Author: 🔫Scof💀, ChainCatcher

Editor: TB, ChainCatcher

The Bullet of Pump Hits the Bullseye

Just now, Alon, co-founder of pump.fun, announced that the official X account of pump.fun was hacked and a scam token "PUMP" was released, reminding users to be aware of the risks.

As the most active meme coin launch platform in the Solana ecosystem, Pump.fun has become a wealth creation myth for retail investors with its "internal incubation + external explosion" two-phase mechanism. Tokens first accumulate liquidity on the platform through the Bonding Curve mechanism, and when trading volume exceeds the $69,000 threshold, they automatically migrate to the leading DEX Raydium to establish a liquidity pool, completing a closed loop from project launch to market speculation. This meticulously designed rule has been operating crazily in 2024:

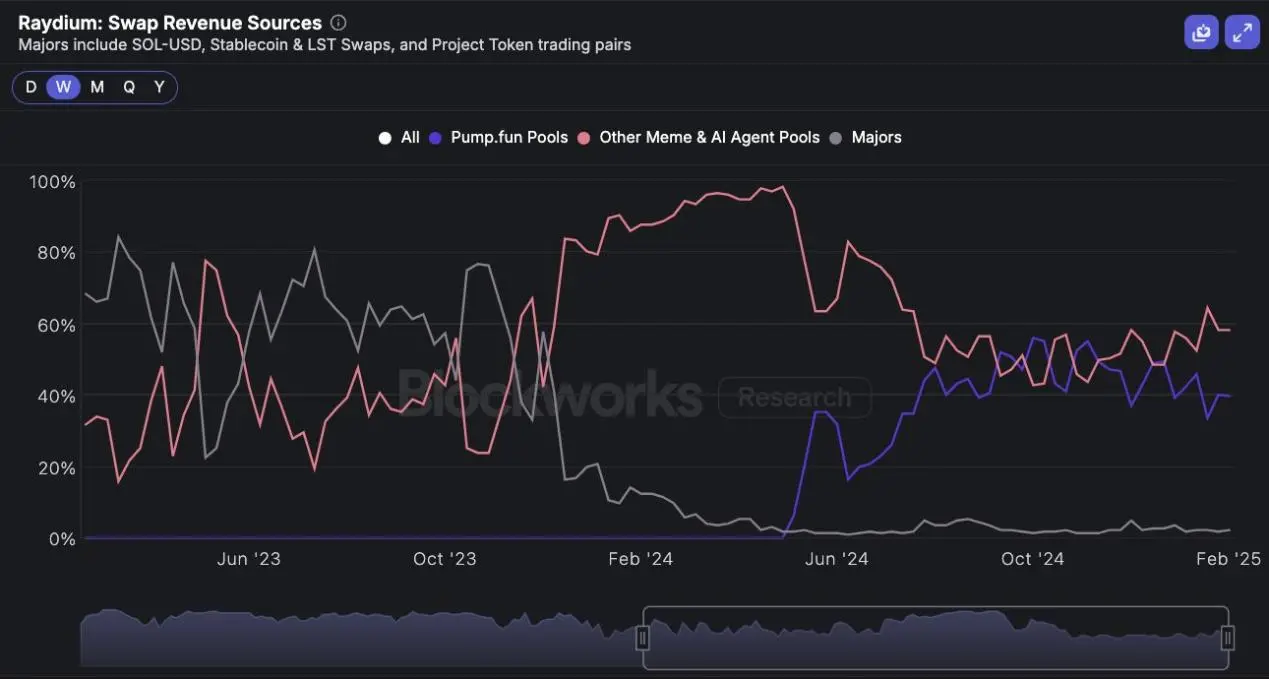

From April 1 of last year to now, tokens launched by Pump.fun have contributed $346 billion in trading volume to Raydium, accounting for half of the total flow of this DEX, while the platform has collected a total of $197 million in fees, of which $104 million came from pump.fun transactions.

However, when celebrities like Trump entered the scene with "flash" tokens (such as TRUMP, MELANIA), this game of hot potato began to expose its naked harvesting logic. On-chain data shows that over 70% of meme coins exhibit a "peak at pool establishment" trend during the external phase, with an average lifespan of less than 48 hours.

An even more dangerous signal comes from the comprehensive retreat of liquidity. On February 24, among the tokens graduated from Pump.fun, only one barely surpassed a market cap of one million dollars, and the on-chain speculative frenzy has nearly frozen. The trading depth of meme coins on Raydium has shrunk by over 90% from its peak, while the market cap of stablecoins on the Solana chain has seen a net outflow of over $1 billion in the past 30 days, marking the largest capital loss since the FTX collapse.

This collapse is not accidental. When project parties, trading platforms, and celebrities form a "harvesting iron triangle," and when the mathematical model of the Bonding Curve becomes a tool for siphoning off profits, retail investors' confidence has long been worn down by repeated "opening and crashing" dramas. The failure of Pump.fun is not only a microcosm of the liquidity crisis in the Solana ecosystem but also a brutal interrogation of the entire crypto world regarding the meme narrative—when the bubble bursts and the carnival ends, who will clean up the wreckage of this capital wasteland?

SOL Falls Over 50% from Its Peak, Ecosystem in Decline

As one of the most outstanding public chain tokens in 2024, Solana rode the wave of Pump and meme, surging nearly 200% throughout the year.

However, since Trump launched tokens on Solana on January 18, this wave seems to have finally washed ashore: the price of SOL first hit a historic high of $295 on January 19, then quickly turned downward, with a decline exceeding 50%.

With only three days left until the largest token unlock in Solana's history (valued at $2 billion), 11.2 million SOL will be unlocked for circulation, most of which were purchased from the FTX auction at a cost of $64, which could create significant selling pressure.

In addition to poor token price performance, according to Defillama data, the TVL of the Solana ecosystem has dropped from a peak of $12.19 billion to today's $7.22 billion, and daily trading fee income is also continuously decreasing.

Moreover, the net inflow data for the Solana ecosystem over 24 hours shows that $260 million flowed out on just January 18 and 19, and the funds flowing in afterward have also been decreasing, far less than during the previous Pump period.

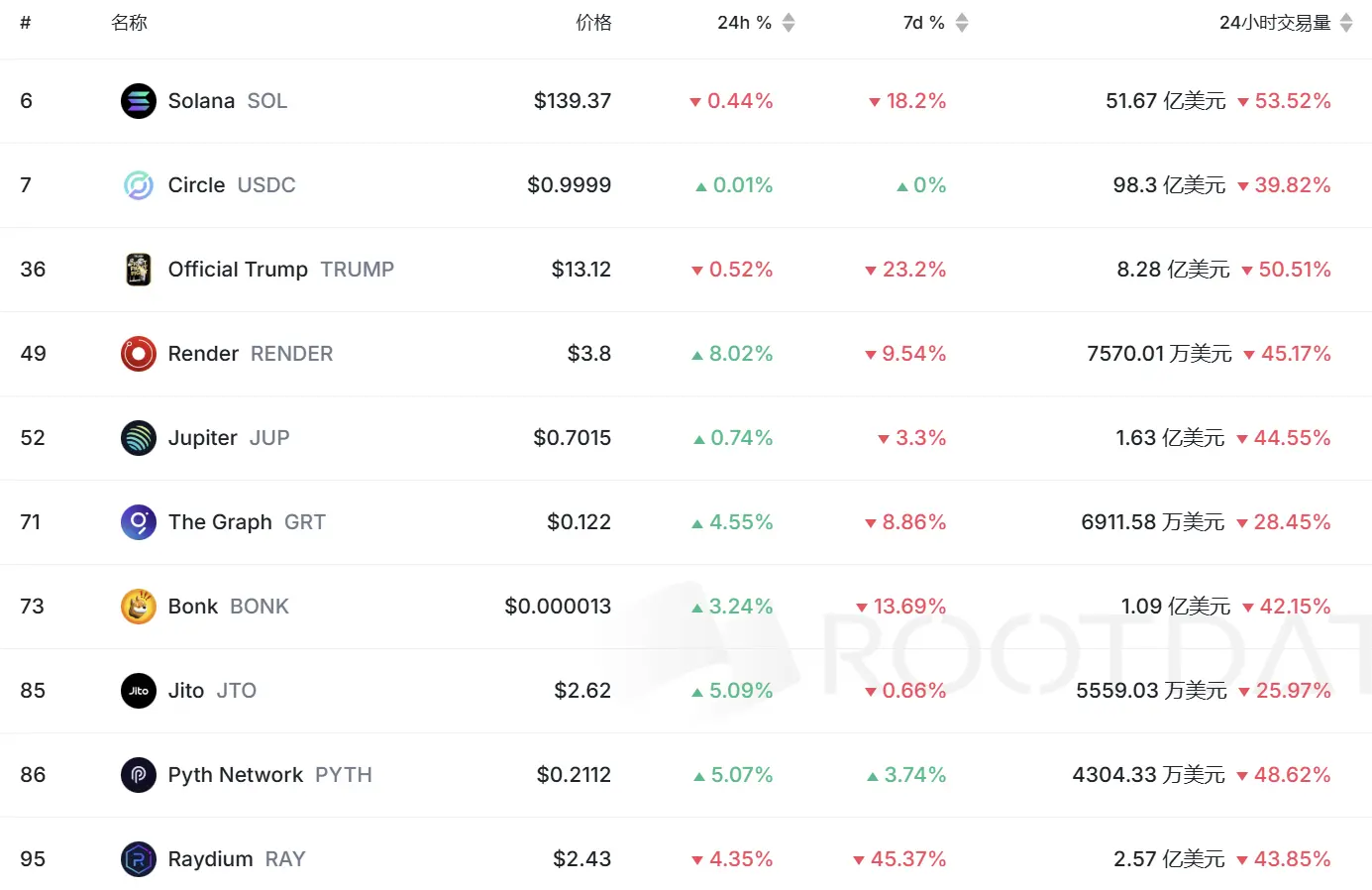

Not only that, but a series of other indicators are also not optimistic, as the performance of mainstream protocol tokens in Solana has shown a downward trend over the past week:

Overall, the ecosystem presents a scene of "when the tree falls, the monkeys scatter."

This inevitably raises the question: Is the story of Solana over?

Solana Labs Co-founder Toly Also Fears Collapse!

Facing the risk of token price collapse, the Solana ecosystem is experiencing the greatest fear, uncertainty, and FUD since the FTX explosion. Some analysts estimate that scammers have amassed over $10 billion during the entire meme coin speculation cycle.

In response to the unavoidable reality, many community members have also reacted.

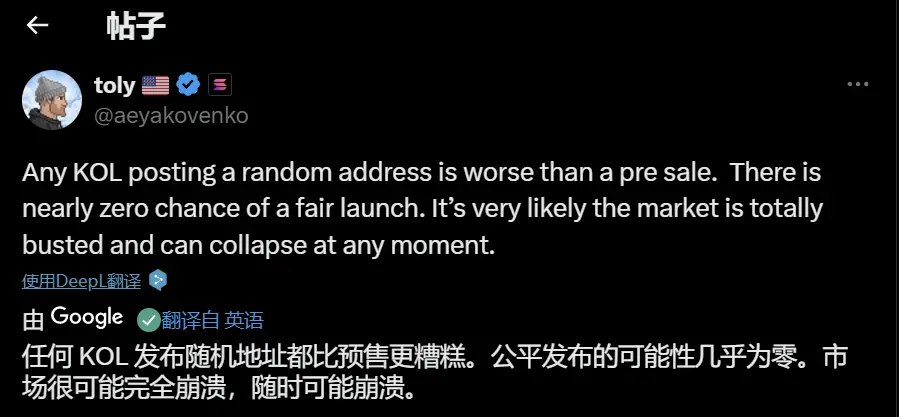

As a co-founder of Solana Labs, Toly has always advocated for healthy technological development and innovation. He has repeatedly called for builders to return to innovation and establish quality projects. Although he did not directly criticize, he has often revealed his dissatisfaction with Pump in conversations with other community members on X. In response to long-time supporters' doubts, he stated, "The assholes that mess with markets to max extract can go f’ themselves." It is clear who this group refers to.

Crypto KOL @cobie has also pointed out the issues with the PVP model multiple times. He stated, "The current market development trajectory is that market participants rush into these scams like moths to a flame, most of whom know these are scams, but their goal is to sell to the next buyer at three times the price. They just want to get rich in two weeks, not in 2-4 years. Players hope to win big in the next action."

Of course, the community is also making attempts to save itself. On February 26, Solana launched the SIMD-0228 proposal, setting a target staking rate of 50%. If the staking rate exceeds 50%, the issuance will decrease, and the yield will lower; if it is below 50%, the issuance will increase, and the yield will rise. The minimum inflation rate is 0%, and the maximum inflation rate is determined based on the current issuance curve. This proposal aims to shift SOL issuance to a market-driven model.

Additionally, a Solana spot ETF has become another lifeline—prediction platform Polymarket shows that the market believes the probability of approval before 2025 is as high as 85.4%, and the probability of approval before June has also risen to 34%. If realized, referring to the capital siphoning effect of Bitcoin ETFs accumulating hundreds of billions and Ethereum ETFs hundreds of billions, Solana could see a significant influx of capital in the billions.

The predicament of Solana is by no means an isolated case but a microcosm of the entire industry’s "speculation backfiring on innovation."

As KOL @0xNing0x summarized: "We have now entered the settlement moment of this cycle, the P small players are the MVPs, Solana, Pump.fun, Jupiter are the best support, TRUMP is the layup dog, AI16Z is the layup dog, JLP holders are the layup dogs. The losing side SVP is Base and Virtual, while Ethereum, Arbitrum, Optimism, ZkSync, and Starknet are the supports in the jungle, mid-lane, and jungle."

At present, Solana may have only two paths: either rely on external capital like ETFs to force a continuation of life, which may deepen the path dependence on financial casinos; or, as Toly advocates, undergo "surgical treatment" to endure short-term pain and rebuild developer faith.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。