Preface

In 2011, a 17-year-old Russian-Canadian boy initially wrote articles for a website called "Bitcoin Weekly," earning 5 bitcoins per article. "This was my first real job, and my hourly wage was about $1.30," he later recalled.

Those 5 bitcoins are worth $600,000 today—a staggering increase that reflects the explosive growth of the entire cryptocurrency era.

Even more astonishing is that the boy, Vitalik Buterin, created Ethereum, which has developed at a pace comparable to Bitcoin itself: now with a market capitalization of over $400 billion, it facilitates more than $5 trillion in transactions annually.

Follow this article as we look back at the ten years since the launch of Ethereum's genesis block, a decade marked by the fervor of the blockchain industry, and see how he transformed from a $1.30-an-hour writer into the architect of an infrastructure that changed the operational logic of the entire digital world, exploring the technological changes at the grassroots level that led to shifts in the superstructure.

1. Prehistoric Story—Bitcoin is the Beginning of a Dream

1.1, From Bitcoin Inspiration to Ethereum Creator

In 2013, the soaring price of Bitcoin ignited Vitalik's boundless imagination, but it also made him aware of Bitcoin's limitations. As a writer for "Bitcoin Magazine," he delved deeper into the Bitcoin community, only to find that this revolutionary financial system faced significant challenges in transitioning to new programmable goals, making it difficult to expand the blockchain framework beyond mere financial products.

At that time, the concept of smart contracts was still extremely vague—there were no definitions, no samples, and certainly no direction.

In the initial vision, contracts were merely scripts supporting a few fixed functions—such as simple multi-signatures, time locks, or bilateral contracts like Mastercoin, where participants A and B would both invest funds and then distribute profits according to a preset formula. This scripting language was not Turing complete; it could only describe the terms of the relationship between the two parties, far from being a true "world computer," let alone intelligent.

Vitalik argued to Bitcoin core developers that the Bitcoin platform should have a more comprehensive programming language for developers. However, the conservatism and minimalist philosophy of the Bitcoin community fundamentally conflicted with Vitalik's vision of a more universal and open blockchain. Moreover, at that time, various scaling solutions in the market were merely patching up existing issues, and no one dared to propose a completely redesigned solution.

Thus, he made a decision that, in hindsight, truly changed the world: to develop a new platform.

With a forward-looking decision made, the path backward was still unclear. Although it was a new platform, how to design and implement it was a significant question.

A turning point came at the end of 2013 during a long walk in San Francisco. He suddenly realized that contracts could be generalized—if it were a smart contract, it could itself be a fully mature account, capable of holding, sending, and receiving assets, and even maintaining permanent storage of some state. Why not go further and break away from scripts that describe fixed relationships to design a virtual machine capable of executing arbitrary computations?

The initial design of Ethereum even adopted a register-based architecture (as opposed to the later stack-based architecture) and included an innovative fee mechanism: with each computational step executed, the contract's balance would decrease slightly, and if the contract funds were exhausted, execution would stop. This was the early prototype of the "contract pays" model, which later evolved into the familiar "sender pays" and Gas system.

At the end of 2013, Vitalik wrote the Ethereum white paper, which defined the goal—to create a general-purpose decentralized computing platform where anyone could deploy and run decentralized applications, not fixed-function scripts, but a truly Turing-complete computing environment.

However, there was a significant gap to bridge between the ideal vision and the achievable technical specifications. At this point, Gavin Wood's involvement became a critical turning point. In 2014, Gavin Wood wrote the famous "Ethereum Yellow Paper," which served as the formal technical specification for the operation of the Ethereum Virtual Machine.

1.2, Key Technical Decisions and Evolution in Berlin

From 2014 to 2015, Berlin became the spiritual home of Ethereum. Vitalik often "pilgrimed" in the Bitcoin Kiez area of Berlin, with Room 77 becoming a gathering place for the early crypto community. In an office just 1.5 kilometers from Room 77, at Waldemarstraße 37 A, the core team of Ethereum was coding day and night.

During this phase, the Ethereum protocol underwent countless technical iterations: transitioning from a register-based architecture to a stack-based architecture, evolving from the "contract pays" model to the "sender pays" Gas system, and changing from asynchronous internal transaction calls to synchronous execution. Many decisions had far-reaching impacts.

For example, the EVM (Ethereum Virtual Machine) unified the 256-bit integer model, initially to accommodate the common bit width of hash functions and cryptographic algorithms while avoiding overflow risks in design. Although it seemed overly conservative at the time, it naturally adapted to the complex high-precision mathematical operations in DeFi (such as fixed-point arithmetic, multiplication, and division rounding), also avoiding precision issues found in JS/float-type languages.

Additionally, if a transaction exhausts its Gas, the entire execution would roll back rather than partially complete. This design eliminated the entire attack surface of "partial execution attacks," becoming the cornerstone of all smart contract security later on. Moreover, this design had economic incentives; on one hand, it was technically impossible to predict the Gas required before contract execution, and on the other hand, because failure would incur losses, senders were more motivated to control costs and behavior, avoiding blind transaction submissions.

The technical creativity of everyone led to many unexpected surprises. For instance, Vitalik initially envisioned an asynchronous contract call model, but Gavin Wood, considering engineering and semantic consistency during implementation, naturally adopted synchronous calls. This seemingly unintentional shift laid the critical technical foundation for the later composability of DeFi—allowing one contract to synchronously return execution results when calling another, creating the predictability and atomicity of "money Legos."

It is important to note that Ethereum's DeFi applications are highly interdependent and do not exist in isolation. For example, lending protocols use DAI/USDC as collateral, while stablecoin minting modules call Chainlink for oracle services, and many market-making protocols leverage Aave and Compound for leverage. This series of interactions relies heavily on synchronous calls, which, while beneficial, also complicate performance scaling, leading Ethereum to later adopt more complex scaling strategies (see the L2 section below).

Moreover, the well-known POW mining algorithm underwent multiple iterations, from the Dagger algorithm proposed by Vitalik to the Dagger-Hashimoto developed in collaboration with Thaddeus Dryja, and finally to Ethash, which emphasized ASIC resistance. Throughout these processes, various directions were explored, such as adaptive difficulty, memory-hard structures, and random access circuits.

Of course, many difficulties brought unexpected joys, but they also became subsequent technical debts. In 2025, when Vitalik proposed replacing the EVM with RISC-V, he admitted, "Ethereum has often failed to maintain simplicity in its history (sometimes due to my own decisions), leading to excessive development expenditures and various security risks, often in pursuit of benefits that have proven to be illusory."

1.3, A Historic Moment: July 30, 2015

On July 30, 2015, Vitalik still remembers the scene in the Berlin office that day: "Many developers gathered together, and we were all watching the block count on the Ethereum testnet reach 1028201, as this marked the automatic launch of the Ethereum mainnet. I still remember we were all sitting there waiting, and then it finally reached that number, and about half a minute later, Ethereum blocks started being generated."

At that moment, there were fewer than 100 developers in total for Ethereum, and the entire ecosystem was merely a technical experiment. The first decentralized Twitter application, "EtherTweet," had an interface as rudimentary as "the Wright brothers' plane," and each tweet required a high on-chain fee. Smart contracts were still toys for a few geeks, and DeFi, NFTs, and Layer 2 existed only in the imagination of white papers.

Now, searching that address on Google Maps still shows the label "Ethereum Network Launch (30/07/2015)" along with a group photo of the early core members of Ethereum—one of the most important photos in crypto history.

On July 30, 2025, when Ethereum celebrates its tenth anniversary, as of the first half of 2025:

- In the first quarter of 2025, a record 6.1 million wallets participated in on-chain governance voting.

- Ethereum adds approximately 350,000 new wallets weekly, thanks to users joining through Layer 2s.

- As of March 2025, the number of active Ethereum wallets reached 127 million, a year-on-year increase of 22%.

- Leading the stablecoin market with a market capitalization of $82.1 billion, accounting for 60.0% of the total market cap.

- The total locked value (TVL) of various DeFi protocols exceeded $45 billion.

- Uniswap's daily trading volume surpassed $2.1 billion, and lending platforms like Aave and Compound held over $13 billion in locked assets.

- In the past 12 months, Ethereum recorded over 28,400 GitHub commits in its core repository.

- The number of active developers contributing to Ethereum-related projects currently exceeds 5,200.

There are many more data points that the author will not list here, but the intention is to express that this "marginal experiment," which once had fewer than 100 developers involved, has now grown into the largest development platform and ecosystem in the Web 3 world.

Over the past decade, Ethereum has transformed from a few daily transactions to an annual processing volume of $5 trillion, from transaction fees of several dollars to less than one cent on Layer 2, from PoW mining consuming as much energy as a small country to a PoS mechanism that consumes less energy than a building, and from the rudimentary EtherTweet demo application to a mature DeFi ecosystem valued at 80% in ETH. Behind every number lies the relentless efforts of countless developers and the trust of users. When the U.S. SEC approved nine ETH spot ETFs and the first-day trading volume exceeded $1 billion, this once "marginal cryptocurrency experiment" had become a large-scale asset ranking among the world's top, making a profound impact at the core of the mainstream financial system.

However, the journey from a boy in a Berlin office to the creator of a new generation of global financial infrastructure was not smooth sailing. Over the past decade, Ethereum has faced the growing pains of technological upgrades, the trials of hacking attacks, the baptism of market cycles, and countless critical decisions concerning its survival. Each crisis has been a reshaping, each upgrade a transformation, and each controversy a growth opportunity. It is these pivotal moments that have shaped the Ethereum we see today.

Let us return to those decisive moments and re-examine how this legend was forged through storms.

2. A Decade of Journey—Key Nodes and Evolutionary Logic

2.1, 2015-2017: From Genesis to Hard Forks and the ICO Craze

The launch of the Ethereum mainnet that summer marked the beginning of the smart contract era.

In its early days, Ethereum resembled an experimental technology showcase rather than a truly usable product. Most of the applications running on the network were simple demo applications—such as EtherTweet (a decentralized Twitter clone), WeiFund (a crowdfunding platform), and various rudimentary voting contracts.

The instability of Gas prices made every interaction feel like a gamble, with transactions sometimes taking over an hour to be confirmed. For developers, the immaturity of the Solidity language was even more frustrating, as the compiler frequently encountered strange bugs (such as variable shadowing, stack overflow, and jump logic errors), and the security of smart contracts often relied on the personal experience of developers.

Despite the technological immaturity, the Ethereum community exhibited an unprecedented idealistic enthusiasm. Weekly developer meetings were always packed with programmers from around the world discussing how to reconstruct the entire world with smart contracts—from autonomous organizations to prediction markets, from identity systems to supply chain management, which indeed flourished in hindsight. Moreover, this optimistic sentiment was mixed with an almost fervent belief: code is law, mathematics is truth, and decentralization is freedom.

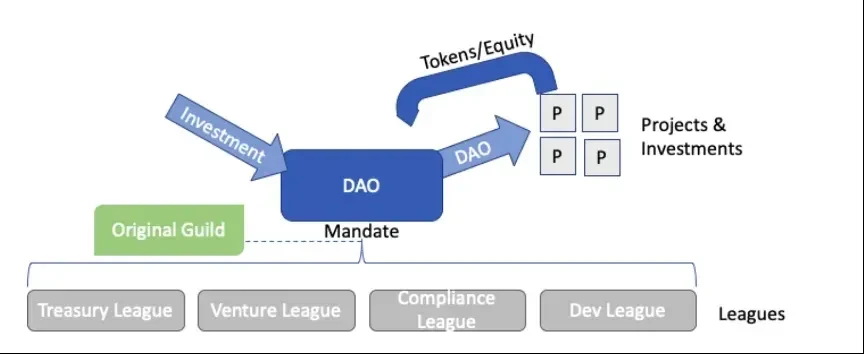

Carrying this sentiment, in May 2016, a project called "The DAO" launched on Ethereum, hailed as "the largest crowdfunding experiment in human history." In just 28 days, it raised $150 million worth of ETH (accounting for 14%-15% of the entire network), becoming the largest venture capital fund in the world at that time.

Source: The DAO White Paper: https://github.com/the-dao/whitepaper

At this point, a massive crisis quietly approached. On June 17, a hacker exploited a reentrancy attack vulnerability in The DAO smart contract, successfully stealing 3.6 million ETH (about 5% of the total Ethereum supply at the time).

The core of this attack lay in the design of the splitDAO function in The DAO smart contract, which had a typical reentrancy vulnerability—a classic attack pattern that would later be included in smart contract security textbooks.

When a user called the splitDAO function, the contract executed the following steps: first, it sent rewards to the user through the withdrawRewardFor function, and only then updated the user's balance. The problem was that the withdrawRewardFor function ultimately used the low-level call.value() method to send ETH to the recipient (using such a low-level transfer mechanism was also a point of concern). Subsequently, when the recipient (the attacker) received the ETH, their fallback function was triggered, which immediately called the splitDAO function again. This created a reentrancy attack, as the first call had not yet completed (the balance had not been updated), allowing the attacker to repeatedly withdraw funds based on the same balance.

The attacker deployed two identical malicious contracts, achieving up to 29 recursive withdrawals. Each withdrawal was calculated based on the same original balance, ultimately successfully transferring tens of millions of dollars worth of ETH to their controlled sub-DAO. Ironically, this vulnerability had been discovered and warned about by several developers before the attack occurred, but under the belief of "code is law," no one thought to pause the contract's operation.

This plunged the entire Ethereum community into an unprecedented philosophical crisis. On one side were the technical purists, who insisted that the immutability of the blockchain was sacred and inviolable, believing that while the attack was morally wrong, it was "legitimate" from a technical standpoint because the attacker was merely acting according to the contract's code logic. On the other side were the pragmatists, who believed that protecting investors' interests and maintaining the Ethereum ecosystem was more important than abstract principles.

In response, Gavin Wood (one of the co-founders, former CTO, and author of the Yellow Paper) stated in a public interview: "The blockchain should be immutable, and the code on-chain should be the true controlling logic." But he also admitted, "If I saw someone being robbed on the street, I would be willing to step in to stop the robbery and return the stolen goods."

Vitalik Buterin later wrote in his blog: "I spent the night sleepless, repeatedly pondering what true decentralization is. If we can arbitrarily modify history, what difference is there between Ethereum and a traditional database? But if we watch the attacker take away the community's funds, how do we face those who trust us?"

After intense community debate, Vitalik ultimately chose to implement a hard fork (which is the story of the split between Ethereum and Ethereum Classic). He later reflected, "We learned a harsh truth—absolute decentralization is a beautiful ideal, but in the real world, we must find a balance between pure principles and human needs." This lesson has been reflected in every subsequent network upgrade: technical decisions must serve the overall interests of the community, rather than abstract ideologies.

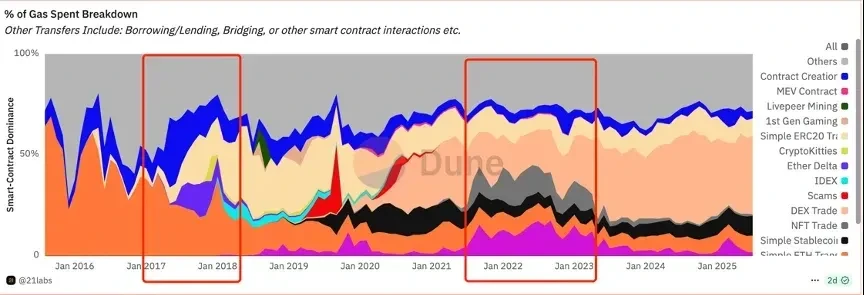

If the DAO incident was Ethereum's rite of passage, then the ICO craze of 2017 was its adolescence. That year, over 50,000 ERC-20 token contracts were deployed on the Ethereum network, raising over $4 billion, as blockchain began rewriting the rules of traditional venture capital.

Source: Dune: https://dune.com/queries/2391035/3922140

Historical data shows that, aided by Gas consumption analysis, a large number of contracts were generated in 2017-2018 (the yellow part in the left red box of the chart), and ERC-20 transfers became popular, transforming on-chain assets from native coins (ETH) to a diverse array of ecological applications.

Additionally, a digital cat game called CryptoKitties occupied 15% of the network's transaction capacity within just a few days, causing Gas fees to soar from a few cents to tens of dollars, extending transaction confirmation times from minutes to hours. This experience served as a lesson, leading to the calm handling of the second wave of NFT craziness after the London upgrade completed in 2021 (the gray part in the right red box of the chart).

The demand for on-chain space from each cycle's explosive ecology made people acutely aware of how far the actual processing capacity of 15 transactions per second was from the grand vision of a "global computer."

2.2, 2018-2022: Forging the Future in Silence—From Technological Accumulation to Ecological Explosion

Ongoing Technological Revolution (2018-2022)

When the ICO bubble burst in 2018 and speculators exited the scene, the number of Ethereum developers did not decrease but rather increased. It was during this forgotten period of silence that Ethereum completed a series of key technological upgrades, laying a solid foundation for the subsequent ecological explosion.

Almost annual upgrades followed, with the Byzantium fork, Constantinople fork, and Istanbul fork successively released. Many changes were relatively unnoticed by users, bringing more underlying transformations. For instance, by reducing the block reward from 5 ETH to 3 ETH, Ethereum began to seek a balance between inflation and security; these upgrades also introduced various underlying support for Layer 2 scaling, including the prelude to zero-knowledge proof technologies like zk-SNARKs. The introduction of the CREATE2 opcode allowed multi-chain contracts to have deterministic address creation capabilities.

As mentioned earlier, the real solution to alleviating users' perception of transaction congestion was EIP-1559 in the London upgrade of 2021. This proposal addressed the flaws of the traditional "blind auction" mechanism through a dual mechanism of base fee and priority fee. Before EIP-1559, users had to guess the appropriate Gas price—bidding too low could result in transactions not being packaged for a long time, while bidding too high would waste a lot of funds. Worse still, during network congestion, users often panicked and significantly raised their bids, leading to a spiraling increase in fees and creating a "price war."

However, congestion did not cease after EIP-1559, as EIP-1559 addressed the "price discovery" issue rather than the "capacity" issue.

The actual throughput of the Ethereum mainnet did not significantly increase as a result—still only able to process about 15 transactions per second. It merely made prices more predictable during congestion due to the automatic increase of the base fee, until some users abandoned usage due to high prices. It was akin to building better toll booths, making queues more orderly and fees more transparent, but the number of lanes on the highway itself did not increase.

Real "road expansion" still relies on Layer 2 solutions—this is why rollup technologies like Arbitrum and Optimism, as well as EIP-4844's blobs, have become central to Ethereum's scaling roadmap.

During this period, there was also a fundamental technological shift: the evolution of Ethereum's consensus mechanism. Initially, Ethereum inherited Bitcoin's PoW model, but it began exploring PoS solutions in 2015, going through various technical routes such as Casper FFG and Casper CBC, until the successful launch of the Beacon Chain finally determined its direction.

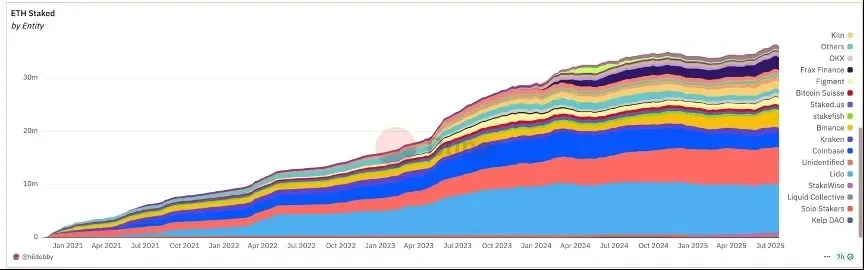

On December 1, 2020, 520,000 ETH were staked in just one month. By the successful launch of The Merge in 2022, Ethereum's energy consumption was reduced by 99.95%, not only meeting the environmental requirements of regulators and investment institutions but also laying the groundwork for future sharding expansion and further optimization of the Beacon Chain, truly achieving a transition from "mining equals security" to "staking equals governance."

However, the gap between ideals and reality was starkly evident—complexity of the dual-chain architecture, high learning costs, and institutional access barriers.

Source: Ethereum Staking Data: https://dune.com/hildobby/eth-2-staking

To date, Ethereum has over 1.1 million validators, with 3.6 million ETH locked for staking, accounting for approximately 29.17% of the total supply. Such a scale of staking participation provides unprecedented economic security for Ethereum—if an attacker wants to launch a 51% attack, the cost would be in the millions of ETH, making it extremely expensive, and the participants in staking are diverse, making the overall security even more difficult to shake.

However, consensus is not meant to remain unchanged for the long term. The successful transition of Ethereum to PoS without losing its degree of decentralization is largely due to its years of operation under PoW, resulting in a highly decentralized token distribution. This inherent advantage is not something that any PoS chain can match. On the other hand, the existing consensus still brings limitations to user experience.

For example, Ethereum still operates on a finality delay mechanism, requiring multiple epochs to confirm block finality, which is inconvenient in cross-chain and rollup settlement scenarios. Therefore, future solutions like Single Slot Finality (SSF) aim to compress finality to a single slot (12 seconds). There is also the concept of Beam Chain, which provides several possible directions for future consensus design, such as allowing validators to participate in consensus without owning the full state, enhancing the feasibility of lightweight clients. Coupled with designs like EIP-4844 and Danksharding, the Beam model can support more flexible data access paths, accelerating the decoupling of validators and executors.

Thus, the path of consensus remains ever-evolving, continuously adapting to higher levels of decentralization requirements and matching user experience.

The Ecological Miracle of DeFi/NFT Summer (2020-2023)

After years of infrastructure iterations, when the technological foundation is solid enough, innovation will emerge like bamboo shoots after a spring rain.

In the summer of 2020, Compound's liquidity mining acted as a singular point, igniting the fuse of DeFi. However, what truly made this revolution possible was the technological foundation accumulated over the previous three years. Uniswap's automated market maker model, Aave's flash loans, Curve's stablecoin trading optimization—each innovation was built on Ethereum's increasingly mature smart contract infrastructure. Moreover, the interdependence of leading DeFi protocols on Ethereum formed a true "money Lego" ecosystem, and this composability is the crystallization of years of technological accumulation on Ethereum.

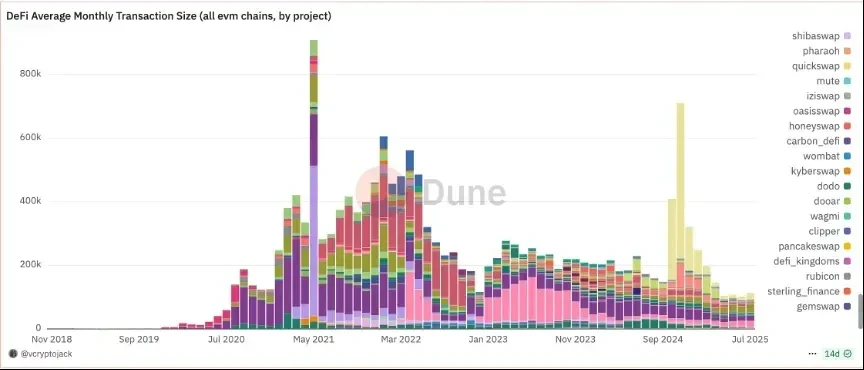

Source: Dune: https://dune.com/queries/4688388/7800121

This chart shows the trend of DeFi applications on various EVM-architected chains. Although some EVMs are not Ethereum or its Layer 2 ecosystem, it illustrates how, since the most disruptive period in 2021, the competition among several major players has led to a situation where it is hard to discern how many colors (projects) are blooming on various chains, each satisfying diverse financial needs on-chain.

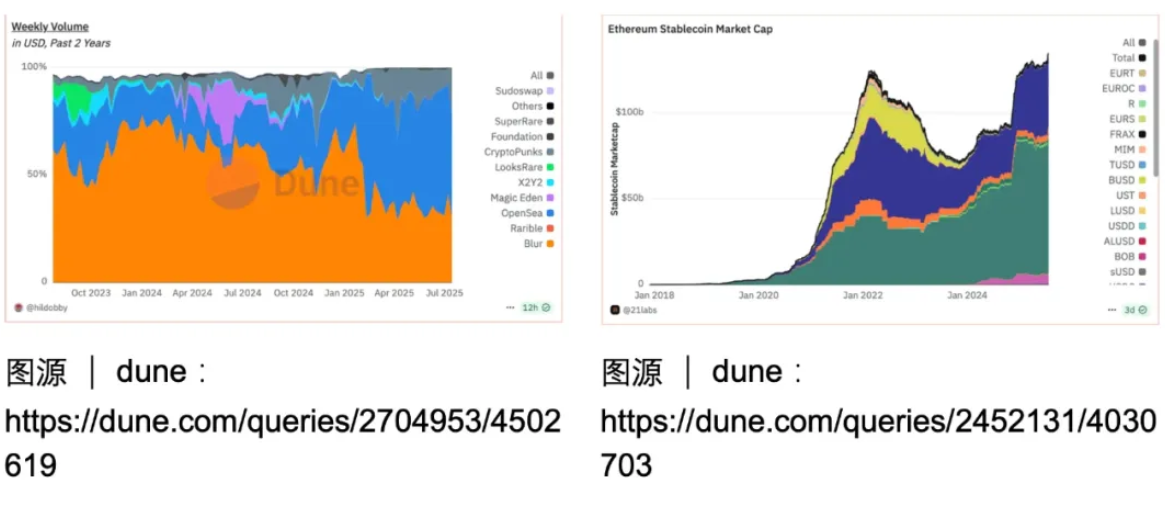

On the other hand, from CryptoPunks to Bored Ape Yacht Club, NFTs have not only redefined digital ownership but also allowed Ethereum to find new value anchors in the fields of digital art and culture. The rise of OpenSea/Blur demonstrates Ethereum's immense potential as a cultural infrastructure, and the foundation of all this is Ethereum's well-established token standard system.

It is worth mentioning that even now, the single project of CryptoPunks (shown on the left side of the image, in gray) still occupies a significant share of the entire NFT market. It even predates the NFT standard, with the contract itself built-in with trading market functionality, allowing for direct interaction with the chain without needing a front end to complete order transactions.

In terms of stablecoins, after the DeFi Summer of 2021, over $130 billion in funds have been divided among USDC, USDT, DAI, and others.

Looking back over the past decade, from the initial ERC-20 to ERC-721, ERC-1155, and now the emerging standards being explored like ERC-3525 and ERC-3475, Ethereum has built a digital framework capable of expressing almost all asset types in the real world.

These five major standards constitute a complete expression system from simple currencies to complex financial contracts, and there are many more standards that have not yet been finalized but are gradually being adopted in different applications, leaving room for continuous development.

This is the source of innovation; a more open protocol layer builds a market that allows for greater intellectual creativity. Through EIPs (Ethereum Improvement Proposals), it does not create products but rather serves as a mechanism for proposing improvements to Ethereum, allowing protocol participants to reach consensus at different levels, whether regarding contract standards, client implementations, or process optimizations related to user experience, ensuring that every improvement suggestion is recorded in history, subjected to technical review, and ultimately adopted or rejected by the network.

2.3, 2023-2025: The Differentiation of the Rollup-Centric Era

Ethereum's Path to Scaling: Layer 2

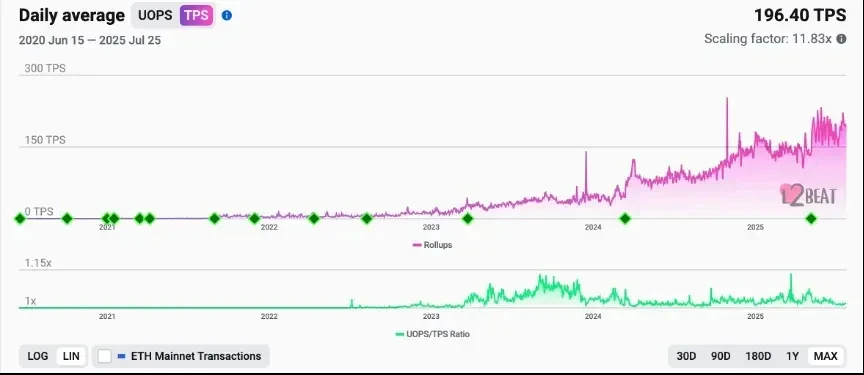

This path has come a long way; Layer 2 has now become an important part of the Ethereum ecosystem, accounting for 85% of transaction counts and 31% of transaction volume, with the number of active addresses reaching 3-4 times that of the Ethereum mainnet. Behind this prosperous scaling success lies a more complex process of comprehensive reconstruction of technology and business models.

As mentioned earlier, Ethereum's TPS was 15/s; so what is the actual TPS of the entire Ethereum ecosystem now?

Source: L2 Beat: https://l2beat.com/scaling/activity

Vitalik once calculated using blobs: with EIP-4844, we now have 3 blobs per slot, with each slot's data bandwidth being 384 kB, which translates to 32 kB per second. Each transaction on-chain requires about 150 bytes, resulting in approximately ~210 tx/sec.

Comparing this with the actual numbers on L2 Beat, the results are quite similar, achieving a tenfold increase in just a few years, which is indeed powerful.

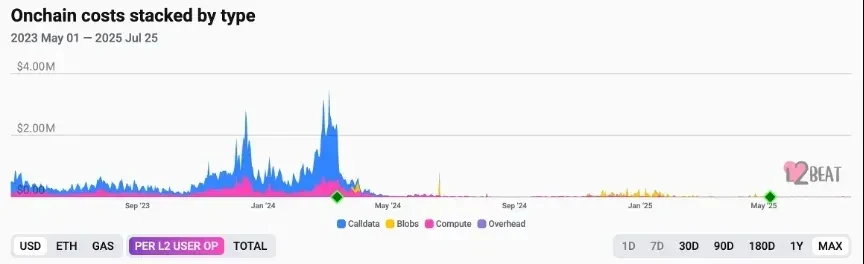

How should we understand the blobs of EIP-4844? There is an interesting website that illustrates the differences.

Source: TxCity: https://txcity.io/v/eth-arbi

First, let’s look at the left side, which shows Ethereum's block production process. Each person in the image represents a transaction interacting with a certain application, which then enters different blocks based on gas prices to complete the packaging process.

Now, let’s look at the right side, which represents one of Ethereum's Layer 2 solutions, Arbitrum One. Similarly, each person in the image represents a transaction interacting with a certain application. They leave a note at the counter, and after a certain period, a postman comes to collect all the transactions, forming the current blob, and then this postman goes to the left side, to the Ethereum mainnet, to submit it into a certain compartment.

In this way, blobs avoid unnecessary data being permanently written to the Ethereum mainnet, only serving a purpose during validation and for a limited time, thus reducing Layer 2 fees by 90%.

However, objectively speaking, the market's views on this are mixed, as Layer 2 has not brought a proportional increase in revenue to Ethereum. Previously, EIP-1559 introduced a deflationary mechanism through the burning of ETH, which brought cheers from the community, as deflation often represents an increase in value for the vested interests.

But today, with 85% of transactions moving to Layer 2, MEV revenue is naturally captured by various rollups, causing the mainnet to fall back into an inflationary state. Inflation itself can affect the security of Ethereum staking (a currency that depreciates over the long term tends to be held for a long time).

However, in my view, Ethereum has actively chosen to forgo profits in exchange for ecological prosperity, not adopting the traditional "corporate" approach—maintaining profits through increased fees or limiting competition—but instead opting to share benefits, repositioning itself as a highly decentralized, permissionless Layer 2 issuance protocol.

This strategy has led to a collision of various viewpoints. Regardless, it can be said that we are witnessing a new model of value capture—ETH no longer relies on a burning mechanism to control supply to simply obtain value, but rather acquires value assessment through powerful network effects in an ever-expanding ecosystem.

Furthermore, compared to the early scaling roadmap, we are now shifting from the early vision of "homogeneous sharding" to the reality of a "heterogeneous ecosystem." The sharding concept from 2016 envisioned creating multiple identical EVM copies processed by different nodes; today, Layer 2 has practically realized this vision but introduced a fundamental difference—each "shard" is created by different participants, following different standards, forming a de facto heterogeneous network.

The traditional "single-chain governance" model has given way to a "multi-chain federation," where each Layer 2 has its own governance mechanism, economic model, and community culture. Base can focus on providing a seamless experience for Coinbase users, Arbitrum can pursue maximum EVM compatibility, not to mention unique experiences like ZkEVM. This diversity is impossible to achieve under a single chain architecture.

However, this heterogeneity also brings new challenges. How can using Ethereum feel like using a single ecosystem rather than 34 different blockchains? This is a more complex coordination challenge than The Merge, as it involves more participants, more dispersed interests, and a tighter time window.

The exploration of Layer 2 continues, but regardless of the outcome, Ethereum's "self-sacrifice" has already become one of the most unique experiments in blockchain history—where a technical system actively relinquishes power for its ideals, and a protocol gives up monopolistic profits for ecological diversity.

This may be the best embodiment of Vitalik's statement, "The technical project and the social project are inherently intertwined."

2.4, 2015-2025: A Decade-Long Journey of Account Abstraction

The vision of account abstraction is even older than Ethereum itself. It is a dream about "making technology invisible"—just as we do not need to understand the underlying Unix system when using an iPhone today, blockchain users should not be forced to become cryptography experts.

Imagine a scenario where you need to remember a string of 12 random words to access your bank account; if you forget them, you can never retrieve your deposits, and if they are leaked, all your assets will be stolen. This sounds like a bug in a science fiction novel, but it has been the real experience of blockchain users for the past decade.

This seemingly "pure" design of autonomy actually stems from an early technical compromise in Ethereum: EOA (Externally Owned Accounts) couples ownership and signing authority under the same private key. In simpler terms, your "ID card" is also your "bank password," and exposing the private key means the door is wide open, leading to total loss.

The root of this design comes from Ethereum's transaction structure—standard transactions do not have a "From" field but instead derive the sender's address through VRS parameters (i.e., user signatures).

Account abstraction aims to resolve this "technical necessity" that has hijacked user experience.

In November 2015, just four months after the Ethereum mainnet launched, Vitalik proposed EIP-101—the first account abstraction proposal. The vision at that time was radical and straightforward: turn all accounts into smart contracts, making code, rather than private keys, the sole controller of accounts.

But ideals are often grand, while reality can be harsh. Ethereum carries a heavier historical burden than any new chain—millions of existing EOA accounts, assets worth hundreds of billions of dollars, and a vast and complex ecosystem. Any radical change could have catastrophic consequences.

Thus began a long technological journey:

- EIP-101 in 2015 envisioned the blueprint for contract-based accounts.

- EIP-859 in 2018 attempted to implement contract wallets at deployment.

- EIP-3074 in 2021 sought to add smart contract functionality to EOA.

- ERC-4337 proposed in 2021 was launched in 2023, achieving account abstraction without changing the protocol layer.

- EIP-7702, based on EIP-3074, was ultimately deployed on the mainnet in the 2025 Pectra upgrade.

This decade-long exploration is akin to changing engines on a plane in flight—ensuring safety while achieving upgrades, with each step requiring extreme caution. EIP-7702 brings not only a change in technical architecture but also serves as a technical foundation for enhancing user experience. Let’s look forward to the upcoming future:

Passkey Technology: You no longer need to remember 12 mnemonic words; you can securely access your digital assets using Touch ID or Face ID.

Gmail Recovery: When you forget how to access your wallet, you can send a zero-knowledge proof to your Gmail using ZK Email technology to regain control of your wallet without revealing any privacy. This sounds like magic, but it is indeed real technology.

One-Click Complex DeFi Operations: For heavy on-chain users, multiple transactions can be bundled together for execution—from borrowing to trading to staking complex operation sequences, all completed with one click, significantly reducing wait times and failure risks. Of course, this requires a reliable wallet to construct such transactions for you.

Looking back at the Pectra upgrade, we once again see Ethereum's reflection and persistence regarding its future direction. The Layer 2 grand strategy has entered a stable execution phase; while the roadmap of Ethereum has seen changes in details, the core goal remains consistent: to build a secure, decentralized, highly scalable, and easily verifiable green blockchain. The introduction of various user experience proposals represents Ethereum's relentless exploration to enhance competitiveness while ensuring decentralization—even in the face of fierce competition from a new generation of public chains vying for dominance, it strives to remain the ideal world computer.

3. Stars and the Sea—Moving Towards Openness and Fairness

On July 30, 2024, on the ninth anniversary of Ethereum, Vitalik posed a profound question of the era at EDCON: "The past ten years of Ethereum have been a decade focused on theory, and by 2024, we have this technology. In the next ten years, we really must change our focus, not only considering Layer 1 but also truly thinking about what impact we are actually having on the world."

Ten years ago, a 19-year-old boy was coding with his teammates in an office in Berlin, dreaming of creating a "world computer." Ten years later, his dream has partially come true: today's Ethereum carries the flow of value worth trillions of dollars, connecting tens of millions of users worldwide and supporting an unprecedented decentralized financial ecosystem.

However, like all great innovations, the story of Ethereum is far from over.

From the trauma of the DAO Hack to the revelry of DeFi Summer, from the victory of The Merge to the differentiation of Layer 2, and the ups and downs of the decade-long journey of account abstraction, each crisis marks the beginning of a new birth, and each controversy propels the process of evolution.

A decade has passed, and Ethereum remains that unfinished world computer, an ongoing myth. In its early days, it gave up efficiency thinking, allowing Ethereum to operate as a protocol and become a resilient system.

It embodies humanity's collective imagination for a more open, fair, and autonomous digital future. And this may be its greatest value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。