Author: Luo Han Lun Dao

In the decentralized ideal envisioned by web3 technology, the accuracy of information has always been of utmost importance, serving as a fundamental guarantee for the proper functioning of a trustless world. Thus, within the blockchain ecosystem, a component known as an oracle has been entrusted with the hope of facilitating information exchange. The research we introduce today focuses on the oracle problem in blockchain, exploring the dilemmas faced by web3 technology in the real world and potential solutions.

Oracle, translated as "divine message," originates from the Latin word ōrāre, meaning "to speak," or refers to the person or thing that conveys prophecies.

The most important oracle in ancient Greece was undoubtedly the Delphic maxims. Currently, we may be most familiar with Oracle Corporation, the database service provider named after the oracle. Additionally, in statistical learning and high-dimensional statistical theory, "oracle" is also used to denote an idealized estimator.

However, the "oracle" we are discussing today is a key infrastructure within the blockchain ecosystem (also translated as "oracle"). By definition, an oracle is a mechanism that writes external information into the blockchain, serving as a bridge between smart contracts and the real world.

Recently, Professor Cong Lin from Cornell University's Johnson School of Business delivered a talk on the oracle problem in blockchain, introducing a new concept: the Oracle Trilemma. He believes that no oracle system can simultaneously satisfy the following three characteristics:

Decentralization

Truthfulness

Scalability

Subsequently, Professor Cong shared how to alleviate this problem in the current technological context and discussed the limitations of decentralized technology, as well as the combination of centralized and decentralized ecosystems.

The Blockchain Ecosystem is Not "Open"

Although open blockchains represented by Bitcoin and Ethereum have opened their doors to everyone, their ecosystems remain closed. In other words, while we can freely join these two ecosystems, there is no naturally existing bridge between Bitcoin and Ethereum.

In fact, for any two digital platforms, they are assumed to have no interaction until we artificially introduce a communication channel. This lack of interaction exists not only between platforms but is also widespread between platforms and reality.

Let’s imagine two people signing a smart contract on Ethereum, betting on tomorrow's weather. We know very well that this contract can only proceed once the actual weather conditions are revealed in the real world. To facilitate the execution of the contract, we need to bring real-world (off-chain) information onto Ethereum (on-chain). It is precisely due to this mutual independence between ecosystems that we believe blockchain is not yet "open" enough, thus necessitating oracles and oracle networks to promote information exchange.

In practice, the prediction market platform Polymarket has achieved considerable success with its oracle system based on the UMA (Universal Market Access) protocol, providing an excellent way to aggregate information through this decentralized mechanism. We also see the oracle industry collaborating with traditional financial institutions like SWIFT and Google Cloud, and we observe interesting attempts by practitioners, such as how to introduce AI agents into oracle networks to automatically collect real-world information, and how to establish standards for interaction between chains to facilitate communication.

Starting from the Oracle Problem in Blockchain

Next, we will first introduce the detailed background of the oracle problem and review the development journey of the oracle industry in addressing this issue.

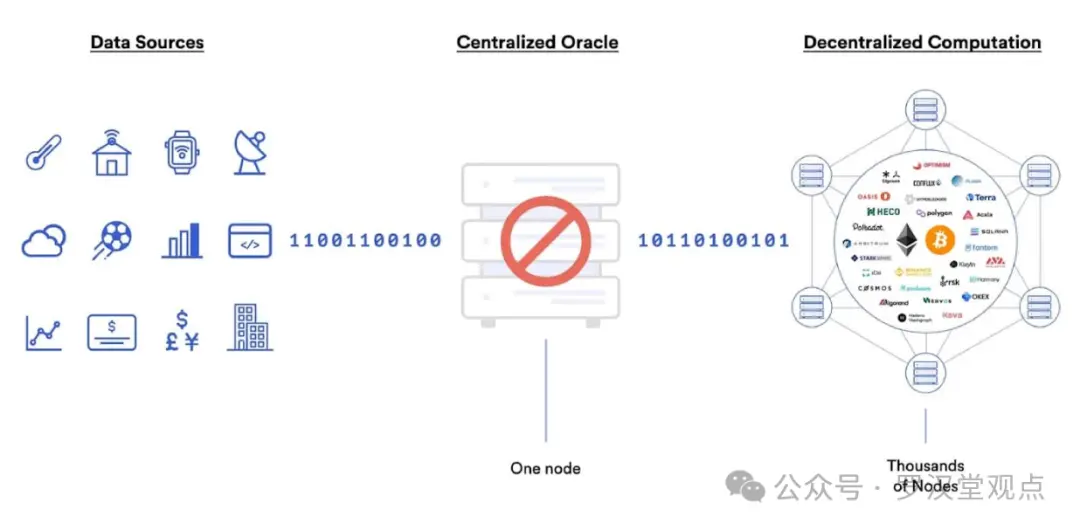

As we mentioned earlier, a single blockchain is an isolated system that does not have the authority to access external data; we need oracles to bring information to the blockchain. It is termed a "problem" because we cannot ensure that this external information is accurate and reliable, especially when we overly rely on centralized oracles. Of course, this is not to belittle centralized oracles; in fact, they perform quite well in certain areas. However, in many scenarios, we still hope for a decentralized system.

From an economic perspective, we are not specifically advocating for any particular form. If a decentralized system can help us achieve our goals (such as accuracy, fairness, inclusivity, etc.), we are naturally willing to accept it. Moreover, based on current observations, our optimal choice is more likely to be a combination of centralized and decentralized systems. Nevertheless, we should focus more on the decentralized structures proposed by the industry and the progress they have made.

It is important to note that decentralized oracle networks still face many issues, such as the possibility of collusion among oracle nodes, and the existence of multiple equilibria with insufficient communication, making it difficult to determine the direction we will take. In practice, we have also witnessed numerous incidents caused by decentralized oracle networks, such as the bZx oracle attack and the Pyth BTC price anomaly. For this reason, we need to better understand the advantages and limitations of oracle networks.

What is the Oracle Trilemma?

We will introduce a new concept: the Oracle Trilemma.

You may have heard of a similar concept called the blockchain trilemma, which states that a public blockchain cannot simultaneously satisfy decentralization, security, and scalability.

We believe this new concept presents a more challenging problem. We know that for blockchains, all information is on-chain; for example, in Bitcoin, all transaction information can be obtained online, so verifying information is not that difficult.

However, for oracle networks, we need to aggregate a large amount of information from outside the blockchain ecosystem, which means we first need to worry about whether this information can be trusted. Secondly, we need to consider how to aggregate and report this information to upload it to the blockchain.

To solve these problems, we need sophisticated mechanism design and information design to provide the correct incentives, which is precisely the advantage of economists in this field.

Specifically, the Oracle Trilemma refers to the fact that no oracle system can simultaneously satisfy decentralization, truthfulness, and scalability.

We can think of a simple example: suppose there is a basic fact, but no node in the oracle network can perfectly observe this fact; the observations of individual oracles will be affected by noise.

However, when the number of oracles is sufficiently large, we assume that the mean of the observations will be close enough to the true value. After observing their respective signals, each oracle needs to decide what information to report to the system; they can honestly report their observations, even though there may be a deviation from the true value, or they may choose to lie, as only they know their own observations. After receiving reports from all oracle nodes, the system will aggregate all the information to provide the final prediction.

The three characteristics mentioned above are the properties we hope the oracle network can possess in an ideal state. However, let’s imagine that our oracle network has already satisfied decentralization and scalability; a large number of oracle nodes will report information to the system, which leads to the marginal contribution of a single node's truthful report being negligible for the entire system. When the cost of obtaining information for some oracles is too high, they will naturally have the idea of free-riding. Due to this concern, the truthfulness of aggregated information is not the only equilibrium state. Similarly, the other two scenarios can also be argued.

Ouyang Shumiao (University of Oxford): When the number of oracle nodes is sufficiently large, according to the law of large numbers, the noise terms will cancel each other out, ensuring that we can obtain an accurate signal. From this perspective, is it possible to balance the accuracy of information with the scale of the system?

Cong Lin: Yes, we certainly hope to increase the number of nodes to help us cancel out the noise. But the problem here is that each node may not necessarily report their observations truthfully, and this is an incentive issue. In a "good" equilibrium, if I know that everyone will report truthfully, I will likely tell the truth as well, but excessively high information acquisition costs can completely reverse my willingness, thus lowering the quality of the aggregated result and moving it away from the true value.

The trilemma we just described is even just a weak form, meaning that achieving all three goals is difficult. In fact, there is also a strong form: achieving any two goals simultaneously is quite challenging. Imagine if our oracle network possesses both decentralization and scalability; this means a large number of nodes are providing information to the blockchain, but we know that the capacity of the blockchain is limited, constrained by factors such as energy, making it technically very difficult to put all data on-chain. In other words, regardless of the truthfulness of the information, operating such a blockchain is itself a difficult task.

Can We Solve the Problem?

As economists, we will attempt to solve these (strong form) problems in a unique economic way.

First, architectural innovation can alleviate the conflict between decentralization and scalability to some extent. We just mentioned that the cost of aggregating all information on-chain is quite high, but if we can allow the oracle network to complete the reporting and aggregation of information off-chain, only uploading the final aggregated information to the blockchain, the cost of this process will be greatly reduced, thus ensuring scalability. More importantly, the reduction in costs will lead to more positive outcomes: more oracle nodes will be willing to participate in the blockchain ecosystem, thereby promoting decentralization.

Second, introducing a warning mechanism can simultaneously strengthen truthfulness and scalability. Specifically, when participants in the ecosystem believe that the current aggregated information is far from the true value, we allow them to issue a warning. Subsequently, a trusted but costly-to-verify third party can validate or dismiss the alert. If the alert is deemed valid, the participating faulty oracle will be punished, while the party that initiated the warning will be rewarded, and vice versa. This mechanism can cleverly balance costs, risks, and incentives, thereby ensuring the truthfulness of the information. However, since we often assume that costly verification mechanisms indeed exist and are difficult to manipulate, reliance on trusted third parties naturally becomes a limitation of this mechanism.

Third, the current incentive designs in blockchain are almost all static, while as economists, we are more accustomed to thinking about dynamic incentive structures. Imagine that when a cryptocurrency winter arrives and the value of tokens decreases, the incentives they can provide are limited. By introducing appropriate dynamic incentives, we hope that each oracle node can maintain good performance during the "winter," as they understand that the reputation they build at this moment will bring considerable returns in the future. In this way, dynamic mechanism design can address the issues of decentralization and truthfulness.

However, even if we completely solve the Oracle Trilemma, we still cannot fundamentally eliminate the security risks of blockchain, nor can we ensure the long-term sustainability of the ecosystem. Blockchain oracles have many vulnerabilities at both technical and economic levels, and we need robust architectural and mechanism designs to address these gaps.

What is the Future of Oracle Networks?

In addition to providing data, oracle networks can also integrate with industries such as finance and trade in diverse ways, and the integration with oracle networks will affect the performance, stability, and interconnectivity of blockchains and protocols.

For example, Professor Cong's recent research analyzed 4,988 DeFi protocols from early 2021 to November 2024 to assess the impact of oracle integration. They found that protocols integrated with decentralized oracle networks experienced a 75% increase in asset growth and a 43% increase in market capitalization within the first month after integration. This effect was particularly significant in protocols that completed integration before launching their applications.

Looking ahead, oracle networks outline a promising direction for academic research and industrial development. Overall, the Oracle Trilemma remains a core challenge, and future research should prioritize developing recursive incentive mechanisms that ensure truthfulness in scalable systems. Complete decentralization may not be our ultimate goal; a hybrid architecture that combines centralized and decentralized elements may better balance speed, cost, and security. Additionally, exploring efficient and robust governance models is crucial for solving the Oracle Trilemma and building a long-term sustainable governance structure.

Chen Long (Luo Han Tang): I greatly appreciate the efforts of economists in combining mechanism design with technology. Today's research on web3 reminds me of the influx of quantitative practitioners to Wall Street in the 1970s and 1980s. However, I believe there is a fundamental difference with today's field: the current web3 is more revolutionary, aiming to create a trustless world to replace the current institution-dominated world. I have three questions and a final comment:

First, you just mentioned that you are not an advocate for decentralized systems; you want to ensure that these systems are genuinely effective. Through your years of research and observation, what real progress do you see in this field beyond DeFi?

Second, can you imagine another useful decentralized world beyond cryptocurrencies? And is such a world what we truly need? If such a world does exist, what should it look like? Or, if the future is a combination of centralized and decentralized worlds, where are the boundaries between the two?

Third, how significant is the impact of the oracle networks you discussed? Will it lead to explosive (or significantly high) growth at the application level? It seems that decentralized systems ultimately need to integrate into this centralized world; in this view, is the marginal improvement brought by oracles quite limited?

Finally, I have one more comment. I believe, as you have shown us, that trustworthy data is still very important, and this is closely related to the institutional background of the current world. I think a trustless world is still far from us, or rather, this decentralized system is ultimately just a supplement to our real world, not a replacement. The areas that will benefit the most will be those that can effectively combine both.

Cong Lin: Your comments have actually answered your questions! First, regarding progress, compared to generative AI, the progress of DeFi and decentralized systems has been quite slow. I believe the most successful application so far is stablecoins, especially in a multipolar world, as they have the potential to maintain growth.

Moreover, governments and various institutions do not seem to be completely opposed to stablecoins; in fact, they appear to have a more open attitude towards them than towards central bank digital currencies. Another example is decentralized exchanges (DEXs); although they are not yet significant in scale to challenge traditional exchanges, the mechanisms they introduce are quite interesting, and these emerging applications are very active. I also believe that the tokenization of real-world assets will be a major event, and regardless of whether we apply centralized or decentralized systems, oracle networks are highly relevant.

Regarding the second question, I find it difficult to imagine a completely decentralized world, but this is actually quite intuitive for economists. We know that everything is about trade-offs; both centralized and decentralized systems have their own advantages and disadvantages, and we are likely to arrive at an optimal interior solution. This will certainly not please those blockchain enthusiasts who wish to "decentralize for the sake of decentralization." Such groups do exist, but I am skeptical of their ability to disrupt any market forces. I believe humans are ultimately driven by incentives; if centralized systems are helpful, why not keep them? In this sense, what I can imagine is a more virtualized world that grows alongside web3.

Finally, given that we are considering a combination of centralized and decentralized systems, I believe the impact of oracle networks is quite significant. Centralized systems have many issues, such as excessive market concentration and the significant market power held by individual digital platforms. Recently, we have seen JD.com attract a lot of public attention, as the platform expressed great sincerity towards its delivery workers. However, from an economic perspective, once a platform grows into a monopoly, we cannot guarantee that it will not turn around and exploit employees, suppliers, and consumers.

I believe that decentralized structures are a way to address this issue. Otherwise, we will continuously discuss antitrust issues and have to break up a large platform, thus losing the benefits of scale.

In this sense, I believe that if we are in a hybrid model, the role of oracle networks will be very significant, as oracles are key to digitization, and digitization is a fundamental issue. If we are willing to believe in a Hayekian setting, where information is highly localized, using centralized nodes to aggregate information will be very difficult, which provides a reasonable motivation for building a decentralized system.

Chen Long (Luo Han Tang): I believe the right direction is to explore the inefficiencies in various worlds and find a mechanism that can combine their strengths.

Cong Lin: One more point is that when we consider information and trust, we even see that there is a trend towards decentralization even on centralized web2 platforms.

For example, due to the explosion of information, we no longer have trustworthy, centralized sources of information. At this point, how to verify information becomes a problem, which is very troublesome for the production and aggregation of information in society as a whole. We can either take the web3 route, providing appropriate incentives for information sources, or we can introduce more regulation and verification of information sources.

If we allow platforms to grow without any restrictions, to be honest, I don't know how to trust this information, which is definitely a big problem for society.

Tang Bo (Hong Kong University of Science and Technology): In the Oracle Trilemma you introduced, which characteristic do you think is the most crucial? In a hybrid model that combines centralized and decentralized systems, which functions do you think can be delegated to centralized systems? Which functions must remain decentralized?

Secondly, what do you think are the main challenges of combining AI with oracles? Once the two are intertwined, will we encounter new systemic risks or ethical dilemmas?

Cong Lin: I will first answer the second question. I believe that having an AI agent that can continuously monitor and report information is useful; such automated programs can effectively replace some of our work.

Additionally, when we need to stress-test a system, we can use AI agents for simulation, which has advantages over traditional agent-based modeling methods. This applies not only to oracle networks but can also be used in traditional economic forms.

For related research, if your paper contains both "AI" and "web3," considering that our field is relatively conservative, some may say, "Ah, you are just chasing trends." This criticism is sometimes not without reason, but in any case, I believe that writing an academic paper that connects the two is still challenging.

However, for the industry, I believe practitioners are exploring the combination of AI and oracles, even though they may be a bit overly optimistic and always eager to find the next growth point.

But this is also why I have always believed that economists can participate in this industry and provide our insights. For example, what is true innovation? What is technically feasible but economically unrealistic? This all requires our rigorous analysis.

Returning to your first question, I believe our views on decentralization are aligned; the path of "decentralization for the sake of decentralization" is likely unfeasible. On this basis, I believe scalability is not particularly difficult; at least we have many experiences to refer to on a technical level. My personal view is that truthfulness is more challenging and more important.

Whether it is the quality of off-chain information or the mechanism for aggregating information, these challenges need to be addressed with changes to the current mechanisms, and we currently lack sufficient thinking about optimal mechanism design, which presents a huge opportunity for economists. When the dot-com wave arrived, we were 20 years late. Now, facing a new wave of web3 and digital networks, I believe this is an excellent opportunity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。