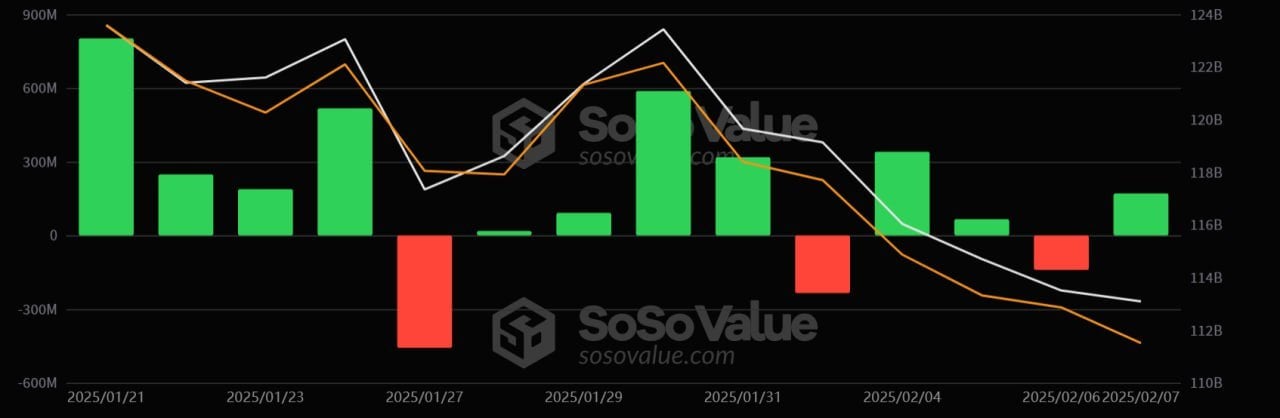

Bitcoin ETFs experienced a net inflow of $171 million on Friday, Feb. 7, to close the week on a high after a mixed trading week. In contrast, ether ETFs saw no net inflows or outflows, halting their six-day consecutive inflow streak.

Ark and 21Shares’ ARKB led the bitcoin ETF inflows, bringing in $59.04 million, increasing its total net assets to $4.99 billion. Fidelity’s FBTC followed with a $52.47 million inflow, bringing its net assets to $20.32 billion.

Other contributors to the inflow included Blackrock’s IBIT with $21.87 million, Vaneck’s HODL with $21.76 million, Bitwise’s BITB with $10.47 million, and Franklin’s EZBC with $5.57 million.

This ended a mixed trading week for bitcoin ETFs with three days of inflows and two days of outflows.

Despite the pause in inflows, ether ETFs have demonstrated strong performance over the past week. Blackrock’s ETHA maintains net assets of $3.56 billion, while Grayscale’s ETHE and Fidelity’s FETH hold $3.43 billion and $1.19 billion, respectively.

The stabilization in ether ETF flows may indicate a period of consolidation following a sustained period of growth.

As of Feb. 7, cumulative net inflows for bitcoin ETFs total $40.7 billion, while ether ETFs have accumulated $3.18 billion in net inflows during the same period.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。