"Peak" or "Fake Fall"?

Written by: Zhao Ying

Source: Wall Street Journal

With an unexpectedly large official release, Labubu is experiencing a dramatic shift from being sold at dozens of times the retail price to a sudden halving of second-hand prices overnight, as market sentiment towards Pop Mart has turned from fervent enthusiasm to mass sell-off.

Just a week ago, Labubu was still "hard to get," with scalpers monopolizing the supply using order-snatching software, reselling at a markup of 10 to 30 times and still finding buyers. However, from June 18 to 19, the situation took a dramatic turn.

On the evening of June 18, Pop Mart's official mini-program restocked the Labubu "High Energy Ahead" series with unprecedented intensity and opened online pre-sales for the first time.

The official "generosity" instantly ignited the second-hand market, with data from trendy toy resale platforms showing that Labubu series prices generally plummeted by about 50%.

The market also began to question the sustainability of the IP's popularity, with some investors believing that Labubu might follow the same path as the violent bear, leading to Pop Mart's stock price dropping over 5% today due to the news!

A "Routine Restock" Turns Scalpers from Huge Profits to Losses

On June 18, a "routine restock" by Pop Mart triggered an earthquake in the second-hand market.

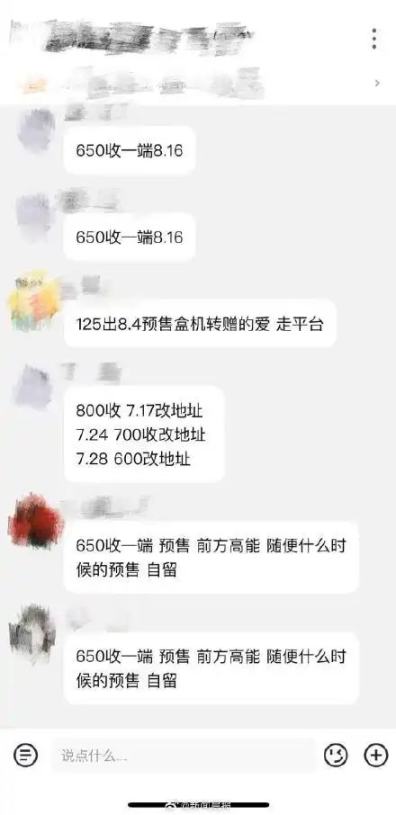

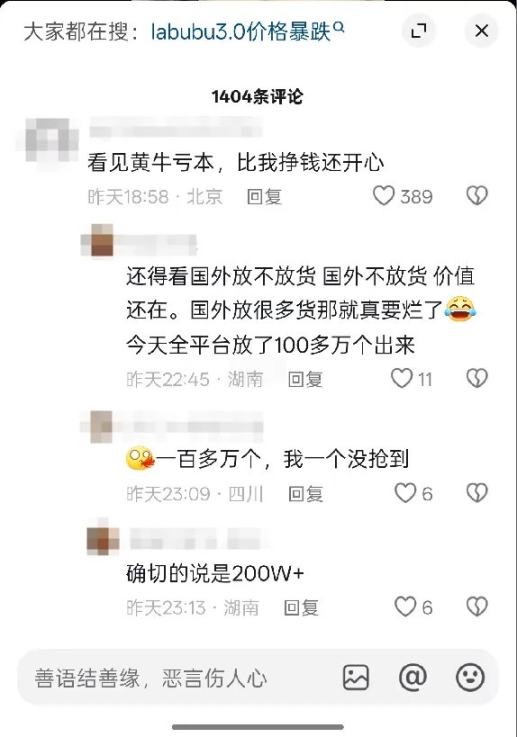

Data shows that this restock caused a price avalanche: according to trendy toy resale platforms, Labubu series prices generally fell by about 50%. Previously, whole boxes (6 blind boxes) had been speculated to prices as high as 1500 to 2800 yuan, but they plummeted to the range of 650-800 yuan. Even the rare hidden version "Original Me" saw its price drop from a high of 4600 yuan to around 2800 yuan, a decline of over 38%.

On social media, consumers who had previously struggled to get their hands on the product shared screenshots of their successful orders, with some stating that the quantity and frequency of this restock far exceeded previous ones, indicating that the official really wanted fans to buy.

In the once-booming scalper groups, the atmosphere has dropped to freezing point. Sellers listing pre-sale orders at 1200 yuan received no inquiries, replaced instead by low-price offers of "700 yuan available."

Some scalpers faced daily losses of tens of thousands of yuan due to the sudden price drop, and this dramatic reversal has led netizens to gloat: seeing scalpers lose money makes me happier than making a profit myself.

This "ugly cute" elf, which once drove global superstars like Rihanna and Beckham crazy, is experiencing its first price collapse since its inception—this may just be the beginning of the challenge to Pop Mart's 350 billion Hong Kong dollar market value myth.

Market Debate: "Peak" or "Fake Fall"?

The doubts facing Labubu stem not only from price fluctuations but also from fundamental skepticism about the sustainability of its IP popularity. Investors are beginning to compare it with historically phenomenal IPs to look for signs of decline.

Previous articles have pointed out that, based on internet popularity data, these concerns are not unfounded. The popularity of the violent bear lasted from 2020 to 2022, maintaining for two years; while the hit game "Black Myth: Wukong" saw its popularity last less than three months; and Nezha during the Spring Festival similarly only maintained its high-profile moment for about three months.

Further analysis suggests that there are four common signals indicating that the hype around assets among four types of young people has peaked: first, media and search popularity rates peak first; second, producers take advantage of high prices to release large quantities; third, the price gap widens between "high-end stability and mid-end collapse"; and fourth, liquidity stagnates. LABUBU is highly likely to repeat the paths of AJ and the violent bear in the next 6 to 12 months, with a probability of ≥50% retracement after prices are emotionally overvalued, with an objective probability of about 95% (±10 percentage points).

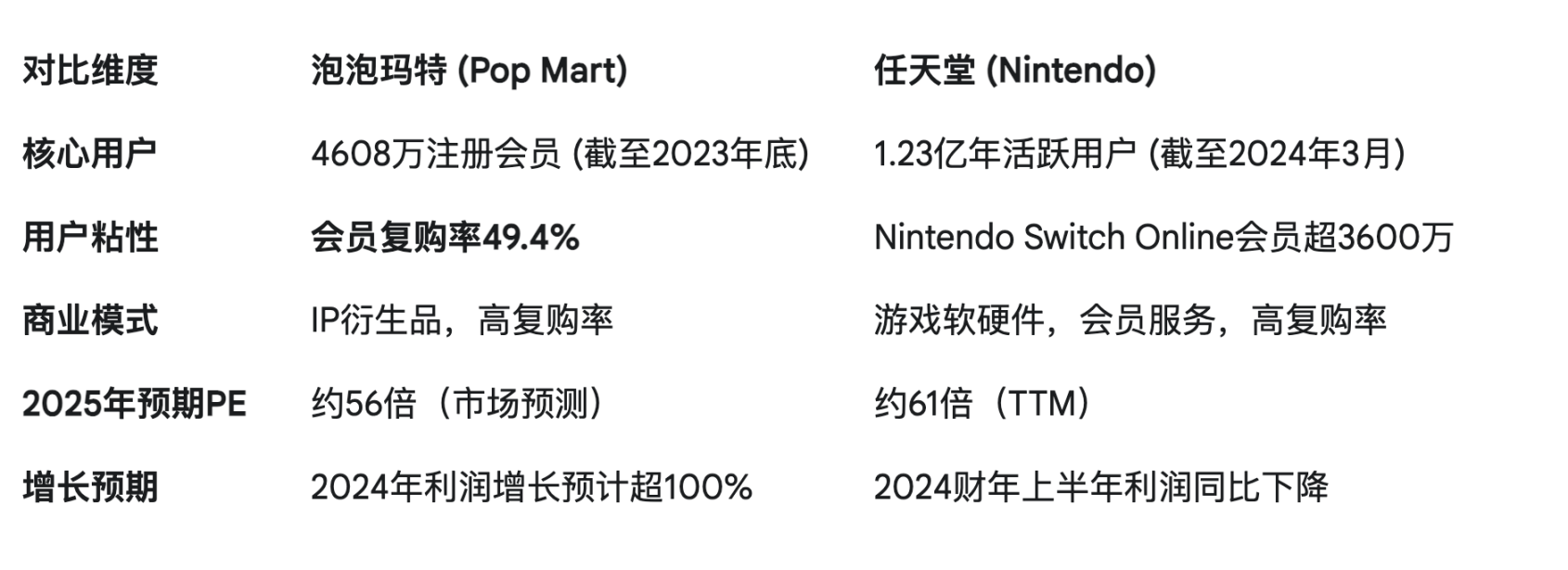

However, supporters have proposed a different reference point, comparing Pop Mart with another company that also relies on core fans and IP ecology—Nintendo.

The analysis compares Pop Mart with gaming giant Nintendo: Nintendo has 106 million active users, a market value of about 850 billion yuan, revenue of 78 billion yuan, and a price-to-earnings ratio of 61 times; while Pop Mart has 46.08 million registered members, a member repurchase rate of 49.4%, an expected price-to-earnings ratio of 56 times in 2025, and an anticipated profit growth of over 100%.

This analysis argues that Labubu, like games, does not need to be "loved by everyone." Its commercial foundation lies in a large and highly loyal fan base with a high repurchase rate. Pop Mart's nearly 50% member repurchase rate is the "moat" of its business model.

From this perspective, Pop Mart's valuation does not seem unreasonable. The key question is whether Labubu can become a timeless classic IP like Super Mario, rather than a fleeting internet celebrity product.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。