On the daily chart, bitcoin’s price remains well below the prior peak near $97,900 and continues to trade within a descending formation. Stabilization between $67,000 and $70,000 signals equilibrium, not reversal. Major support is defined at $60,000 to $62,000, with intermediate support at $66,500 to $68,000. Major resistance stands between $72,000 and $75,000, and only a decisive daily close above $75,000 would invalidate the current cautious bias.

BTC/USD 1-day chart via Bitstamp on Feb. 18, 2026.

On the 4-hour chart, bitcoin fluctuates within a defined range following the recovery from the $60,000 threshold. A sequence of descending peaks is emerging, compressing into lateral consolidation. Volume participation has diminished during upward attempts, indicating reduced conviction behind advances. Trade zones are clearly defined: support between $66,500 and $68,000 with structural risk below $65,800, and resistance between $72,000 and $73,000 with invalidation above $73,800. The prevailing approach in this environment remains mean-reversion until a breakout confirms otherwise.

BTC/USD 4-hour chart via Bitstamp on Feb. 18, 2026.

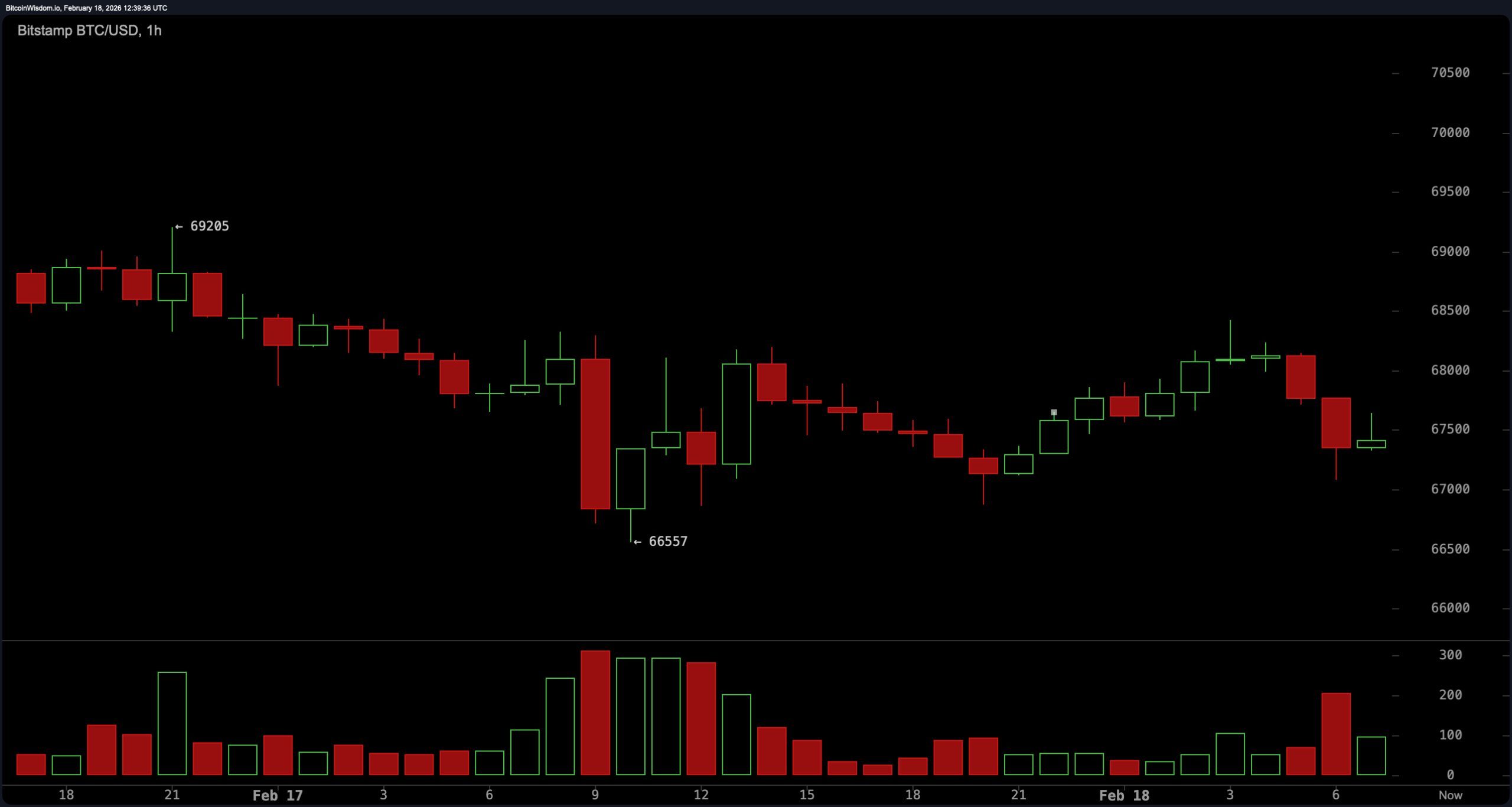

On the 1-hour chart, short-term structure shows descending peaks and marginal new lows, reinforcing intraday weakness. Momentum is subdued, with recent recoveries appearing corrective rather than impulsive. Price action continues to suggest that sellers maintain intraday control. Identified zones include a bounce area between $68,000 and $68,500 with defined risk below $67,700, and failed recovery resistance between $70,500 and $71,000 with risk above $71,400. In short, intraday attempts higher have yet to demonstrate sustained follow-through.

BTC/USD 1-hour chart via Bitstamp on Feb. 18, 2026.

Oscillators reflect neutrality with selective constructive signals. The relative strength index ( RSI) reads 36, neutral. The Stochastic prints 48, neutral. The commodity channel index (CCI) registers a negative 47, neutral. The average directional index (ADX) stands at 57, also categorized as neutral within the report’s framework.

The Awesome oscillator shows negative 11,127, neutral. Momentum at negative 453 and the moving average convergence divergence ( MACD) level at negative 4,643 are the only indicators classified constructively. The takeaway: internal momentum is attempting stabilization, but broad confirmation remains absent.

Moving averages remain overwhelmingly positioned above the current price, reinforcing structural overhead pressure. The exponential moving average (EMA) appears at $69,519 for the EMA (10), while the simple moving average (SMA) prints $68,739 for the SMA (10). Beyond the short-term cluster, the EMA (20) stands at $72,810 and the SMA (20) at $72,074, both elevated above spot. The EMA (30) at $75,861, SMA (30) at $77,763, EMA (50) at $80,180, SMA (50) at $83,491, EMA (100) at $87,067, SMA (100) at $86,987, EMA (200) at $93,608 and SMA (200) at $100,105 all remain positioned above price. The hierarchy is clear: longer-term trend resistance remains firmly intact.

Until participation expands and structural levels resolve decisively, this remains a technically defined consolidation — and consolidation, as seasoned market participants know, rarely lasts forever.

Bull Verdict:

A decisive 4-hour close above $72,500, accompanied by increasing participation, would signal structural strength returning to the market. A confirmed daily close above $75,000 would invalidate the broader cautious bias and suggest that consolidation has resolved upward, shifting the technical posture from compression to expansion.

Bear Verdict:

A breach of the $66,000 level would expose bitcoin to renewed downside pressure, with potential rotation back toward the $60,000 to $62,000 corridor. Failure to reclaim overhead resistance while descending peaks persist across lower time frames would reinforce continuation within the prevailing corrective structure.

- What is bitcoin’s price on Feb. 18, 2026? Bitcoin is trading at $68,827.93, consolidating between key support and resistance levels.

- What are the key support and resistance levels for bitcoin right now? Major support sits at $60,000 to $62,000, while major resistance stands between $72,000 and $75,000.

- What do bitcoin’s technical indicators signal today? Most oscillators are neutral, while momentum (10) and moving average convergence divergence ( MACD) level (12, 26) show constructive signals.

- Is bitcoin in a breakout or consolidation phase? Bitcoin remains in a range-bound consolidation phase pending a decisive move above $72,500 or below $66,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。