I. Summary of Core Views

Challenges to the Credibility of Fiat Currencies: The core value of fiat currencies relies on a credibility system. Currently, the United States faces cracks in its commitment to maintain low inflation due to high public debt, rising bond yields, and uncontrolled deficit spending. From a macro perspective, the strategy for managing the debt burden in the U.S. is likely to trigger moderate to high inflation; if holders of dollar assets form this expectation, they will turn to alternative stores of value.

The Value Storage Potential of Crypto Assets: Cryptocurrencies such as Bitcoin and Ethereum have the potential to become alternative stores of value, essentially serving as monetary assets based on innovative technology. As a vehicle for value storage, their core advantage lies in programmatic transparent supply mechanisms and autonomy free from individual and institutional control, similar to physical gold, whose utility partly stems from its fixed attributes and independence from political systems.

Driving Logic Behind Crypto Asset Demand: If public debt continues to expand disorderly, the government's commitment to maintaining low inflation will lose credibility, intensifying market skepticism about the value storage function of fiat currencies. In this environment, macro demand for crypto assets is expected to continue rising; conversely, if policymakers take effective measures to solidify the long-term credibility of fiat currencies, macro demand for crypto assets may decline.

Core Value of Blockchain Technology: Investing in crypto assets is essentially an investment in blockchain technology, which builds a public transaction database network based on open-source software, reshaping the internet circulation model of monetary and asset goods. Grayscale believes that blockchain technology will have a revolutionary impact on digital commerce, payment systems, and capital market infrastructure, and its value extends beyond enhancing the efficiency of financial intermediaries to providing new tools for avoiding risks associated with traditional fiat money. Understanding blockchain technology requires knowledge of computer science and cryptography, while recognizing the value of crypto assets necessitates an understanding of the characteristics of fiat currency systems and macroeconomic imbalances.

II. Fiat Currency: The Underlying Logic of Trust and Credibility

(1) The Operational Basis of the Fiat Currency System

Currently, mainstream economies worldwide adopt a fiat currency system, where the currency forms (paper and digital) have no intrinsic value but are anchored in a systemic framework. To ensure the effective operation of the system, expectations for currency supply must be stable—without a commitment to supply constraints, fiat currency will lose its circulation foundation. Therefore, the government must commit to controlling the scale of currency supply, while the public assesses the credibility of that commitment based on their own judgments, essentially forming a trust-driven system.

(2) Historical Experience and Institutional Improvement

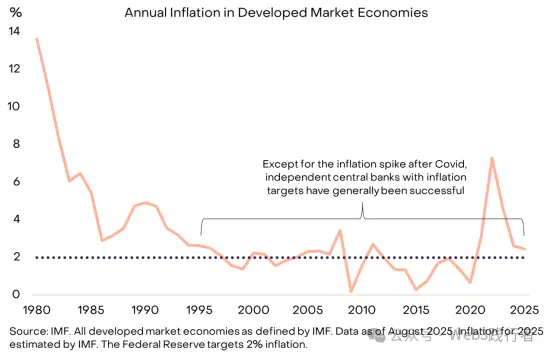

Historically, governments have frequently overissued currency (leading to inflation) due to short-term policy needs, violating trust and causing the market to naturally doubt the commitment to supply constraints of fiat currencies. To enhance the credibility of commitments, countries generally construct institutional frameworks, with the current mainstream model delegating currency supply management responsibilities to independent central banks, which explicitly set inflation targets. Since the mid-1990s, this model has become the global mainstream, achieving significant results in controlling inflation.

Figure 1: The Supporting Role of Inflation Targets and Central Bank Independence in Building Trust

(Note: Data source is the IMF, covering all developed market economies as defined by the IMF. As of August 2025, the 2025 inflation data is an IMF estimate; the Federal Reserve's inflation target is 2%. Except for the short-term spike in inflation post-COVID-19, independent central banks with inflation targets have generally achieved low inflation management.)

III. Real Cases of Fiat Currency Failure

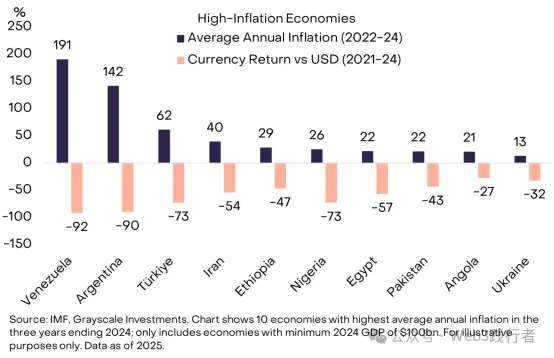

When the credibility of fiat currency is high, market attention to its value storage function is low, which is the ideal state for policymakers. For groups in a low-inflation stable environment, it may be difficult to understand the necessity of "holding currency that cannot be used for daily payments or debt repayment," but in many economies worldwide, the demand for quality currency is extremely urgent. In Venezuela and Argentina, for example, citizens convert part of their assets into foreign currencies or cryptocurrencies, with the core demand being to obtain reliable stores of value.

Figure 2: Cases of Currency Supply Management Failure in Some Countries

(Note: Data source is the IMF and Grayscale Investments, covering the 10 economies with the highest average inflation rates from 2022 to 2024, with a GDP of no less than $100 billion in 2024; the chart shows the average annual inflation rates from 2022 to 2024 and the currency exchange rate changes against the dollar from 2021 to 2024.)

The total population of these 10 high-inflation economies is about 1 billion, and cryptocurrencies have become an important "currency lifeboat" for them, including not only mainstream cryptocurrencies like Bitcoin but also blockchain assets pegged to the dollar (such as Tether (USDT) and other stablecoins). The widespread use of stablecoins is essentially a new form of dollarization—shifting from domestic fiat currency to the dollar, a phenomenon that has existed in emerging markets for decades.

IV. The Global Dominance of the Dollar and Potential Risks

(1) The International Monetary Dominance of the Dollar

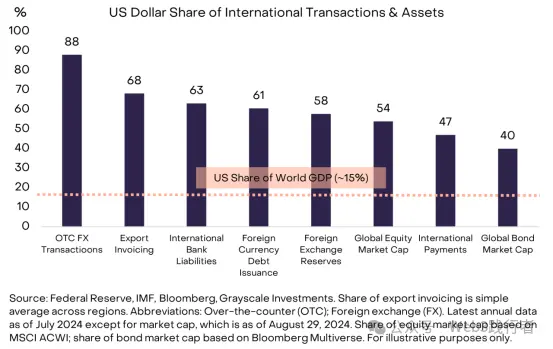

The dollar possesses both the attributes of a domestic currency in the U.S. and a core global international currency. Any risks regarding the stability of the dollar have global implications. According to estimates by the Federal Reserve, the dollar accounts for approximately 60%-70% of international currency usage across various indicators, far exceeding the euro (20%-25%) and the yuan (less than 5%).

Figure 3: The Global International Monetary Dominance of the Dollar

(Note: Data source is the Federal Reserve, IMF, Bloomberg, and Grayscale Investments; the export pricing share is a simple average across regions. Data on OTC FX trading, international bank payments, foreign exchange reserves, external currency debt, foreign asset liabilities, global stock market value (based on the MSCI ACWI index), and global bond market value (based on the Bloomberg Multiverse index) is as of July 2024, with market value data as of August 29, 2024.)

(2) The Unique Potential Risks of the Dollar

It should be noted that the U.S. is currently not experiencing the currency management issues seen in emerging economies as shown in Figure 2, but as the core global currency, the stability risk of the dollar affects all asset holders (not limited to U.S. residents). Compared to currencies like the Argentine peso and the Venezuelan bolívar, the risk of the dollar is the core factor driving large-scale capital to seek alternative assets like gold and cryptocurrencies. Although the challenges to U.S. monetary stability are not the most severe globally, their impact is the highest.

V. Debt Issues: The Core Root of Dollar Credibility Risks

The value of fiat currency relies on commitments, trust, and credibility. Currently, the dollar is facing a credibility gap—the credibility of the U.S. government's commitment to maintaining long-term low inflation is continuously declining, primarily due to unsustainable federal government deficits and debt levels.

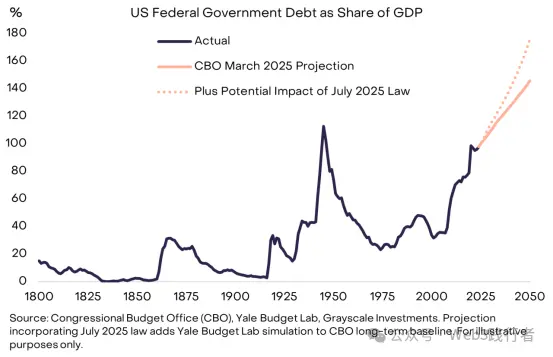

(1) The Evolution of U.S. Debt Imbalance

This imbalance began with the 2008 financial crisis: in 2007, the U.S. deficit accounted for only 1% of GDP, and the debt stock accounted for 35% of GDP; however, after 2008, the federal government's annual deficit rose to about 6% of GDP. As of now, the U.S. national debt has reached $30 trillion, accounting for about 100% of GDP (close to the level at the end of World War II), and is expected to continue rising significantly.

Figure 4: The Unsustainable Expansion Trend of U.S. Public Debt

(Note: Data source is the Congressional Budget Office (CBO), Yale Budget Lab, and Grayscale Investments; the July 2025 legal potential impact forecast is based on CBO long-term baseline data combined with Yale Budget Lab simulation results.)

(2) The Structural Dilemma of the Deficit Issue

High deficits have become a common challenge faced by both parties in the U.S., and even when the unemployment rate is relatively low, the deficit issue persists. Currently, U.S. fiscal revenue can only cover mandatory spending (such as Social Security and Medicare) and interest payments. To achieve budget balance, politically sensitive policies such as tax increases or spending cuts would need to be implemented, which is extremely difficult.

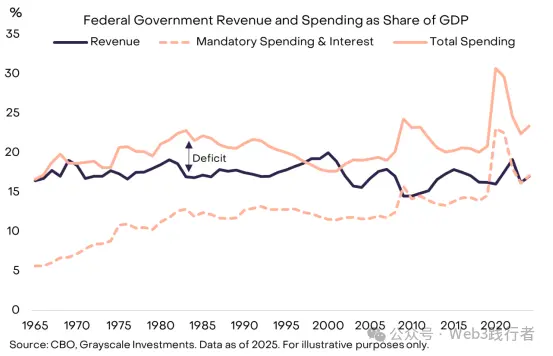

Figure 5: The Relationship Between U.S. Government Revenue and Expenditure as a Percentage of GDP

(Note: Data source is CBO and Grayscale Investments, as of 2025; in the chart, "deficit" represents the difference between total revenue and total expenditure, showing that current revenue can only cover mandatory spending and interest payments.)

VI. Interest Payments: The Constraint Bottleneck of Debt Expansion

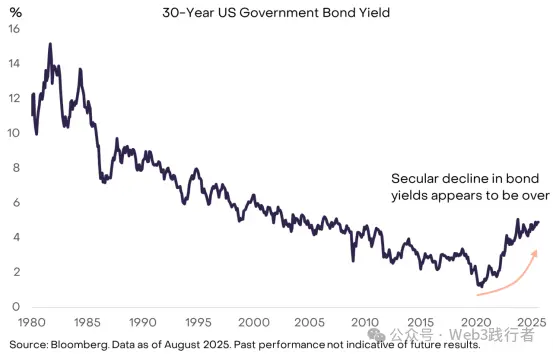

Economic theory cannot define the "safe scale of government debt," with the core measure being debt financing costs. If the U.S. government can still borrow at low interest rates, debt expansion may be sustainable without significantly impacting institutional credibility or financial markets—some economists have held a moderate view on debt growth in recent years based on the judgment of low financing costs. However, the decades-long downward trend in global bond yields has ended, and the constraints on debt expansion are beginning to emerge.

Figure 6: The Constraint Effect of Rising Bond Yields on Debt Expansion

(Note: Data source is Bloomberg, as of August 2025; past performance does not guarantee future results. The chart shows that the long-term downward trend in bond yields has ended, and rising debt financing costs will constrain debt expansion.)

(1) The Supply and Demand Driven Logic of Bond Yields

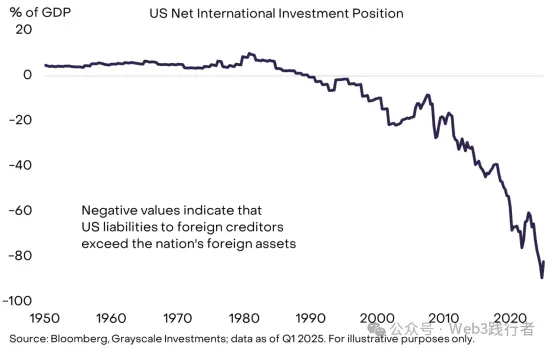

Like other asset prices, bond yields are determined by supply and demand. The U.S. government continues to increase debt supply, while in recent years, market demand for low-yield (high-price) U.S. debt has reached saturation. From the perspective of funding sources, the U.S. government relies on both domestic and overseas savers for financing, but domestic savings cannot meet all borrowing and investment needs, resulting in the U.S. having a large public debt stock while being a net debtor in international accounts.

Figure 7: U.S. Dependence on Overseas Savers for Financing

(Note: Data source is Bloomberg and Grayscale Investments, as of Q1 2025; negative values indicate that U.S. liabilities to overseas creditors exceed its overseas asset scale.)

(2) Multiple Factors Behind Declining Overseas Demand

In recent years, overseas market demand for U.S. government bonds at low interest rates has significantly decreased due to factors such as: a slowdown in official reserve accumulation in emerging markets and the end of Japan's deflationary cycle; additionally, geopolitical adjustments may also weaken the structural demand from overseas investors for U.S. Treasury bonds.

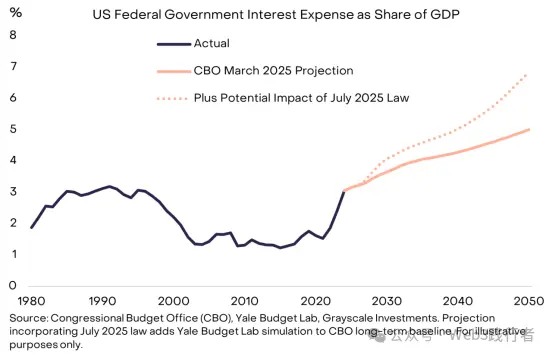

(3) The Pressure of Expanding Interest Payments

As the U.S. government refinances its debt at higher interest rates, the proportion of interest payments in total expenditures continues to rise. Over the past 15 years, low bond yields have masked the impact of debt stock expansion on interest payments, but this buffering effect has now disappeared, significantly increasing the urgency of the debt issue.

Figure 8: The Constraint Effect of Interest Payments on Debt Growth

(Note: Data source is CBO, Yale Budget Lab, and Grayscale Investments; the July 2025 legal potential impact forecast is based on CBO long-term baseline data combined with Yale Budget Lab simulation results.)

VII. The Formation Mechanism of the Debt "Snowball Effect"

To control the debt burden, policymakers need to achieve two main goals: (1) balance the primary deficit (the budget deficit excluding interest payments); (2) ensure that interest costs are lower than the nominal growth rate of the economy. Currently, the U.S. primary deficit accounts for about 3% of GDP; even if interest rates remain stable, the debt stock will continue to rise; the risk of the "snowball effect" (where interest rates exceed the nominal growth rate, leading to accelerated debt burden expansion) is continuously increasing.

(1) The Core Equation of Debt Burden

Under the premise of balancing the primary deficit:

If the average debt interest rate < nominal growth rate, the debt burden (public debt / GDP) will decrease;

If the average debt interest rate > nominal growth rate, the debt burden will increase.

(2) Scenario Simulation of Interest Rates and Growth

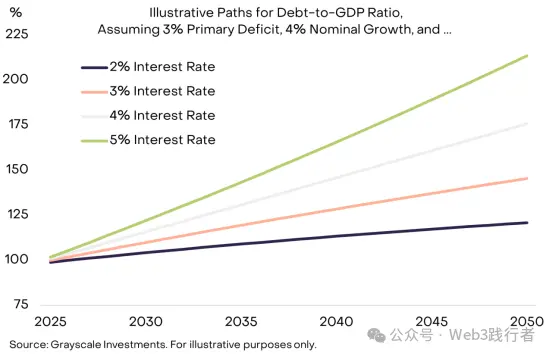

Assuming the primary deficit remains at 3% of GDP and the nominal GDP growth rate stabilizes at 4%, the speed of debt burden expansion varies significantly at different interest rate levels—higher interest rates lead to a more pronounced "snowball" effect on the debt burden.

Figure 9: The "Snowball" Effect of Debt Burden in a High-Interest Rate Environment

(Note: Data source is Grayscale Investments; the simulated scenario assumes a primary deficit of 3% of GDP and a nominal GDP growth rate of 4%, showing the changes in the debt/GDP ratio from 2025 to 2050 at different interest rate levels.)

(3) Structural Factors Behind Slowing Nominal Growth

With rising bond yields, the market generally predicts that the structural GDP growth rate in the U.S. will slow down: the Congressional Budget Office (CBO) estimates that the potential labor growth rate will decline from the current 1% per year to 0.3% per year by 2035. If the Federal Reserve can achieve a 2% inflation target (which currently has uncertainties), lower real growth will lead to a decline in the nominal growth rate, further accelerating the expansion of the debt stock.

VIII. Potential Outcomes of the U.S. Debt Issue

By definition, unsustainable trends will eventually end, and the disorderly expansion of U.S. federal government debt is no exception, but the specific manner of termination is uncertain. Investors need to assess the probabilities of various potential outcomes based on data, policy actions, and historical experience, with four non-mutually exclusive outcomes at the core.

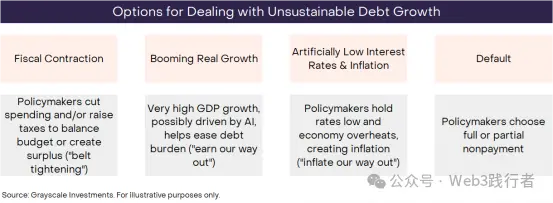

Figure 10: Four Paths to Address Unsustainable Debt Growth

(Note: Data source is Grayscale Investments; the four paths are: fiscal contraction (balancing the budget or achieving a surplus through spending cuts/tax increases, i.e., "tightening"), booming economic growth (driving high GDP growth through technologies like artificial intelligence, i.e., "increasing revenue"), artificially low interest rates and inflation (maintaining low interest rates to overheat the economy and diluting debt through inflation, i.e., "inflation resolution"), and default (failure to meet all or part of the debt obligations).)

(1) Probability and Feasibility Analysis of Each Outcome

Default: Extremely low probability. U.S. debt is denominated in dollars, and the cost of diluting debt through inflation is far lower than defaulting on debt, providing no incentive for the government to choose default.

Fiscal Contraction: May become part of the solution in the future, but short-term feasibility is low. The recent passage of the "Big and Beautiful Act" by Congress ensures that fiscal policy will maintain high deficits over the next decade, making it unlikely to reduce deficits through tax increases or spending cuts.

Booming Economic Growth: Ideal but lacks realism. Current U.S. economic growth is sluggish, and the potential growth rate is expected to continue slowing; although artificial intelligence (AI) technology may drive a surge in productivity, it has not yet formed substantial growth support.

Artificially Low Interest Rates & Inflation: The path with the highest probability. If the U.S. maintains interest rates around 3%, 2% real GDP growth, and 4% inflation, it could theoretically stabilize the debt stock without reducing the primary deficit. Although the Federal Reserve has independent monetary policy decision-making power, its independence is facing scrutiny; historical experience shows that when fiscal pressures increase, monetary policy often yields to fiscal policy, making debt resolution through inflation the "path of least resistance."

Based on the above analysis, Grayscale judges that the long-term strategy for managing the U.S. debt burden is likely to lead to inflation rates consistently exceeding the Federal Reserve's 2% target.

IX. The Macroeconomic Hedging Value of Cryptocurrencies Returns

(1) The Demand Logic of Cryptocurrencies

Due to the large debt stock, rising interest rates, and lack of effective solutions, the credibility of the U.S. government's commitment to controlling money supply and inflation has declined. The value of fiat currency essentially relies on the government's credible commitment to "not overissue currency"; if this commitment is questioned, holders of dollar assets will be forced to reassess their investment portfolio risks and seek alternative stores of value—cryptocurrencies are one of the potential options.

(2) Classification and Value Positioning of Crypto Assets

Cryptocurrencies are digital commodities based on blockchain technology, with a wide variety and significant differences in use cases, most of which are unrelated to the "store of value" function (such as public chain applications used for payments, gaming, artificial intelligence, etc.). Grayscale, in collaboration with FTSE/Russell, has developed a "Crypto Sectors" framework to classify crypto assets based on core use cases.

Among numerous crypto assets, only a few possess feasible store of value attributes, needing to meet three major conditions: broad market adoption, high decentralization, and limited supply growth. Currently, the highest market capitalization cryptocurrencies, Bitcoin and Ethereum, meet these standards, with their value not stemming from "asset backing," but relying on two core advantages: (1) supporting peer-to-peer digital payments without censorship risk; (2) possessing a credible commitment to "not overissue."

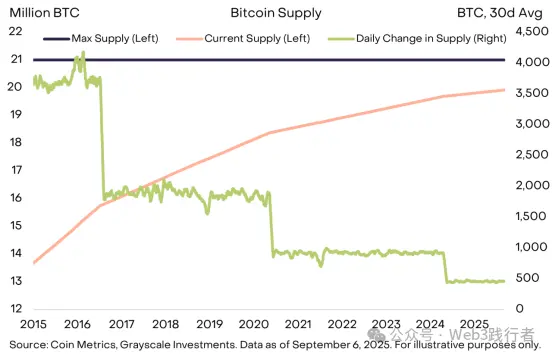

(3) Case Study of Bitcoin's Supply Mechanism

Taking Bitcoin as an example, its supply cap is fixed at 21 million coins, with a current daily supply of about 450 coins, and the new supply growth rate is halved every four years. This mechanism is explicitly written into the open-source code, and any modifications require consensus support from the Bitcoin community, remaining unaffected by external entities such as governments or institutions (e.g., it does not need to overissue to repay debts). The core characteristic of "transparent, predictable, and ultimately limited supply" has driven Bitcoin's market value to exceed $2 trillion.

Figure 11: Bitcoin's Predictable Transparent Supply Mechanism

(Note: Data source is Coin Metrics and Grayscale Investments, as of September 6, 2025; the left axis of the chart shows Bitcoin's current supply and maximum supply (in millions), while the right axis shows the daily average supply change (in coins).)

(4) Common Value of Cryptocurrencies and Gold

Similar to gold, Bitcoin does not generate interest and is not widely used for daily payments, but its core utility lies in its "passive attribute"—the supply scale is not influenced by government debt repayment needs, and no institution can control its supply, which is its core hedging value when the credibility of fiat currency is shaken.

Currently, investors need to allocate assets in an environment of "macroeconomic imbalance (especially the disorderly expansion of public debt)." The core purpose of holding alternative currency assets such as cryptocurrencies is to provide a hedging tool against the risk of fiat currency devaluation for the investment portfolio. As long as this risk continues to escalate, the value of cryptocurrencies with hedging properties is expected to further increase.

X. Potential Reversal Factors for Cryptocurrency Demand

Investing in cryptocurrencies carries multiple risks. From a macro perspective, the core risk to their long-term value lies in the government's ability to reshape the credibility of fiat currency through effective policies. Specific measures may include stabilizing and reducing the government debt/GDP ratio, reaffirming support for central bank inflation targets, and strengthening central bank independence.

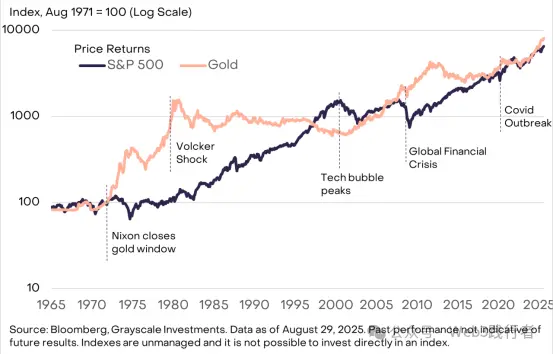

Fiat currency already possesses the attributes of a convenient medium of exchange. If the government can simultaneously ensure its effective store of value function, the market demand for alternative tools such as cryptocurrencies will significantly decline. For example, gold performed exceptionally well during the period of diminished institutional credibility in the U.S. in the 1970s, but its price performance remained weak after the Federal Reserve successfully controlled inflation in the 1980s and 1990s.

Figure 12: The Correlation Between Inflation and Gold Prices (1980s-1990s)

(Note: Data source is Bloomberg; the chart shows the trend of U.S. inflation rates and gold prices from the 1980s to the 1990s, indicating that gold performed poorly during the inflation decline cycle.)

Public chain technology provides innovative momentum for the digital finance sector. Currently, the highest market capitalization blockchain applications are digital currency systems with "differentiated characteristics," whose demand is highly correlated with macroeconomic imbalance factors such as high public debt. Grayscale believes that in the long run, the growth of the cryptocurrency asset class will be driven by two main factors: first, the hedging demand triggered by macroeconomic imbalances, and second, the market adoption of various innovative applications based on public chain technology.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。