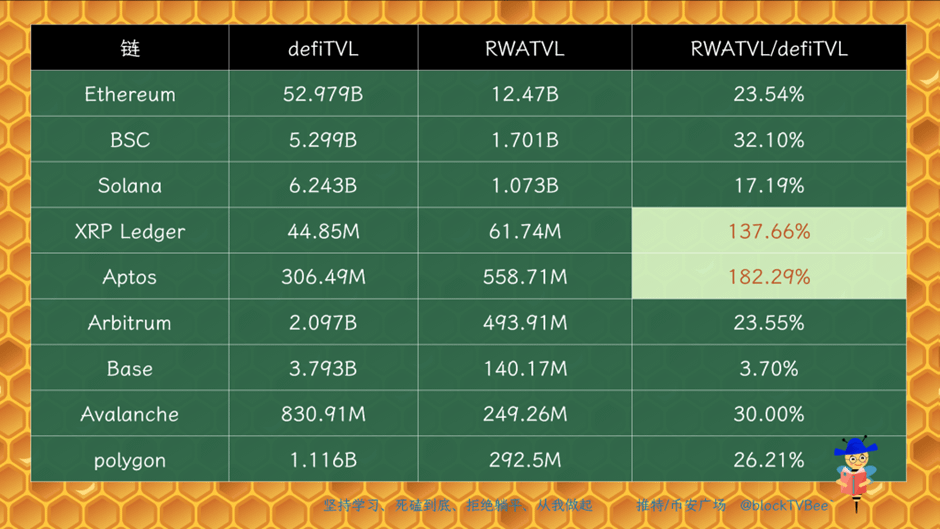

Compared to several ecosystems with high RWA TVL, XRPL is one of the two ecosystems where RWA TVL exceeds DeFi TVL.

This is because XRP, as a global financial ecosystem, is very suitable for developing RWA products.

On-chain RWA products also bring a new dimension of demand for RWAfi.

┈┈➤ XRPfi Ecosystem—Doppler

Doppler is such an XRPfi product that fills the gap in the XRP ecosystem and provides more possibilities for XRP's liquidity.

╰┈✦ XRP and RLUSD Yield Products

Doppler is a native protocol on the XRP Ledger chain, built around yield-generating DeFi for XRP and XRP Ledger ecosystem assets, currently supporting XRP and RLUSD (Ripple USD).

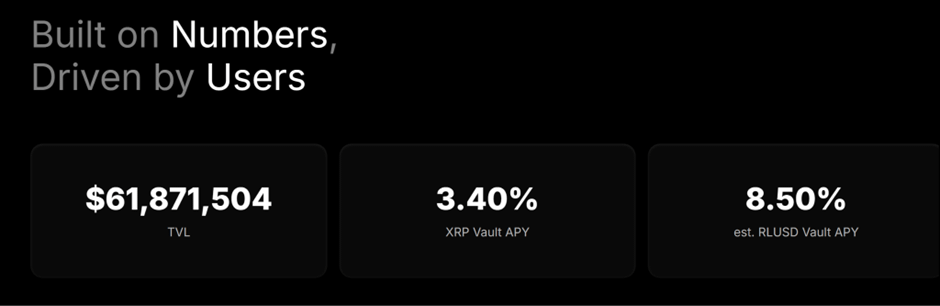

Currently, the total TVL of the Doppler protocol is approximately $61.87 million, with an annualized yield of 3.4% for XRP and 8.5% for RLUSD, making it one of the higher-yielding stablecoin investment products on the market.

╰┈✦ Sources of Yield for XRP and RLUSD

The Doppler protocol provides yields for users depositing XRP and RLUSD, and the source of these yields is not solely from loan users.

Doppler employs a delta-neutral strategy, which simply means achieving a very low-risk yield strategy through risk hedging, thereby providing yields for users depositing XRP and RLUSD. As analyzed earlier, XRP, as a payment tool, has arbitrage opportunities, which is one of the chances for Doppler to generate yields for users.

╰┈✦ Demand Points for Doppler

Currently, the main yield of the Doppler protocol is achieved through a delta-neutral strategy for arbitrage. The XRP ETF was listed at the beginning of the bear market, and in the future, the XRP ETF market itself may bring growth to XRP, indirectly creating potential yield growth space for the Doppler protocol.

Secondly, the XRPfi ecosystem is still in its early development stage, and there will likely be demand for XRP loans in the future, which may lead to growth in demand for the Doppler ecosystem.

Thirdly, RWA is currently one of the hot topics in Web3. Previously, CZ's remarks at Davos also clearly indicated optimism about the prospects of RWA. As a payment network, XRP has a significant institutional market globally, making it very suitable for developing RWA. Users participating in the RWA ecosystem on the XRPL chain can deposit XRP into Doppler, take out stablecoin loans to participate in the RWA ecosystem, which also represents potential loan demand.

╰┈✦ The Explosive Point of the Only Major Prince in the XRP Ecosystem—Doppler

Observing the protocols in the XRPL ecosystem, all are cross-ecosystem, while Doppler is the only protocol focused on XRPL.

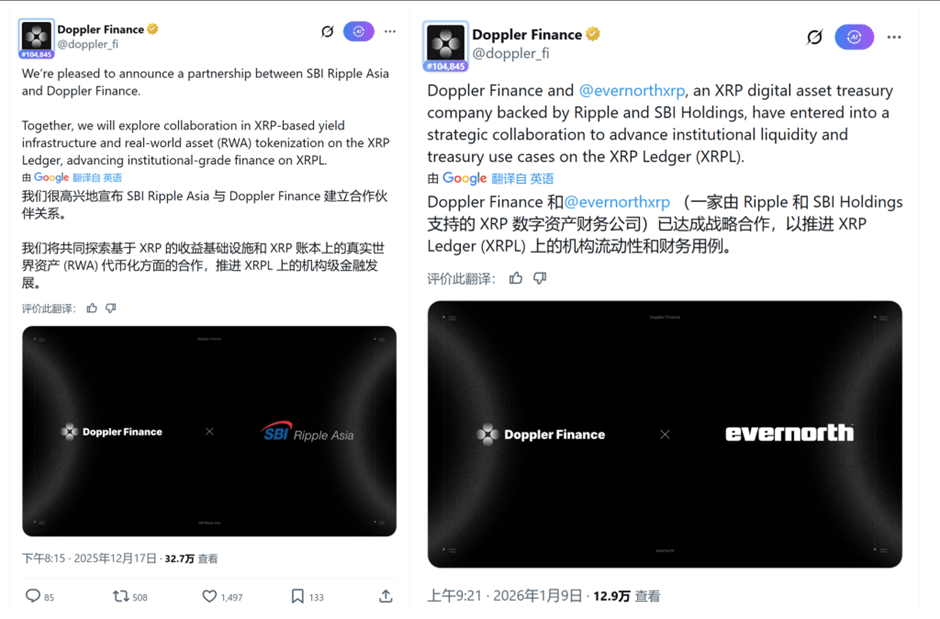

From December 2025 to January 2026, Doppler will successively collaborate with SBI Ripple Asia and Evernorth.

◆ Doppler + SBI Ripple Asia

SBI Ripple Asia was established in 2016 as a joint venture between Ripple and SBI Holdings, focusing on developing fintech solutions in the Asia-Pacific region based on blockchain technology. Doppler collaborates with them to develop the RWA ecosystem.

SBI is Japan's largest comprehensive online financial group, and the deep cooperation between Ripple and SBI is beneficial for tapping into XRP's potential in Asia and the Chinese-speaking region.

◆ Doppler + Evernorth

Evernorth is a company supported by Ripple and SBI and is the largest publicly listed company holding XRP. In simple terms, Evernorth is the XRP version of MicroStrategy, having gone public through the acquisition of AACI, with the stock code XRPN.

Doppler collaborates with them to achieve a structured approach to institutional liquidity deployment. In simple terms, it means scientifically and systematically deploying the XRP held in Evernorth's treasury into the Doppler protocol.

Before going public, Evernorth already held 388 million XRP, which, at the current price of $1.45, means Evernorth holds no less than $550 million in XRP.

Such a structured injection of funds into Evernorth… the explosive potential is evident.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。