Economic uncertainty has "further" increased, and the risks of rising unemployment and inflation have also increased.

Author: Wall Street Insight

Key Points:

The Federal Reserve has paused interest rate cuts for three consecutive meetings, in line with market expectations.

The statement noted that economic uncertainty has "further" increased, adding the phrase "the risks of rising unemployment and inflation have increased."

The statement reiterated that recent indicators show economic activity continues to expand robustly, but pointed out that fluctuations in net exports have affected the data.

The balance sheet reduction continues.

This decision received unanimous support from all FOMC voting members, unlike the last meeting where one member opposed.

The "New Federal Reserve News Agency": Fed officials are considering whether to focus on the risks of employment or the risks of inflation.

U.S. President Trump expressed disappointment again. Despite his repeated calls for interest rate cuts, the Federal Reserve chose to remain cautious, not cutting rates, and even hinted that Trump's policies could trigger the risk of stagflation.

On Wednesday, May 7, Eastern Time, the Federal Reserve announced after the FOMC meeting that the target range for the federal funds rate remains unchanged at 4.25% to 4.5%. This marks the third consecutive monetary policy meeting where the Federal Reserve has decided to pause. Since last September, the Fed has cut rates three times, totaling a reduction of 100 basis points, and has been on hold since Trump took office in January.

The Fed's decision to pause interest rate cuts was fully anticipated by the market. By the close on Tuesday, CME tools indicated that the futures market expected a greater than 95% probability that the Fed would keep rates unchanged this week, with over a 68% probability of no rate cut in June, and about a 77% probability of a rate cut in July. Before the Fed's decision was announced on Wednesday, pricing in the derivatives market showed that traders reduced their bets on rate cuts, expecting about three 25 basis point cuts starting in July.

The U.S. non-farm payrolls data released last Friday for April exceeded expectations, reflecting that the labor market remains resilient, which cooled investors' expectations for rate cuts. Nick Timiraos, known as the "New Federal Reserve News Agency," commented that the non-farm data reduced the likelihood of a rate cut in June; facing the dilemma of recession and inflation pressures, the Fed is likely to lean towards avoiding uncontrolled inflation, thus possibly delaying rate cuts.

After the Fed's decision was announced on Wednesday, Timiraos commented that the Fed warned of increased risks of rising unemployment and inflation, and officials are considering whether to focus on the risks of rising prices or the risks of weak employment. In other words, the Fed needs to consider whether to prioritize job preservation or inflation control.

Economic uncertainty has "further" increased, and the risks of rising unemployment and inflation have also increased

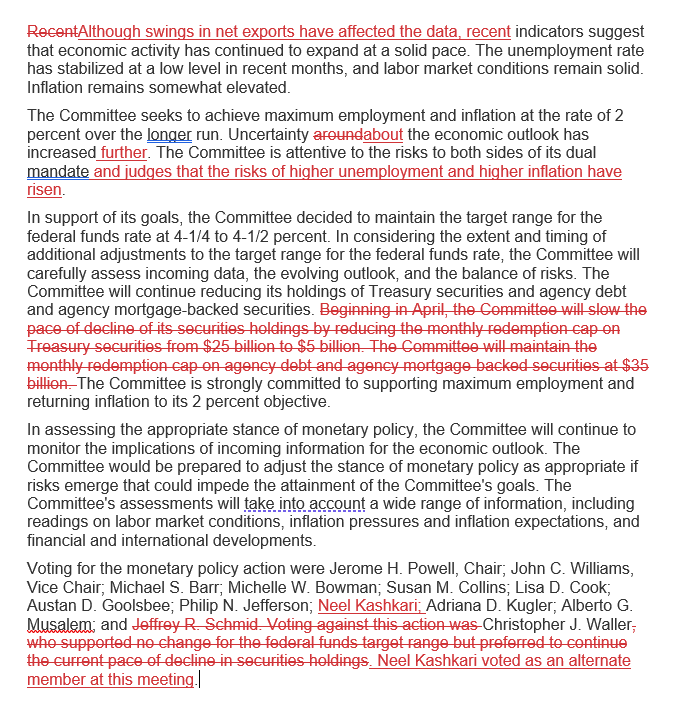

Compared to the last FOMC statement in late March, this Fed decision statement has three main changes. First, in the assessment of the economy.

The last statement removed the phrase "the risks to achieving employment and inflation goals are broadly balanced," adding a new sentence stating "uncertainty regarding the economic outlook has increased." This statement has been adjusted again to "uncertainty regarding the economic outlook has further increased," adding the word "further" to emphasize the reality of increased "uncertainty."

Following this adjustment, the statement reaffirms that the FOMC is focused on the two-sided risks it faces in achieving its dual mandate of maximum employment and price stability, then adds half a sentence:

"and determined that the risks of rising unemployment and inflation have increased."

Additionally, there was a slight modification in the first paragraph of the statement assessing the economy. The first sentence of the last statement was that recent indicators show economic activity continues to expand robustly. This statement added half a sentence before that, resulting in the opening of the statement reading, "Although fluctuations in net exports have affected the data, recent indicators show economic activity continues to expand robustly."

Continuing to reduce the balance sheet, all FOMC voting members support the decision

The last decision indicated that the Federal Reserve decided to further slow the pace of reducing its balance sheet (quantitative tightening, QT) after June of last year.

Specifically, starting in April, the monthly redemption cap for U.S. Treasury securities was lowered from $25 billion to $5 billion, while maintaining the monthly redemption cap for agency debt and agency mortgage-backed securities (MBS) at $35 billion.

This statement did not mention again the adjustment made to the U.S. Treasury redemption cap starting in April, directly removing the sentence regarding the adjustment, and reiterated that the Fed will continue to reduce its holdings of U.S. Treasuries, agency debt, and agency MBS.

This means that after slowing the balance sheet reduction starting in April, the Fed's guidance on balance sheet reduction has not changed further.

Another significant difference from the last meeting's statement is that all FOMC voting members supported this decision: neither adjusting interest rates nor changing the balance sheet reduction.

In the last meeting, one FOMC member opposed the decision. The dissenting vote was cast by Federal Reserve Governor Christopher Waller, who supported continuing to pause rate cuts but did not advocate slowing the balance sheet reduction, wishing to maintain the current pace of balance sheet reduction.

The following red text shows the deletions and additions in this decision statement compared to the last one.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。