Author: Jeff Dorman, Chief Investment Officer of Arca

Translation: Felix, PANews

With Bitcoin hitting new highs and cryptocurrencies sweeping Wall Street and Washington, now is the perfect time to explain cryptocurrency investment to those around you again. Most "industry experts," crypto KOLs, and mainstream media do a poor job of explaining this asset class to new investors, and the constant misinformation only discourages more people rather than excites them.

Most people are even unaware of the existence of the world of token investments (beyond Bitcoin and meme coins). However, now that ETH, SOL, BNB, HYPE, stablecoins, and Polymarket are appearing in the news daily, they are starting to pay attention. Investors do not care about the underlying technology, liberal ideals, or decentralization. They care about how to achieve growth and profit.

For nearly a decade, I have been communicating with new cryptocurrency investors, and the explanation below resonates most with them because it articulates cryptocurrency investment in a way that investors can understand. Even those with preconceived negative views will grasp the industry after reading the following explanation.

So, if you want to try explaining blockchain to the public again, here is the simplest (and fastest) explanation I have found.

Beginner's Guide: Understand Blockchain in 5 Minutes

- The internet allows you to communicate instantly, borderlessly, and at no cost.

- Blockchain allows you to send assets instantly, borderlessly, and at no cost.

The first asset sent via blockchain was a completely fictional cryptocurrency called Bitcoin (BTC), which was sent through the newly created Bitcoin blockchain. Bitcoin is the biggest outlier/smoke screen in investment history. Its success is miraculous and unique, and should not be studied or applied to anything else. While Bitcoin assets and the Bitcoin blockchain were the first pioneers, it does not mean it is the only blockchain or asset that can be sent in a similar way. Bitcoin demonstrated a single use case of this technology, but it is not the only use case. Similarly, SPY is the first exchange-traded fund (ETF) in the U.S., but many other products can be packaged in ETFs since then.

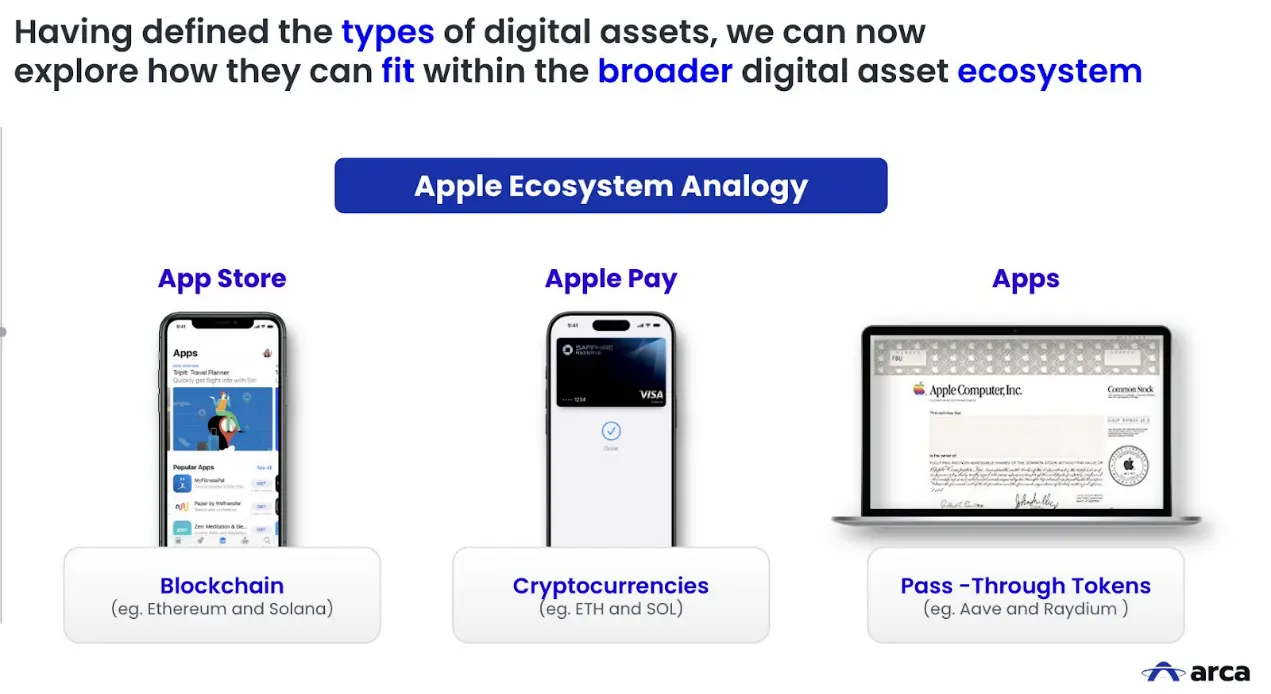

Other blockchains (like smart contract platforms such as Solana and Ethereum) are more flexible than the Bitcoin blockchain, allowing for the creation and transfer of other assets. In fact, you can think of smart contract platform protocols as an app store that anyone can develop. Just as your app store allows you to access banking, gaming, mapping, collectibles, and social applications in iOS or Android operating systems, your smart contract platform protocol allows you to access banking (DeFi, stablecoins), gaming (Polymarket), collectibles (NFTs), mapping (Hivemapper), and social (Pump.Fun) blockchain applications.

- Crypto applications = Companies

- Smart contract protocols = App stores

Blockchains have their own tokens, just as Apple and Google have their own stocks, but many applications within these platforms also have their own tokens, which, if designed with proper token economics, can become a quasi-equity form for that business. This is no different from many iOS or Android applications having their own stocks in publicly listed companies.

The applications on your phone create value for Apple or Google, just as these crypto applications create value for the smart contract protocol blockchains they are based on. When applications are used (generate revenue), both the application companies and the stocks (or tokens) of the operating system/blockchain appreciate. Of course, since any asset can be created out of thin air and transmitted via blockchain, there will also be some "junk" assets (like meme coins) or assets loosely associated with companies but lacking value drivers for the tokens themselves (like XRP). Tokens come in various forms, largely depending on who issues them and how the token economics are constructed.

But don’t most crypto startups fail? Of course, just like the "internet bubble" period gave rise to a variety of startups, most native crypto blockchains and applications will also fail. However, the current blockchain development is about to say goodbye to the “.-crypto” phase (where all investable tokens are issued by some emerging cryptocurrency companies) and enter a new phase where long-established century-old companies will also adopt blockchain technology and issue tokens. No one today would call a company an "internet company (.com)" because every company is an "internet company (.com)." Every business operates on the internet. Walmart, JPMorgan, and Domino's Pizza are now internet companies, even though they existed before the internet; they did not emerge because of the internet but grew with it. The crypto space will soon be the same.

About 99% of the world's assets (stocks, bonds, and real estate) have yet to be transferred via blockchain. But these assets are likely to be tokenized and transferred via blockchain in the near future, replacing a large number of meaningless crypto assets that currently exist.

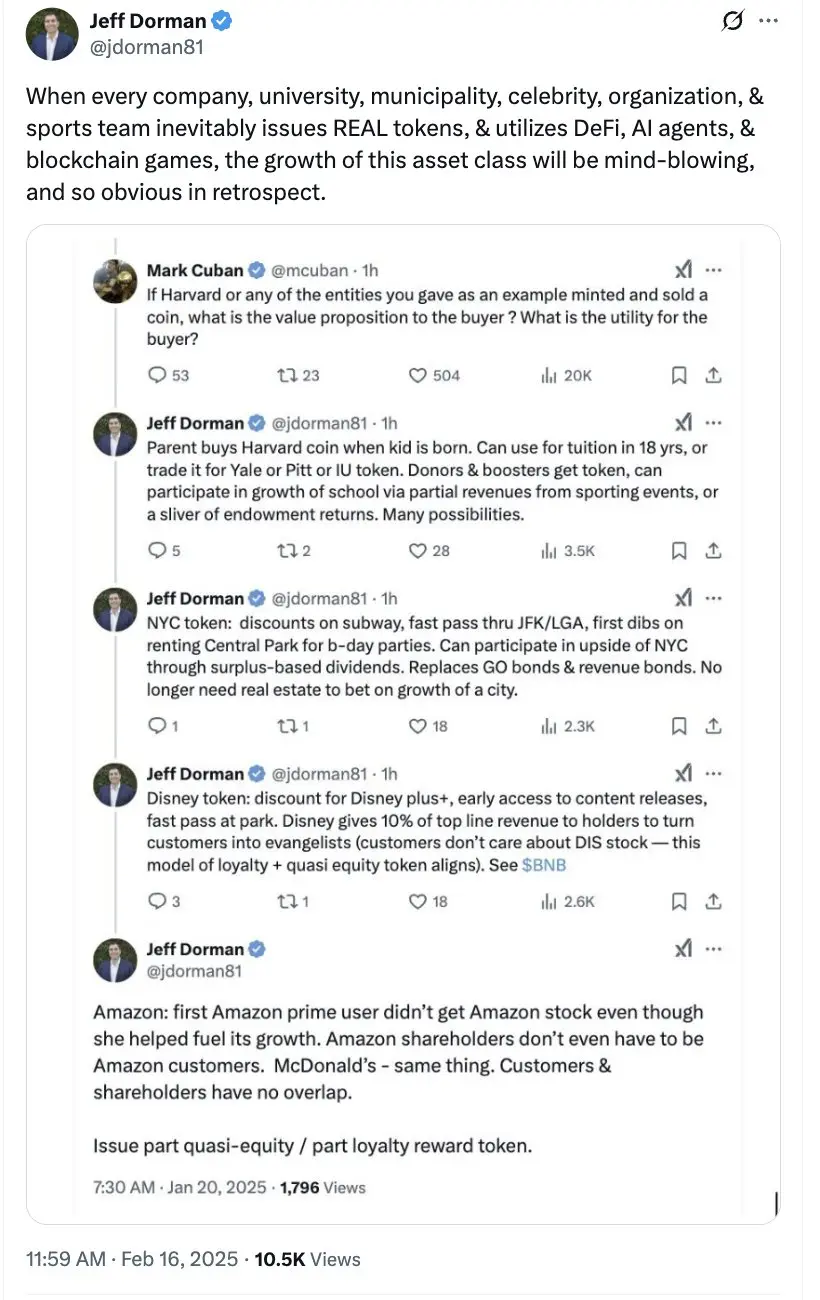

Today, a company can both tokenize existing assets (like stocks and bonds) and issue new tokens as hybrid tokens. In the future, every company, university, municipality, celebrity, organization, and sports team will inevitably issue their own tokens, which can become a third asset in their capital structure.

- Stocks = Claims on cash flow

- Bonds = Claims on assets

- Tokens = Claims on revenue growth and a hybrid claim of loyalty reward cards used within the company ecosystem

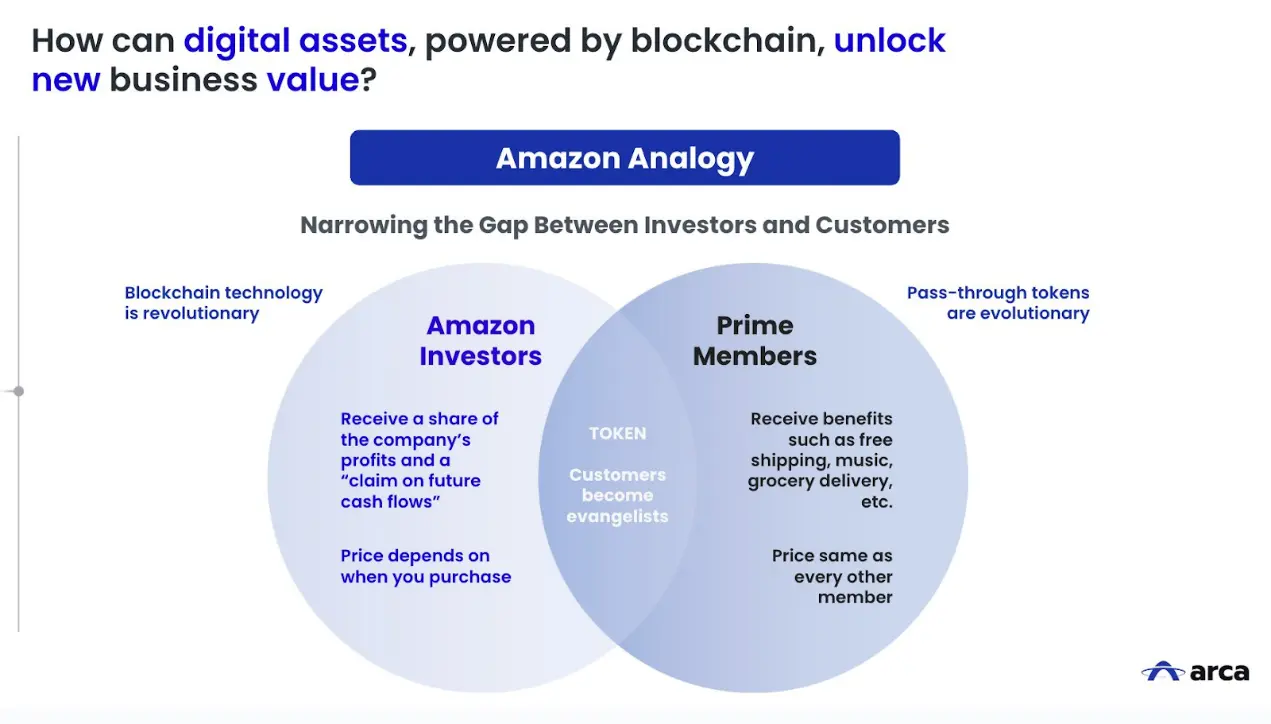

These tokens are often the most powerful capital formation and customer engagement mechanisms created to date, as they unite all customers and stakeholders, making them promoters and loyal users. Tokens are both a way to benefit from a company's success and a medium of exchange for company services. This is fundamentally different from today's corporate structures, where investors and customers often stand in opposition to each other.

- McDonald's shareholders are not customers, and McDonald's customers are not shareholders.

- Uber drivers and passengers cannot benefit from Uber's success.

- Delta Air Lines SkyMiles members do not care about Delta's profits or growth, so they do not help Delta grow; Delta shareholders also do not care about the customer experience.

- Content creators do not benefit from the success of Twitter and Instagram.

- Chefs and delivery workers do not benefit from the success of DoorDash.

Tokens can immediately change this status quo. Take Binance or Hyperliquid as examples—customers of these exchanges are early token holders (through trading or airdrops). You can use HYPE and BNB tokens as collateral to trade on the exchange and profit from their growth through token buybacks. Thus, customers effectively become quasi-equity holders, benefiting from the company's financial success, which drives increased usage of the company's products, higher revenues, and subsequently drives up token prices. But as customers of their products, you can also benefit from holding HYPE or BNB tokens (through discounts, collateral, and paying Gas fees on their blockchain). This is a perfect hybrid model that immediately aligns all stakeholders and transforms customers into loyal users and promoters.

Thus, one can imagine a world where your investments and payments become the same asset. For example, buying a real Tesla with TSLA stock or paying for your Amazon shopping with AMZN stock.

This builds an extremely simple investment thesis for the next five years, eliminating much of the "nonsense" in crypto investment.

Investment Thesis

Blockchain technology has proven to be extremely efficient in asset transfer and trading, but most of the world's popular assets (stocks, bonds, real estate) are currently not tradable on the blockchain (mainly due to regulatory and workflow issues). As the barriers between crypto-native assets and traditional financial assets are broken down, more and more tokenized assets will be issued, transferred, and traded on-chain.

The beneficiaries will be specific smart contract platform protocol blockchains (L1) that support this growth and trading, DeFi applications built on these chains, stablecoins and stablecoin providers on these chains, and a select few applications that help you navigate on-chain in niche areas like gaming and artificial intelligence. However, it is difficult to determine which chains will win, as there are currently almost no assets on-chain globally. If large asset issuers like the U.S. government, Walmart, JPMorgan, and Apple suddenly decide to issue assets on a particular L1, that L1 would become the most important blockchain overnight.

Even now, the outside world has yet to witness the true potential of blockchain, as most global assets have not yet connected to the blockchain system. Everything that has happened in the blockchain space so far has largely been experimental, a trial run before the arrival of real giants (stocks, bonds, real estate, and new tokens issued by companies, universities, municipalities, sports teams, etc.).

Therefore, while crypto traders often indulge in short-term trading, chasing flashy, worthless tokens (like meme coins), the long-term investment thesis revolves around a mundane, globally accepted, and permissionless financial system that makes investing, banking, and consumption more efficient and transparent.

Related Articles: Halving Narrative and Liquidity Resonance, Will Q4 2025 Become the Ultimate Bull Market Celebration?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。