According to Lyn Alden’s research note published Sunday, the Fed’s move away from long-term balance sheet reduction is less about economic rescue and more about plumbing. Alden explains that liquidity shortages in overnight financing markets forced the Fed to resume reserve management purchases to maintain control over short-term interest rates.

Lyn Alden emphasizes that this is not a return to classic quantitative easing. Instead, the Fed is purchasing shorter-duration Treasury securities to keep bank reserves “ample,” a technical distinction that matters less in practice than it does on paper. As Alden puts it, champagne or sparkling wine, it still comes from the same bottle.

In her analysis, Alden outlines expected monthly purchases starting around $40 billion through tax season, before settling into a baseline of roughly $20 billion to $25 billion per month. Over the course of 2026, that implies balance sheet growth in the $220 billion to $375 billion range—hardly explosive by historical standards.

Alden contextualizes those figures by comparing them with prior QE episodes, noting that even a $750 billion expansion would represent only a low single-digit percentage increase relative to today’s $6.5 trillion balance sheet. In her view, “big prints” now require trillion-dollar moves, not incremental adjustments.

Lyn Alden also connects the Fed’s actions to structural trends in bank deposits and fiscal deficits. With U.S. deposits growing by hundreds of billions annually, Alden argues the Fed is effectively forced to expand reserves just to keep pace with the system it oversees.

Beyond the United States, Alden devotes significant attention to Japan’s rising bond yields. While social media chatter points to imminent disaster, Lyn Alden pushes back, explaining that Japan’s central bank ownership of government bonds limits systemic risk, even as yields climb.

Still, Alden warns that Japan faces an uncomfortable trade-off between higher interest costs and currency weakness. Yield curve control, she notes, can cap borrowing costs but risks further yen depreciation—an issue made more sensitive by energy prices and household inflation.

From an asset allocation standpoint, Lyn Alden frames the “gradual print” as mildly supportive for scarce assets and mildly negative for the dollar. That backdrop, she argues, helps explain continued interest in gold and bitcoin, even without headline-grabbing stimulus announcements.

Also read: Saylor Buys Again: Strategy Adds 1,142 BTC as Paper Losses Top $5 Billion

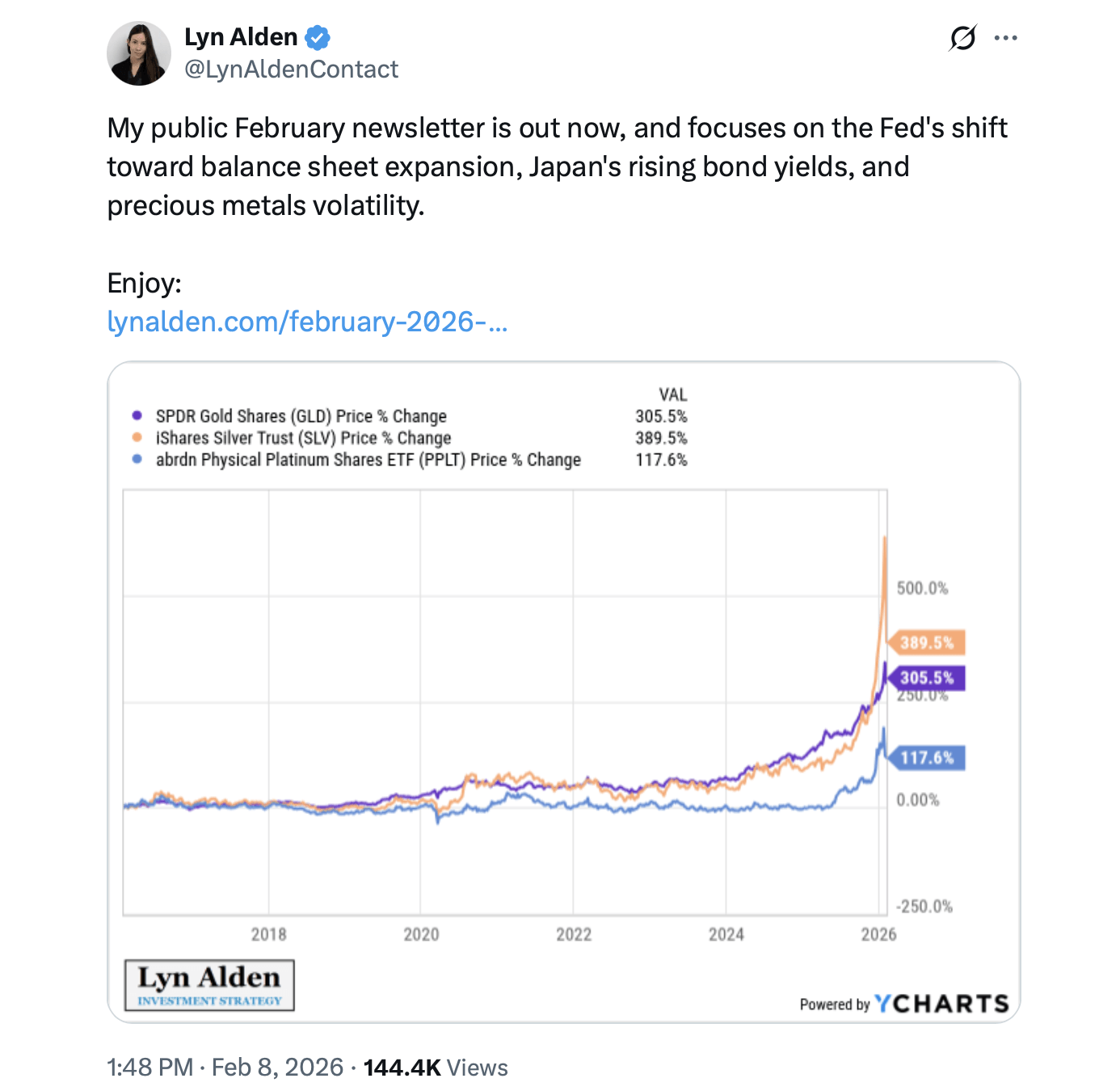

Alden cautions, however, that not all scarcity trades offer the same asymmetry they once did. Precious metals, she notes, have largely repriced from undervalued to more fairly valued, making disciplined rebalancing more important than momentum chasing.

Ultimately, Lyn Alden’s research suggests that the era of dramatic policy shocks has given way to quieter, structural liquidity management. For investors, she argues, the takeaway is less about timing a “big print” and more about understanding why steady expansion has become the system’s default setting.

- What does Lyn Alden mean by the “gradual print”?

Lyn Alden uses the term to describe steady Fed balance sheet expansion aimed at maintaining liquidity, not emergency stimulus. - Is the Fed doing quantitative easing again, according to Lyn Alden?

Alden says no, noting the Fed is buying short-duration Treasurys for reserve management rather than long-term economic stimulus. - Why does Lyn Alden focus on Japan in this report?

Lyn Alden highlights Japan’s rising bond yields as a case study in how heavily indebted nations manage monetary stress. - How does Lyn Alden view Bitcoin in this environment?

Alden continues to see bitcoin as a scarce asset that benefits from gradual monetary expansion and long-term fiscal pressures.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。