Author: Beihu

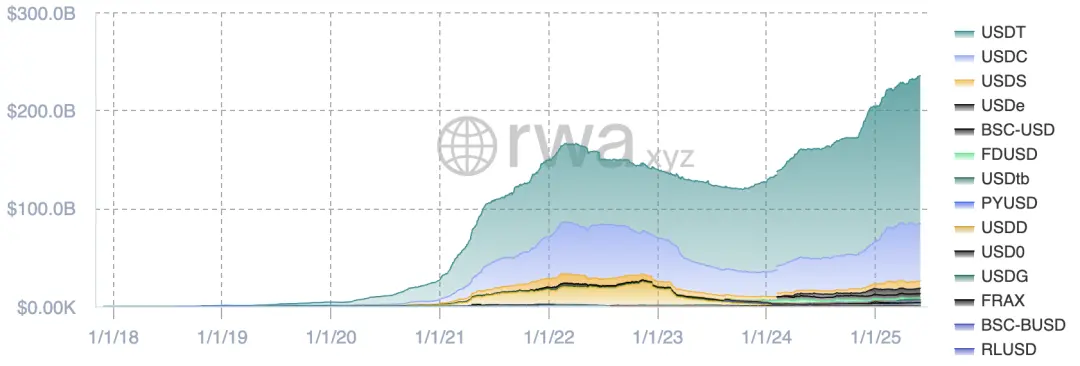

When I first wrote about stablecoins last October, the total market capitalization of stablecoins was only $170 billion. In the following months, the on-chain market heated up, and the U.S. government continued to push forward, the total market capitalization of stablecoins has skyrocketed to $230 billion, an increase of 35% in just over six months. To exaggerate a bit, stablecoins have become a paradigm shift that macro research cannot ignore.

Currently, the mainstream stablecoin issuance model is "collateralize $1, issue $1 stablecoin." Issuers use the collateralized dollars to purchase U.S. Treasury bonds and money market funds, with the interest serving as the company's income.

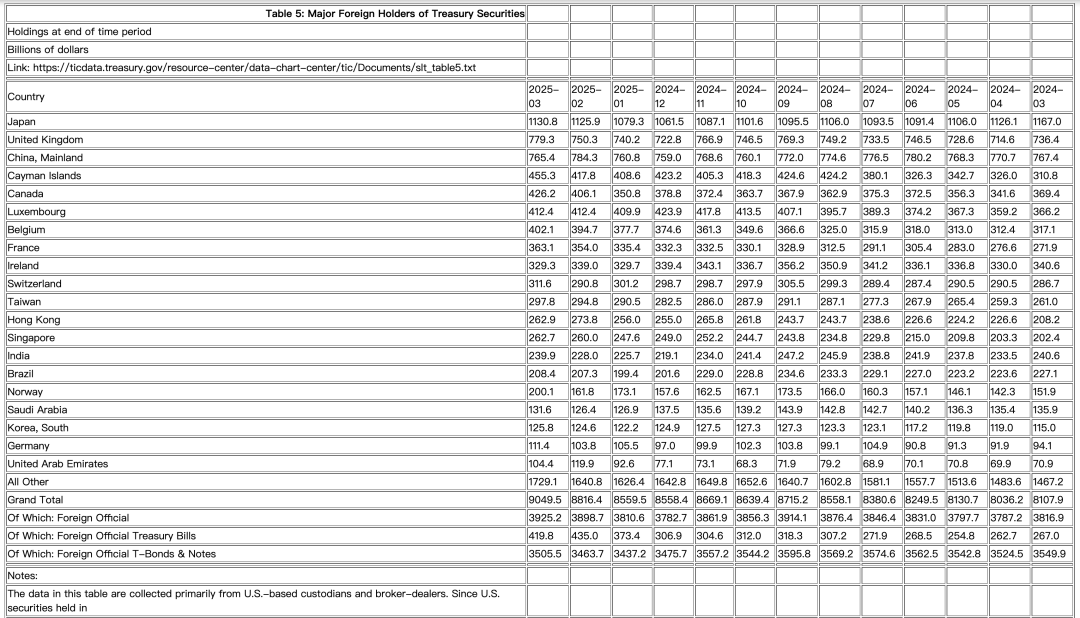

Looking only at the two largest, $USDT has a market capitalization of $150 billion, holding nearly $100 billion in U.S. Treasury bonds maturing within three months, plus $20 billion in reverse repos and money market funds; $USDC has a market capitalization of $58.6 billion, holding $24 billion in U.S. Treasury bonds maturing within three months, plus $30.4 billion in reverse repos. Together, these two hold a total amount of U.S. Treasury bonds that is close to that of South Korea.

This aligns with the conclusions of the BIS latest paper, which found that:

(1) Whenever there is a net inflow of about $3.5 billion (2 standard deviations) into stablecoins, it will lead to a decrease of 2 to 2.5 basis points in the 3-month Treasury yield within 10 days;

(2) Conversely, when there is an equivalent outflow, the yield can increase by 6 to 8 basis points, showing a clear asymmetric effect;

(3) This impact is mainly concentrated on the short-end yield curve, with almost no effect on long-term Treasury bonds (because they only buy short-term);

(4) $USDT has the largest contribution to interest rate effects, accounting for 70% of the total impact (due to its large volume).

From the perspective of marginal purchasing volume, from Q1 2024 to Q1 2025, $USDT and $USDC together increased their holdings of U.S. Treasury bonds by $35.3 billion, which is on the same order of magnitude as the increases from the UK (+$42.9 billion) and Canada (+$56.8 billion), and the decrease from Japan (-$36.2 billion).

Furthermore, a recent study by the NBER reveals the structure of the U.S. Treasury market, categorizing players into two main types:

One type is "granular-demand investors," which have term preferences and institutional constraints, including commercial banks, insurance companies, pension funds, mutual funds, money market funds, foreign central banks, and private investors. Their allocation behavior is usually driven by duration matching, liquidity regulatory requirements, or yield targets, and their demand is insensitive to price changes, possessing cross-term substitutability;

The other type is "arbitrageurs," mainly composed of hedge funds, broker-dealer market makers, and lead underwriters, who have a strong risk tolerance and are responsible for absorbing market imbalances and taking on risk pricing roles in the term structure, especially active in the short-term Treasury market.

One major conclusion of the research is that in the short-term U.S. Treasury market, the degree of arbitrageur involvement is high and risk is low, making the market more elastic (interest rates are less sensitive to supply and demand); in the long-term bond market, risk is higher, arbitrage participation decreases, and prices are more sensitive to supply and demand. To quickly cash out large redemptions, stablecoin issuers can only hold highly liquid, safe assets (such as U.S. Treasury bonds maturing within three months), belonging to the first type of player in the U.S. Treasury market. As the scale expands, stablecoins are forming a new structural force that suppresses short-end interest rates.

How do stablecoins affect the money supply in the U.S.? When $1 is converted from a bank account to an on-chain stablecoin, it reduces the classic measures of M1 and M2; however, as a shadow currency, it does not decrease the actual purchasing power in the economy. If stablecoins are used for everyday payments rather than just trading and earning interest, their velocity V will be significantly higher than that of traditional currency.

But if 1 Argentine peso is directly converted into a dollar stablecoin, the impact would be substantial.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。