Gold Prices Cool but Analysts Maintain $5,000 Q1 View

In its Q1 2026 Quarterly Metals Report, Sucden Financial’s Head of Research Daria Efanova and Senior Research Analyst Viktoria Kuszak said bullion has shifted from a fundamentally supported rally to a more momentum-driven phase.

“We expect gold to consolidate through the remainder of Q1 2026, with price action remaining volatile and two-sided following the late-January correction,” the analysts wrote in the company’s latest quarterly analysis.

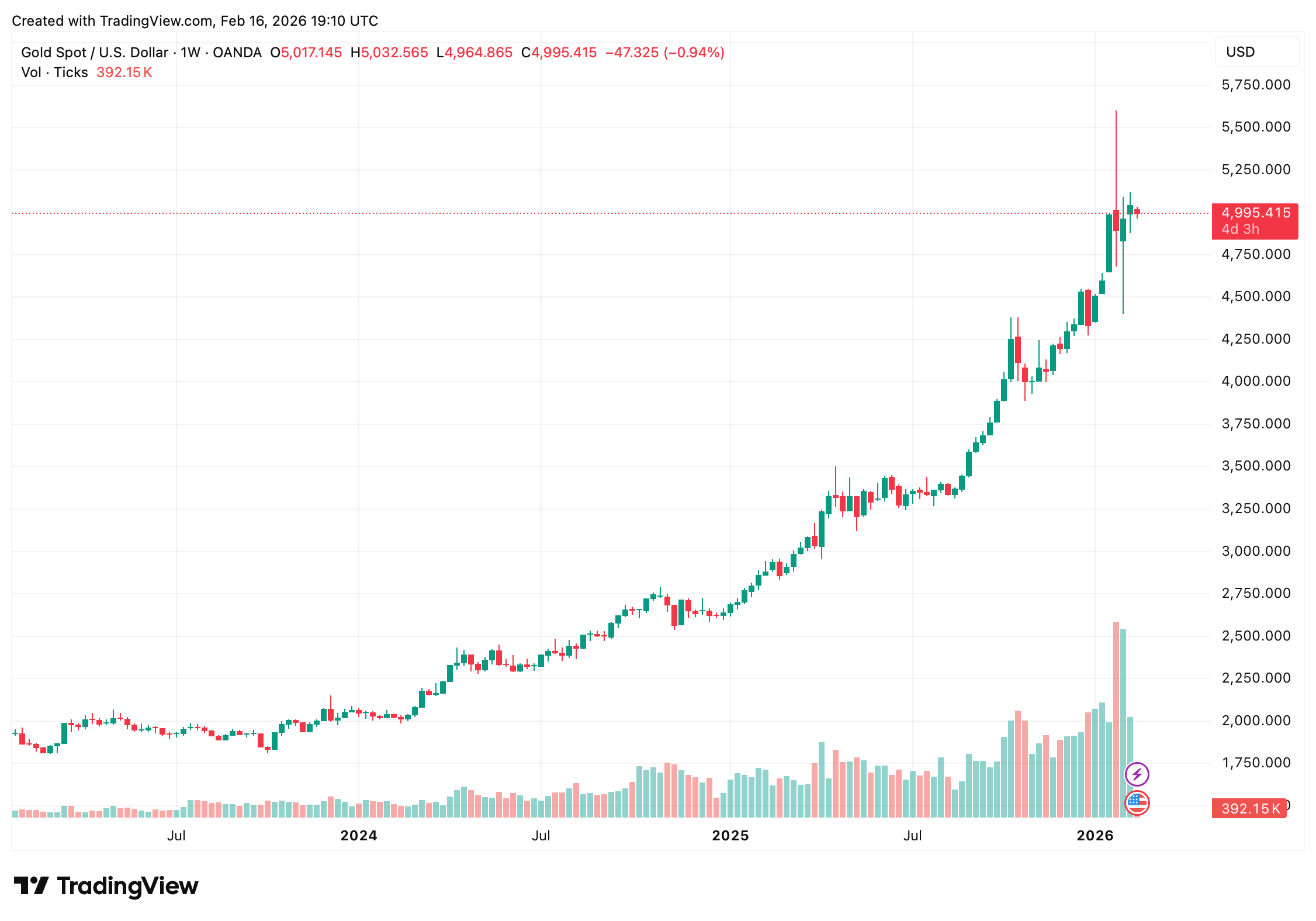

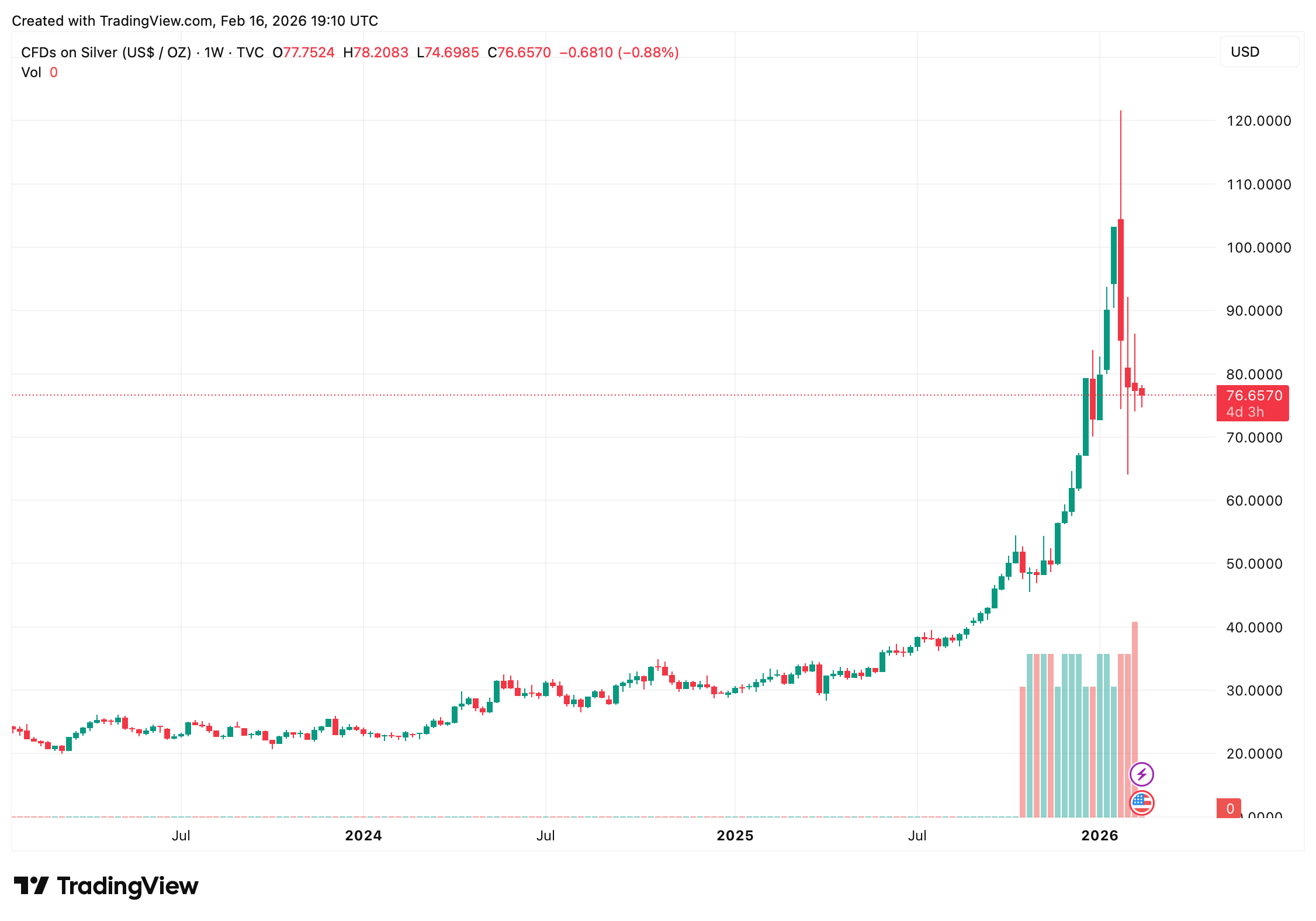

As of 2 p.m. EST on Feb. 16, spot gold traded near $4,993 per ounce, down about 1% on the day, while silver fell 1.6% to roughly $76.73 per ounce. The pullback followed a prior session rally and was attributed to profit-taking, a firmer U.S. dollar, and subdued trading volumes due to U.S. and China holidays.

Spot gold on Feb. 16, 2026.

Despite the day’s decline, gold remains up more than 6% on the month and over 72% year over year, though still below its January peak above $5,600. Silver, which has gained nearly 137% year over year, remains more volatile, reflecting its dual role as both an investment and industrial metal.

Sucden said gold’s rally has increasingly become a broader reflection of macro and policy uncertainty. “ Gold has become a broader expression of macro and policy distrust, even as near-term price action is dominated by speculative flows,” the report noted.

Spot silver on Feb. 16, 2026.

The analysts added that strong investment demand continues to provide downside cushioning, even as positioning-driven volatility increases. In 2025, total gold demand exceeded 5,000 tonnes for the first time on record, supported by central-bank purchases and strong ETF inflows.

Market participants are now closely watching upcoming Federal Reserve communications, including FOMC minutes, GDP updates, and PCE inflation data, for clarity on the timing of potential rate cuts. Expectations for multiple 25-basis-point reductions this year remain embedded in futures pricing, though policy uncertainty continues to shape flows into precious metals.

Sucden said the late-January sell-off, which briefly drove gold toward $4,500, reset positioning after prices climbed above $5,400. The firm expects further two-sided trade through the remainder of the quarter, with pullbacks serving to recalibrate speculative exposure rather than signal a structural reversal.

While recession risks tied to labor-market softness and geopolitical tensions remain in focus, Sucden’s baseline view points to consolidation rather than a sustained breakdown. For now, gold’s role as both a momentum trade and a traditional safe-haven asset appears to be keeping prices anchored near the $5,000 threshold.

FAQ ❓

- Why did gold fall on Feb. 16, 2026?

Gold slipped about 1% to $4,993 amid profit-taking, a firmer dollar and low holiday liquidity. - What is Sucden Financial’s Q1 forecast for gold?

Sucden expects gold to consolidate around $5,000 per ounce through Q1 2026. - Is gold still in a bullish trend?

The report suggests consolidation within a supportive macro backdrop rather than a sustained reversal. - How is silver performing compared to gold?

Silver fell 1.6% on Feb. 16 and remains more volatile due to its industrial exposure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。