Source: Cointelegraph Original: "{title}"

Bitcoin (BTC) price has risen 8% from the low of $76,703 on March 11, partly due to large investors actively buying the dip using leverage.

Long positions on Bitfinex have surged to the highest level since November 2024, increasing by 13,787 BTC over 17 days. This position is currently valued at $5.7 billion, and this bullish leveraged position indicates that despite the recent weakness in Bitcoin prices, investors remain confident in Bitcoin's potential for an upward move.

Bitcoin/USD (orange, left) vs. long margin positions on Bitfinex (right). Source: TradingView/Cointelegraph

Some analysts believe that Bitcoin's price is closely related to the global monetary base, meaning that as central banks inject liquidity, Bitcoin prices tend to rise.

With the risk of economic recession increasing, the likelihood of adopting expansionary monetary policies to increase the money supply is also rising. If this correlation holds, then large investors on Bitfinex may be well-prepared to profit from a Bitcoin surge exceeding $105,000 in the next two months.

Source: pakpakchicken

For example, X platform user pakpakchicken claims to have found an 82% correlation between the global money supply (M2) and Bitcoin prices.

When central banks tighten liquidity by raising interest rates or reducing bond holdings, traders become more risk-averse, leading to weakened demand for Bitcoin. Conversely, periods of monetary easing tend to spark greater investor interest in this asset, enhancing its price potential.

Bitfinex large investors go long on Bitcoin when M2 hits bottom

In early September 2024, Bitfinex margin traders increased their long positions by 7,840 BTC while Bitcoin was in a bearish trend, struggling to reclaim the $50,000 mark for over three months.

Despite the market downturn, large investors on Bitfinex held their positions, and less than two months later, Bitcoin prices soared above $75,000. Notably, as these traders increased their Bitcoin holdings, the global M2 money supply also hit a bottom at the same time, further reinforcing the correlation between the two.

It may be impossible to determine a direct causal relationship between money supply and investors' willingness to accumulate Bitcoin, especially considering the impact of significant events during these periods.

For instance, in November 2024, Donald Trump's election as President of the United States greatly boosted Bitcoin's upward trend due to the new government's supportive stance on cryptocurrencies, independent of global M2 trends and liquidity conditions.

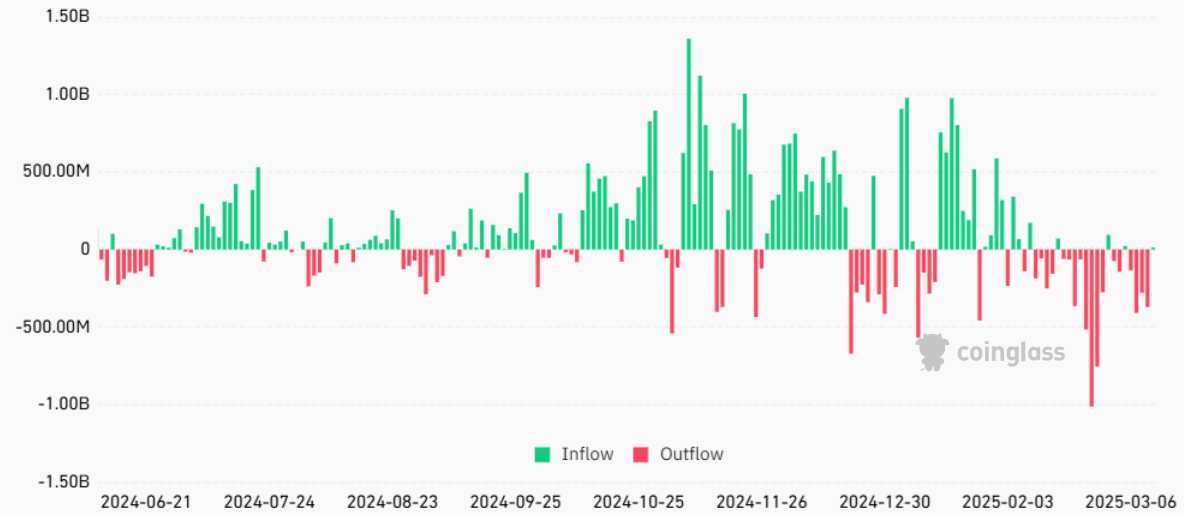

Net inflows of Bitcoin spot ETFs, in USD. Source: CoinGlass

Similarly, Michael Saylor's recent plan to raise up to $21 billion for Strategy to purchase more Bitcoin could change market dynamics, even though there has been a net outflow of $4.1 billion from Bitcoin spot ETFs since February 24.

Strategy remains the largest corporate holder of Bitcoin, holding 499,096 BTC at a total cost of $33.1 billion, reinforcing its long-term bullish strategy.

Clearer cryptocurrency regulations, Strategy's capital increase

Essentially, the expansion of the global money supply may have influenced the increase in long margin positions on Bitfinex, but the push towards Bitcoin's $105,000 price level may primarily be driven by industry-specific news and events.

A March 13 report from The Wall Street Journal revealed that representatives of Trump have begun discussions about a potential acquisition of shares in Binance.

So far, the U.S. government's more favorable attitude towards cryptocurrencies has not brought tangible benefits to the market.

For example, the Office of the Comptroller of the Currency (OCC) has not clarified whether banks can custody digital assets and manage stablecoins without prior approval.

Similarly, SEC acting chair Mark Uyeda announced plans to remove cryptocurrency-related provisions from a proposed rule aimed at expanding the definition of exchanges.

The SEC is currently reviewing requests from Bitcoin spot ETF issuers to allow physical purchases and redemptions, which would enable shares to be exchanged directly for Bitcoin without using traditional cash transactions.

Meanwhile, the global macroeconomic situation has deteriorated, putting pressure on Bitcoin prices. However, these same factors are gradually prompting governments to adopt economic stimulus measures and expand the M2 money supply.

If this trend continues, it should ultimately create conditions for Bitcoin prices to reach the $105,000 level predicted by pakpakchicken by May 2025, and it may even rise higher.

This article is for general informational purposes only and should not be construed as legal or investment advice. The views, thoughts, and opinions expressed in this article are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Related: Bitcoin must achieve a weekly closing price above $89,000 to confirm that the bottom has passed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。