Original Title: Solana may be a memecoin ‘one-trick pony’ — Standard Chartered

Original Author: Adrian Zmudzinski

Original Translation: Tim, PANews

According to a recent report released by Standard Chartered, the Layer1 blockchain Solana may be evolving into a "one-trick pony" focused solely on generating and trading memecoins.

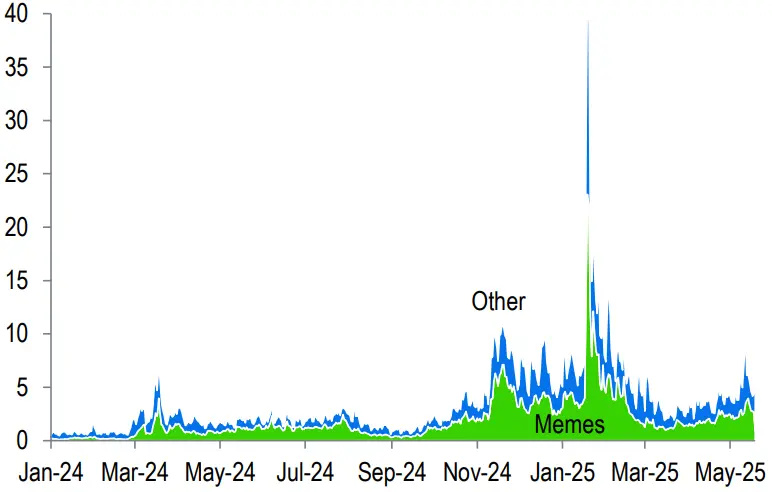

According to the research report dated May 27, Solana dominates the public chain space with high transaction volume and low transaction costs, thanks to its design architecture that allows for fast and low-cost transaction confirmations. However, this technological advantage has led to an unexpected consequence: so far, it has primarily concentrated on memecoin trading, which accounts for most of the activity on Solana (measured by "GDP," or application revenue).

Standard Chartered stated that the memecoin craze has put Solana's scalability to the test, but the volatility and speculative nature of such assets also bring drawbacks. As memecoin trading volume declines, the bank warned that Solana may struggle to maintain its growth momentum.

The Memecoin Frenzy Has Passed Its Peak

The report pointed out that the memecoin frenzy based on Solana has passed its peak, and the decline in usage combined with "cheap" transactions is not an ideal combination. The bank suggested that Solana should expand into other areas that require a large number of low-cost, fast transaction processing, such as financial settlement, decentralized cloud computing, or real-time data exchange, which align well with the high throughput characteristics of its blockchain.

Solana Decentralized Exchange Trading Volume. Source: Standard Chartered

According to the report, these areas may include high-throughput financial applications and traditional consumer applications like social media. However, the bank noted that scaling such applications may take several years, which could have serious consequences for Solana. If progress does not meet expectations, its market competitiveness, developer ecosystem, and platform reputation may suffer significantly, and its valuation could face substantial downward pressure.

"Therefore, we expect Solana's performance to lag behind Ethereum in the next two to three years, before catching up, at least in terms of actual value."

Standard Chartered's Cryptocurrency Target Price. Source: Standard Chartered

Solana's Advantages Are Gradually Disappearing

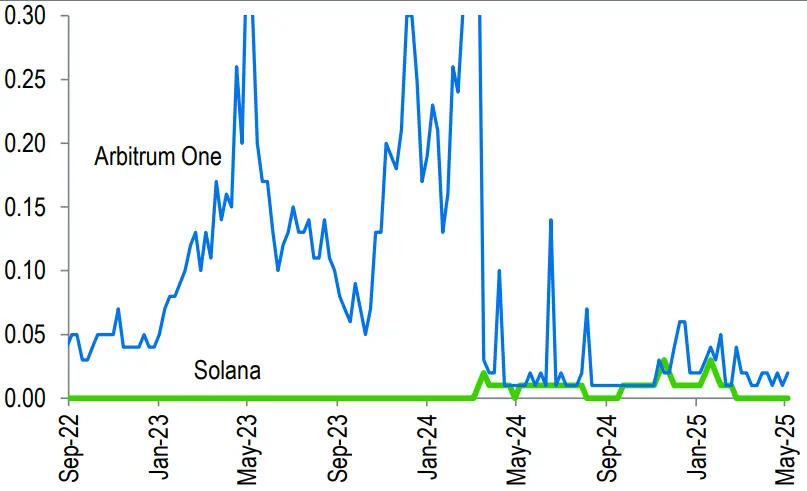

For a long time, Solana has positioned itself as a fast, low-cost, and smart contract-supporting L1 public chain, directly competing with Ethereum. However, this advantage may be gradually weakening.

Average Transaction Fees of Solana and Arbitrum. Source: Standard Chartered

Since the Dencun network upgrade in March 2024, Ethereum's second-layer platform has surpassed Solana in terms of average transaction costs. This shift puts pressure on Solana's value proposition as "the cheapest high-throughput blockchain." Standard Chartered pointed out that Ethereum has achieved more efficient scaling by modularizing data availability, execution, and consensus, maintaining decentralization while enhancing scalability: "The modular approach allows Ethereum to scale transaction processing at low costs (after the Dencun upgrade) while retaining the high decentralization security advantages of the mainnet."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。