China's consumption accounts for only 39%, while the global average is around 52%. There are several reasons for this, with the fundamental issue being the small share of household sectors in income distribution.

According to research from the Cheung Kong Graduate School of Business, in 2021, the share of the household sector in China's Gross National Income (GNI) was 62%, the corporate sector was 23%, and the government sector was 15%. In contrast, the household sector in the United States accounted for about 71%, the corporate sector for 17%, and the government sector for 12%. This indicates that the share of Chinese residents in national income is relatively low, while the share of the corporate sector is relatively high.

Let’s not consider the government for now, but focus on the profit distribution issue between corporations and labor. This actually follows a logical chain:

Limited effective demand => Relative capital surplus => Low capital return rate (lower than the U.S.) => Insufficient number of new enterprises => Insufficient employment => Labor surplus leads to poor bargaining power for labor => Low income proportion for the household sector.

So the fundamental reasons boil down to two: one is that the overall labor force is still relatively large, and the second is that low effective demand leads to poor capital return rates.

Regarding labor, the declining birth rate has already been "working" on this; China's working-age population has been shrinking since 2011 and currently stands at 853 million, estimated to decrease to 800 million around 2034. During this process, the bargaining power of labor will gradually increase.

However, the root cause is actually the relatively low effective demand. Effective demand can be explained in many ways, but currently, the most critical point is: "There is a lot of money, but it is not circulating": from a macro perspective, there is an overall surplus, while from a micro perspective, there is structural imbalance.

👉 It seems like "there is a lot of money," but in reality, it is concentrated in high-net-worth households, leading enterprises, the fiscal system, and the banking system, without being effectively distributed to those with a high marginal propensity to consume and industries.

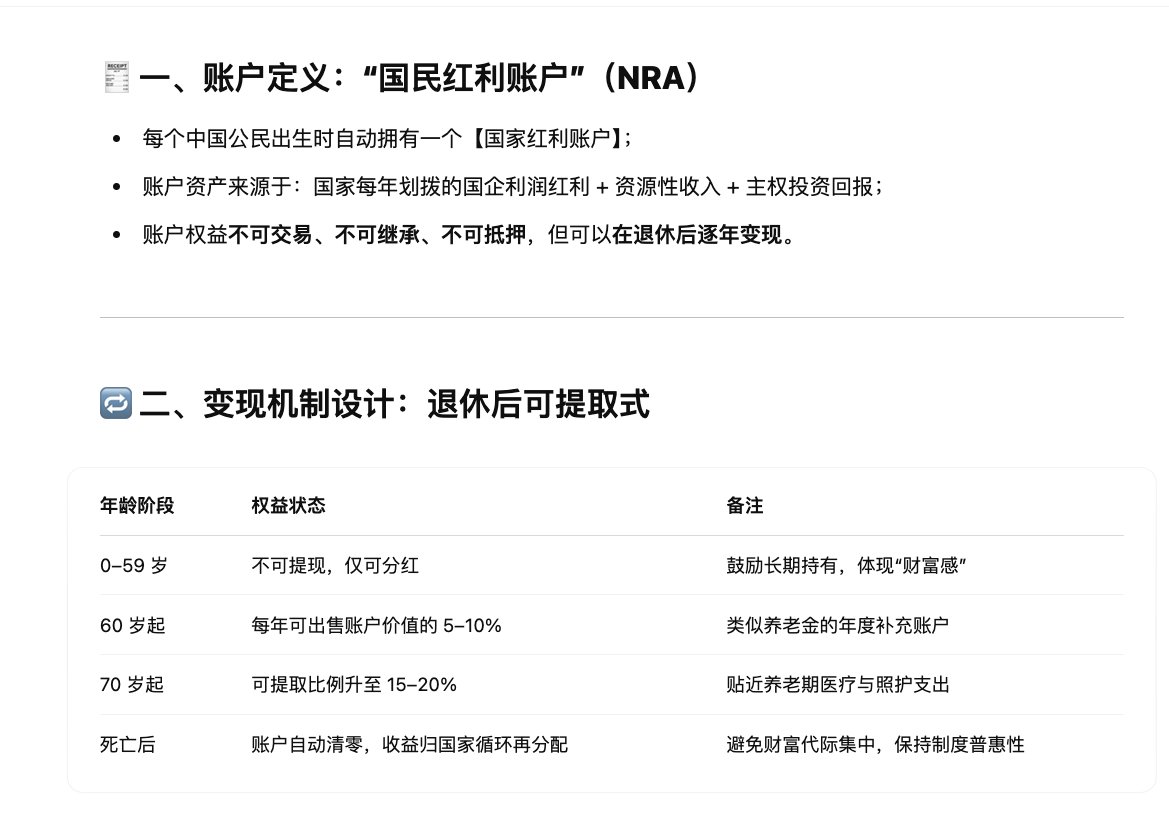

I think a good solution would be to establish a "National Dividend Account," pooling all state-owned enterprises together and distributing shares per capita, with annual dividends. Currently, although the dividends are not much, estimated at 1,000 yuan a year, this portion of equity can be sold at a certain percentage as a pension after reaching retirement age - this at least addresses the issue of retirement.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。