On December 30, 2024, the EU's "Regulation on Markets in Crypto-Assets" (hereinafter referred to as the "MiCA Regulation") officially came into effect, marking a new era for the compliance framework of crypto assets in Europe. In our previous series of articles, we have introduced key definitions of the MiCA Regulation, and interested readers can click on “Interpreting the EU MiCA Regulation: How to Comply with Virtual Currency Custody Services? | Mankun Web3 Legal” for more information. For many Web3 practitioners, especially those interested in the European market, how should they respond after the MiCA Regulation comes into effect? Today, Mankun Lawyers will explore this topic.

Who Must Comply with MiCA?

Article 2 of the MiCA Regulation defines its scope of application, which includes natural persons, legal entities, and other enterprises engaged in the following activities within the EU:

1. Issuance of Crypto Assets (Issuance): Creating new crypto assets.

2. Offering Crypto Assets to the Public (Offer to the Public): Making crypto assets available for public subscription.

3. Admission to Trading of Crypto Assets (Admission to Trading): Allowing crypto assets to be listed and traded on trading platforms (such as crypto exchanges).

4. Providing Services Related to Crypto Assets (Provide Services Related to Crypto-Assets): Involves various services related to crypto assets, including custody, trading facilitation, transaction execution, wallet management, etc.

The MiCA Regulation essentially covers all activities related to crypto assets. In short, any entity wishing to engage in crypto asset-related activities within the EU may fall under the regulation of the MiCA Regulation. We have previously outlined the scope of ten different crypto asset-related services, and readers can refer to “Web3 Interpretation | A Comprehensive Explanation of Why Web3 Companies Need the EU MiCA and Dubai VARA Licenses” for more details.

It is worth noting that regardless of where a crypto asset service provider (CASP) is registered or established, if their services involve serving European interests, they may fall under the regulation of MiCA.

Who Enforces the MiCA Regulation?

According to EU regulations, the enforcement of MiCA is divided into EU-level and member state-level authorities:

1. EU Level

There are two main regulatory bodies responsible for enforcing MiCA: the European Securities and Markets Authority (ESMA) and the European Banking Authority (EBA).

ESMA is the regulatory authority for the EU financial markets. Its role is similar to that of the China Securities Regulatory Commission. According to the Financial Times, "ESMA aims to expand its powers to regulate major securities exchanges and other key parts of the EU financial infrastructure, striving to become the European version of the U.S. Securities and Exchange Commission (SEC)." In the foreseeable future, ESMA will play a more significant role in the European financial market.

EBA is the regulatory authority for the EU banking sector. Its role is similar to that of the former China Banking Regulatory Commission. It establishes unified regulatory standards for the European banking industry.

The differences between ESMA and EBA are as follows:

· Different Regulatory Areas: EBA is primarily responsible for banking regulation, while ESMA oversees securities market regulation.

· Different Functional Focus: EBA focuses more on bank operations and depositor protection, while ESMA emphasizes investor protection and orderly market operations.

2. Member State Level

Previously, each EU member state independently designated its national authority to formulate regulatory policies for crypto assets and implement penalties within its jurisdiction. The names and scopes of authority of regulatory agencies in each EU member state vary. For example, Poland's financial regulatory authority is called the Polish Financial Supervision Authority (PFSA), while Malta has the Malta Financial Services Authority (MFSA).

The MiCA Regulation encourages cooperation between regulatory authorities of EU member states and EU institutions to improve the efficiency of enforcement and closely monitor potential violations in the market. In the foreseeable future, the regulatory framework for crypto assets will become more unified and refined within the EU. So, what are the core points of the MiCA Regulation for Web3 practitioners planning or already conducting business in the EU?

Core Points of the MiCA Regulation

1. Unified Framework, Comprehensive Compliance

If licenses are likened to passports, the direct benefit brought by the MiCA Regulation is that Web3 practitioners can travel across Europe with a "Schengen visa."

Previously, the compliance systems for Web3 in EU countries operated independently, lacking a unified regulatory framework. Now, MiCA has established a unified framework and standards for all EU member states. In the foreseeable future, whether it is the issuers, operators of virtual currencies, or crypto asset service providers, there will be reduced duplication in applications and improved compliance efficiency.

Compared to the previously differing regulatory frameworks of various countries, the provisions of the MiCA Regulation are more detailed and impose higher compliance requirements on Web3 businesses in Europe. For crypto asset service providers, MiCA establishes comprehensive rules covering all aspects from governance and capital requirements to custody and management. For instance, to obtain authorization, a CASP must have at least one director residing in the EU and maintain a registered office within the EU. In terms of marketing, there is a particular emphasis on regulating false statements, complying with rules for marketing communications and information activities, and conducting activities fairly; otherwise, regulatory authorities will issue corresponding warnings and penalties.

2. Sufficient Capital, Stable Value

To prevent systemic financial risks in the crypto market, MiCA has established special requirements for the issuance of stablecoins, stipulating that issuers must hold sufficient reserve assets to support their value stability, ensuring the stability of stablecoin values.

Therefore, stablecoin issuers must maintain adequate capital and liquidity reserves to respond to potential market fluctuations and redemption demands; especially for stablecoin issuers, they must ensure sufficient reserves to support the tokens they issue.

3. Combating Crime, Regulating the Market

The MiCA Regulation emphasizes the prevention of potential illegal activities in the crypto market, such as insider trading and market manipulation. It also requires all crypto asset service providers to implement anti-money laundering (AML) and counter-terrorism financing (CTF) measures, including strict KYC procedures and transaction monitoring, to prevent criminals from engaging in illegal activities through the crypto market. Crypto asset service providers must implement strict customer due diligence (CDD) procedures, monitor suspicious transactions, and report to relevant authorities to prevent money laundering and terrorist financing activities.

Penalties for Violating the MiCA Regulation

For Web3 practitioners, the most concerning issue is whether projects can operate normally. The pursuit of compliance is driven by the fact that the cost of non-compliance is high. After summarizing, Mankun Lawyers categorize the penalties under the MiCA Regulation into the following four types:

1. Warnings

Warnings serve as a reminder of the importance of compliance. The EBA will formally issue a warning indicating that the issuer has failed to fulfill one or more obligations stipulated by the MiCA Regulation.

· Nature: A warning is a formal administrative notice, serving as an official record indicating that the regulatory authority has noted issues with the issuer.

· Applicable Situations: Typically used when the violation is relatively minor or occurs for the first time, and the issuer shows a willingness to cooperate in making corrections. For example, this may involve issues such as delayed information disclosure, minor non-compliance in marketing communications, or small defects in internal management processes.

· Impact: A warning itself may not directly lead to business interruption or financial loss, but it can negatively affect the issuer's reputation and may result in stricter regulatory scrutiny. If the issuer fails to take timely corrective measures after receiving a warning, they may face more severe penalties.

· Example: ESMA warns an issuer that their published white paper lacks certain necessary disclosures and requires them to supplement the information within a specified timeframe.

2. Fines and Daily Penalties

Fines and daily penalties are both economic sanctions, and their differences are as follows:

In short, fines (Fine) are retrospective, punishing past violations, while daily penalties (Periodic Penalty Payments) are prospective, imposing daily fines to deter ongoing or future non-compliance until obligations are fulfilled.

3. Suspension or Prohibition of Activities

Suspension or prohibition of activities is a more severe penalty than a warning and will directly impact the issuer's business operations.

· Suspending Activities: Refers to temporarily prohibiting the issuer from engaging in one or more specific activities for a certain period. For example, suspending public offerings, halting trading on platforms, or pausing marketing activities.

Duration: Typically has a specified duration, such as the "maximum of 30 consecutive working days" mentioned in Article 130.

Applicable Situations: Usually applied when the violation is more serious, or the issuer fails to effectively correct the issues pointed out in previous warnings. For example, this may involve misleading advertising, failure to manage reserve assets as required, or severe deficiencies in internal controls.

Impact: Suspending activities can lead to business interruptions, revenue losses, customer attrition, and severely damage the issuer's reputation.

· Prohibiting Activities: Refers to permanently prohibiting the issuer from engaging in one or more specific activities. For example, permanently banning the public issuance of a certain token or permanently prohibiting trading on a specific platform.

Nature: This is a very severe penalty, meaning the issuer's business in that area will no longer be able to continue.

Applicable Situations: Typically applied when the violation is extremely serious, or the issuer repeatedly violates regulations and refuses to correct them. For example, this may involve fraud, money laundering, or other significant illegal activities, or actions that severely harm investor interests.

Impact: Prohibiting activities can have a devastating impact on the issuer's business, significantly increasing the operational risks of the company.

4. Deregistration or Revocation of License

Deregistration or revocation of license is the most severe penalty under the MiCA Regulation.

· Nature: This refers to the formal withdrawal of the operating license granted to the issuer under the MiCA Regulation by the regulatory authority, resulting in the loss of eligibility to provide related services in the EU.

· Applicable Situations: This is typically used in cases of the most serious violations, such as:

Severe violations of the core provisions of the MiCA Regulation that cause significant harm to the stability of financial markets or investor interests.

Providing false information to obtain authorization.

Repeated and continuous violations of regulations, even after multiple warnings and penalties have not been corrected.

The company being insolvent or facing bankruptcy liquidation.

· Impact: Revocation of authorization means that the issuer must immediately cease all related business activities in the EU and may face further legal actions and penalties. This is a fatal blow to the issuer, as it not only leads to a complete termination of business but also causes irreparable damage to its reputation and future development.

In summary, the four types of penalties constitute a multi-layered punitive system for violations under the MiCA Regulation. Regulatory authorities can choose appropriate penalties based on the specific circumstances of the violations or combine multiple measures to achieve the best regulatory effect. Of course, the four types listed above are not exhaustive; the MiCA Regulation has specific requirements for information disclosure. For Web3 practitioners, understanding these penalties helps better comprehend the compliance requirements of the MiCA Regulation and take necessary measures to avoid violations.

Continuous Compliance: Future Outlook of the MiCA Regulation

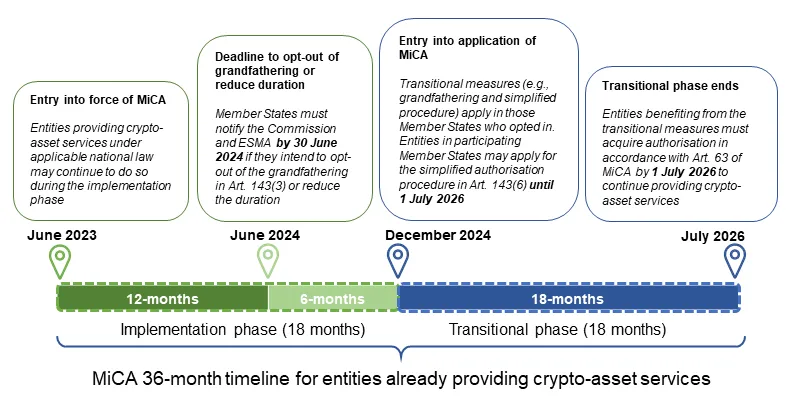

For Virtual Asset Service Providers (VASP), the MiCA Regulation has provided a grace period for practitioners registered before its enactment to transition to the requirements set by the MiCA Regulation. The grace periods vary by country; for example, in Poland, if a company is a registered VASP (old license), it will be allowed to provide services under the VASP license during the grace period until June 30, 2025 (expected date).

However, for virtual asset service providers that have never applied for a VASP license, they must apply for a CASP license before starting operations.

Regardless of how long the grace period is set by EU countries, the MiCA Regulation currently stipulates that all crypto asset service providers (CASP) must complete their license applications by July 2026.

Of course, the MiCA Regulation is not static; regulatory authorities will submit a publicly released report to the European Parliament and Council each year, updating on amendments to the regulation and the direction of regulatory changes based on market fluctuations and the actual applicability of the regulation. At that time, Mankun Lawyers will continue to follow up, providing Web3 practitioners with the latest and most comprehensive compliance guidelines from major crypto regions worldwide.

▲Image Source: ESMA

Summary by Mankun Lawyers

While MiCA introduces strict regulatory standards, it also creates opportunities for businesses to expand into the European market and gain a competitive advantage. By proactively meeting compliance requirements, in the short term, Web3 practitioners can gain official endorsement and seize the initiative; in the long term, a more transparent and regulated business environment is conducive to the sustainable development of projects.

Mankun Law Firm has rich practical experience and profound expertise in the Web3 field, particularly with a relative advantage in crypto asset compliance, international business expansion, and cross-border legal support. We will not only continue to monitor the implementation progress of the MiCA Regulation but also regularly release in-depth compliance interpretations and practical guidelines based on industry dynamics and client needs, helping clients stay abreast of the latest policy changes.

By closely integrating industry trends with legal expertise, Mankun Lawyers is committed to designing tailored compliance solutions for clients, assisting them in efficiently addressing regulatory challenges, seizing market opportunities, and ultimately gaining an advantage in the rapidly evolving crypto asset market. Whether you are a crypto asset service provider, a token issuer, or another Web3 practitioner planning to conduct global business, we can provide you with comprehensive support covering everything from business layout to risk prevention, helping your business achieve significant growth in the EU and globally.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。