Original Author: Grayscale Research

Key Takeaways

· Sui is a next-generation blockchain designed for scalable applications, aimed at supporting consumer-grade applications for the masses (and other scenarios). Grayscale Research believes that Sui has an outstanding combination of technical advantages and supporting strategies, which may allow it to stand out in the competitive Smart Contract Platforms Crypto Sector.

· To attract billions of users, blockchain-based applications must possess functionalities that are on par with or even stronger than current Web 2.0 applications. This means high transaction throughput and a low barrier to entry for mainstream users. Although achieving this is not easy, we believe Sui may have the right elements to reach this goal.

· Mysten Labs, the core development team behind Sui, was founded by key members of the Facebook (now Meta) Diem blockchain project. Mysten Labs has a top-tier technical background and has adopted a proactive vertical integration development approach, building not only at the blockchain layer but also focusing on the application layer to create a complete technology stack.

· The native token of Sui, SUI, currently has a market capitalization of approximately $10 billion [1]. As a project still in its early stages, only 33% of the total supply of Sui is currently in circulation; over 50% of the token supply is expected to be released after 2030 [2].

· The SUI token provides investors with an opportunity to access the next generation of early-stage blockchain, especially as it is expected to make breakthroughs in mainstream consumer applications. Grayscale offers qualified accredited investors a channel to invest in Sui through the Grayscale Sui Trust.

Sui launched in 2023 and was founded by core members of the Facebook Diem project. During their time at Facebook, these team members aimed to create a crypto platform that could serve billions of users worldwide, in other words, they set a "global scale" goal from day one. After leaving Facebook to create Sui, they continued to advance development based on the foundation they had previously built.

Sui is a next-generation blockchain with "usability" and "scalability" as its core design goals. Its vision is to provide on-chain ownership and global instant value transfer capabilities while creating a user experience that matches or exceeds that of top Web 2.0 tech companies. Therefore, we believe the next "hit consumer-grade crypto application" is likely to emerge from the Sui ecosystem.

SUI is the native token of the Sui network and can be found in Grayscale's Smart Contract Platforms Crypto Sector. The Sui network primarily competes with high-throughput, low-cost chains such as Solana, Ethereum Layer 2, and The Open Network (TON) in terms of transaction fee revenue and market share. In this competitive landscape, not all projects can succeed. Therefore, each network needs to have differentiated characteristics to stand out.

Grayscale Research believes that Sui may possess a set of differentiated advantages, including:

· Technical Aspects: Utilizing the Move programming language and a unique blockchain architecture gives Sui a natural advantage in scenarios such as payments and gaming;

· Team Strength: The team comes from Facebook and is operated by Mysten Labs, with members having strong backgrounds in product development, computer science, and cryptography; supported by capital from a16z and Apollo Global;

· Strategic Path: The Mysten team takes a coordinated approach to build a fully decentralized vertical technology stack—not only developing at the blockchain layer but also promoting growth at the application layer to drive ecosystem development.

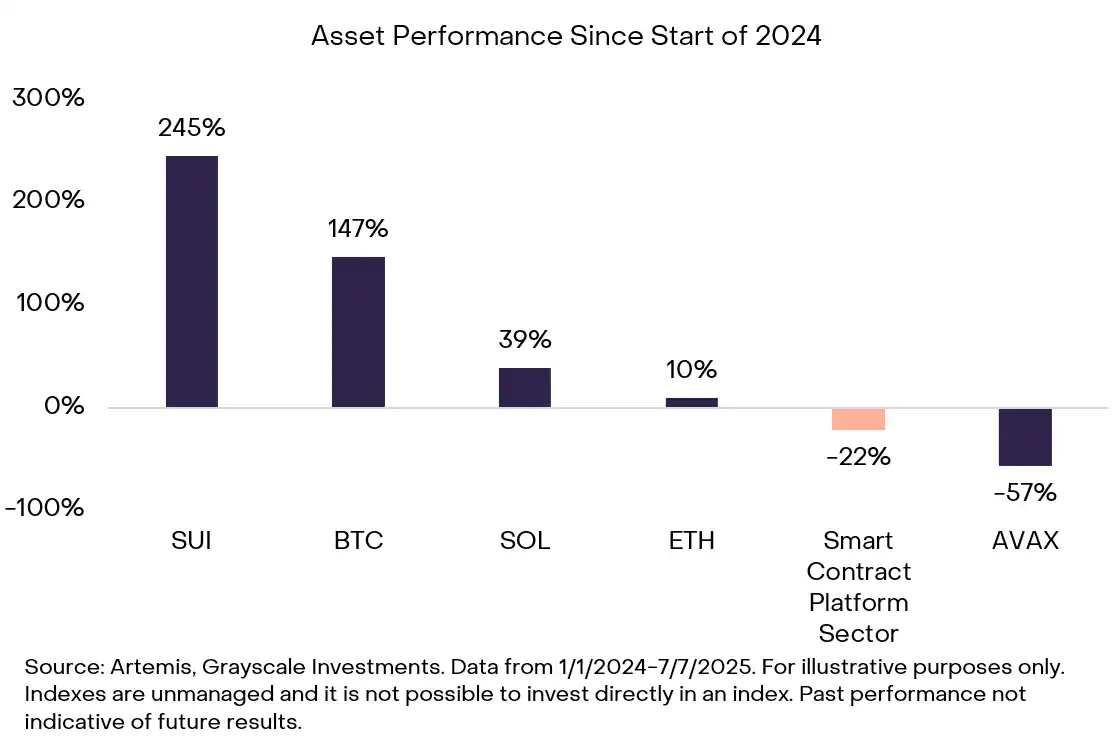

Since early 2024, SUI has become one of the best-performing assets in the crypto market, outperforming Bitcoin (BTC) and its industry and major competitors: Solana (SOL), Ethereum (ETH), and Avalanche (AVAX) (see Chart 1).

Chart 1: Over the past year (from January 1, 2024, to July 8, 2025), SUI has been one of the best-performing assets in the crypto market.

Why Sui Stands Out

Every blockchain aims to achieve "usability" and "scalability" under specific constraints. What sets Sui apart is its technical architecture, the team behind it, and its vertically integrated strategic path.

1. Technology: Blockchain Design and Programming Language

· Blockchain Design: Sui's technical architecture is specifically designed for global large-scale expansion, particularly suitable for high-frequency, low-latency use cases such as payments and gaming.

· Predictable Low Transaction Fees: Low costs and stable, predictable fees help reduce user friction and optimize the user experience.

· Object-Oriented Model and Parallel Processing: Unlike other account-based blockchains like Ethereum and Solana that update a global smart contract ledger, Sui uses an object-oriented model. In this model, each asset is an independent object associated with a wallet, allowing for parallel processing of transactions. The system only updates relevant objects rather than a globally shared state, reducing computational load, improving efficiency, and achieving higher network scalability.

· "Fast Path" Execution Mechanism: Sui distinguishes between simple asset transfers and complex smart contract calls. [3] Peer-to-peer simple asset transfers can be executed via a "fast path," achieving near-instant final confirmation. [4] This gives Sui a significant advantage in payment scenarios.

· Horizontal Scalability: Unlike most blockchains, Sui's network capacity can linearly scale with computational power. Sui's validating nodes can enhance processing performance by adding servers to meet growing demand. The team states that an 8-fold increase in hardware capability can lead to an 8-fold increase in throughput without increasing latency.[5]

· Programming Language: Sui's programming language, Move, was initially developed by Mysten Labs team members during their time at Facebook. The Move language is adapted from Rust, one of the most popular programming languages globally. As a high-level programming language, Move provides strong guarantees for smart contract development, significantly reducing the likelihood of common programming errors and vulnerabilities [8]. In contrast, Solidity (the programming language for Ethereum) lacks these built-in protections, placing a greater burden on developers to manually implement security best practices when writing smart contracts.

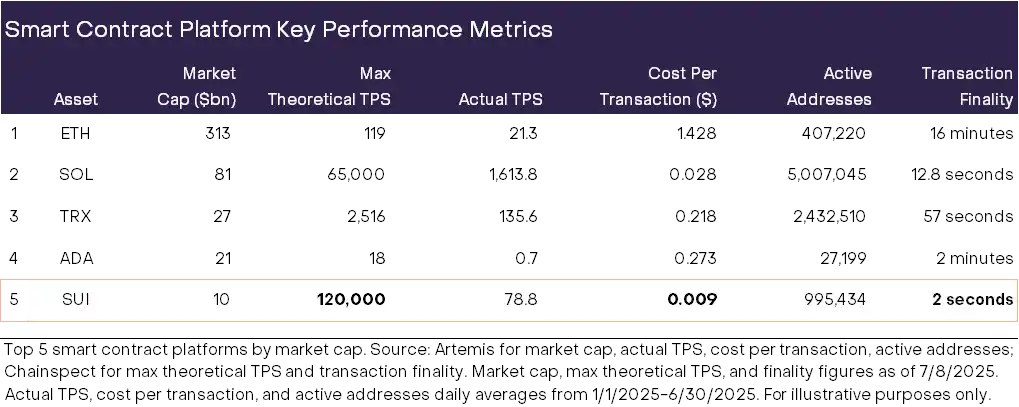

Due to these features, Sui theoretically has the highest throughput [6], lowest fees, and fastest confirmation times among the top five smart contract platforms by market capitalization (see Chart 2). As of July 2025, Sui slightly lags behind Solana in actual transactions per second (TPS), but this is primarily due to the level of adoption still being in development rather than a limitation of its architecture. Therefore, as the ecosystem further adopts, Sui's actual TPS is expected to improve.

Chart 2: Key blockchain metrics for the top five smart contract platforms by market capitalization.

2. Team: First-Class Entrepreneurs with Deep Experience

Mysten Labs brings together award-winning technical experts in product development, computer science, and cryptography, with co-founders including:

· Evan Cheng: CEO of Mysten, former Engineering Director at Facebook/Meta

· Sam Blackshear: CTO of Mysten, founder of the Move language, former lead engineer at Facebook/Meta, involved in the Diem project

· Adeniyi Abiodun: Chief Product Officer at Mysten, previously responsible for Facebook/Meta's cryptocurrency-related products, including Diem and Move

· George Danezis: Chief Scientist at Mysten, recipient of the Computer Laboratory Ring Award

· Kostas Chalkias: Chief Cryptographer at Mysten, former Chief Cryptographer at Facebook/Meta, three-time winner of the best paper award in cryptography research [9]

Mysten Labs has over 100 members, with more than 75 holding PhDs.[10] In our view, what sets Mysten apart is not only its technical background but also its ability to efficiently translate technical expertise into actual products. In contrast, the foundational development teams of other networks often take a more academic approach.

3. Strategy: Vertically Integrated Development Path

Mysten not only focuses on the blockchain infrastructure layer but also actively participates in the application layer development of Sui, building products, tools, and consumer-grade applications throughout the network. This holistic strategy includes the following key components:

Walrus

Walrus is a decentralized storage solution designed for performance and cost optimization. Unlike centralized storage services like AWS, decentralized storage eliminates single points of failure and ensures data integrity. Among various storage solutions, Walrus stands out with significant appeal. Its unique erasure coding technology drastically reduces storage costs, saving up to 80% compared to Filecoin and Arweave.[11] Walrus has been used for content storage by mainstream crypto media such as Decrypt and Unchained Podcast, and it has also been utilized by Plume Network for storing Real World Asset (RWA) data. Walrus is inherently scalable, supporting high-throughput data-intensive applications such as RWA datasets and large language models.

In many ways, Walrus is to decentralized storage what Sui is to the blockchain execution layer: it eliminates friction, reduces costs, and opens new directions for real-world applications. As applications on Sui, such as AI models, video content, and off-chain proofs, continue to grow, Walrus is expected to become the core data infrastructure for future growth of the Sui network.

DeepBook

DeepBook is an on-chain Central Limit Order Book (CLOB) deployed on Sui, designed for institutional-level trading. Currently, most DeFi systems rely on Automated Market Maker (AMM) mechanisms. In contrast, DeepBook supports more precise order control, lower slippage, and tighter spreads, better meeting the needs of professional traders and market makers.[12] As a shared liquidity layer in the Sui ecosystem, DeepBook allows multiple DeFi applications to share a unified order book, thereby enhancing capital efficiency and reducing liquidity fragmentation.

DeepBook currently serves the first and second largest decentralized exchanges on Sui and is adopted by several lending and derivatives applications.[13] As Sui is adopted by more institutions, we believe that DeepBook's trading volume and user count will also grow in tandem, becoming a key component of Sui's on-chain financial infrastructure and a core driver of its DeFi growth.

Other Components

zkLogin: A patented technology that allows users to register with a single click using Google or Twitch accounts, accessing on-chain applications without the need for mnemonic phrases;

SuiNS: Sui's decentralized domain name service, similar to Ethereum's ENS or GoDaddy;

Ika: An innovative network that allows any crypto asset, including Bitcoin and XRP, to be traded directly on Sui without the need for cross-chain bridges or wrapped assets. The Ika token is planned to launch in mid-July.

The Sui ecosystem—including the Sui blockchain itself, zkLogin, DeepBook, Walrus, SuiNS, and Ika—forms the first fully vertically integrated application suite in the crypto industry.

Although Sui's level of decentralization is slightly lower compared to other blockchains, this may be an advantage for its target market (such as mainstream consumer applications). Given that Sui is still in its early stages (having launched only two years ago), the Mysten team is actively rolling out various products covering a wide range of use cases, significantly lowering the development and user entry barriers. This proactivity will help accelerate adoption and further enhance the ecosystem's stability.

Key Growth Factors

Compared to mature networks like Ethereum and Solana, Sui is still in the early stages in terms of developer appeal and ecosystem maturity.[14] However, with its strong scalability and user-centric design, SUI has strong growth potential at its current market capitalization of approximately $10 billion (only 12% of SOL and 3% of ETH).[15]

For Users, Sui provides a low-barrier crypto experience through zkLogin. In an environment where complex mnemonic phrases are still required, zkLogin allows users to access wallets using familiar Web2 credentials like Gmail. This not only lowers the entry barrier but also ensures privacy through encryption, ensuring that identity providers do not know that users are using a crypto wallet—this is a unique feature of Sui.

For Developers, Sui offers a "transaction sponsorship" feature, which can be seen as a "cost of acquiring users" mechanism. Developers can provide "gas-free" transactions, meaning users do not have to pay fees. By combining zkLogin with transaction sponsorship, a complete Web2 user experience can be achieved: users can record on-chain interactions without even opening a wallet or holding tokens.

We believe that a frictionless user registration experience, fee-free application usage processes, intuitive interaction methods, and a secure development environment will provide Sui with a solid foundation for user and developer growth, and are likely to create network effects.

Despite still being in the early development stage, Sui has shown strong network growth in the first half of this year. Monthly active users (MAU) surged from about 10 million at the beginning of the year to over 40 million (ranking second among smart contract platforms), although there has been a slight decline in recent months. In addition to applications launched by Mysten Labs, the Sui ecosystem has also seen widespread adoption of several third-party products, such as Recrd (a monetization platform for creators with 490,000 daily active addresses) and Fan TV (a video sharing platform that has onboarded 5 million wallets into the crypto ecosystem).[16]

Fees and Value Accumulation

The key to long-term competition in the smart contract platform space lies in value accumulation and the ability of the blockchain to generate network fee revenue. Sui generates network revenue through transaction fees, which accumulate value for stakers in the form of rewards, rather than accumulating value for token holders through token destruction.

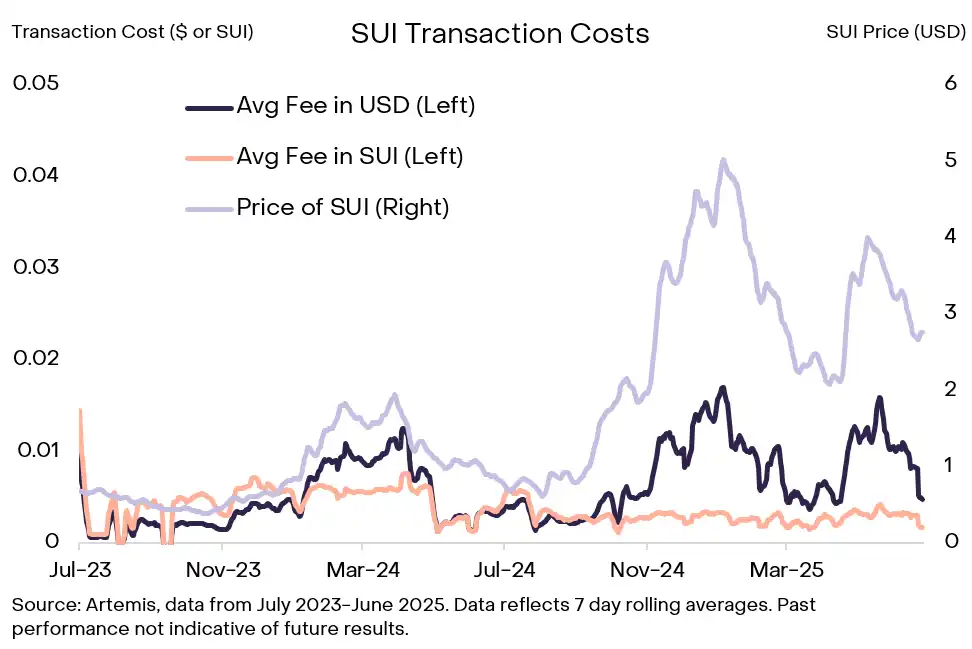

Sui's transaction fees are divided into computation fees and storage fees, with rates generally anchored to a reference price determined by validating nodes every 24 hours. Therefore, transaction costs remain relatively stable throughout the day, achieving smoother and more predictable pricing. This price stability means that Sui is less affected by spikes in gas prices during periods of high network activity, unlike networks such as Solana and Ethereum, which experience significant intra-day fee fluctuations.

Chart 3: Sui's transaction fees are low and stable.

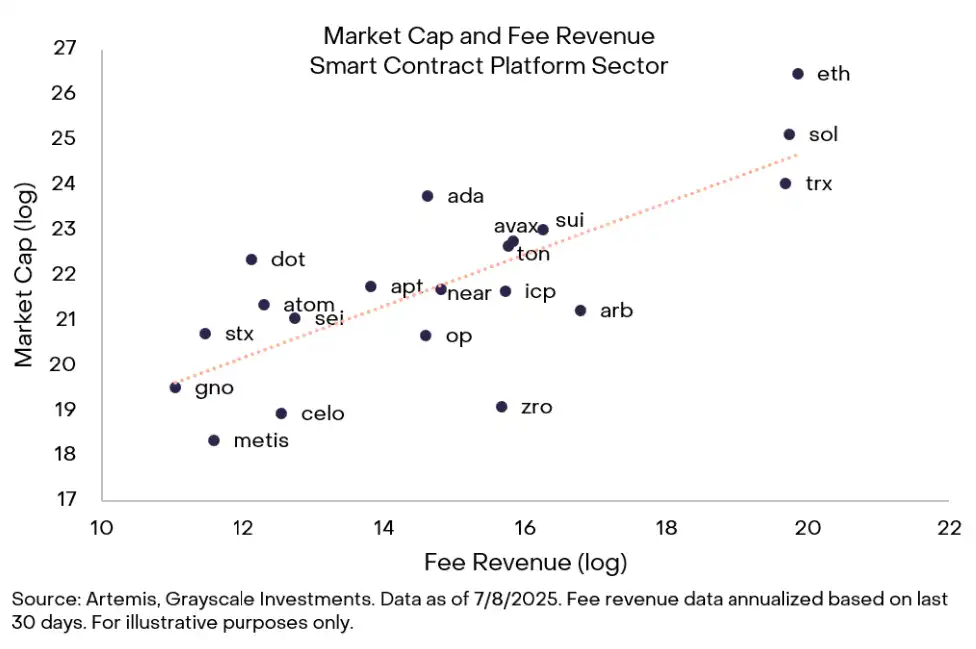

While Ethereum and Solana are expected to generate over $500 million in annualized network fee revenue by 2025, Sui's current annualized revenue is estimated to be only $15 million.[17] This indicates that Sui is still in the early stages of monetizing users, partly due to its extremely low transaction fees (with average fees about 1/3 of Solana and 1/150 of Ethereum).[18] Low transaction costs mean that Sui needs to significantly scale its network activity to reach revenue levels comparable to its largest competitors. In terms of market capitalization and fee revenue comparison, SUI's valuation currently appears reasonable (see Chart 4).

Chart 4: Comparison of market capitalization and fee revenue in the smart contract platform sector.

Token Supply Still Expanding

As a relatively early-stage project, only about 33% of Sui's token supply is currently in circulation, with over 50% of the total supply set to unlock after 2030.[19] Under other conditions remaining constant, the inflation rate of the tokens may exert pressure on valuation, but this can be offset by the growth in network adoption.

The SUI token was issued in May 2023, with a total supply of 10 billion tokens. The initial token distribution is as follows:[20]

· 50% allocated to a community reserve managed by the Sui Foundation, including delegation programs, validation node subsidies, research and development, and funding programs;

· 20% allocated to early contributors;

· 14% allocated to venture capital firms;

· 10% allocated to the Mysten Labs treasury;

· 6% for community access programs and application testers;

In the coming year, SUI's annual inflation rate is 17.4%, which will release tokens worth approximately $1.7 billion to the market (at current prices).[21]

Risk Factors Consideration

While some Layer 1 blockchains adopt a "purely decentralized" approach, Sui has taken a more gradual approach. Currently, Sui has a relatively small number of validating nodes and a high staking threshold,[22] which means it is slightly less decentralized and resistant to censorship compared to more mature networks like Ethereum. In contrast, Sui places greater emphasis on hardware performance and scalability.

Another factor is the strong dominance of Mysten Labs. We believe this is an advantage in the short term, as Mysten Labs can prioritize development and quickly deliver applications. However, if the ecosystem does not further decentralize in the long term, it may limit the scalable market for the Sui network. Additionally, Mysten Labs' deep involvement in both infrastructure and application layers may create a "competitive squeeze" effect in the short term for other developers looking to build applications in the same space.

Sui also faces fierce competition in the smart contract platform space. Established players like Ethereum and Solana hold higher market shares and on-chain asset scales. Emerging networks like Monad offer high-throughput alternatives. Meanwhile, TON can leverage Telegram's massive user base for distribution. However, we believe that Sui's technical capabilities and Mysten Labs' strategic path can achieve differentiation in certain specific scenarios (such as gaming, trading, and payments) by providing lower-latency solutions.

Conclusion

Sui is a next-generation blockchain born for scalability and usability. Its architecture is designed to support consumer-grade applications, featuring low fees, near-instant final confirmation times, and intuitive user registration processes—these are key elements for onboarding large-scale users. Unlike many competing networks that focus on speculative uses or have yet to solve throughput issues, Sui has aimed for large-scale implementation from the start, and Mysten Labs has consistently focused on driving the emergence of the next "killer application." [23]

With a current market capitalization of $10 billion and a majority of its token supply yet to be released, the project is still in the early stages of its lifecycle. But this also means that its growth potential has not been fully realized. In our view, SUI is a growth-oriented investment worth holding firmly, offering diversified exposure to the core proposition of "onboarding consumer-grade applications." With a strong technical foundation, a top-tier team at Mysten Labs, and a vertically integrated development strategy, Sui has a solid basis for achieving this vision.

Glossary

Central Limit Order Book (CLOB): A trading system where buyers and sellers place orders based on price and time priority, facilitating trades and forming a transparent market order book.

Smart Contract Platform: A blockchain system that allows developers to deploy self-executing code (smart contracts) that automatically enforces rules and transactions, eliminating the need for intermediaries.

Throughput: The total number of transactions a system can process within a given time, commonly used to measure blockchain performance.

TPS (Transactions Per Second): An indicator reflecting the scalability of a blockchain, referring to the number of transactions the system can process per second.

Validators: Network participants responsible for verifying and adding new transactions to the blockchain, typically earning rewards through this process.

Automated Market Makers (AMMs): Protocols that facilitate on-chain asset trading using algorithms and liquidity pools, serving as a replacement for traditional order book mechanisms.

Gas Fees/Prices: Fees that users must pay to compensate for the computational resources required to execute transactions or smart contracts.

Token Burns: The process of permanently removing tokens from circulation, usually aimed at reducing supply and increasing the value of the remaining tokens.

Staking: The act of locking tokens to support network operations (such as transaction validation), typically earning rewards or returns in the process.

Data References

[1] Source: Artemis, data as of 7/8/2025.

[2] Source: Artemis, data as of 7/8/2025.

[3] Sui's architecture separates simple object transfers—such as sending tokens—from complex transactions involving smart contract execution. This design enables faster and more scalable processing by allowing simple transfers to bypass the full consensus mechanism.

[4] Chainspect estimates finality at 2 seconds as of 7/7/2025.

[5] Crypto Slate. Sui aims to become the “Internet Coordination Layer,” says Mysten Labs Co-Founder.

[6] Theoretical throughput refers to the amount of transactions per second that a particular blockchain can process at its maximum capacity.

[7] Top by market cap referring to Layer 1s with $10bn in market cap or over.

[8] High-level language features include type safety, memory safety, and support for formal verification.

[9] Outliers: Kostas Chalkias, Mysten Labs: The Cryptographers of Greece and the Blockchain of the Future.

[10] According to discussions with the team.

[11] Hacker Noon: Can Decentralized Storage Finally Go Mainstream? Walrus.xyz on Sui Might Hold the Answer.

[12] Backpack Exchange. What is DeepBook? A Decentralized Order Book for the Sui Ecosystem.

[13] DeFi Llama, data as of 7/7/2025. Cetus and Bluefin, largest by 30d DEX volume.

[14] By number of developers (Electric Capital) and number of dapps (Dapp Radar). Data as of 7/7/2025.

[15] Artemis, data as of 7/8/2025.

[16] Source: FanTV Creators Reach Millions on Sui, Recrd numbers based on Artemis daily transacting users.

[17] Source: Artemis. Based on fee revenue from the first half of 2025.

[18] Artemis, data as of 7/7/2025. Data based on averages for the first half of 2025.

[19] Tokenomist, data as of 7/7/2025.

[20] Figment, Sui Tokenomics.

[21] Tokenomist, as of 7/7/2025.

[22] Around 117 validators as of 7/7/2025 (Suivision.xyz) and a 30 million SUI validator staking requirement.

[23] The Block. Sui creator says crypto's 'ChatGPT moment' coming as protocol celebrates mainnet's first year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。