Author: Viee|Biteye Content Team

At the beginning of February 2026, the winter in Victoria Harbour, Hong Kong, was busier than usual, as the Hong Kong Consensus Conference, a focal point of cryptocurrency narratives in Asia, was held again.

Recently, the price of Bitcoin briefly fell below $70,000, trading volumes were sluggish, and investors were anxious. In this bear market, how will these giants of exchanges choose to respond to the cold wave? For ordinary retail investors, perhaps the question is not when the bull market will come, but whether they can survive this bear market. The platforms are reallocating assets, institutions are building bottoms, so how should we allocate our funds and protect our capital?

This article will start from Binance's statement at the Consensus Conference, analyze the underlying logic behind institutions purchasing Bitcoin, and discuss how retail investors and institutions can prepare together during the industry's winter, combined with recent activities in exchange financial products.

I. Binance's Voice at the Consensus Conference

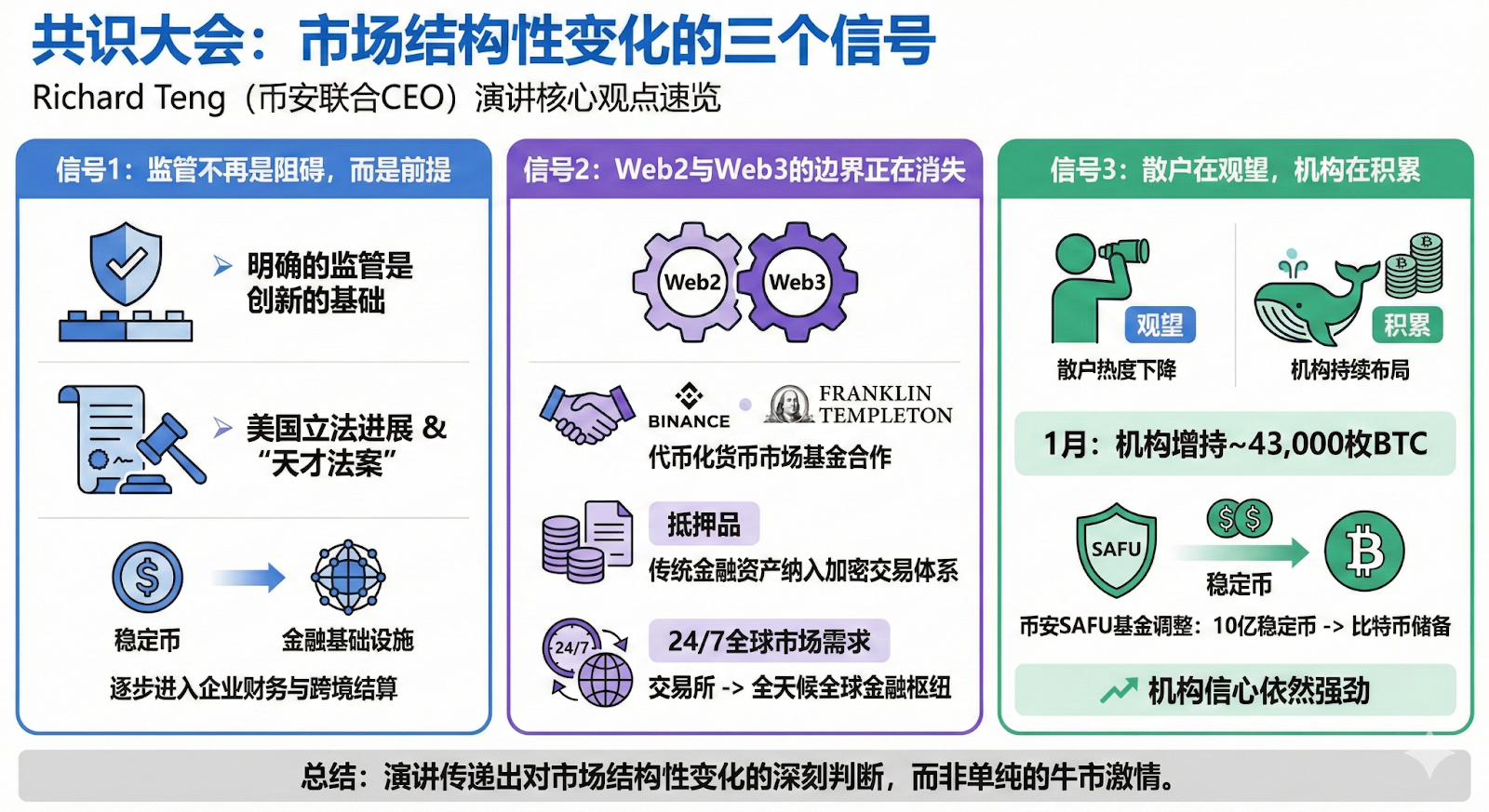

During this period of price volatility and low morale, the speeches at this Consensus Conference differed from the passionate expressions of previous bull market times, feeling more like conveying a judgment on the structural changes in the market. Among them, Binance's co-CEO Richard Teng's speech was particularly representative, capturing several very clear signals regarding regulation, institutions, and infrastructure throughout the conference.

First, regulation is no longer an obstacle, but a prerequisite.

Richard emphasized that "clear regulation is the foundation of innovation," particularly mentioning recent legislative progress in the United States and the confidence boost brought to the stablecoin industry by the "Genius Bill." Stablecoins are gradually transitioning from being liquidity tools within cryptocurrency to integral parts of corporate finance and cross-border settlement systems, indicating that crypto assets are also migrating towards financial infrastructure.

Second, the boundary between Web2 and Web3 is disappearing.

Another noteworthy part of the speech was the collaboration between Binance and Franklin Templeton on tokenized money market funds. Using tokenized funds as institutional collateral also means that traditional financial assets are being incorporated into the crypto trading system.

At the same time, the growth in trading volume of precious metal derivatives also reflects the real demand from institutions for a 24/7 global market. When money market funds, gold derivatives, and stablecoins begin to form a closed loop on the same platform, the role of exchanges shifts from merely matching trades to acting as an around-the-clock global financial hub.

Third, retail investors are on the sidelines while institutions are accumulating.

One critical figure provided by Richard is that in January, institutional investors increased their Bitcoin holdings by approximately 43,000 coins.

The implication behind this number is not that prices will rise immediately, but that the market structure is changing. Retail users from the Asia-Pacific and Latin America remain active, but overall trading enthusiasm is indeed less than during a bull market. In contrast, institutional capital continues to position itself within a low-volatility range. Coupled with the SAFU fund strategic adjustment announced by Binance on January 29, 2026, which will convert $1 billion in stablecoin reserves from the SAFU fund to Bitcoin reserves within 30 days, it indicates that institutional confidence is still strong.

In other words, while retail investors are awaiting clear bottom signals, institutions have already made allocation decisions, suggesting that smart money may not have left the market.

So the question arises, when institutions are buying and platforms are adjusting their asset structures, how should retail investors deepen their understanding of the implications behind these actions?

II. The Market is Still Languishing; Why Are Institutions Acting?

Regarding the institutional buying discussed earlier, let's first review how Bitcoin has attracted substantial institutional capital in recent years, especially since the approval of the first spot Bitcoin ETF in 2024, which has significantly enhanced institutional buying pressure.

1. Analysis of Institutional Buying Trends

Currently, institutional buying primarily enters the market through various forms such as ETFs, investment funds, corporations, and governments. The following points reflect the current trends in institutional positioning:

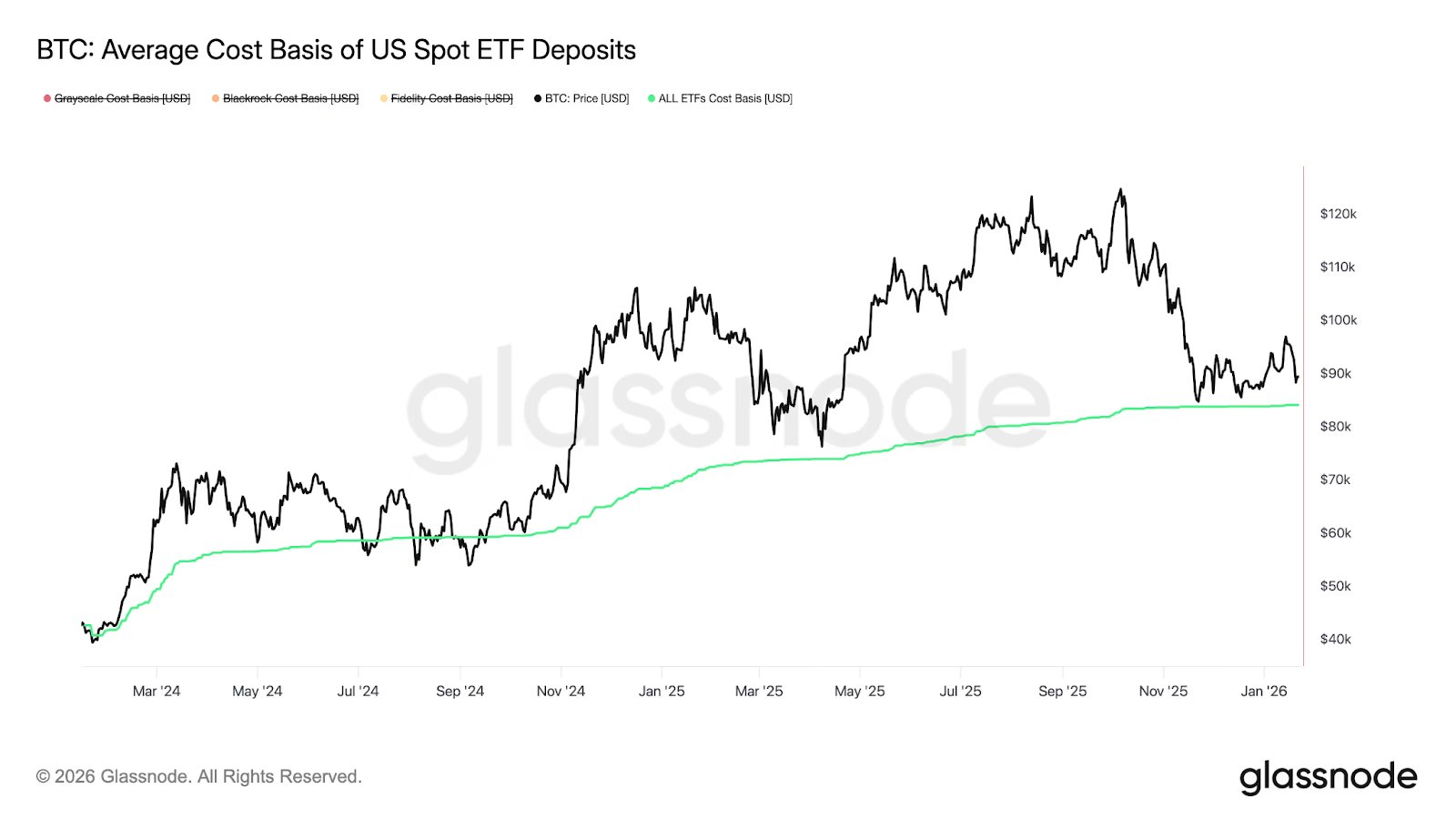

Spot ETFs are booming: Institutions are increasingly using spot ETFs to access the Bitcoin market, and ETF data is also one of the means to gauge market enthusiasm. For instance, according to SoSoValue data, the U.S. spot Bitcoin ETF saw the largest single-week capital outflow since last November in late January (approximately $1.22 billion), and historical experience indicates that large-scale redemptions tend to occur near price local bottoms; thus, Bitcoin may be approaching a temporary low. The data in the chart below indicates that the average holding cost of ETF investors is about $84,099, a price range that has formed key support levels multiple times in the past; if historical patterns repeat, this round of capital outflow may suggest that the downward momentum is nearing its end, and there is potential for market rebound.

Public companies are holding more: Reports indicate that the total amount of Bitcoin held by publicly listed companies globally reached approximately 1.1 million BTC (about $94 billion) in Q4 2025, with 19 new companies purchasing Bitcoin. This shows that Bitcoin is increasingly being viewed as a strategic asset by more enterprises. In addition to well-known treasury management companies, several newly listed companies have also joined the buying camp, further validating the trend of institutional capital inflow. The chart below shows data on the top 10 Bitcoin treasuries.

National-level initiatives: Some countries are also publicly purchasing Bitcoin. The government of El Salvador announced in November 2025 that it had spent $100 million to buy approximately 1,090 BTC in one day, bringing its total holdings to over seven thousand coins.

In summary, from 2024 to now, institutional buying has exhibited features such as explosive ETF inflows and concentrated positioning by companies and investment funds, as Richard Teng stated, this trend is expected to continue through 2026 and continue to provide upward momentum for the market.

2. What are some historically representative public purchases of Bitcoin?

By early 2026, historical public purchases of Bitcoin aimed at "building markets, stabilizing ecosystems, or reserving assets" can be divided into five categories; here are a few representative cases:

From the table above, it is evident that institutional purchases of Bitcoin aimed at building markets can be broadly categorized into three types. The first type is corporate asset allocation, such as MicroStrategy, where these companies base their purchase on shareholder assets, considering BTC as a long-term store of value tool. The second type is national/DAO buying and holding as a reserve alternative. The third type is exchange buying behavior, like Binance's recent SAFU conversion. This approach shifts reserves from stablecoins to Bitcoin, which is more resistant to inflation, censorship, and enables self-custody, thereby enhancing asset independence in the face of potential geopolitical systemic shocks in the future.

The distinction lies here: the vast majority of enterprises buy BTC based on business financial decisions. In contrast, Binance's use of a user protection fund indicates that it is a purchase aimed at restructuring risk.

3. What are the essential differences between Binance's methods and those of other institutions?

First, different asset attributes.

MicroStrategy uses corporate assets, while ETF buying represents passive allocation from user subscription funds without bearing corporate responsibility for price fluctuations. The national-style purchases by El Salvador are more policy-oriented strategic actions, and their decision logic is harder to replicate. In contrast, Binance is utilizing a user protection fund, converting it into BTC, essentially viewing Bitcoin as the most reliable long-term asset.

Second, different execution methods.

Institutions like MicroStrategy and ETFs engage in buying that is more aligned with trends or accumulating at bottoms. Binance, on the other hand, buys in stages and has set a rebalancing mechanism. If the value of SAFU falls below a designated safety line, it will continue to buy, indicating that this is a long-term asset structure management approach.

Third, different market roles.

Corporate purchases mainly influence corporate investment structures, while continuous ETF subscriptions represent that compliant institutional channels are still expanding. Exchange purchases, however, impact overall market liquidity and sentiment structure. When the world's largest exchange locks $1 billion in BTC as a long-term reserve, it reinforces optimistic expectations for the leading platform, creating a demonstration effect.

4. What retail investors need to consider: What does this mean for the market and BTC price?

In the short term, large-scale public purchases have not triggered a sharp price increase, indicating that the market may be in a rational digestion phase. However, from a structural analysis perspective, we believe several mid-to-long-term impacts may exist.

First, the $1 billion worth of BTC locked in the insurance fund reduces circulating supply, although it comprises a relatively low percentage of the total circulation (approximately 0.1%). According to relevant studies, spreading out $1 billion over 30 days entails purchasing approximately $33.33 million daily. In Bitcoin's average daily trading volume of $30 billion to $50 billion, this only accounts for 0.1%-0.2% and is unlikely to form a significant impact. With the TWAP algorithm applied, the buying volume per minute is only about $23,000, making daily fluctuations hard to detect. Therefore, the estimated impact on prices is expected to be within 0.5%-1.5%.

Second, as the strategic purchase of the largest global exchange, it is viewed as an endorsement by authoritative institutions of Bitcoin, potentially triggering additional confidence premiums. Thus, overall, considering both direct buying pressure and market sentiment, the potential rise in Bitcoin's price may exceed 1%, reaching levels of 2%-5%.

Finally, the support mechanism. Since Binance has committed to continue buying if the SAFU value remains below $800 million, this mechanism effectively sets a firm support level. When prices significantly pull back, the market anticipates that Binance will step in to absorb the sell-off, which helps to temper the downward pressure.

In conclusion, Binance's step-by-step $1 billion buying is expected to have a mild uplifting effect on Bitcoin, not leading to a violent surge in the short term, but providing an invisible layer of support for market sentiment and price, reflecting more of a long-term bullish confidence in Bitcoin rather than short-term speculation.

III. Retail Investors’ Survival Rules in a Bear Market: Seek Defensive Yield

As institutions configure their underlying assets, how should retail investors respond? Since they cannot change the market like large funds, the best way is not to waste ammunition.

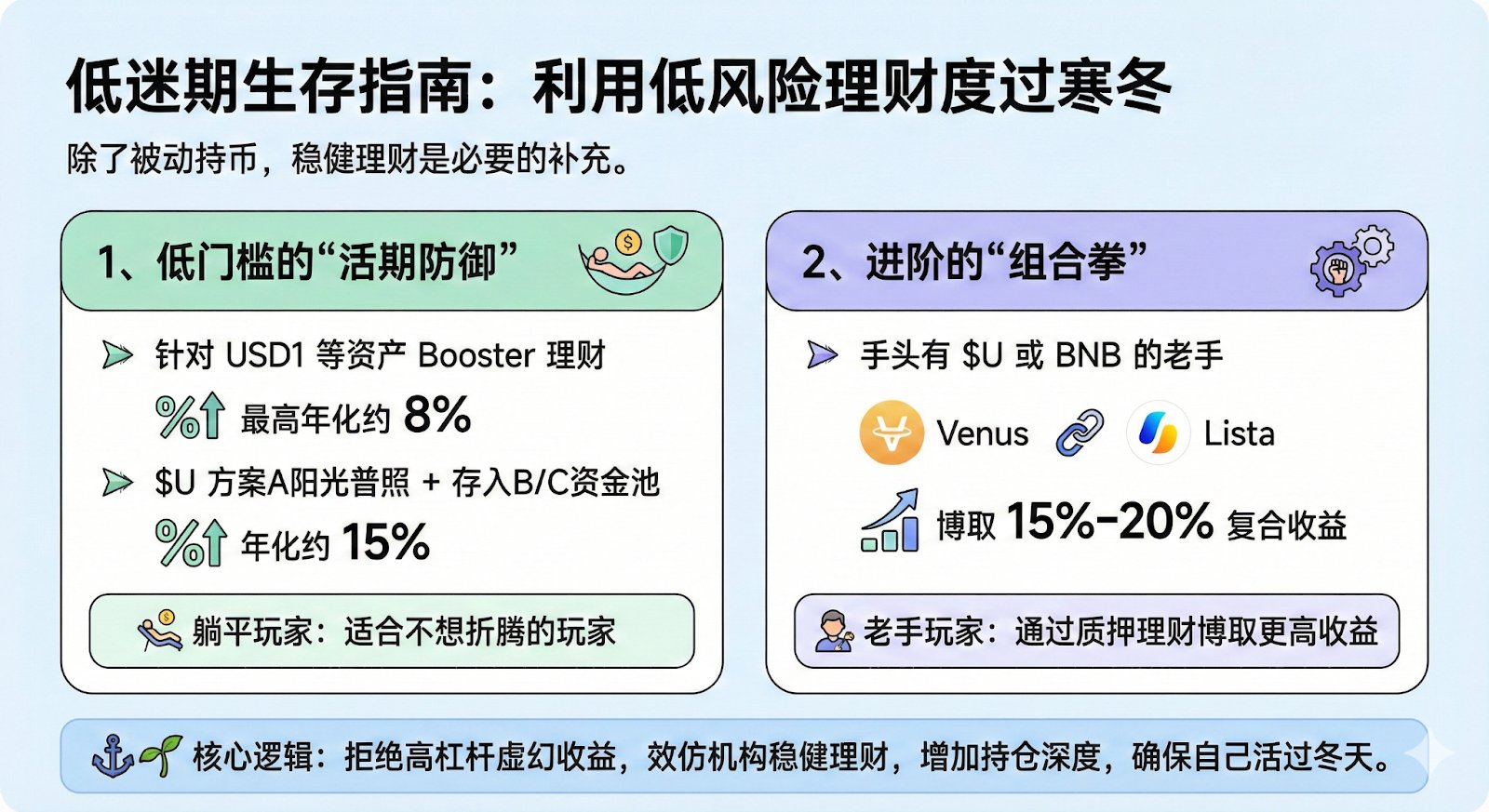

During the current slump, aside from holding coins passively, utilizing platform activities for low-risk financial management is a necessary supplement to survive the winter. Looking at Binance's recent financial activities, the logic is quite clear:

1. Low-threshold "current defense": For USD1 Booster finance, the highest annualized return is approximately 8%. The scheme A provides sunshine to $U + deposits into B/C funds, with an annualized return of about 15%.

This is suitable for those who prefer a laid-back approach.

2. Advanced "combo punches": For experienced holders of $U or BNB, staking financial options (like Venus or Lista protocols) can yield 15%-20% compound returns.

In summary, the core logic is to avoid chasing illusory returns with high leverage at this stage, instead emulate institutions by increasing position depth through stable financial management, ensuring you survive through the winter.

IV. Conclusion: Companions in the Cold Winter

The bear market will eventually pass, but those who survive will have the privilege to welcome the spring.

Currently, this long cryptocurrency winter is still testing the patience of every market participant. Through the window of the Hong Kong Consensus Conference, we have seen the true choices of leading exchanges.

As an old saying goes: "Winter has come, but spring is not far behind?" In a bear market, while some are preparing for the worst, it also signifies that the dawn will eventually arrive. Before that, all we can do is maintain rationality and patience, manage risks well, and treasure the chips in hand.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。