At press time, the Bitcoin network’s computing capacity is gliding at 876.24 EH/s, slightly below its recent peak. This record-setting hashrate arrives as mining difficulty edged up by 6.81%, raising the bar for miners attempting to validate new blocks. The current spot hashprice—the projected daily return for 1 petahash per second (PH/s) of SHA256 hashpower—stands at $46.16 per PH/s. The hashprice has fallen 11.15% since March 5.

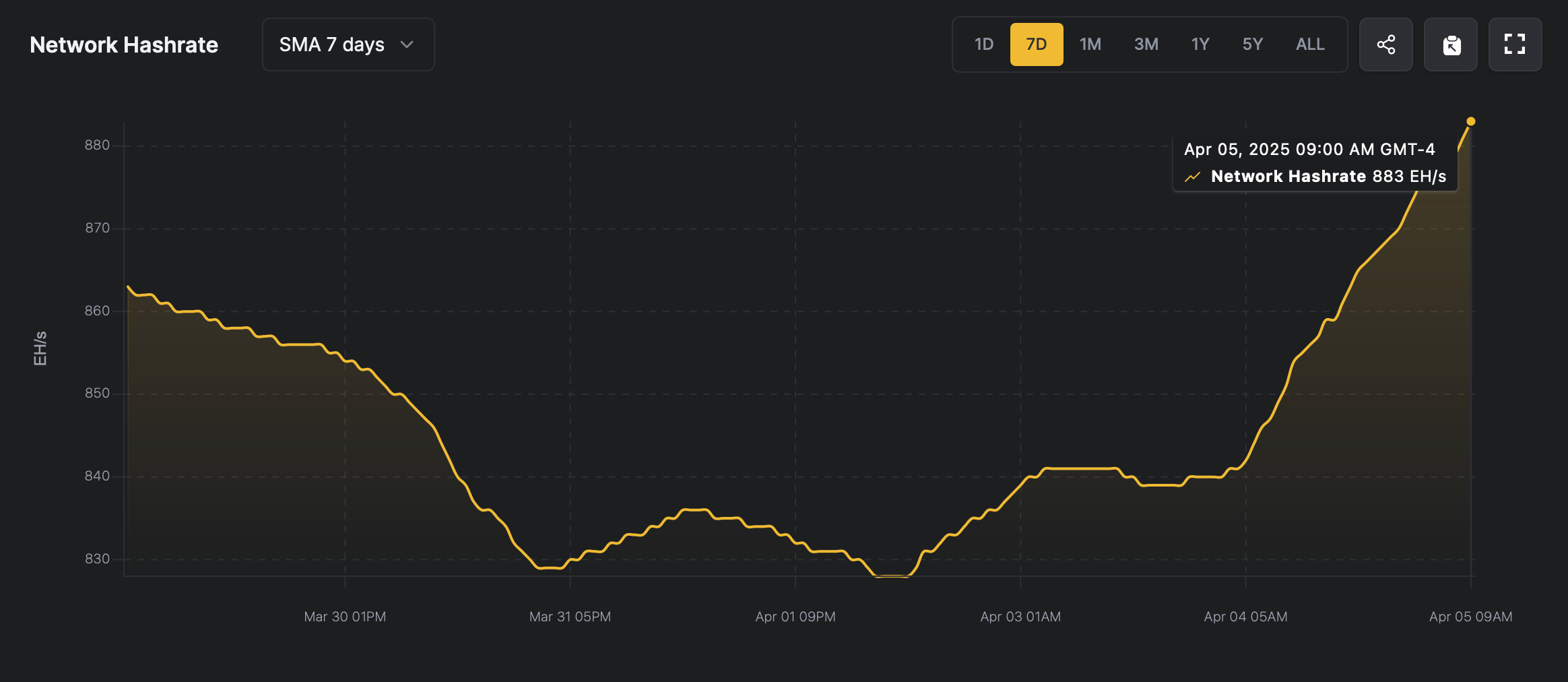

At this pace, the network needs to add just 117 EH/s to cross the threshold of 1 zettahash per second (ZH/s), a milestone that appears likely to be reached in 2025. Currently, 883 EH/s translates to 883 quintillion hashes per second (H/s), or 0.883 ZH/s. This record-setting computational high coincides with a lull in transaction activity, as recent blocks remain largely unfilled. Of all the blocks mined in the past 24 hours and the total revenue collected, less than 1%—specifically, 0.89%—originated from onchain fees.

At the moment, Foundry leads as the top bitcoin mining pool, contributing 32.33% of the global hashrate, followed by Antpool at 17.22%. Viabtc holds 15.02%, and F2pool accounts for 8.97%. Together, these four pools command a combined 73.54% of the network’s hashrate. The 6.81% increase in difficulty could temper the pace of the hashrate, as the metric now stands at an all-time high of 121.51 trillion following the mining of block height 891,072.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。