Original author: Andrew Kang, Founder of Mechanism Capital

Translation: Ken, Chaincatcher

For those who have experienced at least one complete market cycle, you develop an instinct to be wary of price increases that far exceed historical growth rates. Witnessing the dot-com bubble, the 2008 global financial crisis, and the rise and fall of cryptocurrencies will trigger alarm bells for pattern recognition in your brain. You hesitate to enter the market due to high prices, yet you want to sell your assets out of fear of further declines.

However, it is important to recognize that we are in one of history's deepest and most unique moments of asymmetry. The only action available now is to extend your time horizon and completely abandon short-term thinking.

Overly worrying about bubbles is foolish. Trying to time the market is also foolish. Short-term fluctuations and corrections will always occur, but given how close we are to the "singularity," these fluctuations are merely noise. The fields of artificial intelligence, robotics, energy, and innovation are poised for explosive growth like never before.

In the next decade, we will have billions (or even more) of AI agent workers, humanoid robots, space data centers, multi-planet colonization, and significantly improved medical therapies; we will fundamentally change the speed and output of technological breakthroughs across all fields. The technological advancements and economic growth compressed into the next twenty years will surpass the total of human civilization's history.

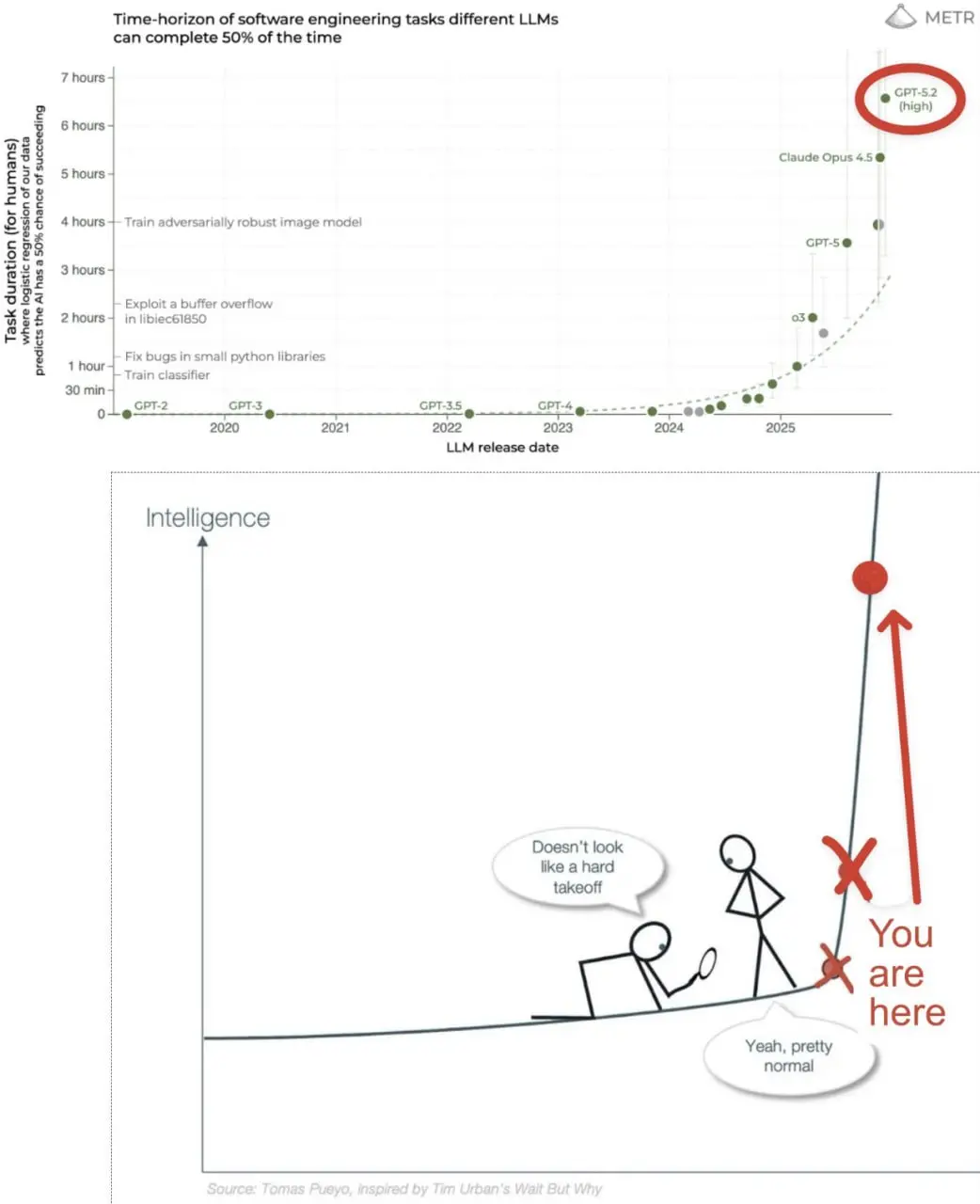

We are currently in an extremely steep phase of a J-shaped curve, but this is hard to notice when we zoom in to the micro level of day-to-day or week-to-week. 100% of the product code at Anthropic is now written by Claude. Product managers have a virtual team of software engineers whose efficiency seems to change the perception of time. Companies that effectively utilize AI experience product iteration speeds that are not single-digit, nor double-digit, but triple-digit in improvements.

Moreover, the capabilities of these tools are still evolving at a faster pace. Whether we reach artificial superintelligence (ASI) in 2027 or 2029 does not actually matter. It will inevitably occur. By the time it's officially announced, the asset prices you want to own will have multiplied countless times.

It is very likely that actual economic growth over the next 3-10 years will reach 20 standard deviations (20-sigma) under any historical distribution model. This level of growth, once thought to be nearly impossible, will be driven by unprecedented second-order and third-order transformations. Traditional valuation models can no longer price these transformations. The potential upward space is so vast that traditional present value calculations struggle to capture them.

The speed of wealth accumulation will be astonishing, much like how cryptocurrencies initially created many billionaires and millionaires in a short period, but this time the magnitude will be far more extreme. If you have no risk exposure, it will be challenging to buy in with asset prices rising so vertically; however, unlike previous bubbles, the creation of real economic value will better keep pace with the vertical rise in asset prices. In the past three years, those who operated in the market with an "exponential mindset" have reaped significant benefits. If you have not adopted this mindset yet, it is not too late.

While it is important to always be aware of downside risks, this is the largest upside risk in world history. Learn to endure risks over a longer time dimension. Now is not the time for swing trading. For the vast majority of people, long-term investment performance typically outperforms short-term trading, but the expected value gap between "trading" and "investing" will be wider than ever before. Ask yourself, what is the intrinsic value of the call option embedded in the singularity?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。