Bitcoin ETFs See $56.76 Million Outflow With Ether ETFs Attracting $12.58 Million Inflow

The daily trading action of crypto exchange-traded funds (ETFs) on Tuesday, Feb. 11 saw contrasting fortunes for bitcoin and ether ETFs.

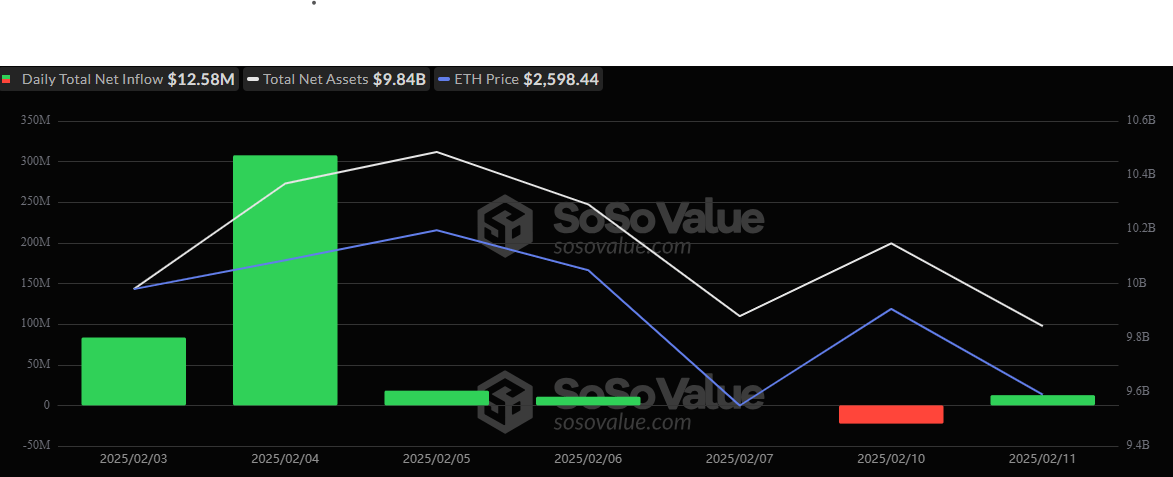

Bitcoin ETFs experienced a net outflow of $56.76 million, marking the second consecutive day of withdrawals. In contrast, ether ETFs attracted a net inflow of $12.58 million, rebounding from Monday’s outflow of $22.46 million.

The major withdrawals on bitcoin ETFs happened on Fidelity’s FBTC and Franklin’s EZBC with $43.63 million and $11.03 million leaving the funds respectively. It is interesting to note that Fidelity’s FBTC also led the outflows on Monday with $136.09 million. Consequently, Fidelity’s FBTC has shed $179.72 million from its net assets.

Other contributors to the outflow on Tuesday were Invesco’s BTCO with $9.51 million, Bitwise’s BITB with $9.32 million, and Wisdomtree’s BTCW with $7.06 million. Blackrock’s IBIT continued to remain the bright spot with $23.8 million in inflows.

These two days of outflows for bitcoin ETFs have seen the value of the total net assets drop to $111.78 billion.

The narrative on ether ETFs was in contrast with a net inflow of $12.58 million which came solely via Blackrock’s ETHA, raising its net assets to $3.53 billion.

The successive outflows from bitcoin ETFs could suggest a cautious sentiment among investors, possibly due to recent market volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。