xStocks and GMGN Strategic Alliance: What Wave of On-Chain US Stock Trading Will Emerge?

When Tesla stocks transform into TSLAx tokens on the Solana chain, the boundary walls between traditional finance and the crypto world come crashing down.

On June 30, Swiss fintech company Backed Finance officially announced the launch of its tokenized stock product xStocks, simultaneously landing on mainstream cryptocurrency trading platforms such as Kraken and Bybit, as well as DeFi protocols within the Solana ecosystem.

Over 60 US stocks—from Apple and Nvidia to Tesla—have been converted into on-chain tokens, opening up trading to global non-US users.

Today, blockchain security platform GMGN announced a strategic partnership with Backed Finance's tokenization protocol xStocks to jointly build a secure infrastructure for US stock trading on the Solana chain. This collaboration marks a significant step into the ecological synergy deep waters of the RWA (Real World Assets) tokenization track, pushing US stock trading into the era of on-chain composability.

01 On-Chain Mirror Engine: xStocks' RWA Innovative Architecture

xStocks is not merely a simple tokenization of stocks; it has constructed a complete pipeline for the tokenization of real-world assets. Its operation is based on a trust chain of multi-institutional collaboration:

Asset Anchoring Mechanism: Backed Finance purchases US stocks through licensed broker Interactive Brokers and deposits them into isolated accounts at Europe's top custodian Clearstream, forming an off-chain asset reserve pool. For every share of Tesla stock deposited, one TSLAx token is atomically minted on the Solana chain, achieving value locking between on-chain and off-chain.

Dynamic Minting Protocol: Stock deposits trigger smart contracts to automatically execute token minting, with the entire process verified through zero-knowledge proofs to ensure transparency of asset backing. This mechanism endows traditional stocks with on-chain native asset properties.

Cross-Domain Liquidity Network: Tokens are integrated into centralized exchanges (CEX) like Kraken and Bybit, as well as decentralized exchanges (DEX) like Raydium through API networks, forming a multi-layered liquidity matrix. Market makers utilize cross-market price differentials for real-time arbitrage, maintaining price stability.

GMGN's involvement injects a security enhancement layer into this system. As a blockchain security expert, GMGN will provide xStocks with smart contract auditing, real-time threat monitoring, and asset custody verification services, addressing the previously most vulnerable aspects of the DeFi space.

02 Temporal and Spatial Deconstruction: 7×24 Hour Global Trading Continuum

xStocks reconstructs the temporal and spatial rules of capital flow:

Decoupling of Trading Time: Breaking through the traditional trading hours of the New York Stock Exchange from 9:30 AM to 4:00 PM, achieving continuous trading availability (trading remains open during US market closures, with prices frozen at closing prices). Tokyo investors can respond to Musk's tweets at midnight to buy or sell TSLAx, enabling cross-timezone capital allocation.

On-Chain Penetration of Fiat Currency Boundaries: When Argentine users purchase AAPLx with USDT, they effectively complete an on-chain penetration of sovereign currency. The traditional T+2 settlement cycle for cross-border investments is compressed to sub-second confirmation speeds on Solana.

DeFi Composability Breakthrough: In the Kamino protocol, NVDAx and SOL can be combined into LP tokens, or TSLAx can be collateralized in Compound to borrow USDC, achieving liquidity integration across asset classes. The asset isolation walls of traditional brokerages are breached by on-chain interoperability.

Table: Comparison of xStocks and Traditional US Stock Trading Paradigms

Dimension

Traditional US Stock Trading

xStocks On-Chain Trading

Trading Hours

Monday to Friday during market hours

5×24 hours (price synchronization) + 7×24 hours (trading functionality)

Settlement Speed

T+2 days

Sub-second confirmation

Cross-Border Costs

3%-5% fees

≈$0.01 per transaction

Asset Interoperability

Not supported

Can access DeFi protocol combinations

03 Ecological Expansion Map: GMGN's On-Chain Security Foundation

The collaboration between GMGN and xStocks is not merely a simple interface connection but rather the construction of a secure foundation for on-chain finance:

Smart Contract Firewall: GMGN's real-time monitoring system scans for contract vulnerabilities, preventing a repeat of incidents like the 2023 Curve attack.

Asset Mapping Verifier: Through dual verification of off-chain reserve audits and on-chain token supply, it prevents risks of asset decoupling similar to FTX.

Compliance Sandbox: Provides technical compliance support for Backed's Swiss DLT license and Jersey Island digital asset regulatory framework, constructing a regulatory adaptability architecture.

This collaboration comes at a time of explosive growth for the xStocks ecosystem: Kraken has launched over 60 tokenized stocks, Bybit supports trading of 78 stock assets, and the TVL of Solana DeFi protocols has increased by 23% month-on-month due to the injection of RWA assets. GMGN's involvement serves as a security accelerator for this expansion.

04 Underlying Risks and Challenges

Tokenized US stocks are not a risk-free utopia; they face three major challenges:

Decoupling of Rights Dilemma: Token holders find themselves in a vacuum of shareholder rights—without the ability to vote at Apple shareholder meetings, and dividends must be redistributed through Backed. This makes tokens more akin to price trackers rather than true equity.

Regulatory Hyper-Surface Game: The US SEC has explicitly included tokenized securities under securities regulation, leading xStocks to proactively block US users. Although a new framework has been established for stablecoin licensing in Hong Kong, there are still gaps in cross-border regulatory collaboration.

Technical-Credit Dual Risks: The lessons from the FTX bankruptcy, which left tokenized stock holders at the back of the line for claims, are still fresh. While Solana achieves high throughput, its history of network interruptions raises questions about financial-grade stability.

In response, GMGN introduces an MPC (Multi-Party Computation) custody solution, storing private key shards and establishing an on-chain asset freeze switch, setting up a circuit breaker mechanism for potential black swan events.

05 Expert Perspectives: Reconstructing the Financial Gravity Model

Industry leaders hold a strategically optimistic view of this ecological evolution:

"xStocks provides global investors with low-cost, instant access to US stocks through blockchain technology, reshaping traditional investment models."

—Arjun Sethi, Co-CEO of Kraken

"Tokenized securities are akin to the revolution of digital music, enhancing market efficiency and transparency, and reshaping securities issuance and trading."

—Paul Atkins, Chairman of the SEC

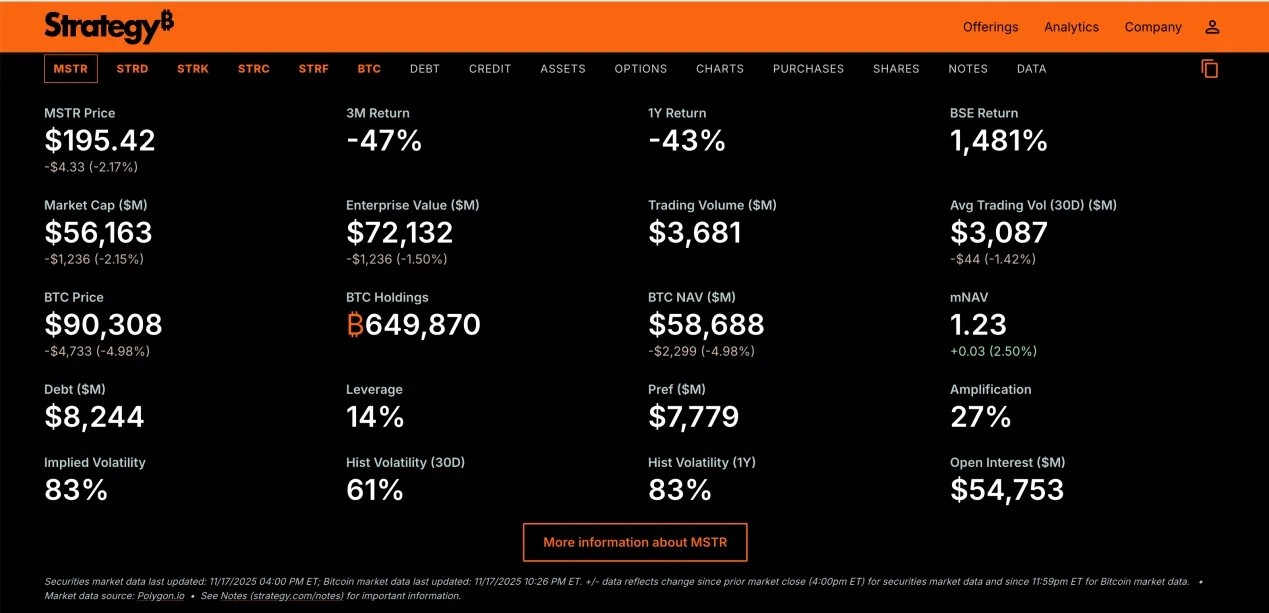

Boston Consulting Group predicts that by 2030, the global scale of tokenized assets will reach $16 trillion. Traditional institutions are actively positioning themselves:

Nasdaq collaborates with R3 to develop a Corda blockchain asset management platform.

Ondo Finance has tokenized US Treasury management assets totaling $580 million.

80% of BlackRock's institutional clients plan to allocate to tokenized assets by 2025.

As over 37% of Tesla's circulating shares are converted into on-chain tokens, the NYSE ticker may degrade into a historical reference frame—new capital pricing power is being restructured in the nebula of Solana's order book.

With GMGN's secure foundation, xStocks processes tens of thousands of TSLAx transactions daily on the Solana chain, while the paper certificates in Clearstream's vault remain silent as before. This juxtaposition reveals the core contradiction of the future of finance: the value carriers are migrating on-chain, while the institutional moats have yet to be fully reconstructed.

The bronze bull statue on Wall Street still stands, but as Nasdaq deploys Corda nodes and the wallet address of BlackRock's CEO is monitored holding Ondo tokens, the genetic mutation of traditional finance has already begun. The handshake between GMGN and xStocks has installed a safety valve for this silent revolution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。